Air travel is seeing an upswing, with the International Air Transport Association (IATA) forecasting 4.35 billion global passengers carried this year alone.

This resurgence, however, presents an ironic twist. As air travel soars, so does the urgency to reduce emissions—not just in airlines but also airports.

Two global powerhouses, the U.S. and European Union (EU), are navigating this challenge, but their compasses point in very different directions. Whereas the former is investing in new airport infrastructure and modernizing facilities to meet ambitious climate goals, the latter is choosing to combat emissions by restricting the number of flights.

The U.S.: Reimagining Infrastructure

The U.S. is staring at a daunting projection: a 158% increase in passenger traffic by 2040 compared to 2019 levels, according to Airports Council International (ACI). This massive influx demands advanced infrastructure to accommodate passengers, ensure seamless operations, stimulate competition and offer world-class customer experiences. These aren’t mere niceties; they’re necessities, especially if you consider that airports contributed an impressive 7.2% to the U.S. GDP pre-pandemic.

But beyond bracing for this surge, there’s another colossal challenge—the commitment to reducing CO2 and other greenhouse gases.

The Federal Aviation Administration (FAA) recently allocated over $90 million to help 21 U.S. airports achieve zero emissions by 2050. It’s a laudable step, aligning with the 2021 Aviation Climate Action Plan, but a gaping financial abyss remains.

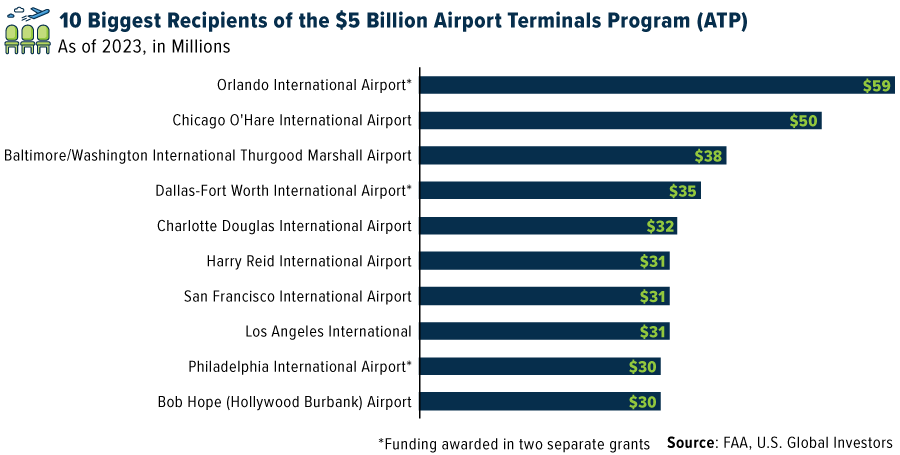

Nevertheless, thanks to the Bipartisan Infrastructure Law, signed in 2021, many U.S. airports are being awarded tens of millions of dollars to upgrade terminal buildings and improve energy efficiency. Among the biggest recipients of federal money is the Dallas-Fort Worth International Airport (DFW), which is getting $25 million to replace an aging HVAC system, install dimmable smart glass in terminal windows and reduce nitrogen oxide (NOx) emissions. A further $10 million is set aside for DFW’s new renewable energy plant, which is on track to deliver 100% net-zero carbon power by 2030.

These grants don’t include the billions that airports are already investing in themselves. The most notable example by far is Los Angeles International (LAX), the fifth-busiest airport in the U.S. and sixth-busiest in the world, which is spending a staggering $30 billion in anticipation of the 2028 Summer Olympics, to be held in LA. It’s believed to be the largest public works program in the city’s history.

Here in San Antonio, home to U.S. Global Investors, the international airport (SAT) is undergoing a $2.5 billion expansion and improvement plan. In addition to getting a third terminal, the airport has plans for a new ground loading facility, which will bolster its capacity. Last month, SAT saw over 1 million passengers, a new record for July traffic.

The European Strategy: Restriction & Redirection

Europe, in contrast, paints a different narrative. While the U.S. leans into infrastructure enhancement and modernization, the EU is nudging its citizens toward alternative modes of transportation.

France stands out in this respect. In May, the country banned domestic, short-haul flights between cities where train alternatives exist. And yet some critics believe this doesn’t go far enough, with some calling for stricter measures such as eradicating flight tax benefits or progressive taxing of frequent fliers.

The same is taking place in the Netherlands. Last month, the Dutch government won a case to cap the number of flights at Amsterdam Airport Schiphol, the country’s main international airport and Europe’s third-busiest airport, having handled 52.5 million passengers in 2022. As a result of the ruling, aircraft movements—defined as the number of arrivals and departures into and out of the airport—will be reduced to 460,000 annually from the current cap of 500,000, before being reduced further to 440,000.

The decision has been met with resistance, as you might expect. Major airlines, including KLM Royal Dutch Airlines, the largest carrier at Schiphol, Delta Air Lines and easyJet, have expressed their disappointment and are advocating for sustainability measures similar to those seen in the U.S.

An Inevitable Crossroads

Both continents aim for the same horizon—a sustainable future for air travel. The difference is that the U.S. is betting on infrastructure improvements and a drive toward modernization, while Europe is gravitating toward shaping traveler habits via regulations and restrictions.

Will the U.S. infrastructure upgrades, with a keen eye on environmental commitments, prove sustainable in the face of rising demand? Conversely, can European restrictions effectively reduce emissions without hampering economic growth and connectivity?

The answers may not be immediate, but as investors, we must remain engaged and informed.

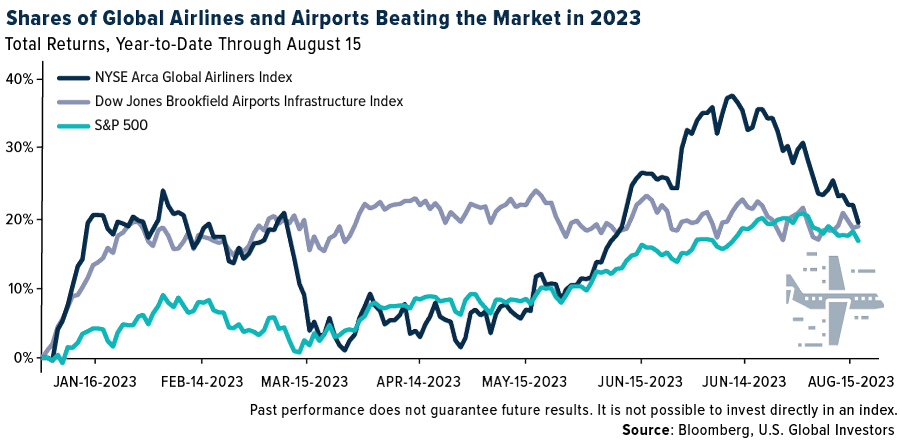

We still like publicly traded airport operator stocks, our favorites being Grupo Aeroportuario del Sureste and Spain-based Aena SME, mainly because they maintain strong moats, or barriers to entry by new competitors. As you can see above, shares of global airlines, as measured by the NYSE Arca Global Airlines Index, and airports, as measured by the 10-member Dow Jones Brookfield Airports Infrastructure Index, are marginally ahead of the market so far this year. Wheels up!

Check out our latest video: 7 Terms to Know When Investing in Airlines

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 2.21%. The S&P 500 Stock Index fell 2.11%, while the Nasdaq Composite fell 2.59%. The Russell 2000 small capitalization index lost 3.41% this week.

- The Hang Seng Composite lost 5.37% this week; while Taiwan was down 1.32% and the KOSPI lost 3.35%.

- The 10-year Treasury bond yield rose 9 basis points to 4.252%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was xxxx, up xx.x%. Embraer reported its second quarter 2023 results. Adjusted EBITDA was $149 million, which was well above consensus. Main positives included EBITDA margin was 11.5%, up 10 points quarter-over-quarter, top line was $1.3 billion, 23% above consensus, and gross margin on the commercial aviation segment was 12.9%, at the best level since the second quarter of 2022.

- The container shipping spot rate has rallied by 13% since late-June, especially for Asia-Europe, with a 17% increase, and Asia-West Coast/East Coast with 72%/49% increase, respectively. The recent spot rate hike is happening due to three reasons: 1) peak season with cargo volume rebound, with Europe end-market demand bottomed out; 2) shipping lines temporarily reducing capacity by slowing speed and idling ships; 3) Panama Canal drought could absorb 2% of total container shipping capacity.

- After meaningfully underperforming international bookings over the better part of this year, domestic bookings are continuing to recover in recent weeks. On a trailing four-week basis, domestic sales have accelerated nearly 8% compared to international sales at 5% points. This week, however, the rate of growth still favors international, with domestic sales up 7.9% and international up 13.9% year-over-year.

Weaknesses

- The worst performing airline stock for the week was xxxx, down xx.x%. Eighty-eight Ryanair flights to and from Belgium’s Charleroi airport on August 14-15 were cancelled due to a strike by the airline’s pilots based in the country, according to the airport’s website. The strike is the pilots’ third this summer, after action on July 15-16 and July 29-30, as they seek higher wages and better working conditions.

- Flight activities of the global air freight industry decreased 5.7% year-over-year in July. This is the 16th consecutive year-over-year decline in monthly flight hours. The 12-month moving average hit a new low in July and with underlying leading demand indicators firmly lodged in contraction territories, there is limited visibility into an inflection point in the air freight cycle.

- “Wheels Up,” a provider of on-demand private aviation in the U.S., postponed the release of its financial results last week stating that “absent the ability of the Company to obtain this additional funding in the near-term, the Company has concluded that there is substantial doubt” about its ability to continue operations. The SEC filing also disclosed that Delta Air Lines provided a short-term capital fusion into the company in the form of a secured promissory notes, but the amount of funding was not disclosed.

Opportunities

- The Mexican government is launching a new airline by reviving the Mexicana brand. Per the government, it is leasing 10 737-800s with a single-class, 180-seat layout, and prices 18-20% above current. The primary base will be the Mexico City airport, with the airport under construction in Tulum to be the secondary base.

- DFDS, a Danish international shipping and logistics company, has upgraded 2023 EBITDA guidance from DKK 4.8 billion (bn) to DKK 5.2bn (up from DKK 4.5bn to DKK 5bn previously, with DKK 4.97bn delivered in FY2022), in an unscheduled announcement. The midpoint of the new range is 4% above company-compiled consensus EBITDA of DKK 4.79bn.

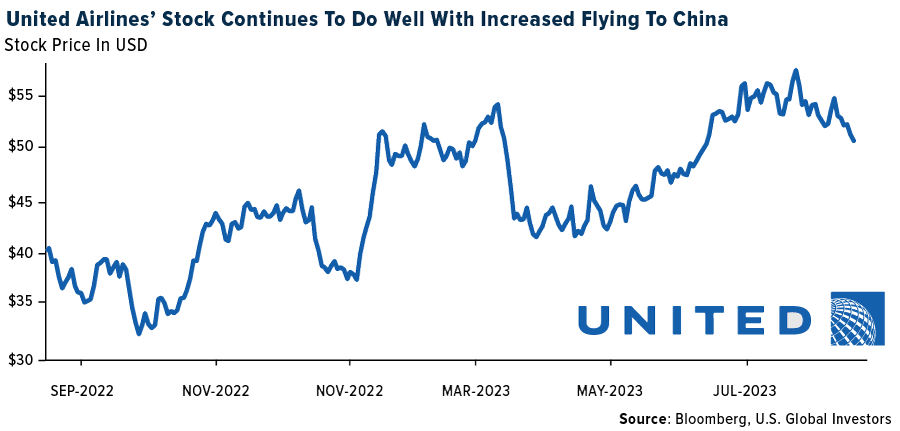

- United Airlines is set to increase the number of flights to China. Last week, the U.S. Department of Transportation (DOT) announced that the number of passenger flights between the U.S. and China will double in the coming months, with the first phase starting September 1 and increasing the number of flights from 12 weekly round trips to 18. The second phase will begin October 29, increasing weekly round trips to 24 flights. In response to this announcement, United Airlines will resume daily flights between San Francisco and Beijing this November and reintroduce daily flights to Shanghai from San Francisco starting in October.

Threats

- Cowen does not have an estimate to share on the impact of the Maui fires, but expects it to be meaningful for Hawaiian Airlines (HA). HA and Southwest are offering $19 fares to help people leave the island and the major U.S. airlines are also working to help their passengers return to the mainland. United, for example, flew empty planes (likely with relief supplies) to help their guests leave and American flew wide-body aircraft in from Los Angeles to help evacuate their passengers.

- A severe drought in Panama is leading to unusually long delays and tough restrictions along one of the world’s most important trade routes, illustrating the challenge that climate change poses to global commerce. High temperatures and one of the driest years on record have led authorities in the Central American country, which is usually one of the world’s wettest, to lower the number of crossings and bar ships with heavy loads from using the Panama Canal. The restrictions — rare during Panama’s wet season, which lasts from May to December — have led big carriers including German group Hapag-Lloyd to announce surcharges for routes that rely on the gateway between the Atlantic and Pacific.

- BofA Flight Signals, the group’s proprietary indicator of airline unit revenues six months out, fell to -2.6 for the fourth quarter of 2023 (from +2.5 last quarter). The indicator is now based on year-over-year figures versus 2019 comparisons since the pandemic has been decelerating since the second half of 2022, given higher capacity and lower fuel prices. This indicator shows how unit revenues could trend, and the latest indicator lines up with BofA’s models, suggesting domestic unit revenues could weaken further from -5.9% in the third quarter to -8.1% in the fourth quarter.

Luxury Goods and International Markets

Strengths

- Pandora, a Danish jewelry maker, raised its revenue forecast this week, supported by stronger sales of lab-grown diamonds. On Tuesday, the company announced second-quarter earnings that beat analysts’ estimates, showing full-year sales increasing as much as 5%. Pandora sells synthetic diamonds in the U.S., the UK, and Canada, with the price tag going as high as $4,450 for a 2-carat synthetic diamond rind.

- The Eurozone’s economic sentiment index (ZEW Survey of Expectations) increased to -5.5 in August, the highest in four months, from -12.2 in the previous month. The improvement in expectations of Europe’s economic situation was driven by hopes that interest rates would stop rising in the near future.

- Seoul Auction CO Ltd. was the best performing S&P Global Luxury stock in the past five days, gaining 2.87%, without any important news to report.

Weaknesses

- Tesla sold 64,285 China-made electric cars in July, down 31% from June’s total but up 128% from the same quarter last year. The company reported a 31% decline in sales in mainland China month-over-month. Tesla, once again, cut car prices. Shares traded lower on concerns of further pressure on its profit margins.

- Tapestry, the company that recently announced buying Capri Holdings for $8.5 billion, released weaker-than-expected results. The company reported full-year revenue of $6.9 billion, above last year’s, but below analysts’ estimates of $6.94 billion. After Tapestry’s acquisition of Capri Holdings is finalized next year, it will be the second-largest luxury player behind LVMH in the United States.

- Farfetch Ltd. was the worst performing S&P Global Luxury stock in the past five days, losing 48.82%, after the company reported weak second quarter financials.

Opportunities

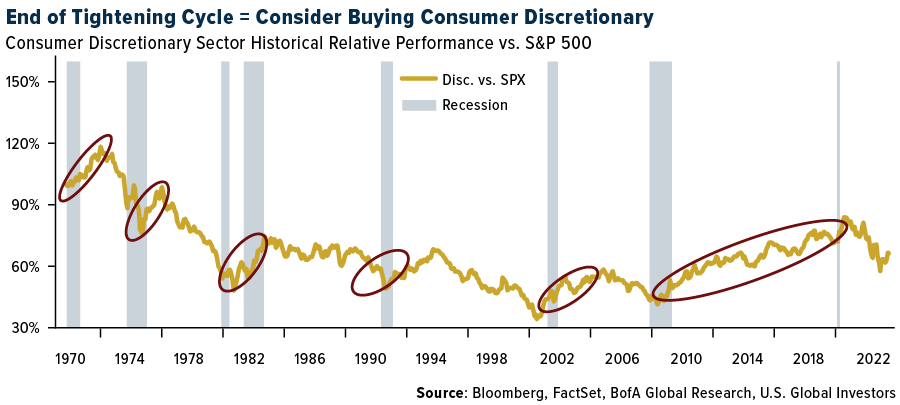

- Bank of America’s research team advised investors to overweight consumer discretionary stocks and lower exposure to staples. The broker expects no recession to take place in the United States and predicts a rise in U.S. consumption growth by 100 basis points this year. Because we are at the end of the tightening cycle, this should bode well for consumer discretionary stocks.

- In another research piece from Bank of America this week, highlighting the luxury sector, the group says that Chinese consumers will progressively start spending more offshore. In the second quarter of this year, 20-30% of Chinese luxury spending took place outside of Mainland China versus 60-70% pre-pandemic, highlighting that a large shift offshore is likely still ahead of us. Bank of America believes that the return of Chinese tourism to Europe is the single biggest area of upside potential.

- Aubrey Drake Graham (or “Drake”), a Canadian rapper, singer, and songwriter, gave one lucky concertgoer Wednesday night in Los Angeles a $30,000 Hermès Birkin bag. Drake has been collecting Birkin bags made by Hermes, for years. His collection includes one of the rarest and most expensive bags in the world.

Threats

- China, one of the larger buyers of luxury products and services, continues to release disappointing economic data, with year-over-year sales and industrial production released below market expectations. The property sector remains under pressure after property developer Country Garden recently missed two dollar-dominated payments. The economic turmoil in China could potentially impact European industries, given the interconnection between China’s economic struggles and Europe’s reliance on Chinese consumer spending.

- For quite some time China has been reporting stress among property developers due to weakening sales. Most recently, Germany, Europe’s largest economy and the biggest real estate investment market on the continent, reported some developers becoming insolvent, where new building permits and construction have dropped as residential property prices fell. Both markets are significant buyers of luxury goods and services.

- Next week, preliminary manufacturing data for August will be reported and we’re likely to witness further weakness across different markets, pointing to a slowdown in economic activity. The Eurozone PMI should remain well below the 50 mark (42.7 in July), which separates growth from contraction. Bloomberg economists expect the U.S. Manufacturing PMI to be released at 49, remaining in contractionary territory as well.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was lumber, rising 7.88%, despite the 30-year fixed-rate mortgage hitting 7.09%, the highest in more than 20-years this week. European gas storage levels are 90% full, sitting at the upper end of the 10-year average. EU gas demand remained bearish in July, down 13% year-over-year and 25% below the 2017-2021 average, continually supporting storage injections. Despite this, EU storage is on track to reach full capacity by mid-September with the pace of the refilling being moderate over time, assuming no major supply disruptions.

- According to Goldman, despite the general negativity on the industrial metals complex at the current juncture, the outstanding strength of China’s copper demand remains a key factor in the group’s expectation for outperformance versus the rest of the complex. With the latest full supply chain data now available for June, Goldman sees China copper end demand having risen 3% year-over-year for the month and 9% year-over-year for the first half of 2023.

- Despite iron ore being the most obvious commodity proxy for China’s continued contraction in early cycle property activity – with close to 25% of global seaborne demand tied to that sector in particular – the market has remained relatively tight so far this year. Benchmark iron ore prices, whilst off the local highs, have displayed resilience close to $100 per ton, a level which hardly prices any supply-side margin pressure. This reflects a combination of surging China steel exports and domestic steel scrap tightness.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 7.26%, on higher production than a year ago and ballooning inventories. Cooler weather is also forecast for next week for both the East and West coast for about 10 days. According to Asian Metals, the spot China carbonate price has moved to 35,000/ton from $42,500/ton at the start of July. According to Benchmark, on the back of the worsening macroeconomic outlook in China, current customer enthusiasm for purchasing EVs has tapered. As such, downstream demand has been relatively subdued.

- According to Goldman, over the past six months, whilst continuing a downward trend, nickel prices have remained volatile. With refined metal inventories at all-time lows, shifting policy expectations have led to short covering rallies, keeping prices range-bound over the past quarter. However, fundamentals have continued to weaken, with the class 2 market moving into greater surplus on weak stainless-steel demand, alongside rising NPI output over the first half of 2022.

- Zinc fell as much as 1.9% as stockpiles tracked by the London Metal Exchange jumped to the highest since April 2022. Historically low stockpiles have supported metals even amid growth headwinds in traditional industrial sectors.

Opportunities

- According to Goldman, barring an actual implementation of strike action impacting LNG supplies, the group expects European gas prices to return to reignite economics for the remainder of summer given how oversupplied NW European gas storage remains. As a result, Goldman keeps its global coal balance views unchanged and reiterates the third quarter forecasts at $129 per ton.

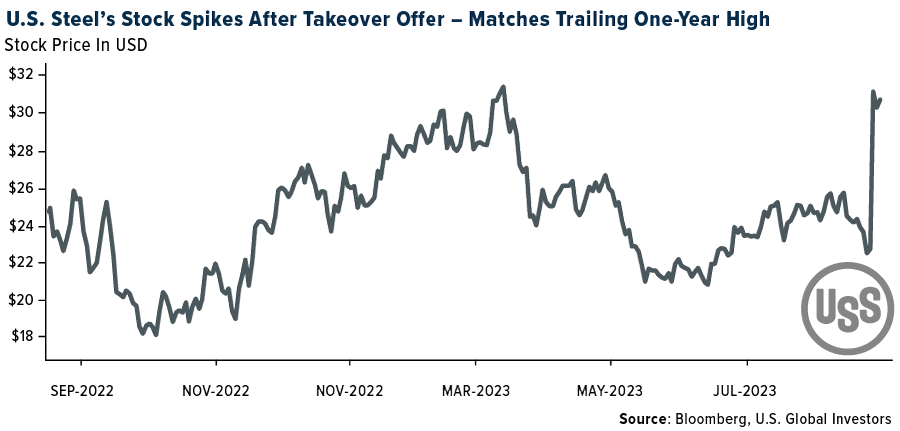

- Cleveland-Cliffs (CLF) made public its intention to acquire U.S. Steel (X) in a cash + stock deal valuing X at $32.53 per share, a 43% premium to last close. X has rejected the offer and announced a strategic review process to seek alternatives. It could create a formidable automotive carbon and electrical steel supplier, lower costs ($500 million of synergies anticipated), improve its FCF profile, and increase competitive positioning versus the ever-rising threat from mini-mill peers. The proposal has been backed by the labor union for both companies.

- Codelco will name its third CEO in a year in the coming weeks as Chile’s state-owned copper company struggles to turn around a slump in output and earnings. With debt at $19 billion and rising, the stakes are getting higher for bondholders.

Production has hit the lowest in a quarter century, costs have surged and ore grades keep on falling, jeopardizing its status as the world’s No. 1 producer. That has sent debt metrics to the worst in years despite copper prices staying more than 20% above the average of the last decade.

Threats

- According to JPMorgan, ex-China lithium production appears to be growing at a slower rate than global demand. However, prices have been falling recently. This implies that Chinese production (around 23% of global supply) could be growing more quickly than anticipated.

- Morgan Stanley’s Global Autos & Shared Mobility research team estimates that a strike involving the Big Three OEMs could impact production volumes by 19,200 units per day. As a general rule of thumb, an average car requires 1 ton of steel; therefore, if a UAW strike involving all Big Three were to occur, it could have a negative impact on steel demand in the second half of the year. If a potential strike were to last for 60 days (in general OEMs’ plants do not run on the weekends), the total impact on U.S. steel demand in 2H23 could be up to 1.2m tons or 2.3%.

- Spot tin prices hit their biggest discount to futures on record on the London Metal Exchange, in a sign of near-term supplies outpacing demand as stockpiles surge.

The discount — a condition known as a contango — reached $280 a ton, the most in data going back to 1994. It marks a stark reversal from sky-high premiums seen earlier in the year, and comes as LME inventories jumped to the highest since 2020 to ease chronic supply constraints seen on the bourse in recent years.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was SEI, rising 1,890.71%.

- Jada AI, an artificial intelligence project that harnesses blockchain technology, has raised $25 million from alternative investment group LDA Capital. The project aims to offer AI services that aid decision-making for organizations and scale up their operations, according to Bloomberg.

- Investors added $49.3 million to crypto-focused exchange traded products (ETPs) during the past month and $232.9 million in the past year, according to data compiled by Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was CFX, down 28.40%.

- Dubai authorities fined the co-founders of failed crypto hedge fund Three Arrows Capital in their latest enforcement action against the duo’s new digital-asset exchange OPNX. The virtual assets regulatory authority said it had issued the company a fine of 10 million dirhams ($2.7 million) in May that remains unpaid, writes Bloomberg.

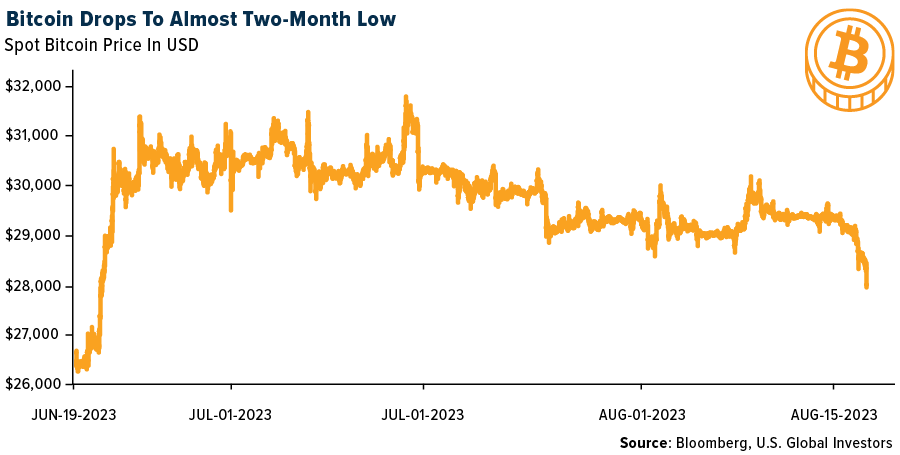

- Bitcoin reached an almost two-month low as risk aversion weighs on the cryptocurrency market, with global government bond yields climbing to the highest in about 15 years, writes Bloomberg.

Opportunities

- Coinbase Global Inc. has gained approval to sell cryptocurrency derivatives directly to retail consumers in the U.S. A subsidiary of the U.S.’s biggest crypto exchange, has secured approval from the National Futures Association to operate a Futures Commission Merchant and offer access to crypto futures, writes Bloomberg.

- Traders on Coinbase’s new Base chain have piled over $450,000 into an NFT offering from brand giant Coca-Cola. This is a strong showing despite the fact that major brand NFT launches have consistently demonstrated a lackluster history on secondary markets, writes Bloomberg.

- The U.S. SEC is poised to allow the first exchange-traded funds based on Ether futures, a major win for several firms that long have sought to offer the products, writes Bloomberg.

Threats

- PayPal Holdings won’t allow UK users to buy cryptocurrencies on its platform from October, saying it needs time to ensure compliance with new local rules, writes Bloomberg.

- SwirlLend, a lending project operating on the Ethereum Layer 2 networks Base and Linea, has seemingly executed an exit scam, making off with an estimated $460,000 in user deposits. According to on-chain analysis from security firm PeckShield, the SwirlLend team drained $290,000 in crypto assets from Base and $170,000 from Linea.

- Chinese authorities have charged a Filecoin mining company with running an $83 million pyramid scheme. The local court in Pingnan county in the Guanxi region has announced that criminal proceedings have commenced against Shenzhen Shikongyun Tech, one of China’s largest Filecoin mining companies and its four executives, writes Bloomberg.

Gold Market