Table of Contents

Show more

Show less

Capital at risk. All investments carry a varying degree of risk and it’s important you understand the nature of these. The value of your investments can go down as well as up and you may get back less than you put in. Where we promote an affiliate partner that provides investment products, our promotion is limited to that of their listed stocks & shares investment platform. We do not promote or encourage any other products such as contract for difference, spread betting or forex. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK. Accurate at the point of publication.

Unless you’re a billionaire, buying a football club outright isn’t usually on the cards. But with several prominent clubs listed on a stock exchange, retail investors can get their own small slice of the action.

Whether you’re a loyal fan or simply curious, here’s what you need to know about buying and selling football club shares.

Which clubs can I buy shares in?

Unfortunately for avid fans, it’s not possible to buy shares in every football club.

Before investors can buy in, the club must be publicly traded – meaning it’s listed on a stock exchange where the public can freely buy and sell shares.

Below are some of the most prominent publicly-listed clubs.

Manchester United

Manchester United ranks among the most valuable football clubs in the world. Its market capitalisation, calculated by multiplying a company’s share price by the number of shares in circulation, is around £2.46 billion at time of writing.

However, the club’s share price has declined over the past five years.

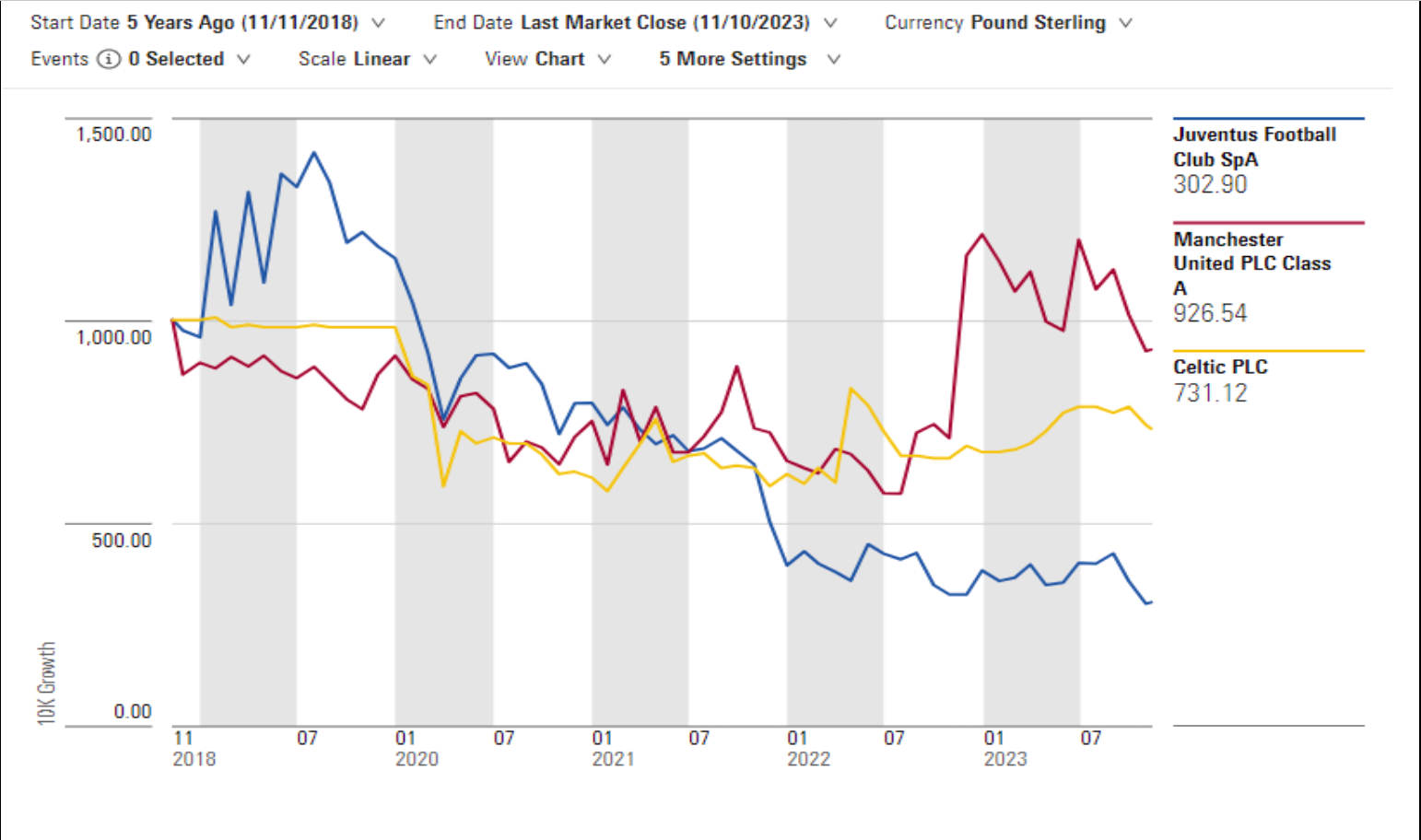

According to Morningstar analysis, if you’d bought £1,000 worth of Manchester United shares in November 2018, your investment would be valued at £926.54 today.

Juventus

This Italian club was listed on the Milan stock exchange in 2001. As of mid-November 2023, it has a market cap of £566.36 million.

Juventus shares have been steadily falling in value since reaching a peak of around £1 in July 2019. As of mid November 2023, each Juventus share is worth £0.23.

If you’d invested £1,000 in Juventus Football Club SpA shares in November 2018, they’d today be worth just £302.90.

Celtic

Celtic, the Glasgow-based club, has been listed on the London Stock Exchange since 1995.

While its share price saw modest growth over the course of 2023, its long-term performance is less encouraging.

A £1,000 investment in Celtic made in November 2018 would be worth £731.12 today.

Other publicly-listed clubs include the German team, Borussia Dortmund, and Italy’s AS Roma.

Unlisted clubs

While the clubs above are all publicly listed at time of writing, others have floated in the past only to return to private ownership.

Arsenal, for instance, previously floated on the specialist NEX Exchange, but ceased to be publicly traded in 2018 when Stan Kroenke became majority shareholder and delisted the club.

As part of the delisting process, investors were forced to sell back their Arsenal FC shares.

Elsewhere, Scottish team Rangers FC failed in its 2015 attempt to list on London’s Alternative Investment Market (AIM) when the club was unable to appoint a nominated advisor – a financial services firm to oversee the AIM listing – within the mandated 28-day window.

It’s also worth noting that the most profitable club in the world, Manchester City FC, is privately owned and thus not open to retail investors.

For keen fans, buying football clubs shares can be a sentimental decision. These shares allow supporters to effectively own a piece of their chosen club.

Besides the emotional benefits, holding shares in a football club confers the same rights as any holding shares in any public company.

Shareholders in a company receive perks such as voting rights at AGMs, and a claim to dividends if the company pays them.

Historically, Manchester United has been the only football club to pay dividends to its shareholders, but these payments have been paused for the 2023/24 financial year.

What are the risks?

As with any investment, the value of football club shares can go down as well as up, and these shares can be particularly volatile for a few reasons.

First, running a club is an expensive endeavour. This means between player salaries, transfer fees, maintaining training facilities and other costs, staying in the black can be tricky, and clubs must invest huge sums if they want to compete at the highest level.

On top of this, club share prices are heavily influenced by wins and losses on the pitch, which can be difficult to predict and cause unexpected swings in value.

Share price performance for three well-known clubs

Source: Morningstar Direct

This volatility was thrown into sharp relief during the Covid-19 pandemic, when public health concerns led to matches being postponed, cancelled, or played behind closed doors.

Manchester United alone reported an annual loss of £92.2 million in the 12 months to June 2021, with matchday revenue plummeting 92%.

While many fans tuned in at home, broadcasting revenues were unable to compensate for the loss of ticket, merchandise and refreshment sales.

Russ Mould, investment director at AJ Bell, said: “Costs, such as salaries and transfer fees, continue to rocket and continually increase the cost of competing. Football clubs therefore look a bit like investment banks – they can generate a lot of cash when things go well, lose a lot when things go badly and even when things go well the money tends to end up in the pockets of the talent, not the owners or shareholders.

“Football clubs in general have proved to be terrible investments over the years.”

Depending on your financial position and tolerance for risk, you may be better off supporting your club by purchasing season tickets than buying shares.

Buying shares in a football club could be a risky investment strategy.

As with any investment, it’s a good idea to build a cash emergency fund worth at least three months’ living expenses before you begin.

Once you’ve decided which club to invest in, you’ll need to work through the following steps.

DIY investors have plenty of options to choose from when it comes to share trading, with a wide array of both online investing platforms and investment trading apps on offer.

As you’re selecting a provider, pay close attention to factors such as fee structure, range of investments and user interface.

You’ll also need to decide whether to hold your investments in a general share trading account, or a tax-free wrapper such as a Stocks and Shares ISA.

- Choose your investment strategy

Next, plan your investment strategy. Usually, this will fall into one of two camps: investing a lump sum, or making smaller, regular investments over time.

In a falling market, drip feeding an investment means you’ll pay less for each share over time, but still gain market exposure right away. In a rising market, however, a lump sum investment offers increased capital growth.

Once you’ve opened a trading account and selected an investment strategy, you can place your order.

The exact process varies between providers, but the basics are usually the same. Once you’ve funded the account (usually via bank transfer or debit card), you can use a search bar or browse an investment catalogue to find the share you want to purchase.

Once selected, you’ll be prompted to enter the number of shares you wish to buy, or the amount you wish to invest.

Many brokerages allow investors to add a ‘stop loss’ order to their account, which limits losses if the share price falls. For example, if you purchased shares at £10, and set a stop loss order of £8, your shares would be sold automatically if the share price fell below £8, limiting potential losses to 20%.

It’s a good idea to monitor how your investments are performing on a regular basis, such as monthly, quarterly or annually.

Checking in gives you the opportunity to buy, sell, or hold your shares depending on their performance.

To sell your holdings, log in to your investing platform, select the investment from your portfolio and choose the sell option. You’ll be prompted to enter the number of shares you want to sell.

If you have made a substantial profit, you may be liable for Capital Gains Tax (CGT). The CGT tax-free allowance for the 2023 to 2024 tax year is £6,000.

Other ways to invest

If you’d prefer not to buy shares in individual clubs, you can also gain exposure by investing in a trust or fund that includes holdings in multiple football clubs.

The Finsbury Growth & Income Investment Trust, for instance, includes holdings in both Manchester United and Juventus.

Alternatively, fans might choose to invest in their favourite club by purchasing memorabilia – such as shirts, signed footballs or collectible cards.

Signed football shirts, for instance, can fetch anything from a few hundred to £10,000 depending on whether they were worn during a match, and whether the team won.

As with any investment, there’s no guarantee your memorabilia will increase in value. These items offer less liquidity than shares, since you’ll need to find a buyer.

Finally, fans can also invest in their club indirectly by purchasing shares in publicly traded companies that sponsor them. For instance, sports apparel giant Adidas is the long-running kit supplier for Manchester United.

If you’re keen to invest in the sport, you may wish to combine multiple investment avenues in order to diversify your portfolio.

Mr Mould at AJ Bell said: “Buy the shares for emotional reasons of attachment by all means, but do so with eyes wide open.”