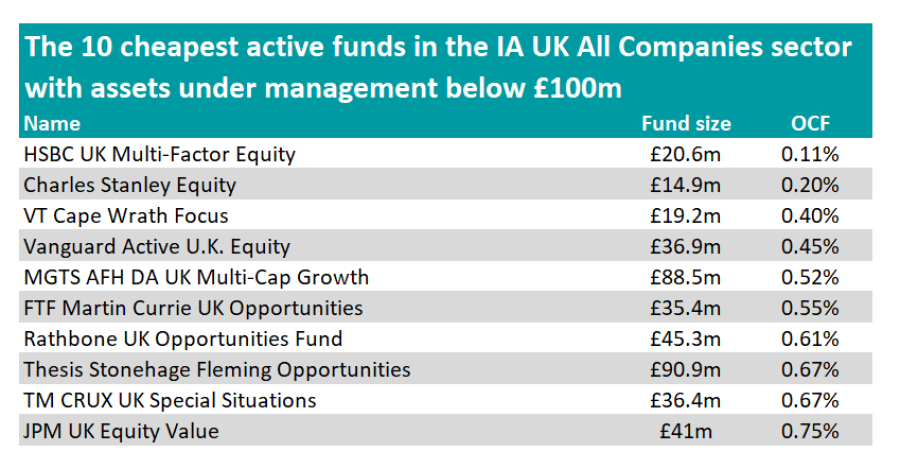

Trustnet researches the 10 cheapest active funds in the IA UK All Companies sector with less than £100m in assets under management.

A benefit of smaller funds is that they can explore opportunities lower down the market-cap spectrum, as they are not constrained by liquidity concerns like their larger peers are.

This can be an advantage in the IA UK All Companies sector, where funds frequently delve into the small- and mid-cap space to find sources of alpha.

However, smaller funds often incur higher fees, and institutional investors typically steer clear of those with assets under management (AUM) below £100m.

Yet, there are always exceptions to the rule. Below, Trustnet highlights the 10 cheapest active funds in the IA UK All Companies sector with less than £100m in AUM.

Source: FE Analytics

The cheapest small active fund in the IA UK All Companies sector is the £20.6m HSBC UK Multi-Factor Equity, which charges 0.11%. The fund, which was launched in August 2020, has made a top-quartile return over three years.

It uses the FTSE 350 index excluding investment trusts, with managers ranking the stocks in the index based on a number of factors and giving them a weighting in the portfolio accordingly.

The second cheapest ‘sub-scale’ active fund in the list is £14.9m Charles Stanley Equity, managed by Chris Ainscough, Will Dobbs and Morgan Bocchietti.

They invest in UK blue-chips such as AstraZeneca, Unilever and GlaxoSmithKline as well as in investment trusts, with Allianz Technology Trust and 3i Group featuring in the top 10 holdings.

As such, the fund benefited from the artificial intelligence hype that boosted US tech companies by holding the Allianz trust and from the strong outperformance of privately listed Dutch discount retailer Action through 3i Group.

Performance of fund over 5yrs vs sector

Source: FE Analytics

As a result, Charles Stanley Equity sits in the first quartile of the IA UK All Companies sector over five years.

The third cheapest small active fund in the list is the £19.5m VT Cape Wrath Focus, which charges 0.40%. The fund sits in the top quartile of the IA UK All Companies sector over five years and has outperformed its benchmark by more than 22 percentage points.

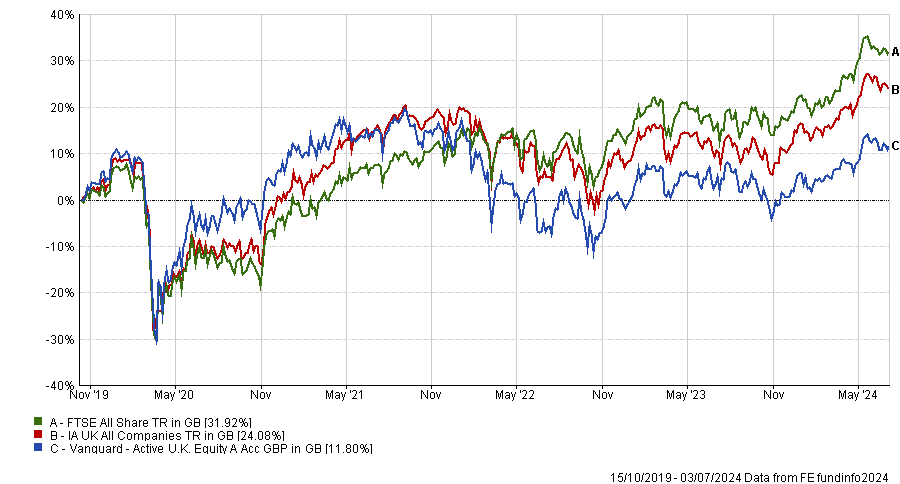

Also of note in the ‘cheap’ small fund list is the £36.9m Vanguard Active U.K. Equity, co-managed by Baillie Gifford Overseas and Marathon Asset Management.

The fund is packed with UK small- and mid-cap stocks such as 4imprint, Games Workshop and Renishaw and has 78 holdings in total.

With an average price-to-earnings ratio of 17.4x, the fund is more expensive than the FTSE All Share, but it boasts better return on equity and earnings growth rate.

However, this has not translated into superior performance, as Vanguard Active U.K. Equity lags behind both the benchmark and the average sector peer since its launch.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

In fact, the fund sits in the bottom quartile of the IA UK All Companies sector over three years, ranking 172nd out of 226.

Also of note is the £45.3m Rathbone UK Opportunities Fund, which has a mid-cap bias, as manager Alexandra Jackson believes it is where the most exciting and rapidly growing businesses are to be found while offering the best reward for the amount of risk taken.

However, the fund’s mandate allows it to seek opportunities across the entire UK market-cap spectrum, as long as companies exhibit a durable business model with management teams that are capable of seizing growth opportunities in their respective industries.

Moreover, the manager avoids companies that won’t be able to make a profit in the near future or that depend on one or two risky ventures. She will also sell holdings when growth is exhausted or risks have increased.

Performance of fund over 5yrs vs sector

Source: FE Analytics

The fund derated in 2022 as central banks hiked interest rates in response to surging inflation. As a result, Rathbone UK Opportunities Fund has underperformed its average sector peer over five years and currently sits in the third quartile of the IA UK All Companies sector.

Another minnow worth highlighting is the £36.4 TM CRUX UK Special Situations fund, which charges investors 0.67% and seeks mispriced opportunities. The manager, Richard Penny, believes there are two ways to identify businesses that the market underestimates.

One approach is to buy companies that the market perceives to be in distress, but where Penny has assessed the upside and believes the market has overreacted.

The second approach is to invest in value creators capable of compounding returns and growing strongly, but that have not yet been identified by the market.

TM CRUX UK Special Situations has underperformed the IA UK All Companies sector over five years, after derating in 2023, and sits in the fourth quartile of the sector as a result.