Trustnet researches the four active funds in the IA UK All Companies sector with less than £100m in assets under management that charge less than 1%.

Funds with fewer assets under management (AUM) have an edge when investing in small- and mid-caps because they do not face the same liquidity constraints as larger funds.

As a result, they can delve even deeper into the market-cap chain to generate more alpha, taking bigger positions in minnows that would be unachievable with too much money to manage.

However, smaller funds often charge higher fees as they do not have the scale to spread costs across a large pool of investors.

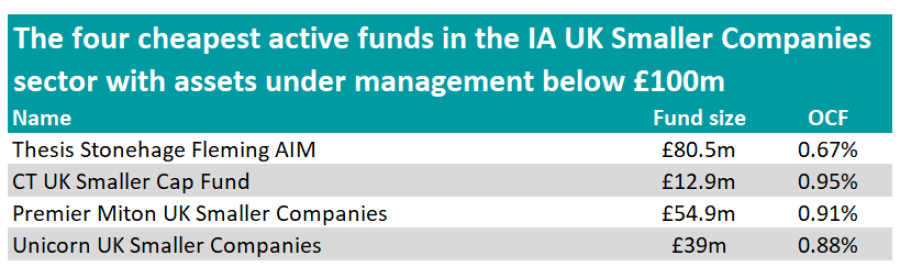

As such, below, Trustnet highlights the four active funds in the IA UK Smaller Companies sector with less than £100m in AUM and charging less than 1%.

Source: FE Analytics

The £80.5m Thesis Stonehage Fleming AIM, managed by Paul Mumford and Nick Burchett, is the cheapest ‘sub-scale’ fund in the sector, with an ongoing charge figure (OCF) of 0.67%.

The fund invests in shares listed on the UK Alternative Investment Market (AIM), although its mandate allows it to hold names that have been transferred to the main market as long as they only form a small portion of the overall portfolio.

It is the second-best performing fund over the past 10 years in the IA UK Smaller Companies sector. However, this outperformance has come with higher volatility, making it one of the 10 most volatile funds over the same period.

Performance of funds over 10yrs vs sector

Source: FE Analytics

Furthermore, Thesis Stonehage Fleming AIM is one of the three most consistent UK small-cap funds, as it has outperformed the Numis Smaller Companies (Excluding Investment Trusts) index more regularly than most of its peers.

The £12.9m CT UK Smaller Cap Fund is the smallest fund on the list, but also the most expensive, with an Ongoing Charge Figure (OCF) of 0.95%.

Managers Catherine Stanley and Patrick Newens focus on companies displaying above-average growth rates or growth potential relative to the Numis Smaller Companies (excluding Investment Trusts) index. Indicators such as earnings and sales growth are used to assess the growth potential of a stock.

CT UK Smaller Cap Fund sits in the second quartile of the IA UK Smaller Companies sector over 10 years but has been one of the least volatile funds during that period.

Performance of funds over 10yrs vs sector and benchmark

Source: FE Analytics

Trustnet recently identified Stanley as one of the few ‘veteran’ managers in the IA UK Smaller Companies sector still producing top returns.

The £54.9m Premier Miton UK Smaller Companies also made the list. It charges investors 0.91% and is managed by Gervais Williams and Martin Turner, who aim to identify companies with information gaps and significant potential for mispricing and returns.

The fund focuses on small- and micro-caps, with 68.4% of the holdings indexed on the FTSE AIM, 8.2% on the FTSE Small Cap, and 6.4% on the FTSE 250, while 7.2% are unindexed.

In terms of performance, the fund sits in the bottom quartile of the IA UK Smaller Companies sector over 10 years, as most of the returns achieved during that period were eroded from the second half of 2021 onwards.

Performance of funds over 10yrs vs sector and benchmark

Source: FE Analytics

At the beginning of the year, Williams shared his view that UK equities within sectors such as insurance, financial, manufacturing, defence and commodity have become “exciting again”, if inflation persists.

Finally, the £39m Unicorn UK Smaller Companies, managed by Simon Moon and Fraser Mackersie, charges 0.88%.

Although the managers do not base their portfolio construction on macroeconomic views, the fund shows a preference for the engineering and financial services sectors, which make up 19.9% and 17.5% of the portfolio, respectively. In contrast, the fund has no exposure to the oil and gas, mining, and biotechnology sectors.

It sits in the second quartile of the IA UK Smaller Companies sector over 10 years, but has made top-quartile returns over more recent periods. It has also been more volatile than its sector peers, ranking 24th out of 40 in terms of volatility.

Performance of funds over 10yrs vs sector

Source: FE Analytics

The managers recently bought shares in the UK technology firm Raspberry Pi, which listed last month. They believe that various industries will increasingly adopt the company’s single-board computer.