Experts stick with the multi-boutique house despite some of its funds underperforming.

Having a consistent investment process is key in asset management, and a good manager will stick to their approach even when it is out of favour.

This has been happening to some of Liontrust Asset Management’s funds recently, particularly in UK small- and mid-caps, but experts agreed that the group’s overall offering remains strong.

Liontrust can be described as a “multi-boutique” whose teams have their own distinct processes and franchises, and its business model is based in part on strategic growth through acquisitions.

One thing the firm has got right with this model is retaining key talent, said FundCalibre managing director Darius McDermott.

Historically, Liontrust’s flagship has been the Economic Advantage team, which manages a range of UK equity funds, including Special Situations, UK Growth, UK Smaller Companies and UK Micro Cap.

The long-term track record of these funds is strong, with the UK Smaller Companies fund being the top performer in the 40-strong IA UK Smaller Companies sector over the past 10 years.

Over five years, UK Growth and Special Situations have fallen into the second and third quartile, respectively; Special Situations stayed in the third quartile over the past one and three years.

Historically, small and mid-cap stocks contributed strongly to the Economic Advantage funds, but weak investor sentiment towards these areas has impacted their performance in the past few years.

A Liontrust spokesperson said that the team remains “passionate believers” in the long-term compounding potential of the entrepreneurial, high-quality smaller companies in which they invest – and so did McDermott.

He emphasised the “excellent” long-term track record under FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, who have returned more than 100% to investors over the past decade. McDermott said this is “concrete proof that the process of targeting companies which must have intellectual property, a strong distribution network or recurring revenues holds up well over the long-term.”

Jason Hollands, managing director at Bestinvest, agreed: “I’ve long been a fan of the overall approach, which has delivered very consistent performance. Liontrust UK Growth is also a Bestinvest top pick for the UK market.”

A prime example of Liontrust’s multi-boutique and inorganic growth strategy is the 2017 acquisition of Alliance Trust Investments, now the Liontrust Sustainable Investment team, which manages the Sustainable Future range of strategies.

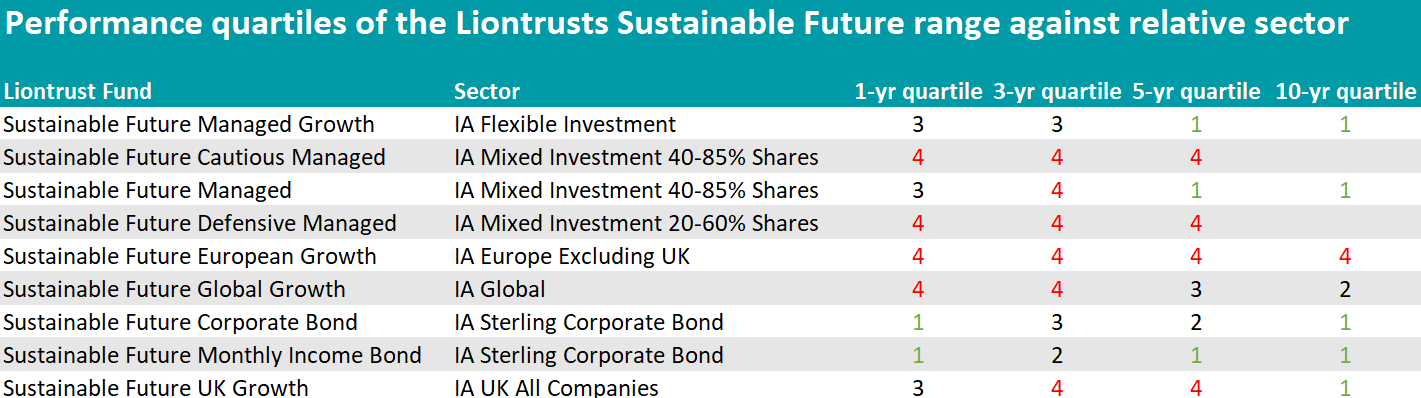

For this range, 2022 was the most challenging year since inception in 2001. Only the Corporate Bond and the Monthly Income Bond funds managed to buck the downward trend, while the European Growth fund has been anchored to the bottom quartile of performance and Global Growth steadily fell from the second to the third, then the fourth quartile – as shown in the table below.

Source: FE Analytics

According to a Liontrust spokesperson, this was due to a series of headwinds, including an abrupt change to the macroeconomic backdrop, higher bond yields and weakness among the growth-focused and quality stocks in which the team invests.

Nonetheless, stocks in the Sustainable Future funds “delivered growth despite the low growth economy”, he said, which is “testament to the structural nature of the themes the team invests in, which the managers believe have strengthened, such as energy security, innovation in healthcare and environmental efficiency”.

For Hollands, the Liontrust Sustainable Future Growth fund’s underperformance “isn’t a surprise” and is “not problematic either”. Most environmental, social and governance (ESG) funds have underperformed, given they missed out on the rally in energy and commodities, he explained.

Hollands still regards the Sustainable Investment team as a jewel in Liontrust’s crown.

The Sustainable Future multi-asset offerings have also faced challenges, said McDermott, but are backed by “one of the most experienced and well-resourced teams in the game”.

“We retain confidence in their ability to deliver long-term growth, especially considering the continued relevance of the themes the team invests in – energy security, healthcare innovation and environmental efficiency,” he concluded.

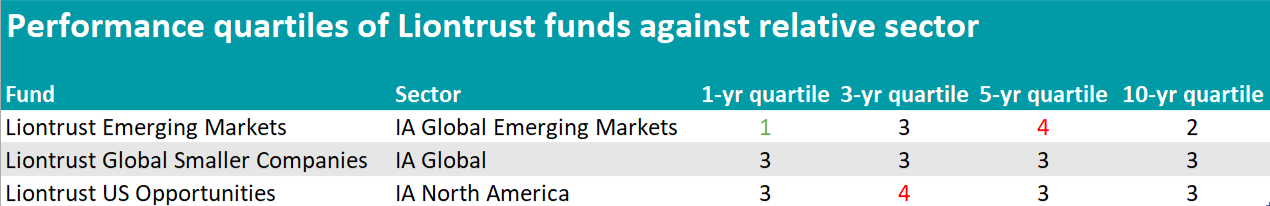

Some funds attached to other investment hubs within Liontrust have also underperformed, including the Global Smaller Companies and US Opportunities funds, as shown below.

Source: FE Analytics

The US Opportunities fund is managed by Hong Yi Chen, who joined Liontrust when it acquired Majedie Asset Management in 2022. The fund has just been moved into the new Liontrust Global Equities team headed by Mark Hawtin. Its investment process has evolved to focus on companies with the potential to exploit change and with catalysts to unlock value.

But the area where Hollands was most sceptical was emerging markets.

Liontrust’s China strategy came 30th out of 36 funds by 10-year performance and has been relegated to the third quartile over the past one, three and five years; the Latin America strategy was the bottom fund in the nine-strong sector over five years.

But Hollands was more concerned about Liontrust Emerging Markets, which came to the group in October 2019 via the acquisition of Neptune Investment Management.

“It is a tiny fund at £9m and appeared in Bestinvest’s last Spot the Dog report as a serial underperformer. At such a small size and with its recent track record, I doubt it is viable,” he said.

Liontrust said most of the underperformance derived from its overweight positions in large-cap technology shares during 2021 and early 2022, which were costly due to a downturn in the semiconductor industry.

Additionally, Brazil dragged on performance as the team’s expectations of recovery initially proved too optimistic – although during the past year, Brazil’s recovery has been a positive contributor to performance.

Asset managers previously covered in this series are Jupiter Asset Management and Schroders.