Round Hill Music Royalty Fund (LON:RHM) adds US$26m to market cap in the past 7 days, though investors from a year ago are still down 31%

This week we saw the Round Hill Music Royalty Fund Limited (LON:RHM) share price climb by 10%. But that doesn’t change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 35% in the last year, well below the market return.

Although the past week has been more reassuring for shareholders, they’re still in the red over the last year, so let’s see if the underlying business has been responsible for the decline.

Check out our latest analysis for Round Hill Music Royalty Fund

While Round Hill Music Royalty Fund made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last twelve months, Round Hill Music Royalty Fund increased its revenue by 70%. That’s well above most other pre-profit companies. Given the revenue growth, the share price drop of 35% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it’s worth checking whether losses have stabilized. Our monkey brains haven’t evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

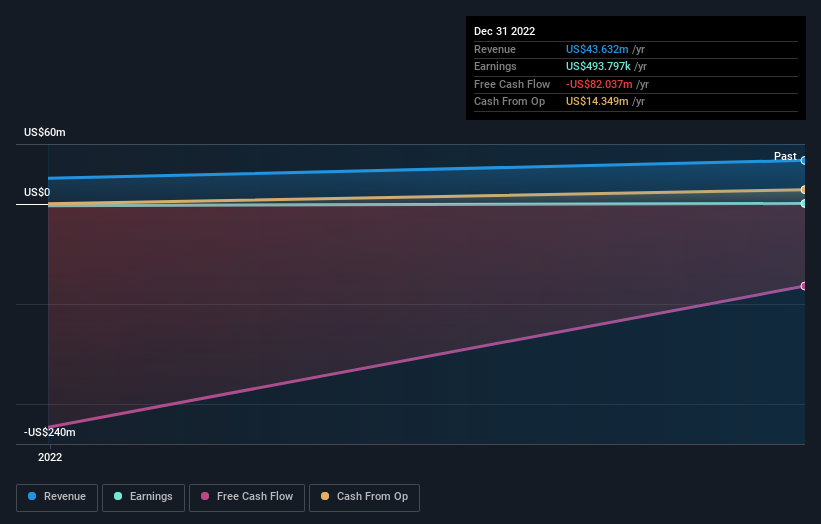

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Round Hill Music Royalty Fund the TSR over the last 1 year was -31%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Given that the market gained 2.8% in the last year, Round Hill Music Royalty Fund shareholders might be miffed that they lost 31% (even including dividends). While the aim is to do better than that, it’s worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 8.5% over the last three months, the market doesn’t seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we’d remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Round Hill Music Royalty Fund is showing 3 warning signs in our investment analysis , and 1 of those is significant…

Round Hill Music Royalty Fund is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here