Trustnet looks at the UK funds attracting and shedding the most money in the first half of the year.

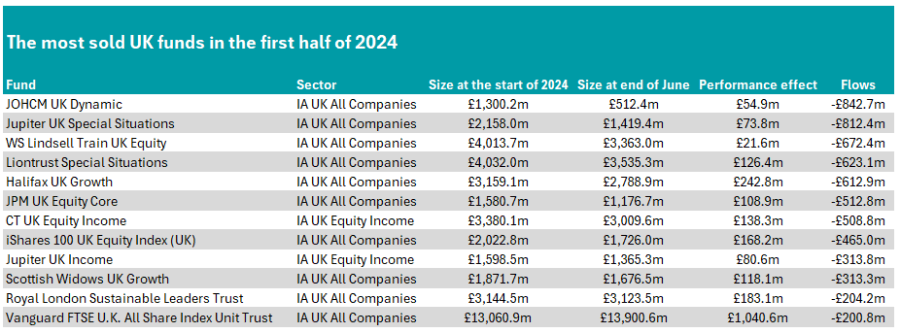

A dozen funds took the brunt of the investors’ chagrin toward the UK market, according to data from FE Analytics.

Since the beginning of the year, investors have withdrawn £3.8bn from UK equity funds but some have been hit more than others. Indeed, investors took more than £100m away from 12 portfolios across the IA UK All Companies, UK Equity Income and UK Smaller Companies sectors.

The top two slots belonged to funds where managers have left. The first is JOHCM UK Dynamic, which had been run by Alex Savvides. The manager is on his way over to Jupiter in the autumn of this year, taking the place of Ben Whitmore as head of Jupiter UK Special Situations.

Both funds experienced outflows however, with investors pulling more than £800m from the pair, although the JOHCM fund (£843m) was hit slightly worse than the Jupiter fund (£812m).

Source: FE Analytics

Next were a pair of industry stalwarts: WS Lindsell Train UK Equity and Liontrust Special Situations. The former is managed by FE fundinfo Alpha Manager Nick Train, who has done a phenomenal job over the long term for investors but has been found wanting in recent years.

The fund has been a top-quartile performer over 10 years but has slumped to the fourth quartile over both one and five years as his quality-growth style of investing has fallen out of favour. Investors took £672m away from the fund in the first half.

Liontrust Special Situations has been much better. Like Train’s fund, it has produced top-quartile returns over 10 years, but over five years it has slipped into the third quartile, although it remains ahead of the overall sector average.

Run by Alpha Managers Anthony Cross and Julian Fosh, as well as Matthew Tonge and Victoria Stevens, the fund also looks for quality stocks, using their ‘Economic Advantage’ process.

Although performance has been strong, the fund is one of the largest in the sector and may have been a victim of the indiscriminate selling of UK assets by investors in the first half of the year. Outflows totalled £623m, with Halifax UK Growth the only other UK fund above £600m.

UK equity income funds held up well, however, with only one name on the list – CT UK Equity Income. Following the retirement of veteran stock picker Richard Colwell in 2022, manager Jeremy Smith has done a good job, with the fund in the second quartile of the sector.

However, over one year it has dropped to the third quartile and investors may still be making their way out of the fund, having given him time to see if the top-quartile performance under Colwell could continue.

No funds from the IA UK Smaller Companies sector made the list, with the most-sold portfolio in the first half of the year – abrdn UK Smaller Companies – suffering net outflows of £144m.

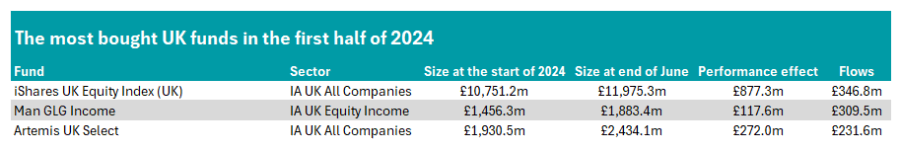

Turning to the more positive end, three funds took in more than £200m in the first half of 2024, with iShares UK Equity Index (UK) raking in £347m.

Source: FE Analytics

Artemis UK Select was the other IA UK All Companies constituent on the list. Managed by Ambrose Faulks and Alpha Manager Ed Legget, the fund has been the best performer in the sector over five years and was third of the 184-strong peer group over the past decade.

Splitting the two was the only member of the IA UK Equity Income sector: Man GLG Income. Alpha Manager Henry Dixon has a deep value philosophy, which has helped the fund to outshine its rivals, topping the peer group over the past decade and making top-quartile gains over one, three and five years as well.

This is no mean feat, as for much of the past decade growth has been in favour, while his deep value strategy has struggled, according to analysts at FE Investments, who also noted that recovery funds “require some patience”.

Again, there were IA UK Smaller Companies funds on the list, with Fidelity UK Smaller Companies the most popular small-cap fund with investors. It took in £91m over the period.