Chris Forgan shares the two funds he has bought to benefit from the new government.

Labour’s landslide election result last week has spurred Chris Forgan, portfolio manager of the Fidelity Multi Asset Open range, to take an overweight position in the UK.

Now that the “dust has settled”, there are several reasons for investors to be optimistic about the UK market, including a potential economic recovery.

The economy is already on the up after a slowdown in 2023, with first quarter GDP being revised up to 0.7% by the Office for National Statistics. This was driven by an uptick in consumer spending, said Forgan, which could continue as consumers are saving more at present but might loosen their purse strings if inflation settles.

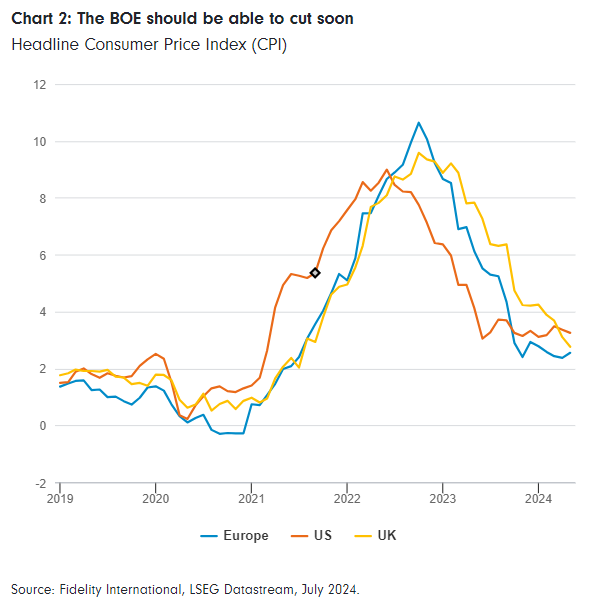

On this front, Forgan noted that price rises are also “looking more positive” with years of rampant inflation now seemingly behind us.

Although UK inflation was “stickier” and appeared more difficult to “get under control” compared to other regions last year, it has fallen “consistently” this year, he said.

“Services inflation is still higher than the Bank of England (BoE) would like, but we believe it has a dovish bias and that it will begin its rate cutting cycle before long. We believe this should further stimulate economic activity,” said Forgan.

On top of this, more mergers and acquisitions (M&A) being completed at “attractive premiums” and valuations that are “some of the most attractive in the developed market universe” suggest the UK has a lot to offer investors from here.

To go overweight the UK, the Fidelity Multi Asset Open range has bought two funds. The first is Polar Capital UK Value Opportunities, which Forgan described as a “market-cap agnostic” portfolio.

Managed by George Godber and Georgina Hamilton, the fund has been under the cosh for some time as it has been hit by the double-whammy of owning value stocks (which have struggled compared to their more growth-oriented peers) as well as mid-caps, which have lagged their large-cap rivals in recent years.

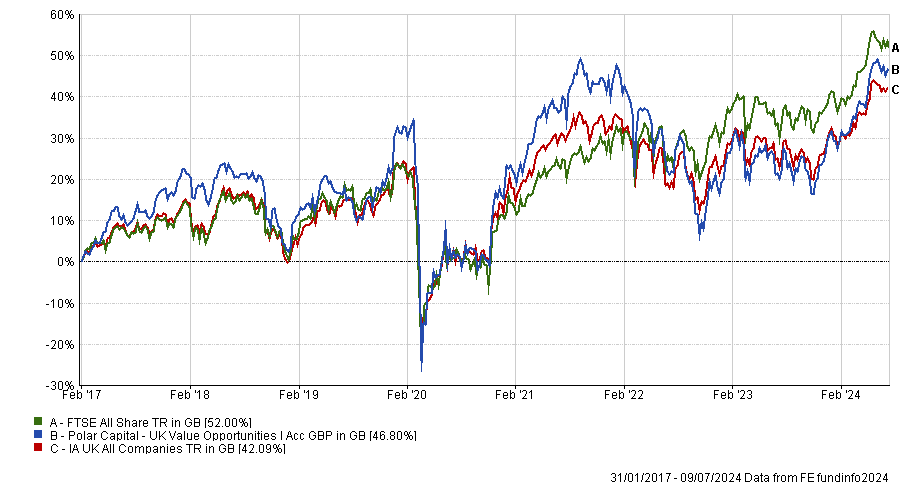

As such, the fund finds itself in the third quartile of the IA UK All Companies sector over three years. However, the fund has come into its own over 12 months and is now ahead of the average peer since its launch, although still lags the FTSE All Share.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

“We like the strategy’s investment process, which is entirely bottom-up, applying a replicable process to each company in the investment universe. The managers apply a value philosophy, looking for stocks trading at a temporary discount to their intrinsic value,” said Forgan.

“We also favour the mid-cap bias the fund currently adopts – nearly 70% is invested in small and mid-caps.”

The other fund he uses is Artemis UK Select, headed by Ambrose Faulks and FE fundinfo Alpha Manager Ed Legget.

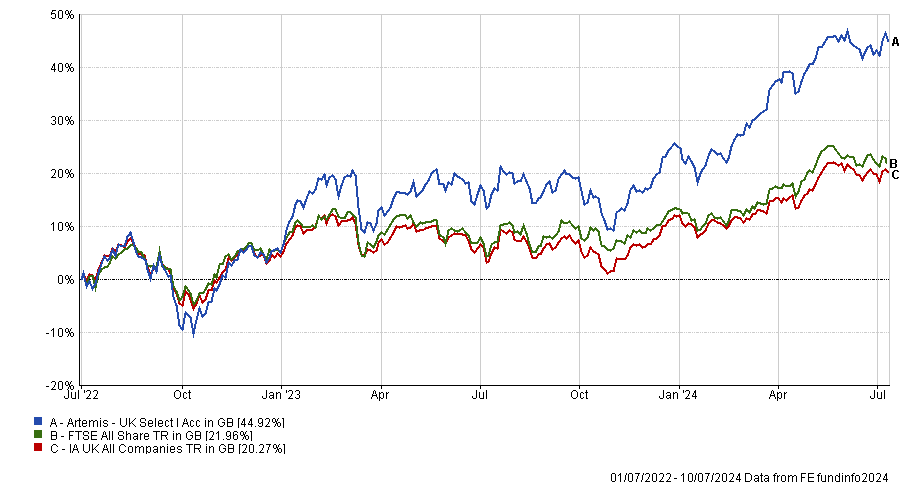

The strategy was added to the Fidelity Multi Asset Open range during the third quarter of 2022, since when it has been the second-best performer in the IA UK All Companies sector, beating both the FTSE All Share index and its average peer.

Performance of fund vs sector and benchmark since July 2022

Source: FE Analytics

“The strategy is a concentrated multi-cap best ideas fund run by experienced portfolio managers with a strong record of managing UK equity portfolios,” said Forgan.

Managers focus on earnings growth, cash flow and balance sheet resilience alongside re-rating potential, resulting in a portfolio that has no size bias and a value tilt.

Forgan was not the only Fidelity manager keen on the UK’s prospects following Labour’s victory. Salman Ahmed, global head of macro and strategic asset allocation, said there were a number of reasons to be positive from a macroeconomic standpoint.

First he highlighted the UK’s relationship with Europe, which should improve as the new government aims to be more “collaborative and constructive” than its predecessor.

“This approach may lead to smoother trade negotiations, reduced tariffs and more predictable regulatory frameworks, benefiting UK businesses operating within and trading with the EU,” he said.

An 11% gap has opened up between the UK’s pre-Brexit business investment trends forecasts and the current reality, according to the Centre for European Reform, with Ahmed noting that improved relations will be “critical to attracting European and global investors back to the UK market”.

Next is fiscal restraint, with the Labour party more likely to take a cautious approach to tax increases in the short term and an improved outlook for borrowing.

“Growth will be key and political stability, coupled with movement on EU relations, may help maintain the projected fall of the debt burden without crippling spending cuts or tax rises,” said Ahmed.

Lastly, political stability should help encourage investors back to the UK, with the current government in power for the next five years, barring any major setbacks.

“Already, we have seen the government announce changes to the planning laws to help alleviate housing shortages, which signals both a willingness to act quickly and the importance of having a strong majority when it comes to delivery,” he said.

Reduced political risk could lead to lower volatility in the stock market, particularly if Labour is “consistent and transparent” in its policymaking. This would “enhance the UK’s reputation as a reliable investment destination”, said Ahmed.