Shorts in all of April’s most shorted stocks dropped or stayed the same last month, with only two new companies – Keywords Studios and Carnival – joining their ranks.

Short positions in all 10 of the UK’s most shorted stocks dropped or stayed the same in May as hedge funds continue their recent trend of easing their bets against UK companies.

Shorting involves firms borrowing shares in a business they expect to struggle, selling them on the open market and buying them back at a cheaper price once their value falls.

All of the most shorted stocks of April had the bets against them drop or stay the same in May, with ITM Power falling the most, according to data from the Financial Conduct Authority.

Short sellers reduced their position in the energy storage and clean fuel company by 0.7 percentage points, bringing the amount of shorted stocks down to 4.3%.

Meanwhile, a 0.4 percentage point reduction in both energy infrastructure company Petrofac and flooring specialist Victoria throughout May took them out of the top 10, with short positions falling to 3% and 3.9% respectively.

Source: Financial Conduct Authority

They were replaced with two new entrants – Keywords Studios and Carnival – which were the only top 10 names to have an increase in short positions last month.

Short sellers upped their bets on Irish video game company Keywords Studios by 2.3 percentage points in May, bringing the total number of shorted stocks up to 3.9%, yet it has proven itself to be one of the more resilient names in the industry, according to Derren Nathan, head of equity research at Hargreaves Lansdown.

Like many sectors that made a roaring trade in the pandemic boom, most video games companies struggled with lower demand post-Covid. Revenues at Keywords, however, were up 34.8% to €690m in 2022 despite these headwinds.

Profit was also up 29.6% throughout the year to €115m, which was made “all the more impressive in the face of a slowdown in demand for video games, and wider macro-economic difficulties”, according to Nathan.

He said much of its durability last year can be credited to the fact that other gaming companies outsource to it, meaning its revenues are not reliant on the sales of individual releases.

“We think Keywords is in a solid position,” Nathan explained. “Its strengths, differentiated business model and continued strong financial performance are reflected in a price to earnings ratio in the high twenties. That’s a significant premium to many of its peers and one we think is merited.”

Nevertheless, this impressive performance could actually be a liability – it has set the bar high with its strong results last year, so any failure to meet these high standards could result in disappointment from investors.

Likewise, Nathan said Keywords’ dividend yield of 0.13% might not be appealing enough to tempt shareholders to hang on through volatile periods.

“A high rating comes with high expectations, and in Keywords case the dividend is not material enough to compensate for any market wobbles,” he added.

“Keep in mind an industry-wide slowdown could have near-term consequences so there could be ups and downs in the short term.”

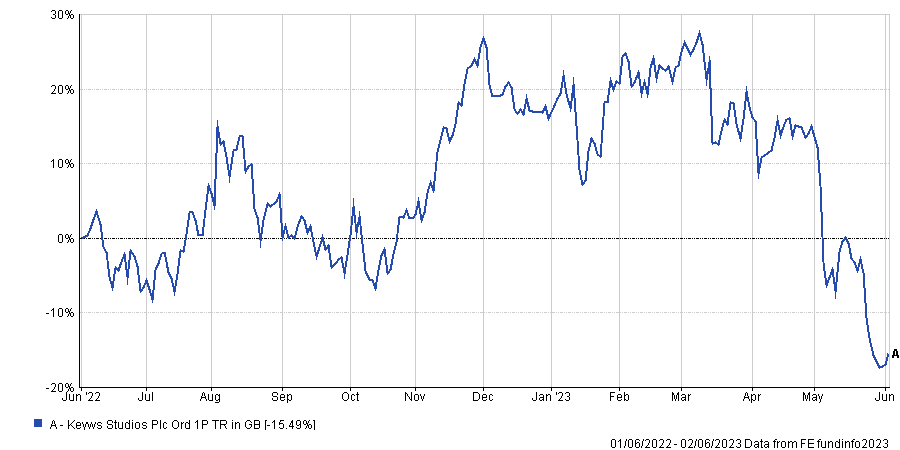

Share price of Keywords Studios over the past year

Source: FE Analytics

Keywords also announced a $15m bid for US-based game developer Hardsuit in May, which resulted in a 5.8% uptick in share price initially, but since sunk 13.5%.

Cruise line company Carnival was the only other business to join the top 10 list in May after short sellers upped their bets by 1.2 percentage points, bringing the total number of positions in the FCA short register up to 3.4%.

It is still recovering from the impact of global lockdowns on the tourism industry in 2020, but Nathan said record high bookings paint a positive outlook for this year.

The cost-of-living crisis and potential rise in unemployment could dampen consumers’ appetite for travel, but this is unlikely to anchor Carnival’s performance too harshly in 2023, according to Nathan.

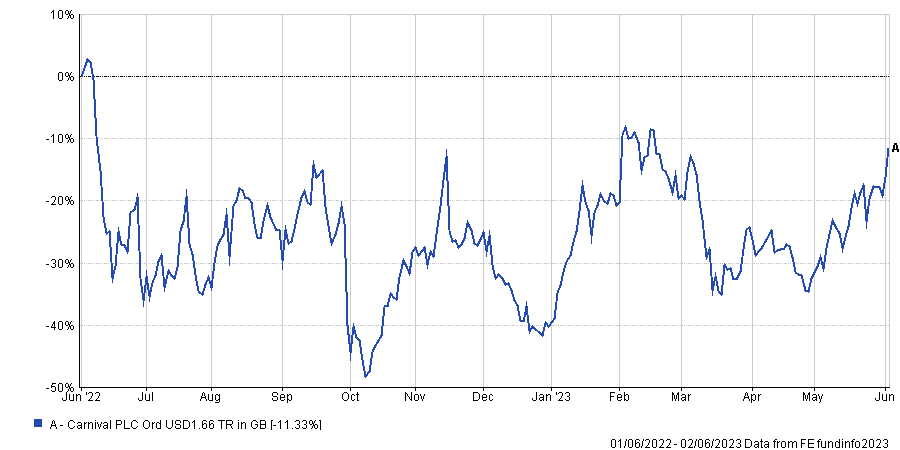

Share price of Carnival over the past year

Source: FE Analytics

Instead, his “biggest concern” is the $30.5bn in debt the company has accumulated since the pandemic. That is much bigger than Carnival’s market cap of $14bn, which is a potential red flag for shareholders, according to Nathan.

He said: “Carnival is well placed to have a good year, but it needs to have a few in a row to make a dent in its debt pile. And with consumers under pressure from all angles, that could still be a big ask.

“[Net debt is] very high. Until it returns towards a low single-digit figure, the risk of default on debt repayments remains higher than we are comfortable with.”