Trustnet looks across the IA Europe Excluding UK sector to see which funds are ahead of their peers on a range of risk and return measures.

Europe has been one of the strongest performers over 2023 so far after a mild winter meant the region avoided the much-feared energy crisis, but which funds have been the strongest in recent challenging years?

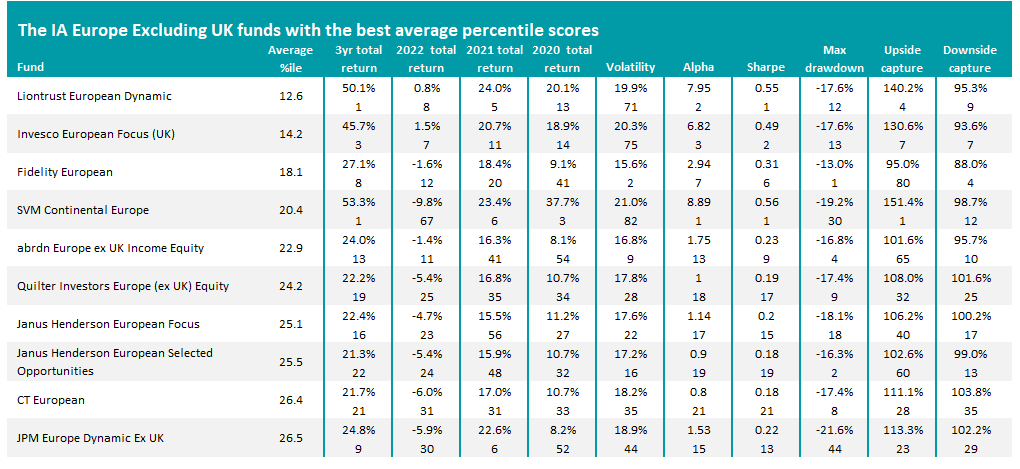

In this ongoing series, Trustnet looks for funds that have beaten their peers on cumulative total returns, volatility, alpha, Sharpe ratio, maximum drawdown, upside capture and downside capture over the past three years, as well as returns in each of 2022, 2021 and 2020.

We then work out an average percentile score for each fund across these 10 metrics: the lower the average percentile, the better the fund has performed overall. When a benchmark for IA Europe Excluding UK funds is needed, we’ve used the FTSE World Europe ex UK index – the most common benchmark in the sector.

Over the three years to the end of 2022, the average IA Europe Excluding UK fund has made a lower return than the FTSE World Europe ex UK – 16.1% from the sector versus 18.6% from the index – while being more volatile and suffering a higher maximum drawdown.

The performance of some individual funds has been much stronger, however. The fund that came in first place in this research is Liontrust European Dynamic, which has an average percentile score of 12.6 thanks to a three-year total return of 50.1%.

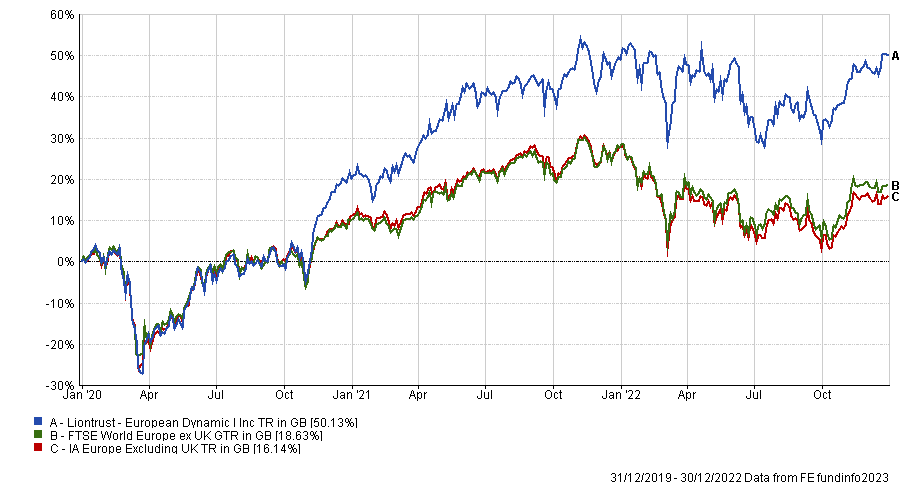

Performance Liontrust European Dynamic vs sector and index over 3yrs to end of 2022

Source: FE Analytics

While it has been more volatile thank both its average peer and the index, the £722m fund is among the best in the sector for metrics such as alpha generation, Sharpe ratio and upside capture.

Managed by James Inglis-Jones and Samantha Gleave, Liontrust European Dynamic uses Liontrust’s Cashflow Solution process. This focuses on companies’ historic cash flows in order to find those that are generate significantly more cash than they need but are lowly valued by investors.

Square Mile Investment Consulting & Research gives the fund an ‘A’ rating. Its analysts said: “The managers follow a very objective investment process that rests firmly on fundamental research. The pair do not believe that meetings with management enhance their process, and consider that the companies’ report and accounts are the primary data source that should be used for analysing stocks.”

The table below shows the 10 IA Europe Excluding UK funds with the best scores in this research; the top row shows the absolute number for the metric in question while the lower row is the percentile rank.

Source: FE Analytics

Invesco European Focus (UK), which came in second place with an average percentile score of 14.2, is one of the smallest in the sector at just £44m in size. The fund is built around the best ideas of managers John Surplice and James Rutland and will look at companies with a range of drivers, including an effective business model, dominant market position or a successful restructuring story.

The fund in third place is probably better known: Samuel Morse’s Fidelity European fund is one of the largest members of the IA Europe Excluding UK sector with assets of £4bn. It concentrates on companies with sustainable margins and a strong balance sheet, with the view of growing their dividend on a three- to five-year time horizon.

Analysts with FE Investments said: “The process has consistently delivered performance in line with our expectations. The fund would suit an investor looking for core European exposure amongst a diversified portfolio of funds.”

Other notable funds in this research’s top 10 include SVM Continental Europe, which has the sector’s highest return for the three-year period under consideration (53.3%), and the £1.8bn Janus Henderson European Selected Opportunities fund, which is another of the biggest funds of the peer group.

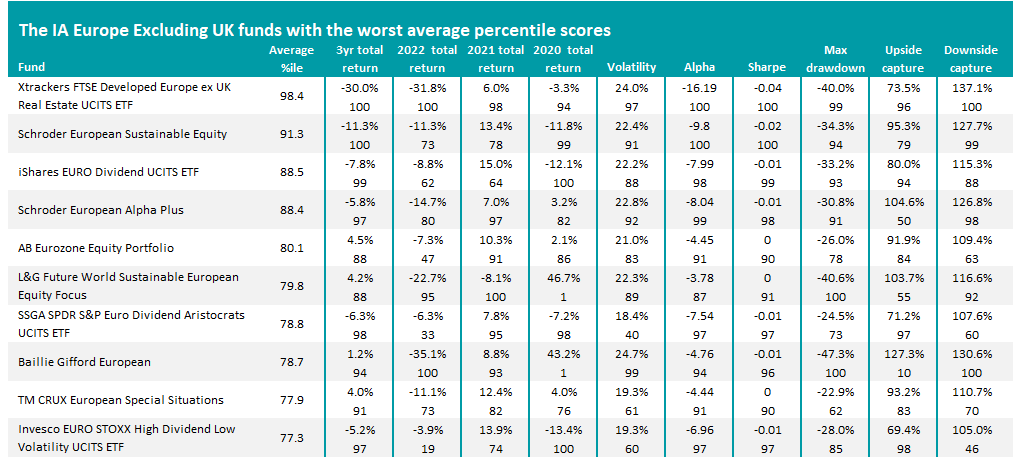

Source: FE Analytics

Xtrackers FTSE Developed Europe ex UK Real Estate UCITS ETF is the worst performer in this research, with an average percentile score of 98.4. It is different to the rest of the IA Europe Excluding UK sector in that it invests in listed real estate companies and REITS rather the conventional equity market.

The most notable name on this list is Baillie Gifford European, which had previously been one of the strongest members of the sector thanks to its bias towards growth stocks. However, it has plummeted down the rankings in recent years after this style fell out of favour.