Despite improved investment returns at the end of the calendar year, unfunded liabilities for state and local pension plans persist at $1.44 trillion.

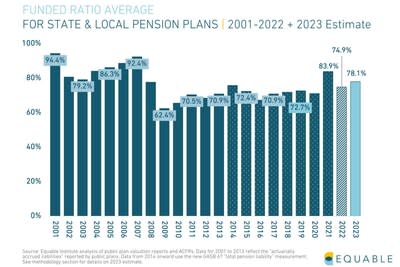

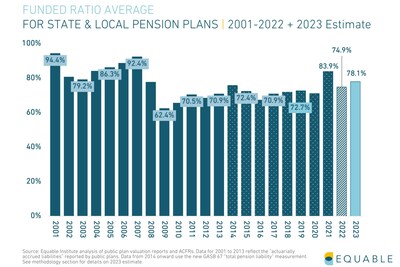

NEW YORK, Jan. 10, 2024 /PRNewswire/ — Today, Equable Institute released a year-end update to its State of Pensions 2023 report. The analysis finds the aggregate funded ratio for U.S. state and local retirement systems are on track to increase from 74.9% in 2022 to 78.1% in 2023, based on available data through December 31st, 2023. Equable Institute estimates that unfunded liabilities will total $1.44 Trillion for the 2023 fiscal year, compared to $1.6 trillion in 2023. While this is a modest improvement year over year, it is also a continuation of the fragile funded status that has persisted for more than a decade and a half after the financial crisis.

The last few months of the 2023 calendar year saw stronger investment performance compared to prior months. Equable estimates this helped public pension plans average a 7.47% return for the 2023 fiscal year, overperforming the average 6.9% assumed rate of return. However, just 53% of public pension plans beat their own assumed return for 2023.

“Funding improvement in 2023 is both welcome and disappointing,” notes Equable Institute’s executive director Anthony Randazzo. “We are more than 15 years on from the financial crisis, lived through a zero-interest rate fueled bull market, seen investments recover from a Covid shock, and watched public plan asset allocations shift steadily into alternatives like private equity and real estate—and still, the national average funded ratio is tepid with little sign that a strong recovery is on the horizon. Instead, we are seeing increasing valuation risk for public plan assets, a further search for investment returns by expansion into private debt, all while the total effects of inflation on pension funds are not yet fully known.”

While aggregate numbers have trended positively in 2023, the report finds that a majority of state and local retirement systems in the U.S. remain fragile or distressed.

The year-end update to State of Pensions 2023 also includes a ranking of estimated 2023 funded status for all 50 states plus Washington D.C. The analysis reveals that Washington D.C. and Utah top the list with aggregate funded ratios of 107.2% and 107.0%, respectively. Kentucky, Illinois and New Jersey, have the worst funded pension plans in the nation at the end of 2023.

|

STATES RANKED BY 2023 FUNDED RATIO |

||||||||

|

Rank |

State |

Funded Ratio |

Unfunded Liability |

Rank |

State |

Funded Ratio |

Unfunded Liability |

|

|

1 |

District of Columbia |

107.2 % |

-$728,545,536 |

42 |

North Dakota |

67.4 % |

$3,387,496,960 |

|

|

2 |

Utah |

107.0 % |

-$3,272,062,976 |

43 |

Mississippi |

66.3 % |

$17,831,391,232 |

|

|

3 |

Tennessee |

105.0 % |

-$3,197,822,464 |

44 |

New Mexico |

65.4 % |

$17,331,079,168 |

|

|

4 |

Washington |

103.5 % |

-$5,050,556,416 |

45 |

Hawaii |

65.4 % |

$12,523,927,552 |

|

|

5 |

Wisconsin |

100.2 % |

-$255,329,792 |

46 |

Vermont |

63.3 % |

$3,396,195,840 |

|

|

6 |

South Dakota |

100.0 % |

$0 |

47 |

South Carolina |

59.9 % |

$27,221,536,768 |

|

|

7 |

Nebraska |

98.1 % |

$346,958,336 |

48 |

Connecticut |

57.8 % |

$37,287,247,872 |

|

|

8 |

Wyoming |

93.6 % |

$732,098,560 |

49 |

New Jersey |

53.5 % |

$95,228,624,896 |

|

|

9 |

West Virginia |

93.1 % |

$1,376,829,952 |

50 |

Illinois |

50.9 % |

$208,011,984,896 |

|

|

10 |

New York |

92.0 % |

$54,593,851,392 |

51 |

Kentucky |

50.1 % |

$40,548,839,424 |

|

|

*Funded ratios are the aggregate of all statewide retirement systems and large municipally managed plans. Data is based on actual reported financial |

||||||||

A full ranking of all 50 states plus Washington, D.C. is available in the year end update to State of Pensions 2023.

To read the State of Pensions 2023 Year End Update, access interactive data visualizations, and download raw data, visit: http://www.equable.org/stateofpensions2023.

About Equable Institute

Equable is a bipartisan non-profit that works with public retirement system stakeholders to solve complex pension funding challenges with data-driven solutions. We exist to support public sector workers in understanding how their retirement systems can be improved, and to help state and local governments find ways to both fix threats to municipal finance stability and ensure the retirement security of all public servants.

Equable.org | Twitter: @EquableInst | Facebook: @EquableInstitute | Instagram: @EquableInst

View original content to download multimedia:https://www.prnewswire.com/news-releases/equable-institute-analysis-performance-of-us-public-pension-funds-remains-mixed-in-q4-302030604.html

SOURCE Equable Institute