[News] U.S. Chip Subsidies Surge, 2024 Construction Funding Reportedly Exceeds Total of Previous 27 Years

The US government’s CHIPS and Science Act is reportedly injecting funds into chip manufacturing at an unprecedented rate. According to a recent report by the U.S. Census Bureau, the growth rate of construction funding for computer and electrical manufacturing is remarkably high. The amount of money the government is pouring into this industry in 2024 alone is equivalent to the total of the previous 27 years combined.

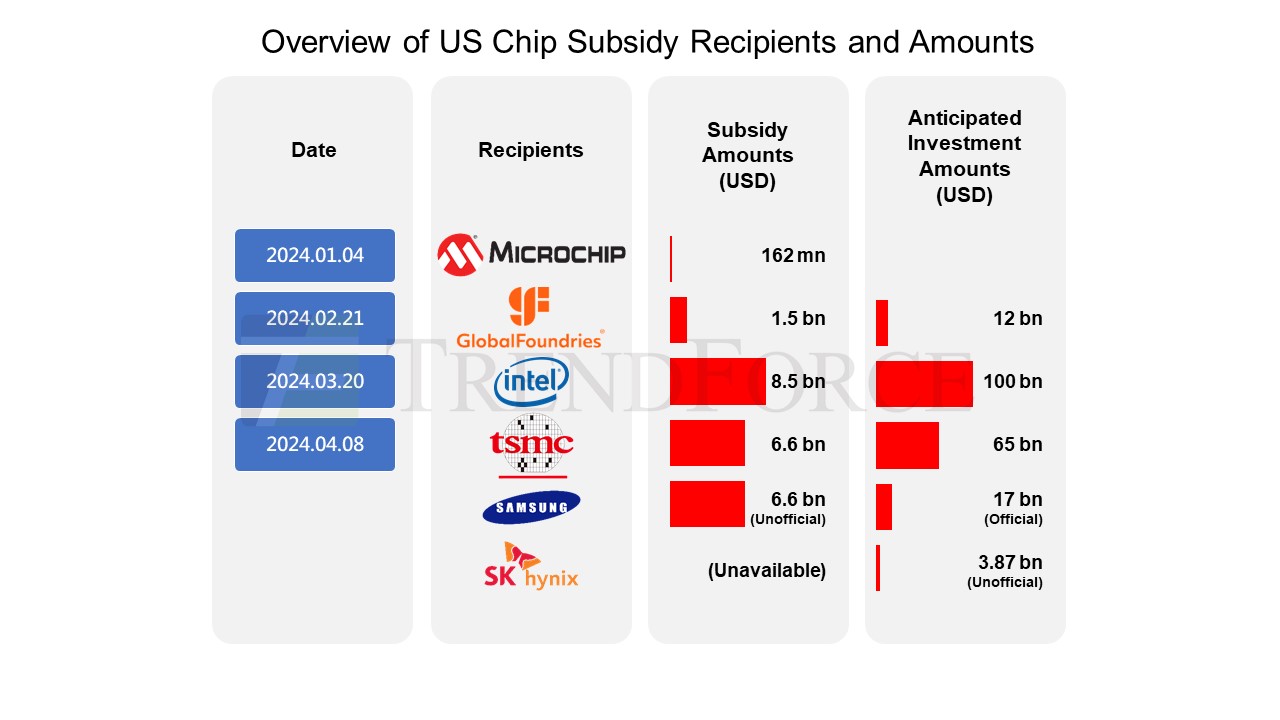

Due to the substantial funding provided by the U.S. CHIPS Act, the construction industry in the United States is experiencing explosive growth. Companies such as TSMC, Intel, Samsung, and Micron have received billions of dollars to build new plants in the U.S.

Research by the Semiconductor Industry Association indicates that the U.S. will triple its domestic semiconductor manufacturing capacity by 2032. It is also projected that by the same year, the U.S. will produce 28% of the world’s advanced logic (below 10nm) manufacturing, surpassing the goal of producing 20% of the world’s advanced chips announced by U.S. Commerce Secretary Gina Raimondo.

Currently, new plant constructions are underway. Despite the enormous expenditures, there have been delays in construction across the United States, affecting plants of Samsung, TSMC, and Intel.

Notably, a previous report from South Korean media BusinessKorea revealed Samsung has postponed the mass production timeline of the fab in Taylor, Texas, US from late 2024 to 2026. Similarly, a report from TechNews, which cited a research report from the Center for Security and Emerging Technology (CSET), noted the postponement of the production of two plants in Arizona, US. Additionally, Intel, as per a previous report from the Wall Street Journal (WSJ), was also said to be delaying the construction timetable for its chip-manufacturing project in Ohio.

Read more

(Photo credit: TSMC)

Please note that this article cites information from U.S. Census Bureau, BusinessKorea, CSET and WSJ.