This Week in European Tech: SVB panic spreads to Europe, Railsr gets sold off, La Famiglia’s fresh €250 million fund(s), and we celebrated #IWD2023

This week, our research team tracked more than 80 tech funding deals worth over €1.3 billion, and over 15 exits, M&A transactions, rumours, and related news stories across Europe.

As always, we are putting all weekly deals together for you in a list sent in our round-up newsletter (note: the full list is for paying customers only, and also comes in the form of a handy downloadable spreadsheet).

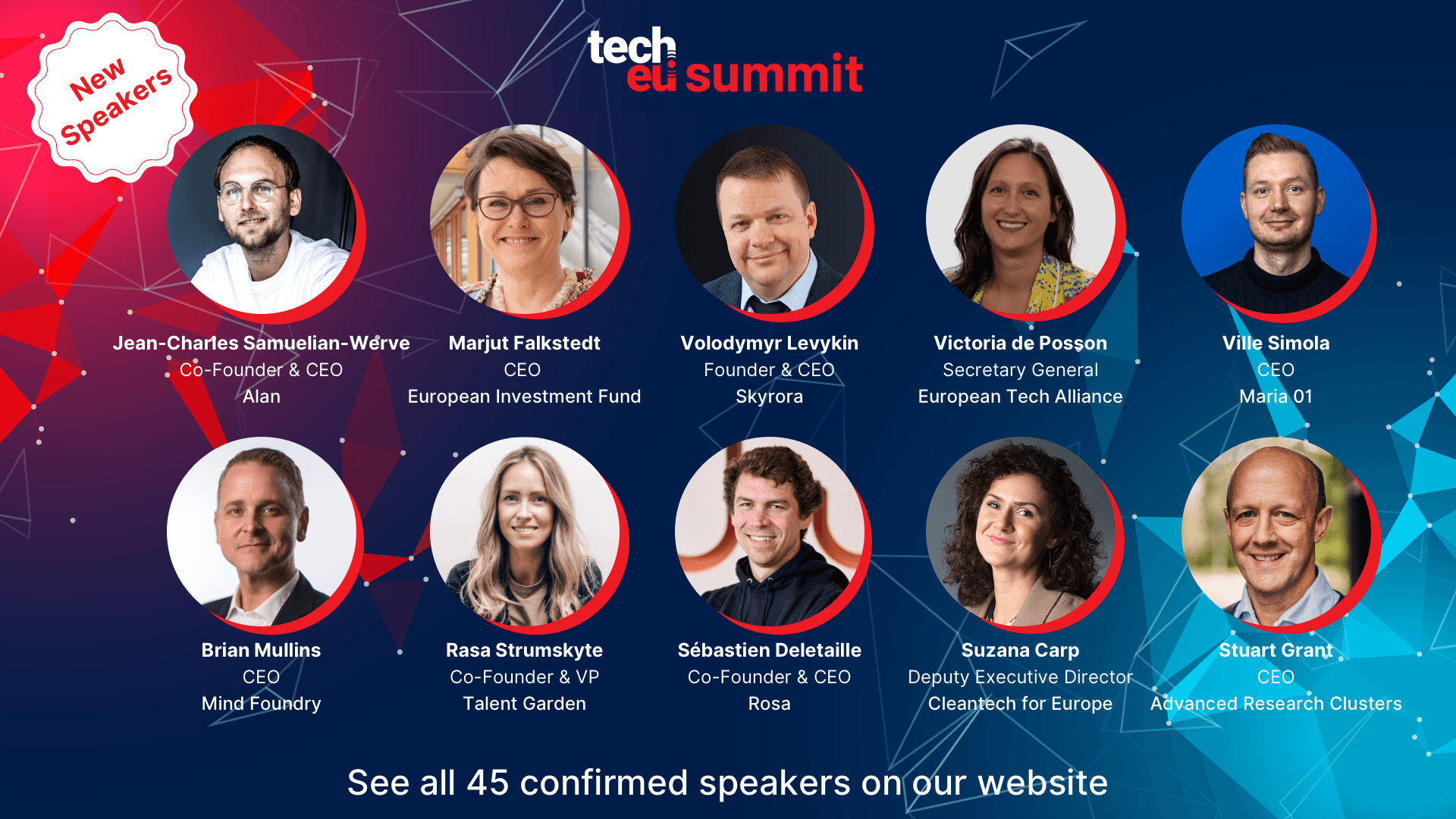

And don’t forget: we’re busy prepping for the next Tech.eu Summit, it’s gonna be epic!

Still on the fence? Check out our 45 confirmed speakers! and the 10 latest additions to the line-up!

With that said, let’s get down to business with the biggest European tech news items for the past couple of days (subscribe to our free newsletter to get this round-up in your inbox).

—–

>> Notable and big funding rounds

London-based consumer loans-focused fintech Abound has raised over £500 million in a new debt + equity funding round.

Milan-based Prysmian Group, a company that claims to be a leader in energy and telecoms cable systems, announced on Monday that it has secured a €120 million loan from CDP.

Automotive holographic tech has been given the open road as Envisics announces $50 million in Series C funding.

Skeleton Technologies, an Estonian manufacturer of ultracapacitors and SuperBatteries, is set to receive €51 million from the German government and the state of Saxony towards its second production unit, to be built in Leipzig.

France-based Aria, which offers embedded invoice financing, has collected €50 million in a debt fundraising round from M&G Investments.

Effect Photonics, an Eindhoven, Netherlands-based developer of highly integrated optical solutions, raised an additional $40 million in funding.

French expense reports, receipts, and mileage for accounting and reimbursements software provider N2F has raised €24 million in a growth investment round provided via PSG Equity.

French start-up Iktos has raised a €15.5 million Series A round fuelling the launch of its drug discovery platform.

Paris-based MentorShow has raised €15 million in new capital as it aims to consolidate its product while at the same time diversifying its offerings and ramp up international deployment plans.

—–

>> Noteworthy acquisitions, mergers, IPOs and SPAC deals

Italy’s first unicorn, Scalapay, a buy-now-pay-later provider, has acquired nearly 40 years in business Italian payment institution Cabel IP.

Railsr, a UK fintech company facing a number of issues and on the brink of collapse, has been sold to a consortium of investors. The deal draws to close several months of uncertainty for the UK fintech scale up, which just one year ago was chasing a £1 billion valuation.

London-based fintech Weavr has confirmed the acquisition of B2B open banking platform, Comma Payments – according to Weavr it’s a first-of-its-kind deal within the world of embedded finance.

Australia’s ColCap has entered the UK mortgage market after acquiring an 80% majority stake in digital lender Molo.

European corporate HRtech startup Coverflex has announced its complete acquisition of Italian digital-only meal solution company EatsReady.

Regulatory technology firm Kaizen Reporting has acquired a majority stake in London Reporting House, a new service that brings insights into the repo market.

—–

>> Interesting moves from investors

La Famiglia, a Berlin-based VC fund, has raised €250 million for its combined third seed fund (which is €165 million) and its first growth co-investment fund (€90 million).

Venture capital firm Matterwave has launched a $79 million fund aimed at European sustainability projects.

Having raised over two-thirds of a targeted €70 million fund, Stockholm’s Node Ventures officially launched its sector-agnostic fund this week.

An investment firm based in London has announced the launch of a $10 million fund focusing on DeFi, GameFi, and AI startups across the UK, UAE, Europe, and the United States.

UBS Next invests in Tenity’s fintech incubation fund

—–

>> In other (important) news

After a 60% stock price drop, Silicon Valley Bank trading was suspended as the company seeks a buyer.

UK Prime Minister Rishi Sunak and Science, Innovation and Technology Secretary Michelle Donelan have laid out a new initiative that will see in excess of £370 million being funnelled into improving infrastructure, investment, and skills for growing UK tech companies, with “trailblazing” tech including quantum, supercomputing, and AI specifically mentioned in the government’s statement.

The European Union told Elon Musk to hire more human moderators and fact-checkers to review posts on Twitter, the Financial Times reported on Monday, citing four people familiar with talks between Musk, Twitter executives and regulators in Brussels.

WhatsApp has agreed to be more transparent about changes to its privacy policy introduced in 2021, the European Commission said on Monday, following complaints from consumer bodies across Europe.

N26’s top executives accused the co-founders of one of Europe’s most highly valued fintechs of promoting a “culture of fear” that threatened to drive the group into a “downward spiral”.

Grover will soon have a new CFO in former Lilium executive Michael Andersen, who successfully led the company to an IPO via a SPAC.

—–

>> Recommended reads and listens

European tech startups – a long way off gender pay equality

Tech.eu caught up with the founder and CEO of fintech scale-up FinalRentals, Ammar Akhtar, to talk about how the UK’s Department for Business and Trade helped him relocate to Wales to continue developing his business in and from the UK, thanks to its flagship initiative – the Global Entrepreneur Programme (GEP).

Mapped: TikTok faces bans, blocks and probes across Europe

UK Women tech founders are taking a bigger share – 24 percent capital increase in 2022 compared to 2021

Can investment in proptech startups increase housing supplies and meet CO2 reduction goals?

Don’t just blame the regulator for London’s failed American dreams

Meet the rising female founders building the Metaverse

In conversation with GEP Dealmaker Martin Ring: Helping founders from all over the world scale their tech businesses in and from the UK

Breaking stereotypes and developing future female talent: advice from a female Chief Revenue Officer in tech

ESG Fintech is advancing beyond just an industry buzzword, with real, tangible results starting to bear fruit. London’s Royal Park Partners took at the sub-vertical helping companies manage their ESG objectives inline with financial goals.

Cowboy brings AdaptivePower to its ebikes and shows why community building is critical to D2C sales

—–

>> European tech startups to watch

London-based Unitary has raised $8 million in new funds. Along the lines of what Checkstep and Bodyguard are doing, the startup uses contextual AI to automate content moderation and keeping the bad actors at bay.

German cloud security firm Edgeless Systems plans to revolutionise the public cloud security industry with its $5 million seed raise.

Berlin-based trawa has raised €2.4 million in a pre-seed round aimed at helping the startup further develop its AI-based energy purchasing software.

Quantum continues to heat up as the Netherlands’ QuantWare lands €6 million.

Barcelona’s Zen Yachts has closed a €5.5 million Series A round provided solely by ocean, rivers, and seas transportation decarbonising specialist fund Ocean Zero.

Tallinn-based Roofit.Solar has raised €6.45 million in a funding round that saw further support from BayWa r.e. Energy Ventures and EdgeCap Partners.

Polish edtech scale-up Coding Giants has announced a funding round of €3.5 million from CEE-based investors PortfoLion and Nunatak Capital.

London startup ViridiCO2 announced a £3 million seed funding round. The University spin-off has developed technology that converts waste carbon dioxide into high-value chemical products.