Markets have been up and down in recent years so Trustnet looks for UK funds that have delivered on all fronts.

UK equity passive and enhanced index strategies have outperformed the IA UK All Companies sector for returns, risk and other closely-watched metrics over the past three years, research by Trustnet has found.

In this annual series, we are examining the major Investment Association sectors on a wide range of performance measures to see which funds have consistently delivered for investors.

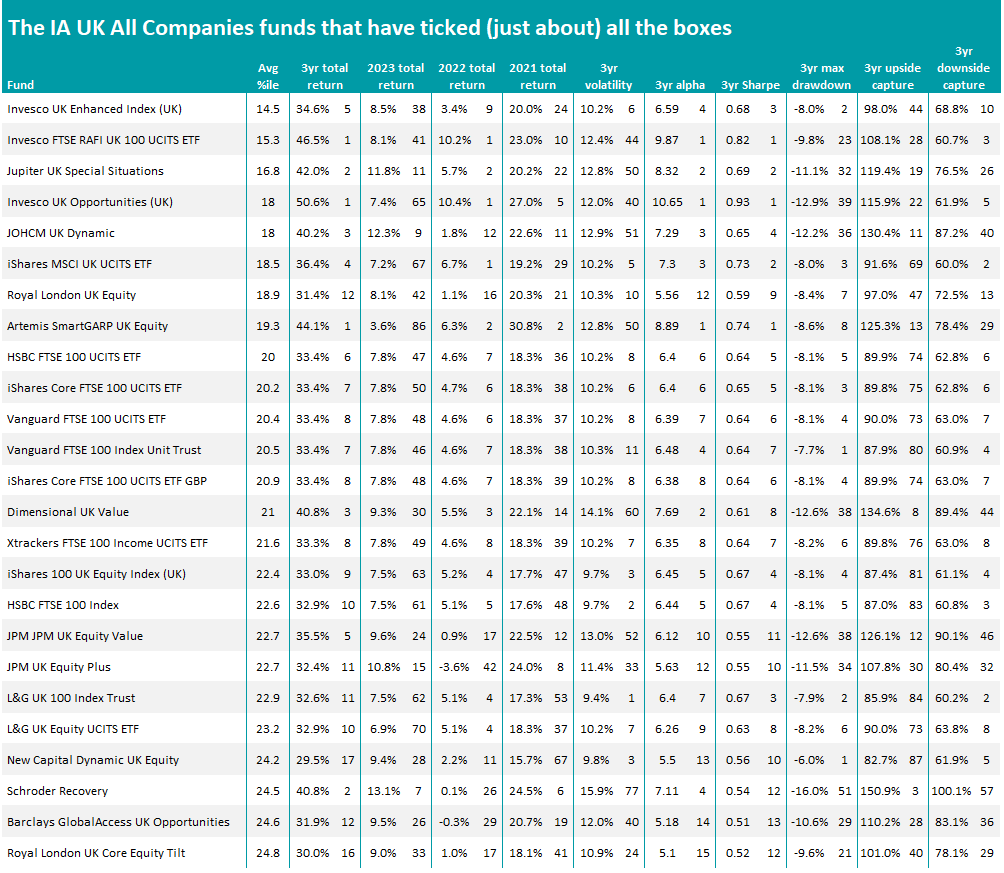

It’s the turn of the IA UK All Companies sector and this research looks at the percentile rankings of each fund for: cumulative three-year returns to the end of 2023 as well as the individual returns of 2021, 2022 and 2023 (to ensure performance isn’t down to one standout year), annualised volatility, alpha generation, Sharpe ratio, maximum drawdown, and upside and downside capture relative to the sector average.

The 10 percentile rankings for these metrics are then collated into an average percentile score for each fund; the lower the score, the stronger a fund has been across the board over the past three years.

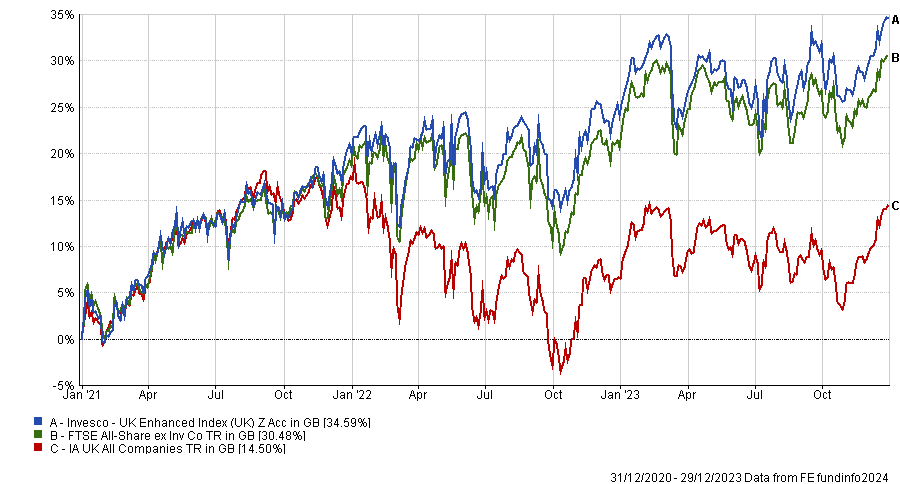

The three-year performance of the fund in first place is shown in the chart below. Invesco UK Enhanced Index has an average percentile score of 14.5, thanks to strong cumulative performance, one of the sector’s best Sharpe ratios and a small maximum drawdown.

Performance of fund vs sector and index over 3yrs to end of 2023

Source: FE Analytics

The fund starts by tracking the FTSE All Share ex Investment Trusts index but tweaks the exact positioning using a systematic factor-based process that looks at earnings momentum, price momentum, quality and value. The aim is to replicate the risk of the underlying index with incremental excess returns.

Invesco UK Enhanced Index topping the tables in this research is something of a departure from past editions of the study, when active funds have tended to come out on in the lead. However, as the table below shows, this is not an isolated incident.

Source: FE Analytics

Of the 25 IA UK All Companies funds highlighted above, 13 of them are either pure index trackers or funds that take an enhanced index approach. This reflects the generally tough conditions facing active managers, leading many to underperform the market.

One of these factors has been the relatively narrow leadership of stock markets, be that due to the strong rise in energy stocks during 2022 or the dominance of large-cap tech stocks in 2023.

By definition, index trackers will always have exposure to these stocks while active managers may own all, some or none of them – increasing the odds of them falling behind the market in times when stock selection was essential.

But trackers and enhanced index funds aren’t the only theme at play in this research: a strong showing from value funds is another. Again, this is a departure from previous studies in this series when growth stocks led the market and the funds that focused on them generated the best scores.

Jupiter UK Special Situations is the highest-ranked active fund in this year’s study and it takes a contrarian approach, seeking out unloved companies that are trading at a discount to their history.

The fund has an average percentile score of 16.8, driven by a high three-year return combined with a Sharpe ratio and alpha that are among the IA UK All Companies sector’s highest.

However, it was recently announced that Jupiter UK Special Situations is losing its manager; Ben Whitmore is leaving Jupiter to start his own value equity boutique. Jupiter has hired Alex Savvides from JO Hambro to run the fund (Savvides managed JOHCM UK Dynamic, which also made it onto the table above).

Other UK value funds with high average percentile scores in this research include Invesco UK Opportunities, Artemis SmartGARP UK Equity, Dimensional UK Value, JPM UK Equity Value and Schroder Recovery.

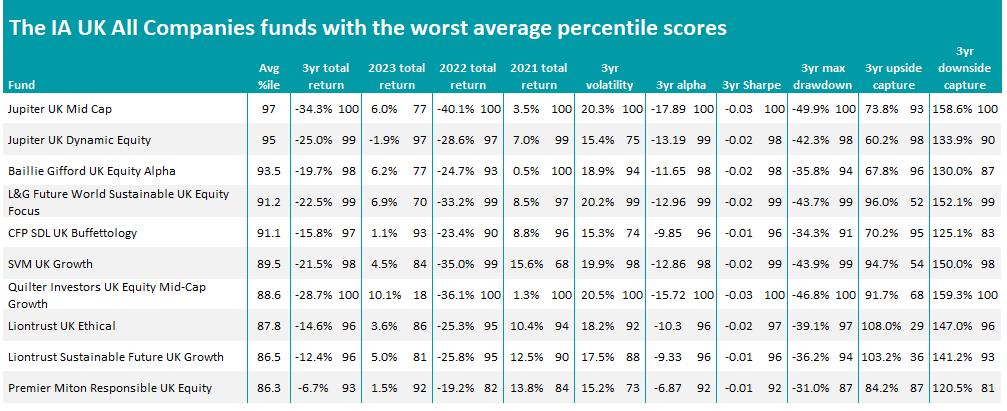

Source: FE Analytics

But while the list of the strongest IA UK All Companies funds in this research features value strategies, the bottom of the rankings tends to consist of growth portfolios.

As mentioned, growth stocks have dominated the market for much of the recent past but value investing has had a resurgence since inflation started to spike and interest rates went up. This benefitted value stocks (even if they had a tough time of it in 2023 when tech stocks rallied) and caused growth funds to start underperforming.