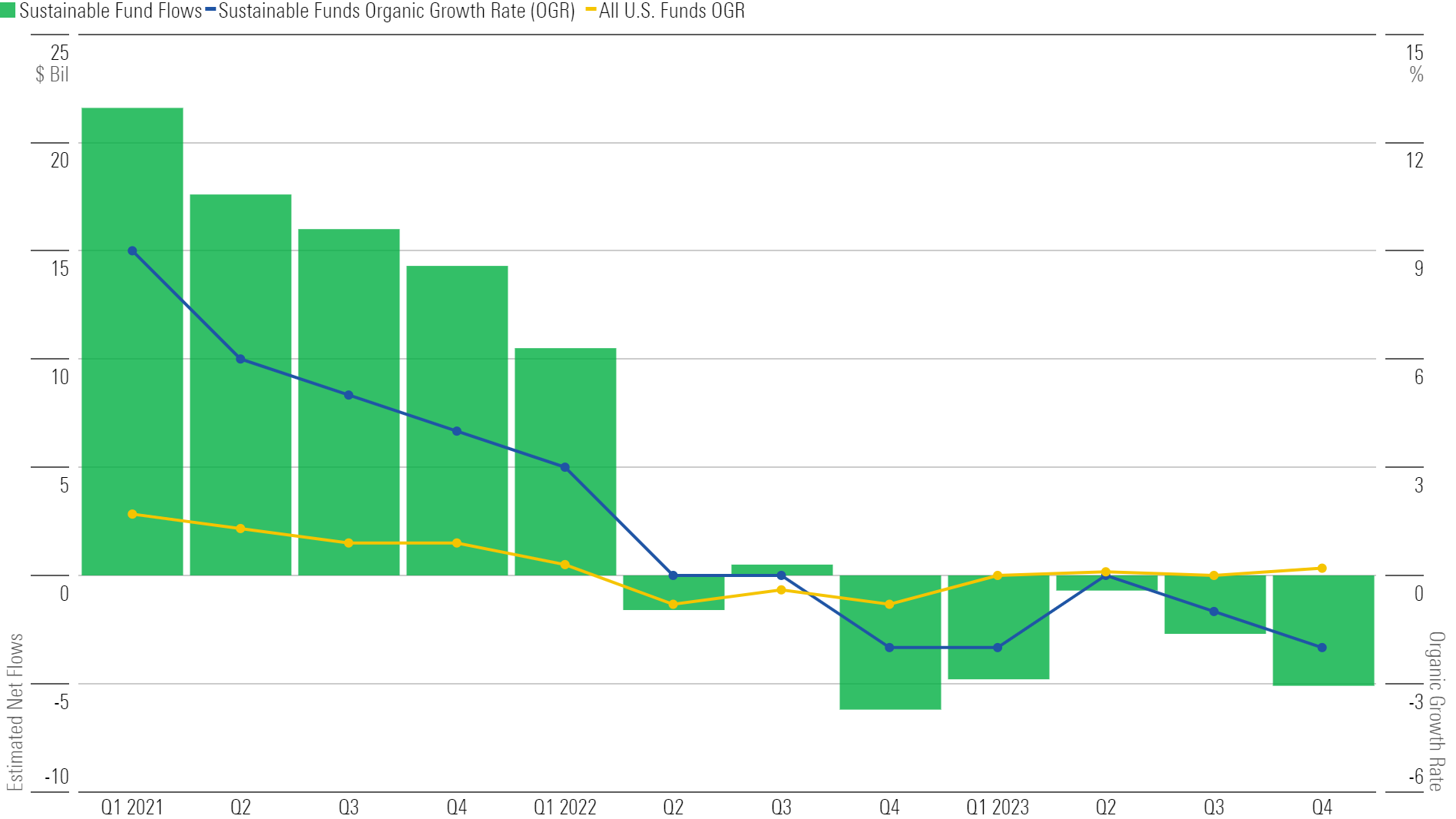

Investors continued their flight from sustainable funds in 2023′s fourth quarter. U.S. sustainable funds suffered their first calendar year of outflows since Morningstar began keeping track more than 10 years ago, making 2023 their worst calendar year on record. Investors pulled $5 billion from U.S. sustainable funds in the fourth quarter for a total of $13 billion last year amid lagging performance, continued political scrutiny in the United States, and a bad year for an iShares fund.

See below for a sneak preview of our annual sustainable funds landscape (the 2022 edition is here).

ESG Funds’ Performance Recovers From 2022′s Lows, but Demand Remains Weak

Sustainable equity funds generally underperformed their conventional peers in 2023, though not by as large a margin as in 2022. The median sustainable large-blend equity fund gained 20.8% in 2023, versus 23.9% for the overall category (encompassing both sustainable and conventional funds) and 26.9% for the Morningstar US Large-Mid Cap Index. Some of the macroeconomic pressures that contributed to their underperformance—such as high interest rates and supply chain disruptions—continue to feature in market outlooks for 2024.

In addition to middling returns, greenwashing concerns persisted in the absence of clear, cross-border regulation for environmental, social, and governance and sustainable investing. Finally, especially within the U.S., continued political scrutiny of sustainable and ESG strategies contributed to a chilling effect on demand for these funds.

While sustainable funds lost money in 2023′s fourth quarter, the overall universe of U.S. long-term open-end and exchange-traded funds, encompassing conventional funds as well as sustainable funds, collected more than $40 billion over the period. Net inflows of $40 billion hardly move the needle for U.S. funds overall, where assets totaled more than $26 trillion at the end of the year. Nevertheless, this marked the fifth consecutive quarter where investor appetite for U.S. sustainable funds was weaker than for their conventional counterparts.

The organic growth rate of sustainable funds, which is calculated as net flows as a percentage of total assets at the start of a period, puts the magnitude of net flows and redemptions into perspective. During the fourth quarter, sustainable funds contracted by 1.7%. By comparison, overall U.S. funds grew by a humble 0.2% during the period.

One iShares Fund Loses Investors in 2023

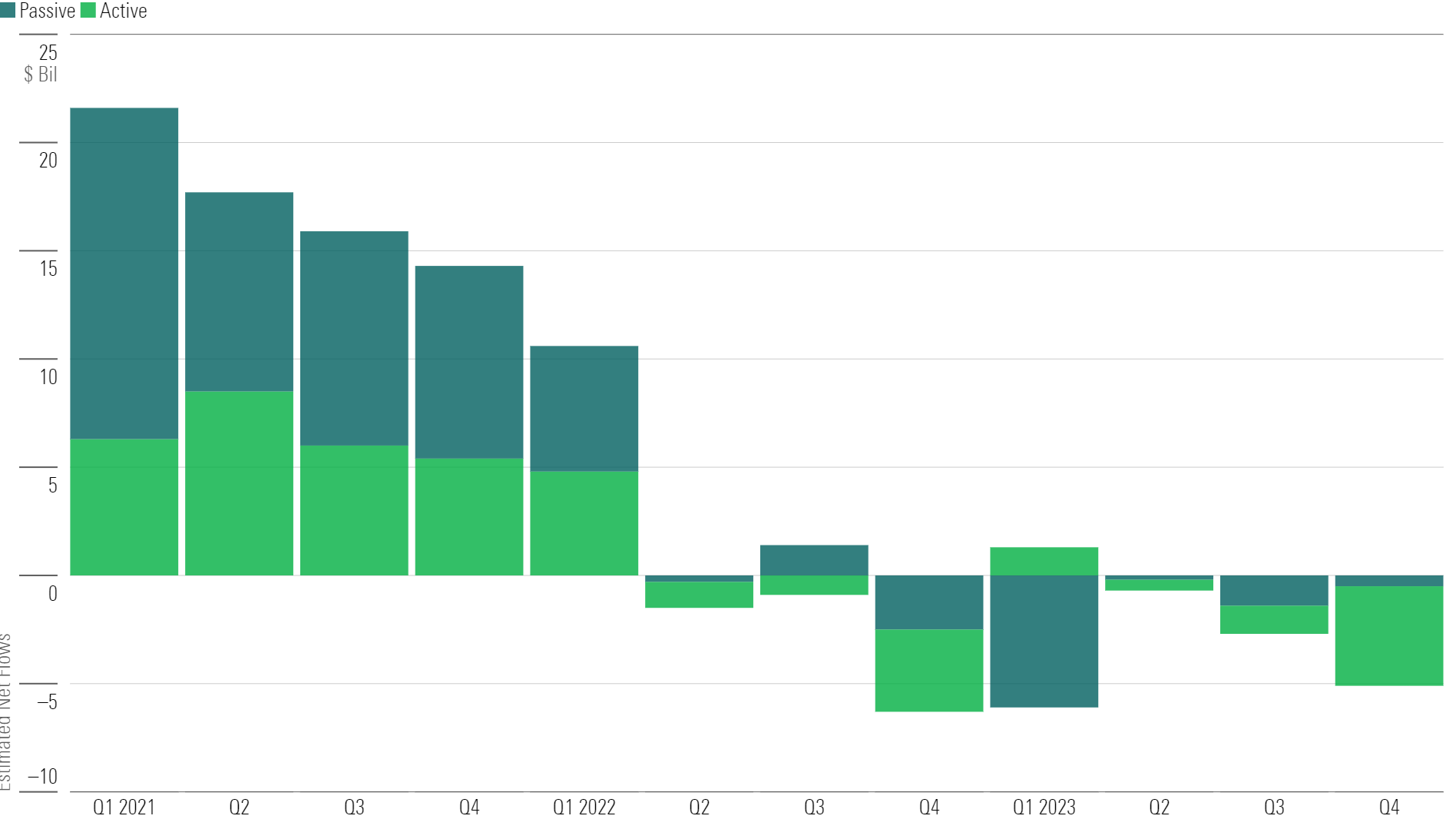

Actively managed sustainable funds shed $4.6 billion during the fourth quarter, which accounted for roughly 90% of net withdrawals from all sustainable funds.

Still, one passive sustainable fund accounted for a substantial portion of 2023′s outflows. Investors pulled more than $9 billion from iShares ESG Aware MSCI USA ETF ESGU during the year, nearly 4 times as much as the runner-up, Xtrackers MSCI USA ESG Leaders Equity ETF USSG. Roughly two thirds of the outflows occurred in 2023′s first quarter (matching a change in BlackRock’s flagship target-allocation ETF model portfolios, which mostly replaced iShares ESG Aware MSCI USA ETF with iShares MSCI USA Quality Factor ETF QUAL). Without this fund, sustainable passive funds would have netted more than $1 billion over the year.

On a quarterly basis, Parnassus bore the brunt of the outflows, with two funds—Parnassus Core Equity PRBLX and Parnassus Mid Cap PARMX—ranking among the worst for fourth-quarter withdrawals. Parnassus Core Equity has been one of the 10 biggest losers in terms of outflows for more than two years straight, shedding more than $4.5 billion over that period. Even so, Parnassus Core Equity remains the largest U.S. sustainable fund with a $10 billion lead over runner-up Vanguard FTSE Social Index VFTNX. Parnassus attributes a portion of the fund’s outflows to the launch of a less-expensive collective investment trust and the subsequent conversion of investors from one vehicle to the other. Our data includes only open-end and exchange-traded funds.

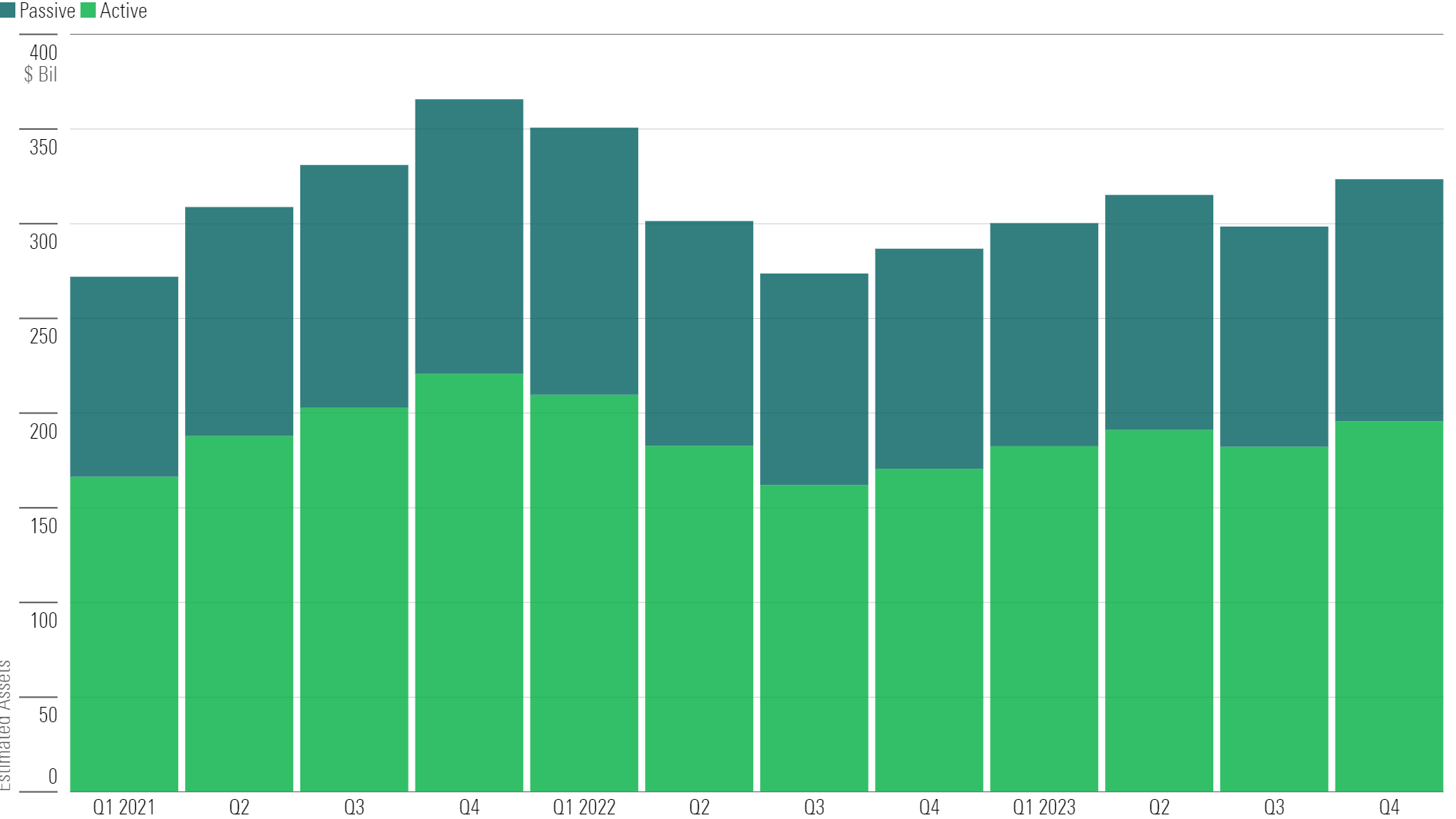

Rising Markets Lift ESG Fund Assets

Despite outflows and although sustainable equity funds tended to lag their conventional peers in terms of 2023 returns, market appreciation carried sustainable fund assets higher to close out the year.

Assets in sustainable funds climbed to $323 billion at the end of 2023. This represents a nearly 12% decline from the record at the end of 2021 but an 18% increase from the recent low in 2022′s third quarter. By comparison, assets in the broader U.S. funds landscape also peaked at the end of 2021 and slid by 5% through to the end of 2023.

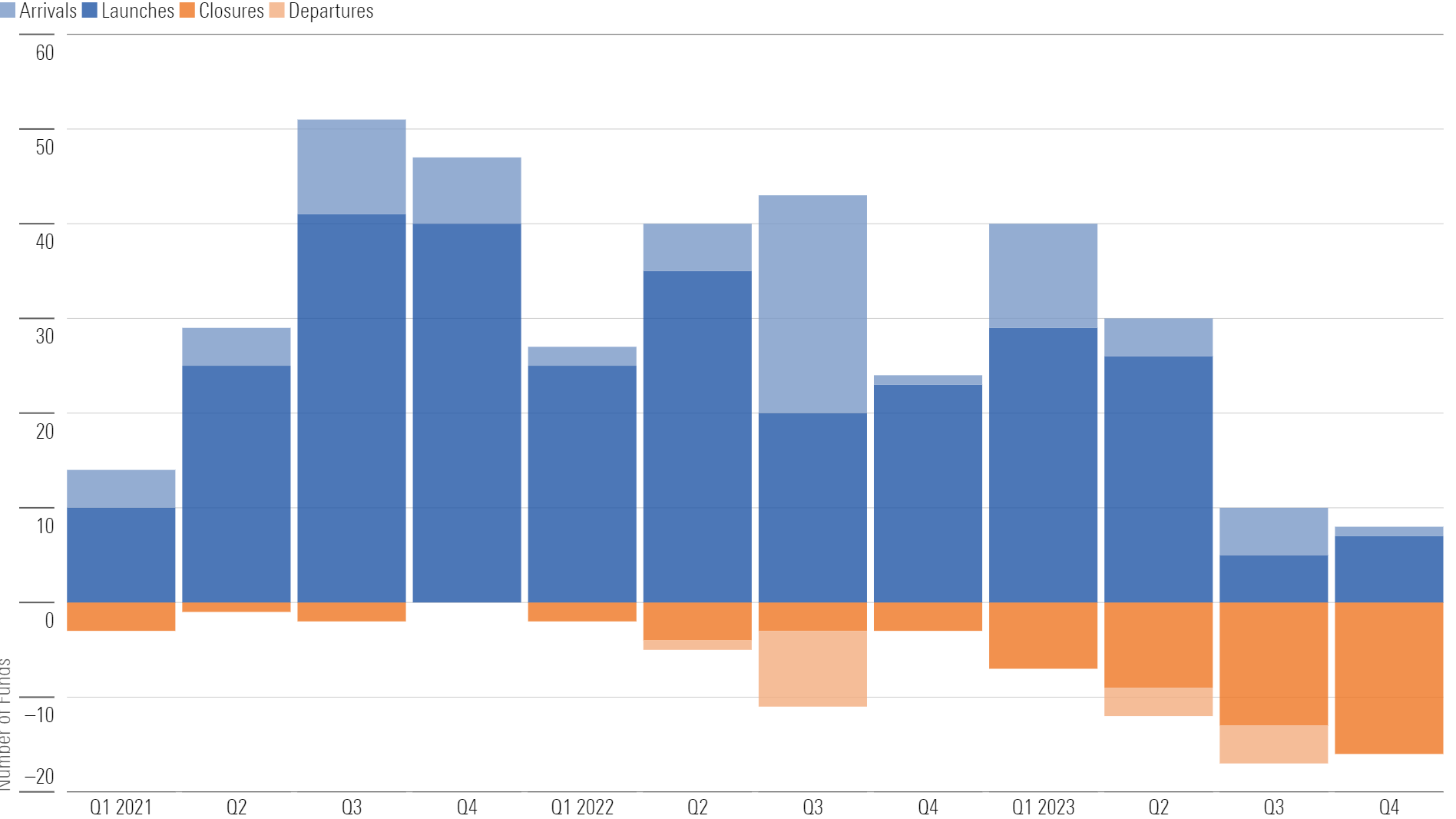

Sustainable Fund Closures Continue

For the second consecutive quarter in recent history, sustainable fund closures outpaced launches. In the fourth quarter, seven new sustainable funds were launched and one existing fund was added to the sustainable funds landscape (labeled Arrivals in the exhibit below). During the same period, 16 sustainable funds were liquidated.

The largest new fund is Vontobel Global Environmental Change ENVRX, which opened in October and closed the year with $11.5 million in assets. The fund seeks to invest only in companies that contribute to positive social or environmental impact, such as clean energy infrastructure, clean water, and low-emissions transportation.

Out of the 16 sustainable funds that were liquidated in the fourth quarter, some of the largest (in terms of assets) were emerging-markets debt strategies from BlackRock. BlackRock Sustainable Emerging Markets Flexible Bond had amassed nearly $35 million in its two years on the market before the firm closed it in December.

Sustainable Funds Deliver Mediocre Returns in 2023

When it came to performance, sustainable funds held up much better in 2023 compared with 2022. Sustainable fixed-income funds performed roughly in line with peers, although sustainable equity funds tended to lag the competition.

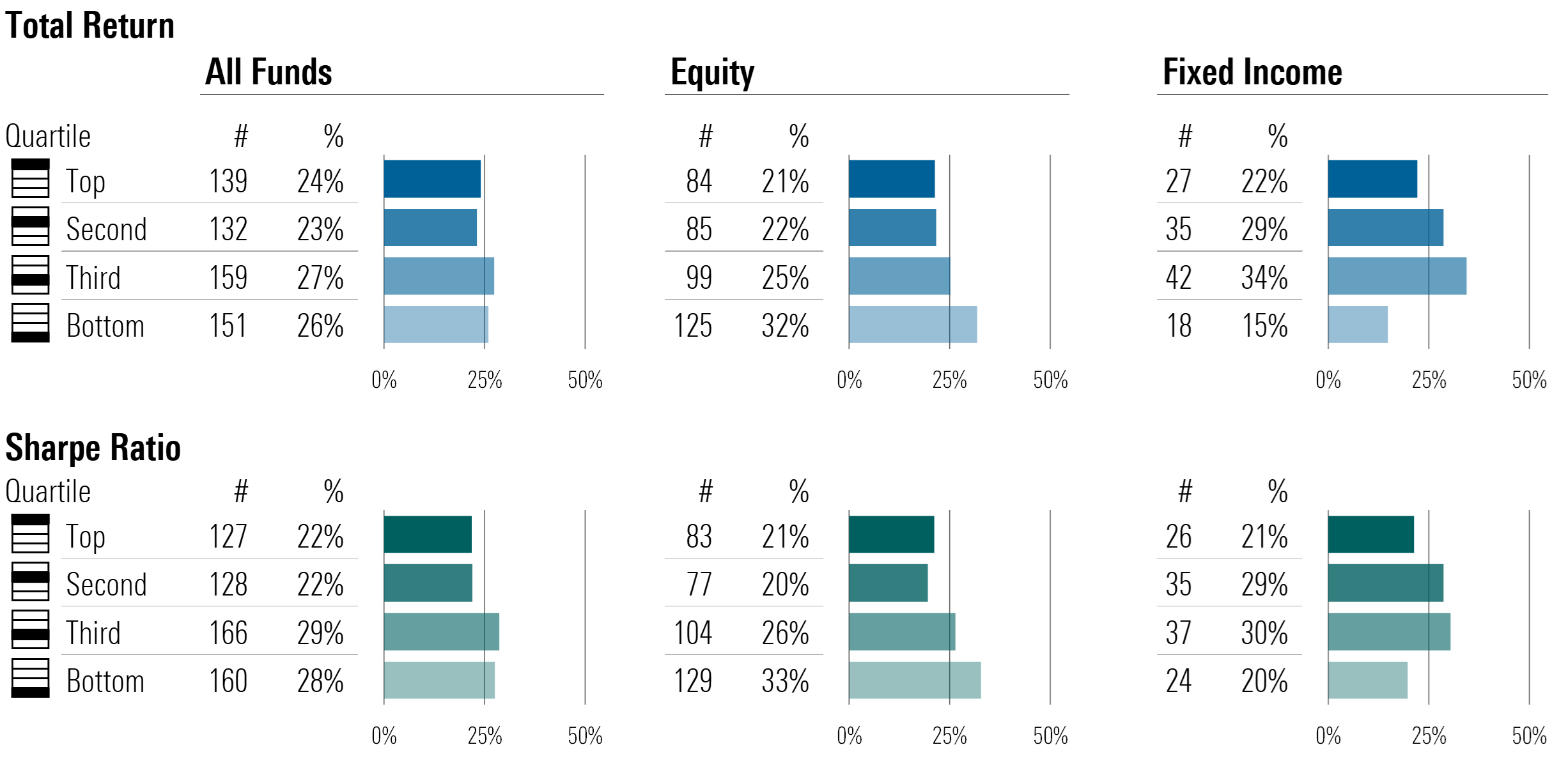

The exhibit below shows how sustainable funds’ total and risk-adjusted returns (as measured by the Sharpe ratio) compared with their respective Morningstar Category peers. On the whole, sustainable funds lagged their conventional peers by a small margin, with 53% of sustainable funds landing in the bottom half of their respective categories.

Equity funds suffered the worst of the underperformance, and 32% of sustainable equity funds dropped to the bottom quartile relative to peers. Among large-blend equity funds (the largest grouping within the U.S. sustainable funds landscape), the median return for sustainable funds was 20.8% in 2023. This trailed the 23.9% median gain for the overall category (encompassing both sustainable and conventional funds) as well as the 26.9% gain for the Morningstar US Large-Mid Cap Index.

The new offerings and repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the U.S. to 647 at the end of the year.

List compiled on Jan. 8, 2024. Flows data pulled on Jan. 11. Revised totals as far back as first-quarter 2021 (inclusive).