The domestic market has suffered significant net outflows since the start of the year.

Fund managers who have been insisting the UK market is cheap and resilient don’t appear to have convinced investors, who continue to move their money elsewhere, data from FE Analytics shows.

UK equity funds have been out of favour for a number of years, owing to headwinds such as Brexit, political uncertainty, lacklustre growth and high inflation. The latest Investment Association data shows that £12.3bn was pulled from the three UK equity fund sectors over the 12 months to the end of February.

More than £9.6bn of this came out of the IA UK All Companies sector and outflows have accelerated from this peer group more recently: around £1.25bn was redeemed in both January and February, compared with an average monthly outflow of £800m over the past year.

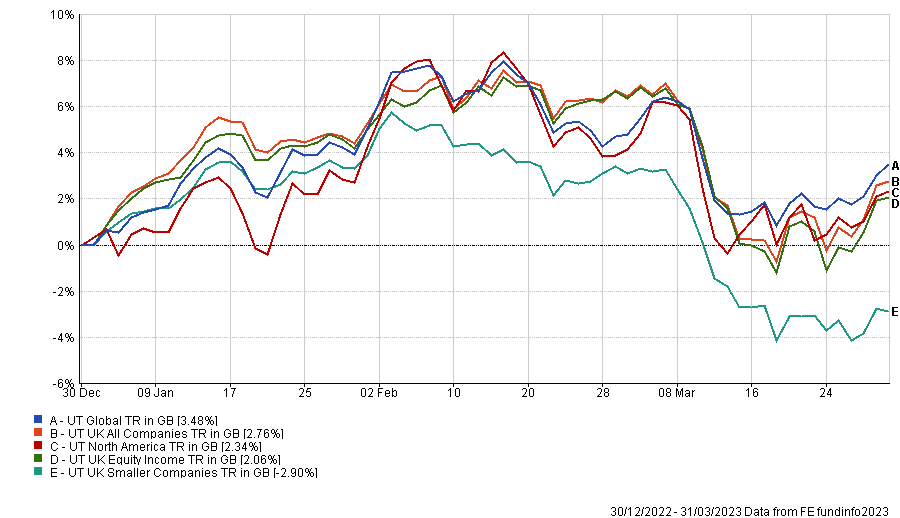

Since the start of 2023, the total return of 2.8% made by IA UK All Companies funds was marginally worse than the 3.5% made by their IA Global counterparts.

Performance of sectors in the first quarter of 2023

Source: FE Analytics

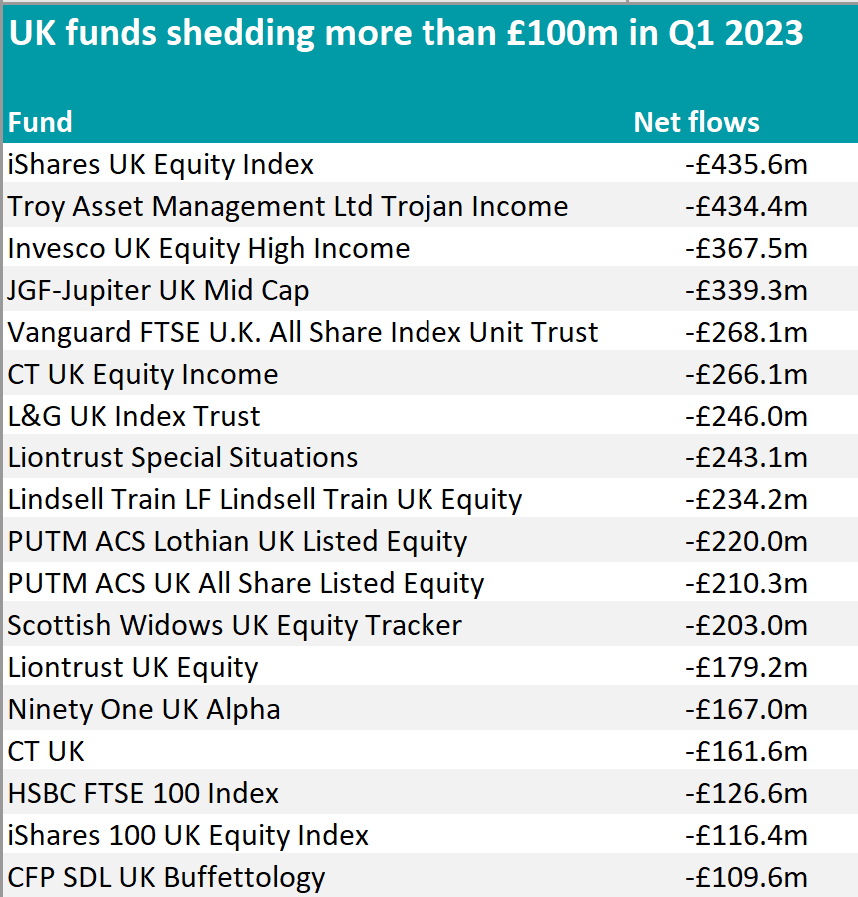

Below, we dive into the UK funds that shed (and attracted) the most money in the first quarter of 2023.

As anticipated, IA UK All Companies was the worst hit – of the 25 funds with the largest outflows, 22 belonged to this sector.

Down £435m, the top loser was iShares UK Equity Index, highlighting how investors turned away from the entire UK market. Another tracker, Vanguard FTSE UK All Share Index, was only a few positions behind.

Active vehicles didn’t do much better, with UK income portfolios failing to convince investors, despite the greater attention that the asset class has been receiving in other geographies.

Trojan Income came in in a tight second position and went from having £2.7bn of assets under management (AUM) at the beginning of 2022 to today’s £1.2bn, after shedding another £434m in the first three months of 2023.

It was followed by another income strategy, Invesco UK Equity High Income. Investors also withdrew £266m from CT UK Equity Income, the first fund on the list to belong to the IA UK Equity Income sector.

After shedding another £339m of investors’ money in the first quarter, Jupiter UK Mid Cap fell to £757m in assets after starting 2022 at £3.3bn.

Liontrust Special Situations, Lindsell Train UK Equity, Ninety One UK Alpha and CT UK also continued on a similar trend. Other notable funds included Liontrust UK Equity, SDL UK Buffettology, Artemis Income and Fidelity Special Situations.

Source: FE Analytics

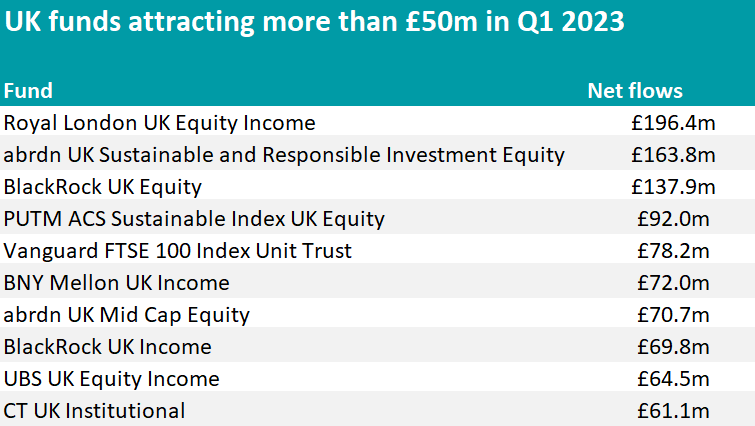

Moving on to the UK funds attracting money, only 10 had inflows greater than £50m.

Leading the table, Royal London UK Equity Income acquired £196.4m, followed in the second half of the list by income strategies from BNY Mellon, BlackRock and UBS.

Investments focused on environmental, sustainability and governance (ESG) principles also figured here, with abrdn UK Sustainable and Responsible Investment Equity in second position.

The passive funds with positive net inflows were BlackRock UK Equity, PUTM ACS Sustainable Index UK Equity and Vanguard FTSE 100 Index Unit Trust.

Source: FE Analytics