These funds captivated investors with the promise of high returns but have so far disappointed.

Some funds do an excellent job at capturing the imagination of investors, convincing them that they can make extraordinary returns on exciting investment themes.

They can gather large inflows as investors are riled up with enthusiasm but don’t always live up to the hype. Here, experts tell Trustnet which funds failed to live up to the high expectations set by investors.

Charles Stanley chief investment analyst Rob Morgan said many investors became “over enamoured” with the all-out-growth stance of Baillie Gifford’s fund range in the booming markets of 2021, but its style has struggled to thrive in the ensuing years.

The firm’s funds were dominant for more than a decade following the financial crisis as the low interest rate and inflation environment benefited growth companies.

However, investors late to the party may be wondering if the hype was worth it. He highlighted Baillie Gifford American as one fund that investors became particularly excited about that year. It is down 33.4% over the past three years whilst its peers in the IA North America sector made a positive return of 29.3%.

Total return of fund vs benchmark and sector over three years

Source: FE Analytics

Like many at the firm, the high-growth approach adopted by managers Tom Slater, Gary Robinson, Kirsty Gibson and Dave Bujnowski was especially vulnerable to rising inflation and interest rates.

Nevertheless, Morgan reminded shareholders of the £2.7bn fund that “investment styles, like catwalk fashions, go in out of favour”.

Despite the recent underperformance, over 10 years it remains a top-quartile performer and it could come roaring back if conditions improve, so investors who clung on through the pain of recent years may want to put off getting cold feet just yet. Indeed, it has returned to the top quartile of the sector over the past 12 months on the back on the artificial intelligence boom.

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

Morgan added: “With fear and scepticism uppermost in investors’ sentiment, the short term could be difficult and higher interest rates are a huge challenge to more cash-hungry, earlier stage business models or companies with debt.

“However, the disruptive growth style will have its day again, ironically when as many investors as possible have completely given up, so the investment opportunity for well capitalised businesses is now greater.”

Similarly, Gavin Haynes, investment consultant at Fairview Investing, highlighted another Baillie Gifford fund as being one of the most disappointing holdings for investors in recent years.

Baillie Gifford Health Innovation garnered much attention from investors when it launched in the pandemic year of 2020, when healthcare was at the forefront of people’s minds.

Since launching, however, the fund has dropped 45.6%. Portfolios investing in the IA Healthcare made a smaller loss over the period, dropping a much shallower 1%.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

In its most recent annual report, managers Julia Angeles, Marina Record and Rose Nguyen apologised for the fund’s “disappointing” results since inception, but stressed that “periods of underperformance are inevitable given the style of investment”.

They added: “We believe that short-term performance measurements are of limited relevance in assessing investment ability and would suggest that five years is a more sensible timeframe over which to judge performance.”

Indeed, Haynes noted that both the style and investment area had an especially difficult ride in recent years – the combined effect made it the 12th worst performer of the 3,360 Investment Association (IA) funds active since its launch.

But he added the sector could improve with time, even if Baillie Gifford Health Innovation has more to make up for than its peers.

“Baillie Gifford will highlight the long-term nature of their approach but despite cyclical headwinds the losses have been brutal and very disappointing,” he said.

“It does feel that the level of pessimism is resulting in the areas in which they invest being oversold and interest rates peaking may be a catalyst for investors to embrace battered valuations in growth stocks. It is certainly a contrarian area and the managers need to exploit structural growth opportunities in healthcare such as artificial intelligence to restore investors faith.”

Growth funds may have disappointed in recent years, but perhaps more shocking was the underperformance of portfolios that investors expected to shine in a high inflation and interest rate environment.

Despite the current environment being the prime conditions for value investing to flourish, IBOSS CIO Chris Metcalfe said the Polar Capital UK Value Opportunities fund undershot the mark.

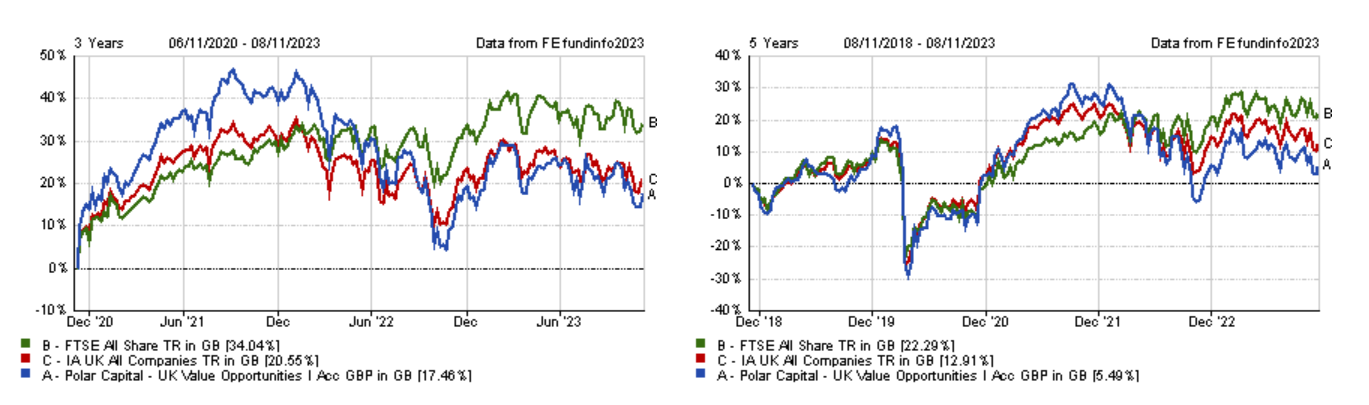

It was up 17.5% over the past three years, trailing 3.1 percentage points behind its peers in the IA UK All Companies sector and dropping below the 34% return made by the FTSE All Share benchmark.

This continues a longer-term trend, with the £747m fund – managed by Georgina Hamilton and George Godber – failing to beat its sector and benchmark since launching in 2017.

Total return of fund vs benchmark and sector over three years and since launch

Source: FE Analytics

Metcalfe said: “The managers spend much of their time looking at the balance sheets of the companies they invest in, but the economic backdrop and market sentiment have been so dire these skills have had little chance to affect the outcome for investors.

“At the same time, the FTSE 250, one of their prime hunting grounds, has gone through one of its worst periods relative to its larger-cap peers, so they are far from alone.”

Still, Metcalfe said its fortunes could change if smaller companies come back into vogue, with Polar Capital UK Value Opportunities’ 61.8% allocation to mid- and small-caps set to benefit.

“In our opinion, interest rates have now peaked, and we anticipate a degree of mean reversion between small and large caps, and we expect Polar to take part in this,” he explained.

“As a further element of safety, UK stocks as a whole are still attractive relative to many other markets as well as their own history.”

On a wider level, the most disappointing outcome following some high expectations was felt by those investing in environmental, social and governance (ESG) funds, according to Darius McDermott, managing director of FundCalibre.

Portfolios contributing to a greener future underwent “immense hype” when they first entered the scene, with low rates creating the prime conditions for them to deliver strong returns on top of their ethical appeal.

However, McDermott remarked that ESG funds have lost their gleam since 2021, as a more hostile market environment put their winning streak to an end.

“Sustainable funds experienced a second consecutive year of underperformance in 2022 due to a decline in investor interest in stocks with prolonged future earnings prospects, driven by rising interest rates,” he said.

“But this does not mean the story is over for ESG. Far from it. We don’t believe ESG is a low-rate bull market luxury, rather decarbonisation is an important multi-decade generational mega-theme that will deliver strong long-term returns as the battle against climate change continues.”