What to do if you’re falling short on your retirement funds: More than half of Americans say they feel ‘behind’ on their later life savings – but experts reveal how you can catch up quick

What to do if you’re falling short on your retirement funds: More than half of Americans say they feel ‘behind’ on their later life savings – but experts reveal how you can catch up quick

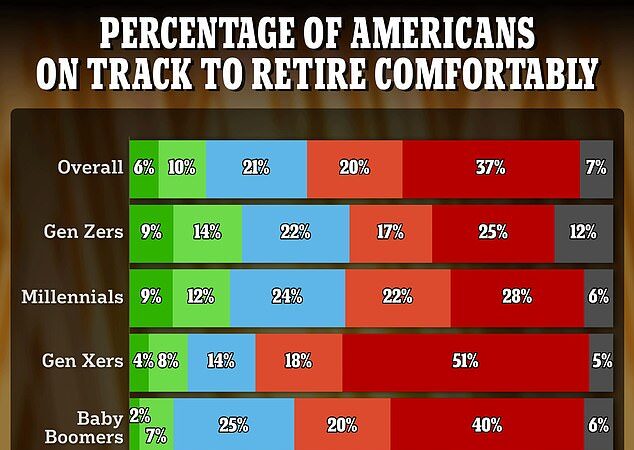

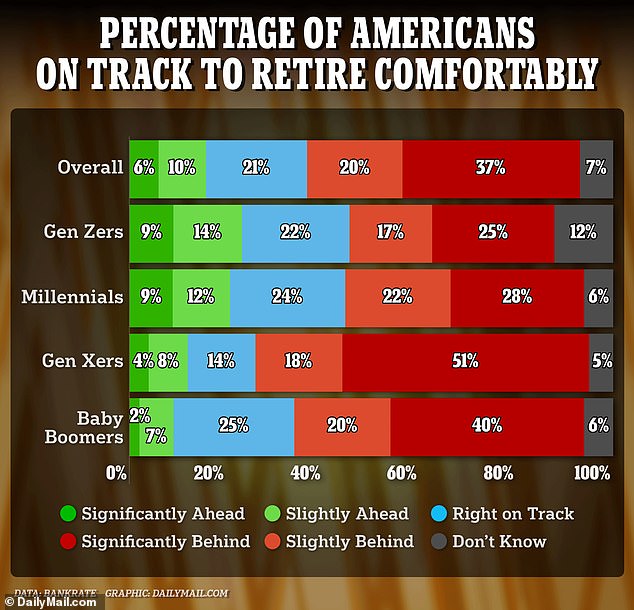

More than half of working Americans feel they are falling ‘behind’ on their retirement savings, a new survey shows.

Rampant inflation and higher interest rates are eroding workers’ opportunities to save for their twilight years – sparking fears of a nationwide ‘retirement crisis.’

The latest study by personal finance website Bankrate found around one-quarter of Americans had not made retirement contributions in at least a year.

Meanwhile one in three said they felt ‘significantly behind on their retirement savings.’

Despite the stark findings, experts insist workers can quickly catch up with the right habits.

Rampant inflation and higher interest rates are eroding workers’ opportunities to save for their twilight years – sparking fears of a nationwide ‘retirement crisis’

Certified financial planner Marissa Reale told DailyMail.com: ‘Somebody who is falling behind with their retirement funds has three options: they can reduce their expenses, invest more aggressively or they can find a way to make more money.

‘It all comes down to your saving habits. I know teachers earning $50,000 a year who save over 30 percent of their paycheck and are on track to retire much quicker than those earning more. It’s a case of keeping your savings rate high.’

According to Bankrate’s findings, 32 percent of Americans said they would need more than $1 million saved up for a comfortable retirement.

Meanwhile 45 percent said it was unlikely they would be able to save enough.

Reale recommends the 4 percent rule which means assuming you will have a 30-year retirement and will spend around 4 percent of your total savings each year.

So to calculate how much you will spend in your first year, you will need to multiple the value of your savings by 0.04. Future years will be adjusted for inflation and savers must also account for their expected social security payments – which will be around $1,907 a month from 2024.

Certified financial planner Marissa Reale told DailyMail.com: ‘ Somebody who is falling behind with their savings has three options: they can reduce their expenses, invest more aggressively or they can find a way to make more money’

Last week the Social Security Administration confirmed that payments will go up by 3.2 percent – or $59 a month on average – as part of cost-of-living adjustments (COLAs) made each year.

The increase is a stark drop from last year’s record-setting bump of 8.7 percent, which was pushed up by rampant inflation.

The program has been frequently criticized because annual COLAs are calculated for the next year using the current year’s rate of inflation.

It means that the boost comes after retirees have already suffered under the weight of high prices.

What’s more adjustments are based off the average basket of goods and services purchased by employed people rather than retirees, who typically spend more on housing and healthcare.

Campaigners have called for the COLA to be calculated using a different experimental measure called the Consumer Price Index for the Elderly, or C.P.I-E., which assesses the goods bought by those aged 62 and older.

Mary Johnson, an analyst at the advocacy group Senior Citizens League, told the New York Times: ‘If that was the law today, the COLA in 2024 would be higher.’