- U.S. jobs report, last batch of Q3 earnings will be in focus this week.

- MongoDB is a buy with upbeat earnings and guidance expected.

- Nio is a sell with disappointing profit, outlook on deck.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

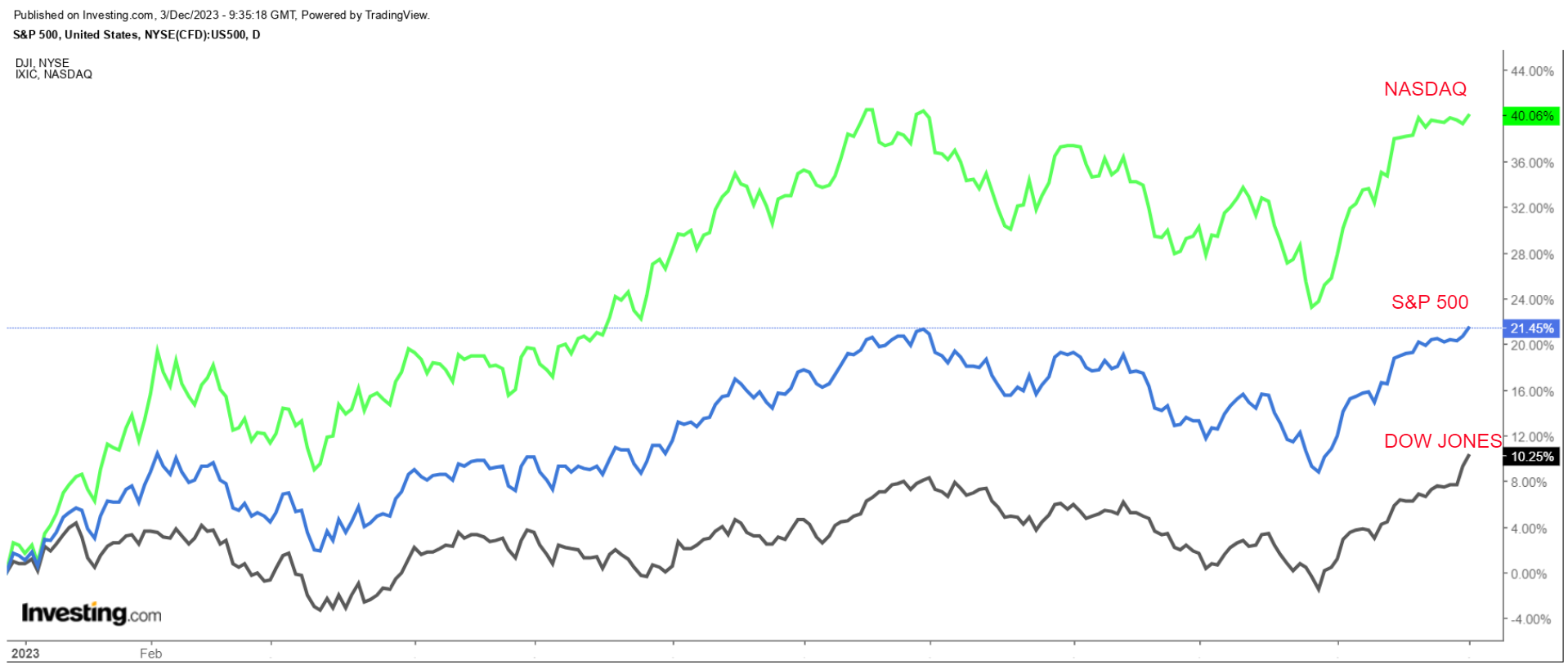

U.S. stocks ended higher on Friday to notch another winning week as remarks from Federal Reserve Chair Jerome Powell bolstered the view that the U.S. central bank is done with raising interest rates.

The benchmark closed at its highest level of the year after Powell said the risks of hiking interest rates too much and slowing the economy more than necessary have become “more balanced” with the risks of not hiking enough to control inflation.

For the week, the blue-chip rose 2.4%, the S&P 500 advanced 0.8%, and the tech-heavy tacked on 0.4%. It marked the fifth straight week of gains for the major averages.

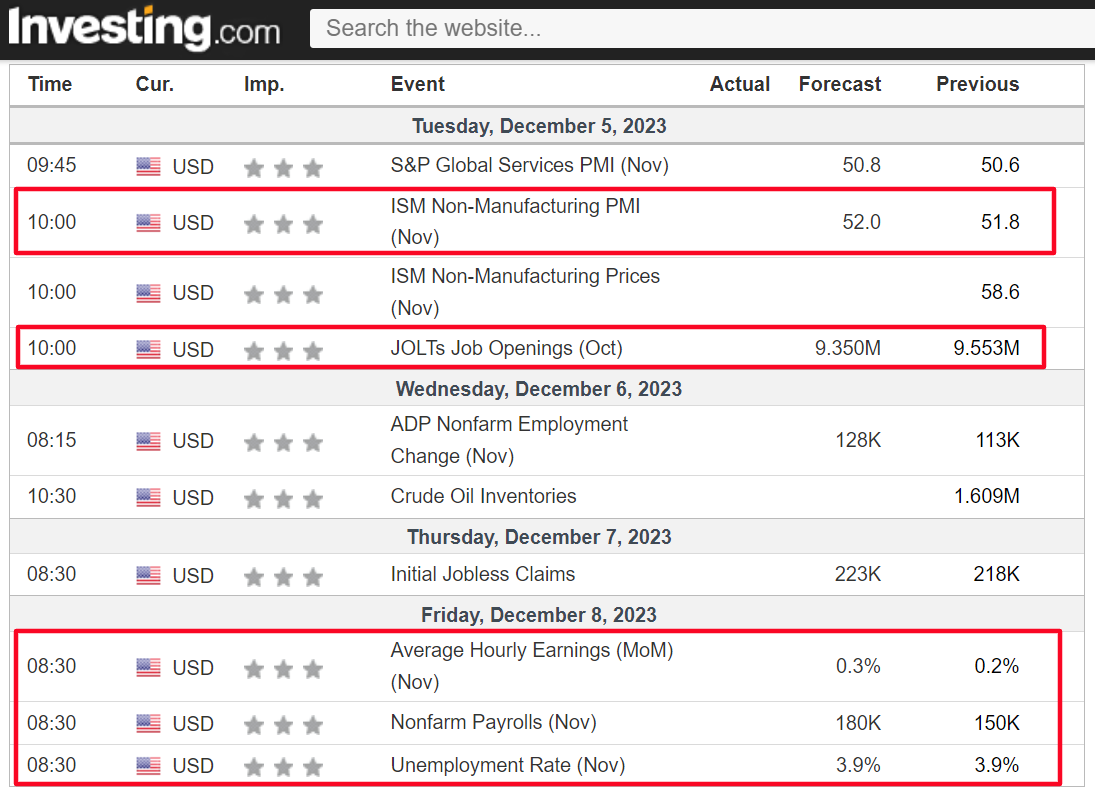

The week ahead is expected to be another busy one as investors continue to gauge the path for the Fed’s monetary policy outlook.

Most important on the economic calendar will be Friday’s U.S. employment report for November, which is forecast to show the economy added 180,000 positions, compared to jobs growth of 150,000 in October. The unemployment rate is seen holding steady at 3.9%.

The data has taken on added significance since a Fed rate cut is now firmly expected in March, according to Investing.com’s .

Elsewhere, some of the key earnings reports to watch include updates from GameStop (NYSE:), Broadcom (NASDAQ:), Lululemon (NASDAQ:), Dollar General (NYSE:), Chewy (NYSE:), Toll Brothers (NYSE:), C3.AI (NYSE:), and DocuSign (NASDAQ:) as Wall Street’s Q3 reporting season draws to a close.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another that could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, December 4 – Friday, December 8.

Stock to Buy: MongoDB

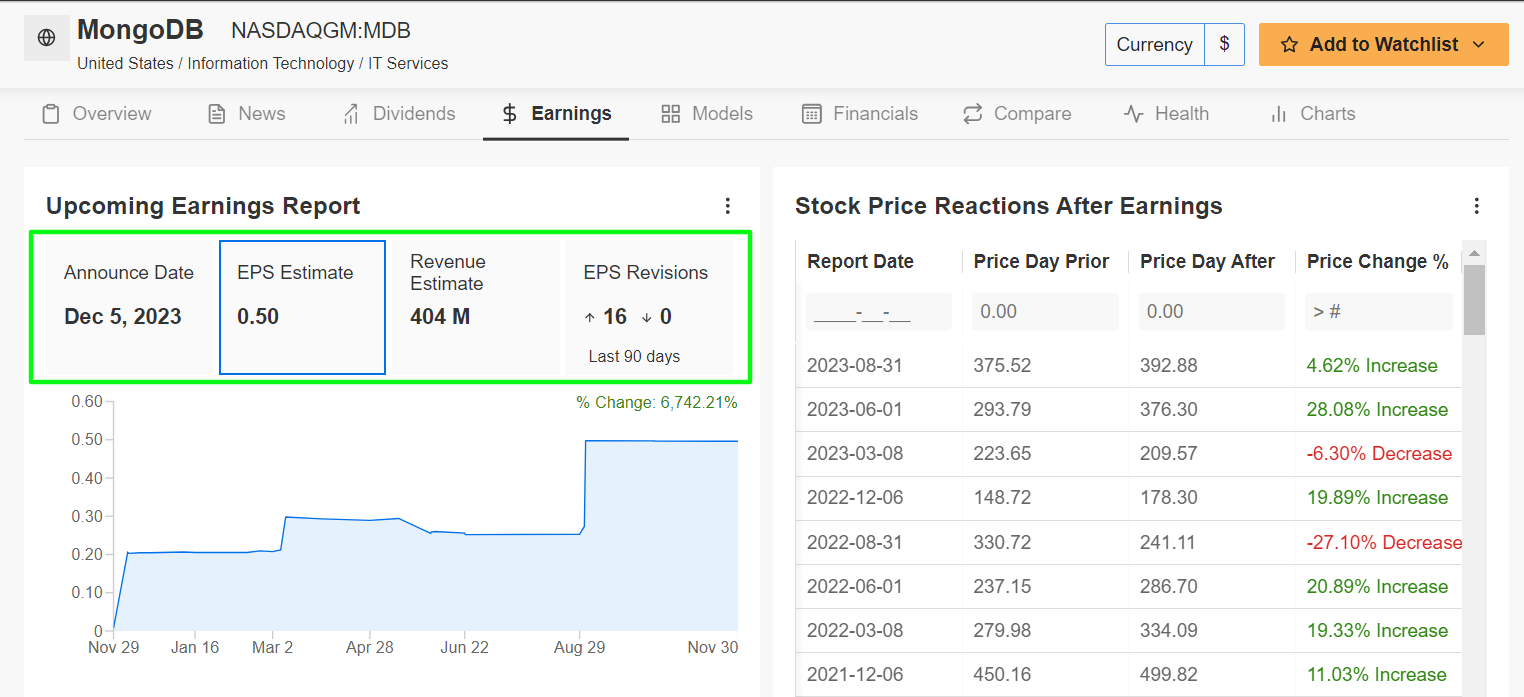

After ending at a new 52-week high on Friday, I expect another strong performance for MongoDB (NASDAQ:) this week as the cloud database software specialist’s third quarter update will easily beat estimates due to favorable industry demand trends.

MongoDB’s latest earnings report is slated to come out after the U.S. market closes on Tuesday at 4:05PM ET, and it is expected to shatter expectations once again as it benefits from strong demand for its cloud-based open-source database offering.

Market participants expect a big move in MDB stock following the print, as per the options market, with a possible implied swing of roughly 12% in either direction. Shares rose 4.6% after the company’s last earnings report on Aug. 31.

Not surprisingly, an InvestingPro survey of analyst earnings revisions points to surging optimism ahead MongoDB’s Q3 print. All 16 analysts covering the stock have raised their profit estimates in the past three months, compared to zero downward revisions. Meanwhile, 30 out 32 analysts surveyed by Investing.com currently have either a ‘buy’ or ‘hold’-equivalent rating on the stock.

Consensus calls for the cloud database-as-a-service (DBaaS) company, which provides an open-source database platform for businesses and developers, to deliver adjusted earnings per share of $0.50, more than doubling from EPS of $0.23 in the year-ago period.

Revenue is forecast to jump 21.1% year-over-year to $404 million, powered by strong enterprise demand for its ‘Atlas’ open-source database software platform. MongoDB is the most-widely used NoSQL solution open-source database software platform.

Highlighting the strength and resilience of its business, MongoDB has beaten Wall Street’s profit and sales estimates in every quarter since going public in October 2017.

Looking ahead, I believe the database platform provider’s full-year guidance will come in above consensus as it remains well positioned to thrive and the economy continues to undergo a sea change of digitization.

MDB stock ended Friday’s session at $435.23, its highest closing price since April 13, 2022. Shares are up 121.1% year-to-date, reflecting the database software maker’s strong fundamentals and robust long-term growth prospects.

At its current valuation, New York-based MongoDB has a market cap of $31 billion.

Stock to Sell: Nio

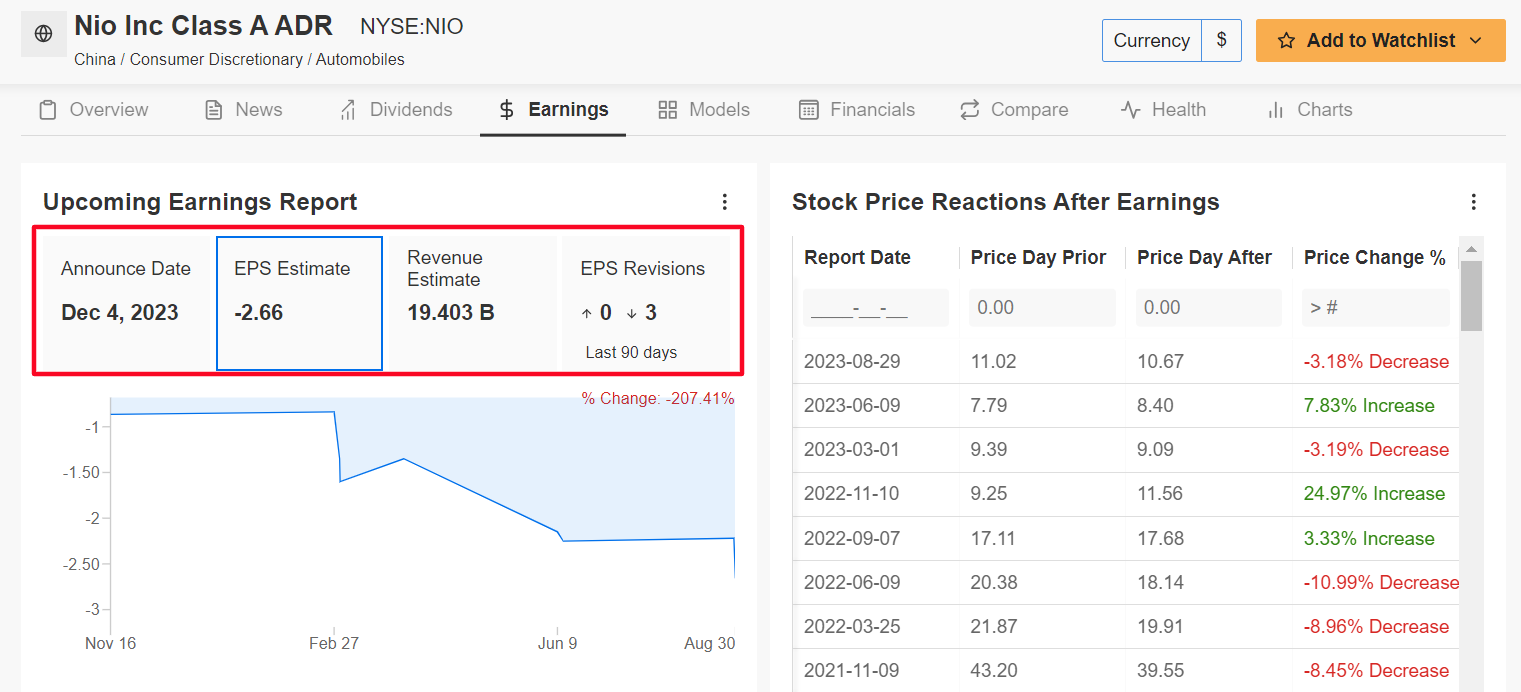

I expect Nio (NYSE:) will suffer a challenging week ahead, with a potential breakdown to fresh lows on the horizon, as the struggling Chinese electric vehicle maker will deliver disappointing earnings, in my view, and provide a weak outlook due to the negative impact of various headwinds on its business.

Nio is scheduled to release its third quarter update ahead of Tuesday’s opening bell at 6:15AM ET and results are likely to take a hit from slowing sales growth due to the difficult economic climate.

As per the options market, traders are pricing in a sizable swing of roughly 11% in either direction for NIO stock after the report comes out. Shares declined about 3% after the Chinese EV company’s Q2 report came out in late August.

As per an InvestingPro survey, analysts have slashed their EPS estimates three times in the last 90 days, compared to zero upward revisions, to reflect a drop of more than 200% from their initial profit forecasts.

Nio is seen losing -$0.38 a share (¥2.66) in the third quarter, worsening from a net loss of -$0.30 (¥2.11) in the year-ago period, as it spends heavily to fend off competition from domestic rivals such as BYD (SZ:), Li Auto (NASDAQ:), Xpeng (NYSE:), as well as more established global automakers, including Tesla (NASDAQ:), Volkswagen (ETR:), and BMW (ETR:). Meanwhile, revenue is forecast to increase 49.2% annually to $2.74 billion (¥19.40 billion).

It should be noted that Nio has missed Wall Street’s top line estimates for five straight quarters, while trailing bottom line expectations four times during that span, amid a deteriorating EV market.

That leads me to believe that there is a growing downside risk that Nio could cut its sales guidance and delivery outlook for the rest of the year, due to concerns over profitability, growth, and free cash flow.

NIO stock fell to a low of $7.01 on Friday, not far from its weakest level since June 2020, before recovering slightly to end the day at $7.15. At current valuations, Shanghai-based Nio has a market cap of $12.7 billion.

With less than a month to go in 2023, shares are off by 26.6% year-to-date. Even more alarming, NIO remains nearly 90% below its January 2021 all-time high of $66.99 amid an aggressive reset in valuations throughout the entire EV sector.

Be sure to check out InvestingPro to stay in sync with the latest market trend and what it means for your trading decisions.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.