How has PSD2 affected the market, and will PSD3 be the answer to major problems in the industry? The evolution of PSD2 should certainly be on the minds of those in the finance industry.

In a recent survey conducted by the

Thales Group, it was found that 38% of users would consider switching their bank if another provider offered better rates or services.

This has led to increased competition among banks, neobanks, and other financial services, with each vying for user attention by introducing new features, services, and products on an annual basis. As a result, the financial market has become highly competitive.

To remain competitive and offer in-demand services such as short-term loans, buy now, pay later (BNPL), or digital wallets, financial institutions in Europe need access to their clients’ data.

However, European banks that handle client data are required to adhere to regulations that ensure the security and protection of sensitive data from potential fraudsters. This is where the Second Payment Services Directive (PSD2) comes into play.

Exploring the Legacy: PSD2

One of the most significant outcomes of implementing PSD2 is the establishment of an open payments ecosystem. This initiative, which supports open banking, has fostered increased collaboration between banks and financial institutions that were previously

restricted from entering the market. This collaboration has resulted in the introduction of numerous new products and services.

From a consumer perspective, PSD2 has simplified payments by allowing consumers to give consent to their bank to share their information with third-party providers. This has given rise to third-party providers (TTPs) that operate with strong customer authentication,

assuring users that their data will remain secure and not be misused.

Looking ahead, there is anticipation about the potential impacts of PSD3 on the financial services landscape. It is essential to understand how PSD3 might affect servic and to strategically plan for responding to upcoming changes.

What Is PSD3?

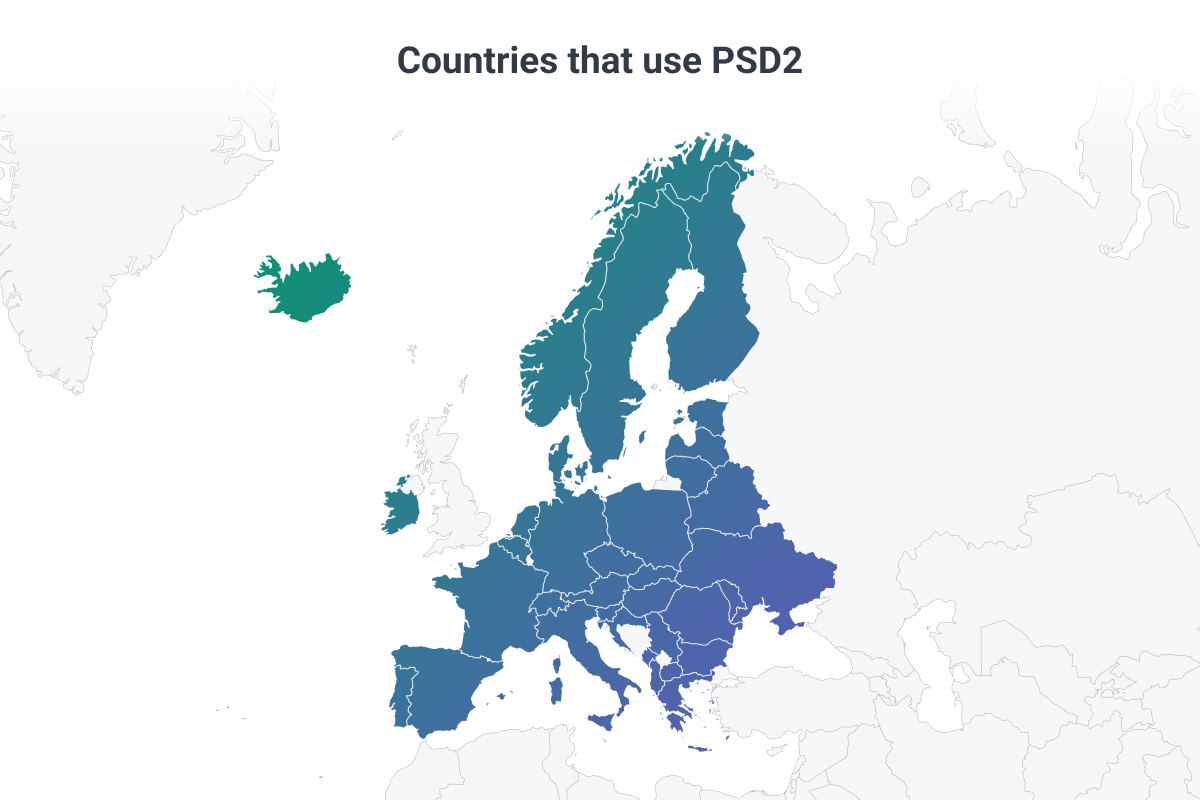

The

Payment Services Directive (PSD) is a regulatory framework governing electronic payments and the banking system in Europe and the European Economic Area (EEA). While PSD2 has been overseeing digital payments and open banking in the EEA since 2019/2020,

PSD3 is expected to continue and potentially expand this regulatory influence.

PSD1 was introduced in 2007 and was later updated in 2015 to become PSD2. The underlying idea for both directives was to establish a flexible framework for retail payments that could adapt to changes in legislation and the evolving payments market.

In last week’s panel discussion at the Open Bank Expo Europe, titled “The Open Journey to PSD3: A New Open Finance Framework,” participants agreed that the adoption of PSD2 had been slow, limiting its potential. While PSD2 achieved success in certain areas,

it lacked a standardized approach that PSD3 might aim to rectify.

Maria Palmieri, the Head of Policy at the Open Banking infrastructure provider, Yapily, emphasized the opportunity for the European Commission to address systemic issues within the growing Open Banking ecosystem.

New Initiatives for PSD3 and Their Significance for Financial Institutions

The European Commission issued feedback on PSD2 and announced on June 28, 2023, that they would be developing an updated EU retail payments strategy, known as the Third Payments Service Directive (PSD3), along with Payment Service Regulation (PSR).

Since PSD2 has had a transformative impact since its implementation three years ago, there are several critical areas that need to be addressed before new regulations are finalized. For example, some banks are concerned that the new standards may require

them to develop new APIs.

Here is an overview of key initiatives that the Commission is working on for PSD3, and how they will affect financial institutions:

1. Improving the Availability of Cash

The proposal aims to enhance access to cash, allowing retailers to offer cash services even without a purchase. It also includes measures such as withdrawal caps and mandatory fee disclosure to ensure fair competition with ATMs.

What this means for financial institutions: Financial institutions must adapt to these changes, as they will likely encounter more diversified methods of accessing cash services. Ensuring smooth access to cash for customers, even without a purchase, will

be a consideration for financial institutions.

2. Combatting Payment Fraud

PSD3 introduces measures to fortify security and consumer protection. These changes will demand adjustments in fraud prevention mechanisms and authentication processes within financial institutions, ensuring robust safeguards against fraudulent activities.

The directive mandates more stringent consumer authentication rules and extends refund rights for individuals falling victim to fraud.

What this means for financial institutions: Financial institutions will be required to facilitate the sharing of fraud-related information among payment service providers. Additionally, it makes it mandatory to align payees’ IIBAN numbers with their account

names for all credit transfers.

3. Improvements to Open Banking

The proposal strives to make targeted amendments to improve open banking while avoiding radical changes. It introduces requirements for dedicated data access interfaces, a list of prohibited obstacles to data access, and clear liability and dispute resolution

mechanisms.

What this means for financial institutions: Financial institutions should view this as an opportunity to expand their service offerings, potentially through innovative partnerships and solutions, to remain competitive in a rapidly evolving financial environment.

4. Enhancing Consumer Rights

PSD3 aims to provide responsible access to customer data across various financial services, expanding beyond open banking. Customers will have the right to access their data and grant access to firms for innovative services while ensuring that payment service

providers access and process personal data only as necessary for specific payment services.

It strengthens data protection for payment service users in the context of Open Banking services and clarifies the processing of personal data related to payment transactions.

What this means for financial institutions: Institutions must revamp their procedures to comply with these requirements, ensuring that customers’ rights are respected and transparently communicated. This includes addressing concerns related to the temporary

blocking of funds, enhancing transparency in account statements, and providing clearer information on ATM charges.

5. Changes Regarding E-Money Institutions

The proposal merges the regulatory regimes for e-money institutions (EMIs) and payment institutions (PIs) into a single piece of legislation to enhance harmonization and simplification.

What this means for financial institutions: For financial institutions, this means simplified cross-border transactions and enhanced accountability. Adherence to the established rules and regulations is essential, promoting a more secure and reliable payment

ecosystem.

6. Addressing Competition Issues for Non-Bank Payment Service Providers

The proposal aims to facilitate easier access to payment systems for non-bank institutions such as payment institutions and e-money institutions.

What this means for financial institutions: Financial institutions need to be prepared to engage with a more diverse and competitive landscape, as they will encounter non-bank players seeking access to the same systems. This shift could lead to new partnerships,

synergies, and business models, necessitating financial institutions to adapt to the evolving ecosystem.

Goals of PSD3

The goal of these initiatives is to enhance access to consumer and business financial data, improve data sharing, and provide customers with greater control over their data.

The Head of Unit at the European Commission, Eric Ducoulombier, expressed confidence in these improvements, highlighting their potential to boost open banking’s role as a source of innovation and competition, especially in conjunction with instant payments.

These developments align with GDPR regulations and contribute to the broader European strategy for data access and sharing in the financial sector.

The Importance of API Standardization

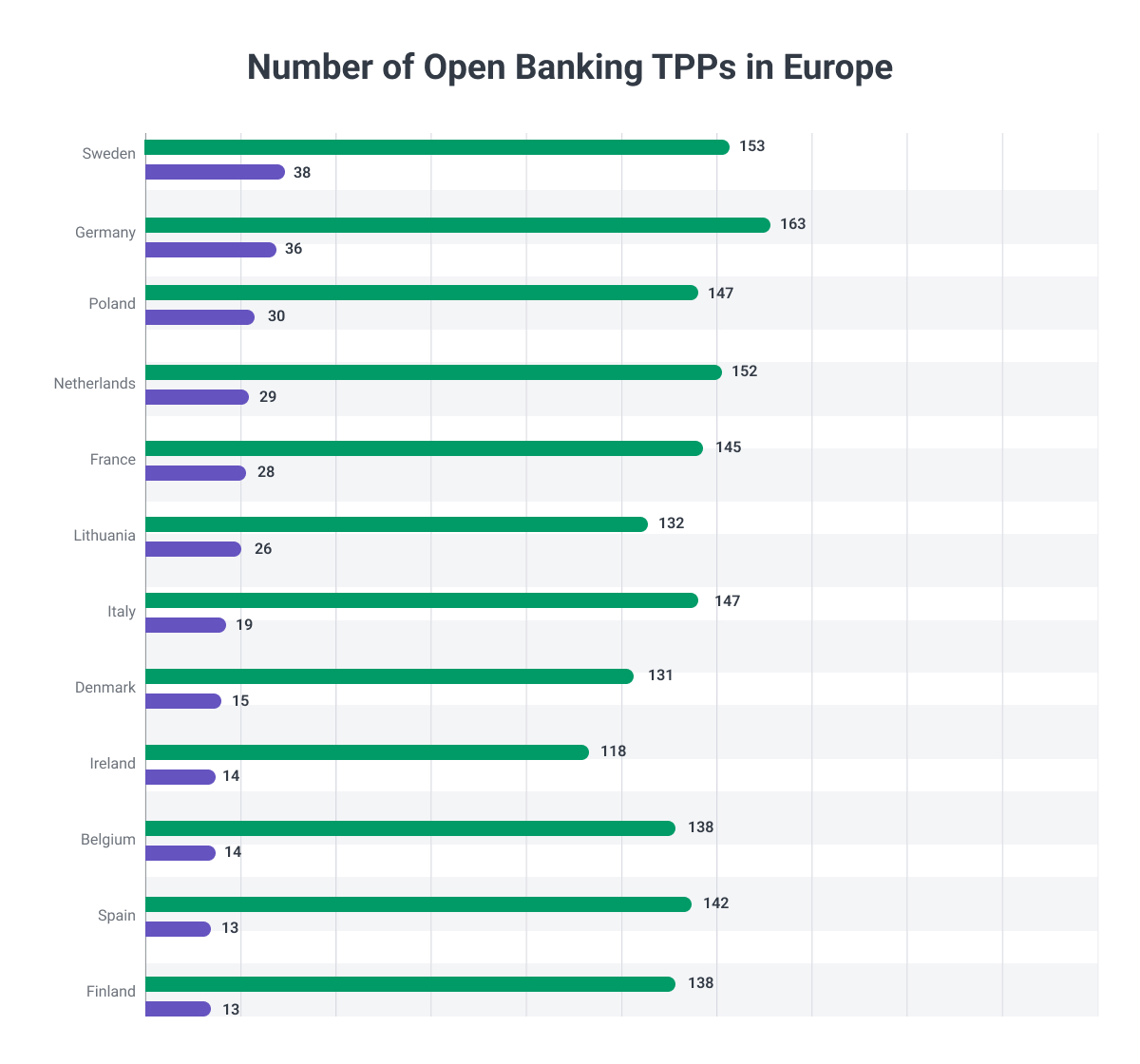

APIs play a crucial role in enabling the sharing of payment account information between third-party providers (TPPs) and account servicing payment service providers (ASPSPs).

The lack of API standardization within PSD2 has contributed to fragmentation in the payments market. To address this, PSD3 is likely to focus on developing API standardization, helping unify the market.

Standardizing APIs will simplify interoperability and provide a more consistent experience across different payment systems and methods used in Europe. This standardization is expected to support the goals of open banking and foster collaboration between

banks and TPPs.

Examples of Collaboration between Banks and TPPs

Digitalization of financial institutions is reaching a significant level, with

banks increasingly partnering with third-party fintechs to offer innovative services to their customers.

These collaborations benefit legacy banks by allowing them to rapidly adopt features that meet the expectations of younger generations of bank users.

Examples of such collaborations include:

- Caixa Geral de Depositos + Backbase: The largest bank in Portugal is working with Backbase to enhance its digital innovation

and offer new services to SME customers. - Deutsche Bank + Traxpay: Deutsche Bank partnered with Traxpay to integrate supply chain financing solutions

into its services. - ABN AMRO + Subaio: ABN AMRO collaborated with Subaio to offer users a convenient way to manage recurring payments.

- N26 + Wise: N26 and Wise (formerly TransferWise) joined forces to provide users with a seamless way to send money abroad using their N26 bank accounts.

Future Outlook

In a rapidly evolving financial landscape, banks cannot afford to ignore the future. Institutions that embrace innovation and work with fintechs and TPPs are likely to be more competitive.

As technology partners with expertise in fintech continue to provide guidance and develop exciting products, both financial and non-financial institutions will be better prepared to navigate market changes

and explore new avenues for growth.

PSD3 holds the potential to address pressing issues and offer support to institutions within the EU financial landscape.

While it will take time to witness the actual changes, PSD3 presents the opportunity for financial institutions to reinforce their commitment to consumer protection, enhance competitive capabilities, and drive innovation.