(Bloomberg) — The British public is providing the government an unexpected funding boost in the run-up to the Budget, easing some of the pressure on markets that are having to absorb a record supply of government bonds.

Retail investors bought more than £13.5 billion ($17.1 billion) of National Savings and Investments products on balance in the first nine months of the financial year, almost double the amount expected for the whole of 2023-24, analysis of Bank of England data shows.

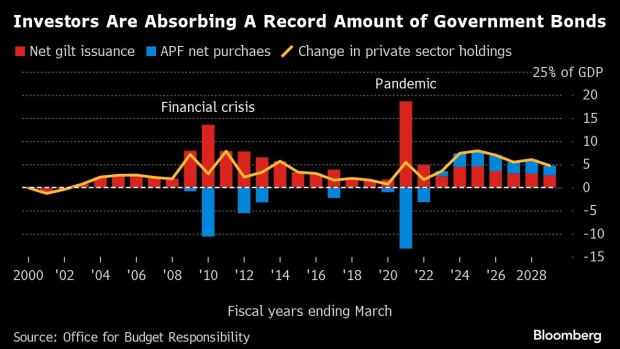

The rush by ordinary investors is helpful for the Treasury because it comes at at time when bond markets are being asked to buy gilts to finance the budget deficit as well as those sold by BOE as it unwinds its quantitative-easing program. Together, the two are expected to amount to a net £204 billion in the coming fiscal year, according to RBC Capital Markets. UK bond yields have risen faster than peers so far in 2024, with the 10-year rate trading around 4.2%.

Analysts said more could be raised from retail investors through the government savings bank in the next financial year. The Debt Management Office will reveal its updated financing plans alongside the Budget on March 6.

The DMO said that it expected to raise £7.5 billion at the time of the Autumn Statement in November. However, much more has been raised as savers are enticed by higher rates offered by the government savings bank.

Sanjay Raja, chief UK economist at Deutsche Bank, said retail investors were “coming to the rescue” of Chancellor of the Exchequer Jeremy Hunt by offsetting an overrun in the government’s net cash requirement.

The NS&I inflows coincided with the state-backed bank raising rates on several of its products, with inflows of almost £8 billion in September alone. Those rates have since come tumbling down again on conviction the BOE’s monetary tightening campaign is over.

Mark Capleton, rates strategist at Bank of America, said it was hard for the government to “finesse the exact flows” into NS&I given the volatile rates environment. He said the recent surge is unlikely to mark a policy shift to bring in more retail investors but added that the UK could use this source more in the future.

“There has been some debate about whether they would use retail products as a form of diversification of financing when the gross financing need is so large,” he said. “I do think there is a a strong possibility that next year we see greater use of NS&I.”

To be sure, the UK’s retail bond program pales in comparison to those in other countries. Italy is currently selling a new retail bond that has already amassed over €11 billion in orders and is set to surpass the previous record of €18 billion set in July, according to Rabobank strategists.

The short-maturity of NS&I’s offerings also differ from the longer-dated nature of gilt financing, meaning it will soon need to be refinanced by the government.

“From a market’s perspective, both NS&I and retail bond issuance are likely to be viewed as short-dated funding sources,” said Imogen Bachra, head of non-dollar rates strategy at NatWest Markets. “Although on the surface it helps to solve the DMO’s supply-demand imbalance, it doesn’t necessarily help with the duration mismatch of supply and demand.”

©2024 Bloomberg L.P.