Trustnet finds out which funds are topping IA Europe ex UK sector on a wide range of performance metrics.

Value funds have outperformed the rest of the IA Europe Excluding UK sector for returns, volatility and a host of other performance measures in recent years, Trustnet research shows, although not all growth funds have fallen behind.

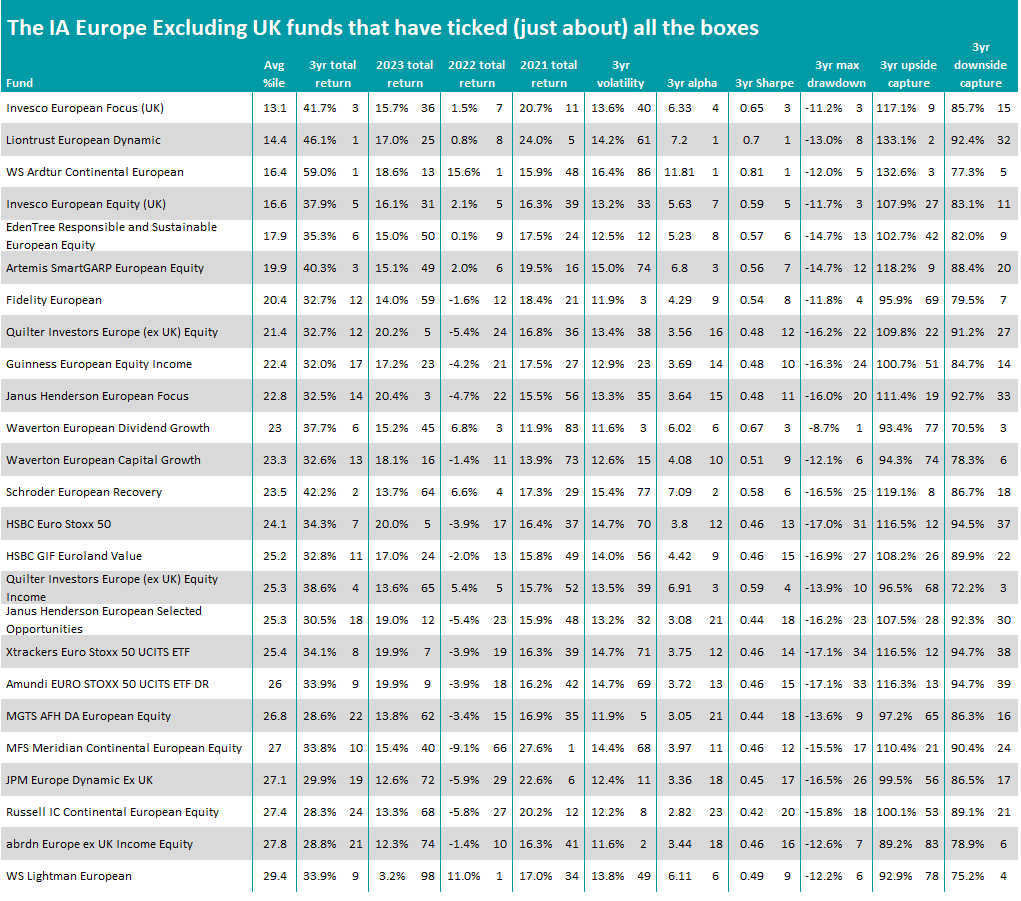

This annual series scores funds on 10 key metrics: cumulative three-year returns to the end of 2023 as well as the individual returns of 2021, 2022 and 2023 (to ensure performance isn’t down to one standout year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown, and upside and downside capture relative to the sector average.

Each fund’s average percentile ranking across these 10 metrics is then used to discover which were most consistently at the very top for the sector across the board. Essentially, the lower a fund’s average percentile score, the stronger it has been over the past three years.

Performance of fund vs sector and index over 3yrs to end of 2023

Source: FE Analytics

In the IA Europe Excluding UK sector, the best result came from Invesco European Focus. This £90m fund, which is managed by John Surplice and James Rutland, achieved an average percentile score of 13.1 thanks to its strong three-year return of 41.7% (the sector’s fourth highest), alpha, Sharpe ratio and maximum drawdown.

The fund is built around a concentrated portfolio of the managers’ best ideas, seeking out companies that can deliver strong returns in the mid to longer-term on the back of an effective business model, dominant market position or a successful restructuring story.

This tends to give the fund a value tilt, something that it shares with many of the others coming out in the lead in this research, as can be seen in the below list of 25 IA Europe Excluding UK funds with the best average percentile scores.

Source: FE Analytics

Some of the funds on this table that take a value approach include WS Ardtur Continental European, Invesco European Equity (also managed by Surplice and Rutland), EdenTree Responsible and Sustainable European Equity, Artemis SmartGARP European Equity, Schroder European Recovery and WS Lightman European.

The value style of investing, which involves buying stocks that are undervalued in the hope they can rebound, lagged for much of the tech-dominated bull run that ran though the 2010s but has had bursts of outperformance more recently after inflation spiked.

FE Analytics shows the MSCI Europe ex UK Value index made a total return of 31.5% in sterling terms over the period this research covers – 1 January 2021 and 31 December 2023 – while the MSCI Europe ex UK Growth index is up just 17%. This market dynamic has helped propel some value funds from the bottom of their sectors to the top.

However, it would be a mistake to think that value has been the only successful way of investing in European equities over the past three years. Liontrust European Dynamic came in second place with an average percentile score of 14.4 and its approach blends elements of both value and growth investing.

Meanwhile, some funds that are growth investors in their approach have performed strongly in this research.

Fidelity European is one of the best known funds in the IA Europe Excluding UK sector and it has a growth approach, looking for companies expected to increase their dividend in the next few years and to fund this through organic growth rather than debt.

Other funds that appear in the table above and have outperformed in recent years with a growth investing approach include Quilter Investors Europe (ex UK) Equity, Janus Henderson European Focus and MFS Meridian Continental European Equity.

Source: FE Analytics

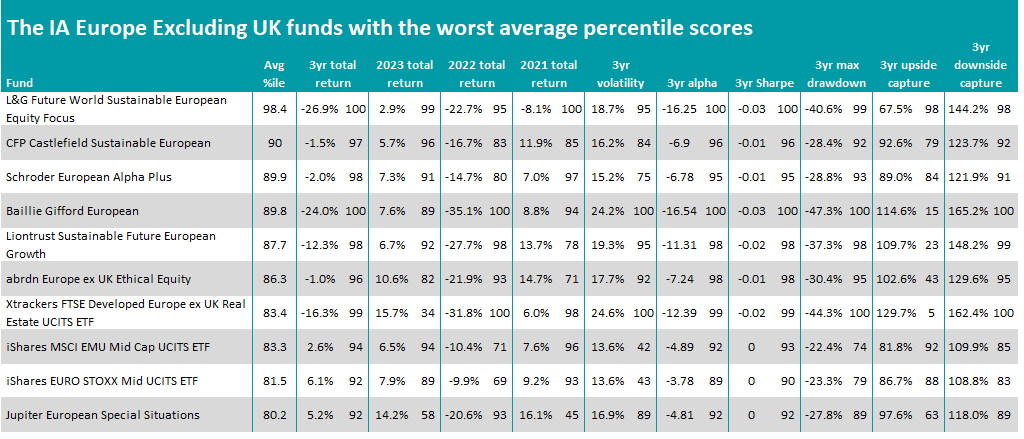

However, when looking at the funds that have come out of this research with the highest average percentile scores – i.e. the ones that have been at the bottom of the sector for multiple risk and return metrics – then the growth style is more common.

The fund with the worst average percentile score – L&G Future World Sustainable European Equity Focus – has a growth approach, as do most of the others on the above list including CFP Castlefield Sustainable European, Schroder European Alpha Plus, Baillie Gifford European and Liontrust Sustainable Future European Growth.

This should come as little surprise, given that the rising inflation and interest rates of recent years put investors off long-duration assets such as growth stocks and channelled them towards investments that could pay off more quickly.