Market conditions have changed significantly post-Covid and some fund managers have adjusted to the new challenges better than others.

Today marks three years since the market lows during the Covid recession, marking the end of a deep downturn that changed the nature of investing for the years following.

Markets have since climbed up from the short and sharp recession of March 2020, but the environment investors find themselves in today is very different from the pre-pandemic market.

High inflation, monetary tightening and a whole set of other domino effects triggered by Covid have created more hostile conditions than many had grown accustomed to over the past decade and some fund managers have fared better than others in this new world.

Here, Trustnet looks at which funds have thrived in the three years since Covid struck and which have struggled to keep pace with the array of new financial challenges.

On a sector level, it’s unsurprising that IA Commodity/Natural Resources funds performed the best over the period given the surge in commodity prices.

Source: FE Analytics

Average returns in the sector were up 125% over the past three years, with the supply chain shortages caused by lockdowns around the world putting many materials in short supply.

Lower production and limited movement during the pandemic were the catalysts for this scarcity of commodities, but demand was further intensified following Russia’s invasion of Ukraine in February last year.

Many countries cut ties with Russia in 2021, leaving a 39% gap in the European Union’s gas usage that the nation previously supplied, according to Paul Bolton, statistician at the House of Commons Library.

Although EU imports of Russian gas shrunk to 15% in the third quarter of 2021, commodities had added tailwinds as the EU and other countries sanctioning the nation scrambled to supplement severed imports.

This surging demand was also reflected in the best performing funds of the past three years, with all but one of the top 10 portfolios investing in energy, oil and gas.

Source: FE Analytics

Schroder ISF Global Energy was the best performing fund in the IA universe in the three years since Covid struck markets, with returns climbing 268.2% over the period.

The $431m portfolio managed by Mark Lacey is housed in the IA Global sector but has a 90% exposure to energy companies.

Indeed, neither the second or third best performers – GS North America Energy & Energy Infrastructure Equity and Active Niche Luxembourg Selection Fund Active Solar – were in the IA Commodities/Natural Resources sector but had an investment focus on energy assets. They were both up 197% and 186.7% respectively over the past three years.

Total return of the three best performing IA funds over the past three years

Source: FE Analytics

Trustnet only included actively managed portfolios in the table, but the top 10 best performers list would have contained six exchange-traded funds tracking commodities indices if not.

The only fund in the top 10 that did not invest primarily in energy was Algebris Financial Equity, which as its name suggests, holds over 60% of its assets in banks. It was up 151.6% over the past three years.

Commodities funds may have thrived since the Covid downturn, but at the other end of the spectrum, fixed income portfolios tanked over the past three years.

All of the 10 worst returning sectors over the period invested in bonds, with UK based ones performing the worst.

The IA UK Gilts and IA UK Index Linked Gilts sectors were the two worst performers in the IA universe, down 25.1% and 23.7% respectively over the past three years, with European fixed income following closely behind.

In the third and fourth spot were IA EUR Government Bond and IA EUR Mixed Bond sectors, each falling 17.4% and 16.8% over the period.

Total return of the four worst performing IA sectors over the past three years

Source: FE Analytics

In the past, bonds have typically been seen has a safe haven that investors can retreat to in times of volatility, but that has not been the case this cycle.

Many bond prices dropped at the same time as equity prices went into decline, so many investors lost the perception of fixed income providing a safety net within portfolios.

UK investors withdrew £4.8bn from fixed income funds in 2022, but the fall in prices and rise in bond yields in recent months has drawn some sentiment back into the asset class. Fixed income funds took in £3.4bn in the three months to January.

The Janus Henderson Inst Long Dated Gilt and abrdn Sterling Long Dated Government Bond funds are among the 10 worst performers over the past three years, with returns down 43.3% and 43.2%.

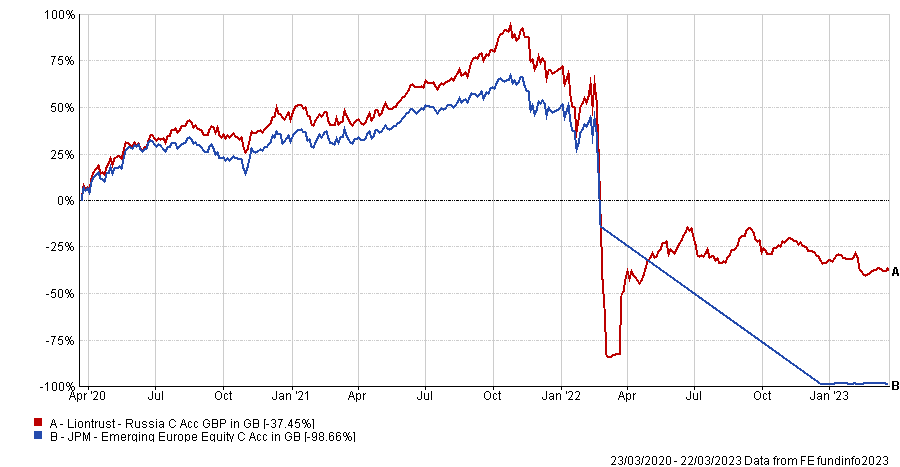

Total return of funds over the past three years

Source: FE Analytics

Of the non-bond funds on the worst performing list, JPM Emerging Europe Equity was top after it dropped 98.7% over the past three years.

It had its largest asset allocation (44%) in Russian equities, so trading was suspended following the invasion of Ukraine last year much like Liontrust Russia, which is down a shallower 37.5% over the past three years.