Research from CB Insights shows that, in 2022, global fintech funding decreased by 46% compared to 2021, totalling USD 75.2 billion, but it increased by 52% compared to 2020. Despite this drop, the deal volume only decreased by 8% YoY. Funding and deals decreased steadily throughout the year, and Q4 of 2022 saw the lowest funding level since 2018, with USD 10.7 billion invested. The downward trend is also confirmed by Statista. The ‘why’ behind this seems to point to supply chain and geopolitical issues.

Less money is poured into fintech, which may indicate a period of a global recession. In 2022, USD 100 million mega-rounds in the global market contributed USD 36.5 billion to funding, marking a 60% drop from the record activity in 2021. The number of mega-rounds worldwide decreased by 52% YoY to 179 as investors reduced their involvement due to market turbulence and rising inflation. In Q4 of 2022, Asia and Europe were tied in mega-round funding, with USD 1.4 billion, exceeding the US with USD 1.1 billion, CB Insights data shows.

The birth of fintech unicorns decreased throughout 2022, reaching a low of 5 in Q4 of 2022, which is an 87% decline from Q4 of 2021. On an annual basis, there was also a significant drop in unicorn births. From 2021 to 2022, the count of new unicorns decreased by 58%, going from 166 to 69.

Q4 funding and findings

Last year was a tough year for fintech investments, as CB Insights showed in its State of Venture 2022 report. Global venture funding in 2022 amounted to USD 415.1 billion, which represents a 35% decrease from the record set in 2021. The decline in funding was particularly significant in the second half of the year, with Q4 of 2022 funding totalling USD 65.9 billion, a 64% YoY drop that returned to pre-Covid levels.

Companies had to find access to cash outside of the funding rounds. This is indicated by a worldwide layoff bonanza that is still going on, abandoned expansion plans, and focusing on what products and solutions work.

Investors seem to be focusing on risk-free ventures (as much as that is possible) and pouring less money than before, in favour of ensuring cash flow and profitability. The fintechs that managed to stay afloat and/or profitable after the end of 2022, did so by carefully planning their finances or by resorting to partnerships and mergers if they were not acquired by bigger fish by then. Speaking of, do check out our previous pieces on M&As and partnerships.

Follow the money

The highest funding round was registered by Viva Republic for its super app Toss. The Series G secured by the company managed to raise USD 405 million to scale the digital lending and online payments capabilities of Toss. It seems that industry-veteran topics such as digital banking and mobile and online payments continue to be the main attractions for VCs (28% of global investment deals were led by venture companies).

Payments took the top place in the total amount of money raised in Q4, with USD 3.4 billion (188 deals), followed by banking, with USD 1.8 billion (62 deals). The US led in global investments, raising USD 3.9 billion in 342 deals. Europe and Asia went neck-to-neck, the first securing USD 2.8 billion in 248 deals, while 228 deals in Asia led to USD 2.7 billion raised in the region, CB Inisights data shows.

Paytech

Payment technology, or Paytech, refers to the use of technology to facilitate and process financial transactions. The appeal of paytech lies in its ability to offer faster, more secure, and more convenient payment options than traditional payment methods.

Investors are attracted to paytech due to its rapidly growing market, potential to disrupt traditional payment systems, scalability potential, use of innovative technology, and customer-centricity. These factors provide opportunities for high returns on investment and the potential for market share growth.

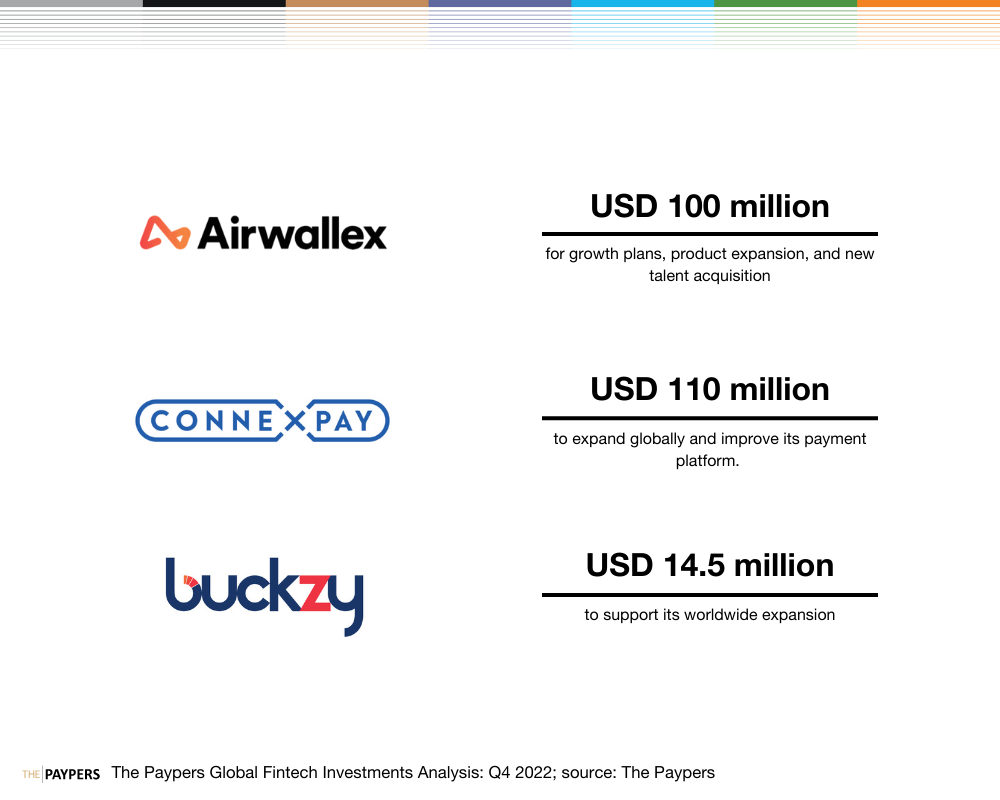

Australian fintech Airwallex raised USD 100 million in its Series E extension, valuing the company at USD 5.5 billion. This investment will fund Airwallex’s growth plans, product expansion, and new talent acquisition. Meanwhile, US-based paytech firm ConnexPay raised USD 110 million in growth equity to expand globally and improve its payment platform. Canadian payment firm Buckzy Payments secured USD 14.5 million in Series A financing to support its worldwide expansion. India-based digital payments company PhonePe announced its intention to raise up to USD 1 billion in an all-equity funding round in December 2022.

Digital lending

Investors are attracted to digital lending because it offers several benefits over traditional lending, including lower costs, faster processing, and wider accessibility. Digital lending platforms can leverage technology to automate the loan application, approval, and disbursement process, reducing costs associated with manual underwriting and loan servicing. This allows them to offer competitive interest rates and fees while still generating high returns for investors.

Additionally, digital lending can provide access to credit for underserved or unbanked populations who may not have been able to access loans through traditional channels. Finally, the growing demand for digital lending solutions, particularly in emerging markets, presents significant growth opportunities for investors in the space.

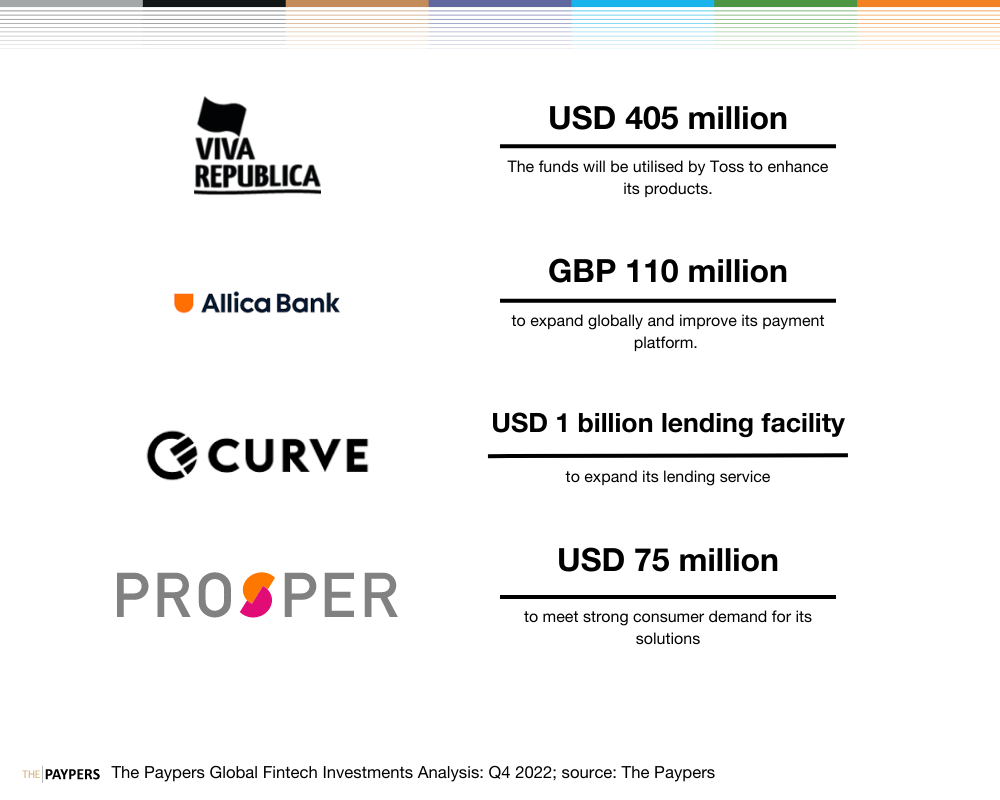

South Korean tech firm Viva Republica, the operator of finance super app Toss, concluded a Series G funding round worth USD 405 million in December 2022. The funds will be utilised by Toss to enhance its products, including digital lending and online payment services for local merchants and individuals. The investment will also enable Toss to accelerate growth for its challenger lender Toss Bank and retail investment app Toss Securities.

Also in December 2022, Allica Bank, a challenger bank for small and medium-sized enterprises (SMEs) based in the UK, secured GBP 100 million in a Series C funding round. The funding will help Allica Bank rapidly scale up its operations and accelerate its disruptive impact in the UK SME market. As a digitally native bank, Allica aims to provide a complete banking solution to established SMEs and entrepreneurs, including lending, savings, and payment services.

Curve, a financial app headquartered in the UK, secured a USD 1 billion lending facility in December by partnering with Credit Suisse. The deal will enable Curve to expand its lending service, Curve Flex, in the UK, the European Union, and the United States.

In November 2022, Prosper Marketplace, a US-based peer-to-peer lending platform, secured a new financing round of USD 75 million from Neuberger Berman. The new funding will allow Prosper Marketplace to meet strong consumer demand for its personal loan, credit card, home equity, and investment products, and accelerate growth opportunities for the company in the coming years.

Ecommerce

Ecommerce is attractive to investors due to its large market potential, low overhead costs, scalability, data-driven insights, and innovative technology.

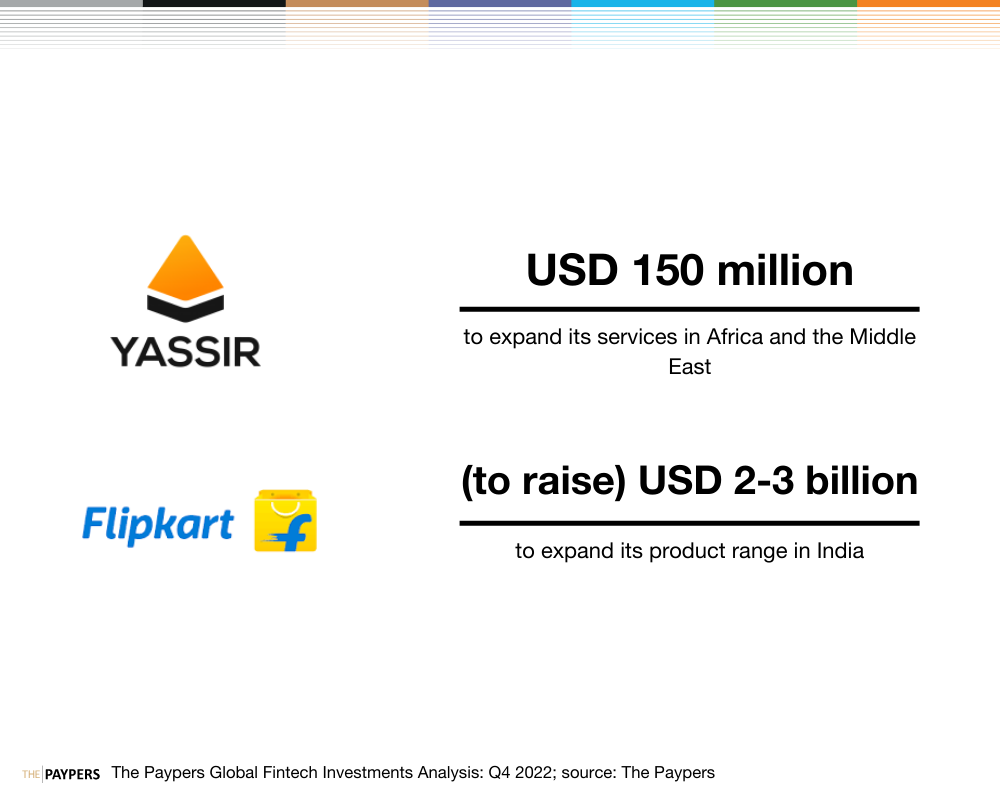

Yassir, a super app based in Algeria, raised USD 150 million in Series B funding in November 2022 to expand its services in Africa and the Middle East. The company currently provides ride-hailing services and Yassir Express, which offers food and grocery delivery in six countries and 45 cities. Yassir aims to include banking and payment solutions in its future offerings.

As per a source familiar with the company, Flipkart, an India-based company, has revealed its intention in October 2022 to raise between USD 2 to 3 billion to expand its product range in India. This expansion is planned at a valuation of over USD 40 billion. Walmart had previously acquired a 77% stake in Flipkart for approximately USD 16 billion in 2018. Currently, Walmart is said to be interested in attracting strategic investors for the Indian company while also considering the possibility of selling to large investment firms that focus solely on investments.

Embedded finance

Embedded finance is a growing trend in the financial services industry, and there are several reasons why investors may be interested in pouring money into this sector. The embedded finance market is expected to grow rapidly over the next few years, with some estimates predicting a market size of USD 7.2 trillion by 2030. This growth potential is largely driven by the increasing digitisation of financial services and the growing demand for seamless financial experiences.

In October 2022, global players in embedded finance and Banking-as-a-Service, Railsr, raised USD 46 million in their Series C round, consisting of USD 26 million in equity and USD 20 million in debt to advance their embedded finance solutions. Also in October, UK-based fintech credit and payment company Kriya (formerly known as MarketFinance) secured GBP 30 million from Viola to expand its B2B Pay Later embedded finance offering for SMEs. In November 2022, India-based embedded AI-based finance startup Lentra raised USD 60 million in Series B funding, valuing the startup at over USD 400 million.

Open Banking and Open Finance

Open Banking is a system that allows customers to share their financial data with third-party providers, such as fintech companies, through secure APIs. The benefits of Open Banking include increased competition, improved customer experience, more personalised products and services, enhanced security and fraud prevention, and increased access to financial services for underbanked populations. It also promotes innovation and collaboration between banks and fintechs, allowing for the development of new and innovative financial products and services.

Additionally, Open Banking can provide valuable insights through data sharing and analysis, benefiting both providers and customers. Overall, Open Banking has the potential to transform the financial services industry by promoting innovation, competition, and better customer outcomes.

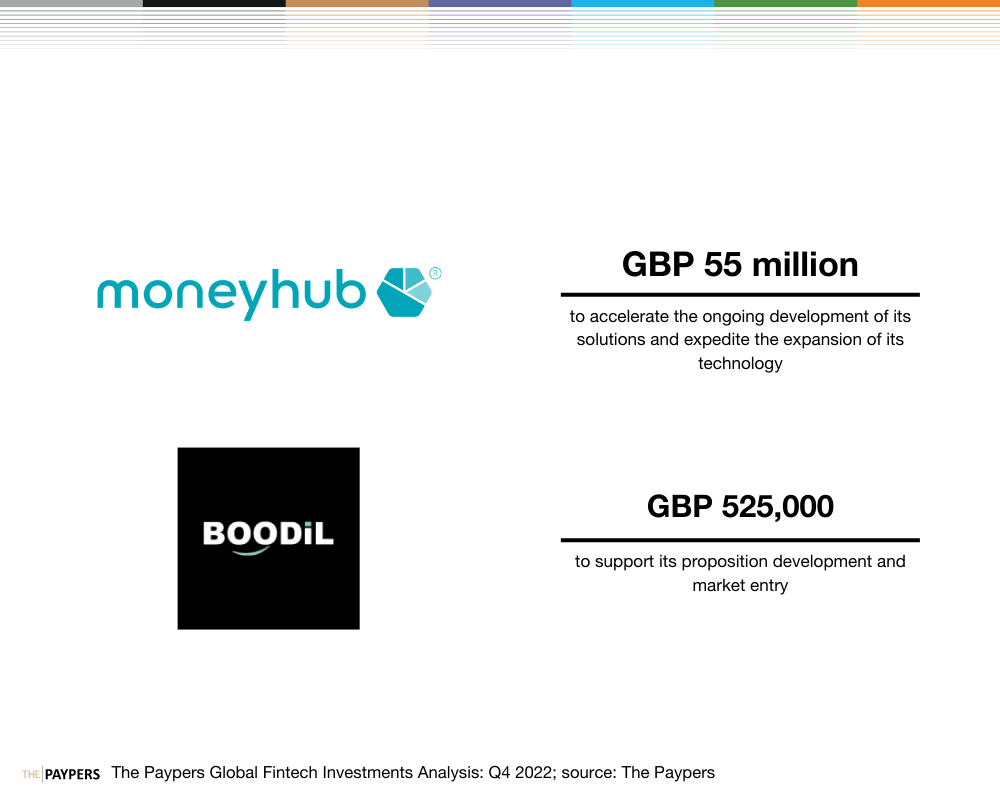

Moneyhub, a UK-based key player in Open Banking and Open Finance, secured an initial GBP 40 million in funding in October 2022 to speed up the development of its solutions, including pensions and wealth, payments, affordability, distribution, and Data-as-a-Service. The funding will also help the company expand its technology internationally. In December 2022, Moneyhub secured an additional GBP 15 million to accelerate the ongoing development of its solutions and expedite the expansion of its technology. Meanwhile, UK-based Open Banking payments and consumer engagement app Boodil raised GBP 525,000 in pre-seed funding in November 2022 to support its proposition development and market entry.

Crypto

The cryptocurrency industry experienced quite a downfall in 2021, especially after the FTX crash. In fact, in November 2022, shortly after the crypto exchange went bust, Singapore-based investor Temasek Holdings decided to write off its USD 275 million investment in FTX following its bankruptcy filing.

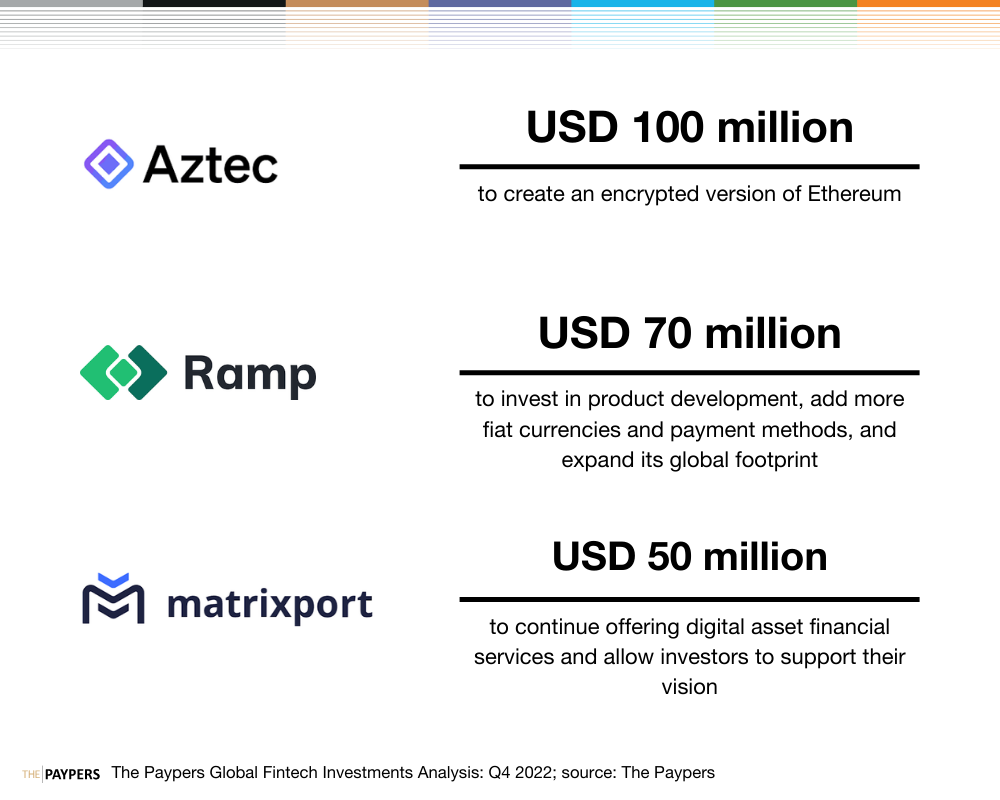

Despite the market-wide crypto winter, some companies managed to secure funding. The appeal of crypto and blockchain for investors lies in their potential for disruption, innovation, and decentralized systems. They offer opportunities for high returns, diversification, and a hedge against inflation and geopolitical risks. Close to the end of 2022, Web3 privacy layer Aztec raised USD 100 million as part of a Series B funding round to create an encrypted version of Ethereum.

In November 2022, Ramp, a US-based crypto payments company, raised USD 70 million in a Series B funding round to invest in product development, add more fiat currencies and payment methods, and expand its global footprint. Similarly, Matrixport, a Singapore-based crypto lending firm, secured USD 50 million in a funding round, with a valuation of USD 1.5 billion, to continue offering digital asset financial services and allow investors to support their vision.

Conclusions

As we expected after Q3’22, the fourth quarter of 2022 came with challenges to the financial industry.

-

Investors did not dig as deep into their pockets compared to previous years and their conservative actions will probably stick around for the foreseeable future.

-

The majority of companies declared that the funds they received will be directed to scaling their products and capabilities.

-

The number of expansion plans has decreased from previous years as well.

-

The companies that managed to raise the most money are those that were already (or close to being) profitable and had strong business models and customer bases.

-

Another conclusion is that, beyond investment deals decreasing in number, a good amount of funding round sums remained undisclosed.

About Vlad Macovei

Vlad is a content editor at The Paypers working on the Banking & Fintech team, where he uses his research, content, and people skills for all activities revolving around Open Banking, Open Finance, Banking-as-a-Service, and more. Vlad has a degree in Biology and Molecular Genetics and an extensive background in creative writing. You can reach out to him via LinkedIn or email (vlad@thepaypers.com).

Vlad is a content editor at The Paypers working on the Banking & Fintech team, where he uses his research, content, and people skills for all activities revolving around Open Banking, Open Finance, Banking-as-a-Service, and more. Vlad has a degree in Biology and Molecular Genetics and an extensive background in creative writing. You can reach out to him via LinkedIn or email (vlad@thepaypers.com).