(Bloomberg) — Chancellor of the Exchequer Kwasi Kwarteng said the Bank of England will be responsible if UK markets suffer renewed volatility after its bond-buying program ends on Friday.

Most Read from Bloomberg

Speaking on the sidelines of the International Monetary Fund’s annual meetings in Washington, Kwarteng told Sky News that any turmoil after the central bank withdraws support “is a matter for the governor.”

Kwarteng and the British government are preparing to make BOE chief Andrew Bailey a scapegoat for the turbulence that may hit the UK next week if stricken pension funds at the heart of this month’s selloff have not unwound their positions and raised the cash they need by the end of this week.

Bailey has given the funds two more days to use the Bank’s £65 billion ($72 billion) emergency backstop facility before the program is closed. The hard deadline raises the risk of more market chaos that could see some so-called liability driven investment strategies fail and would heap pressure on Kwarteng to unveil a revised set of tax and spending plans.

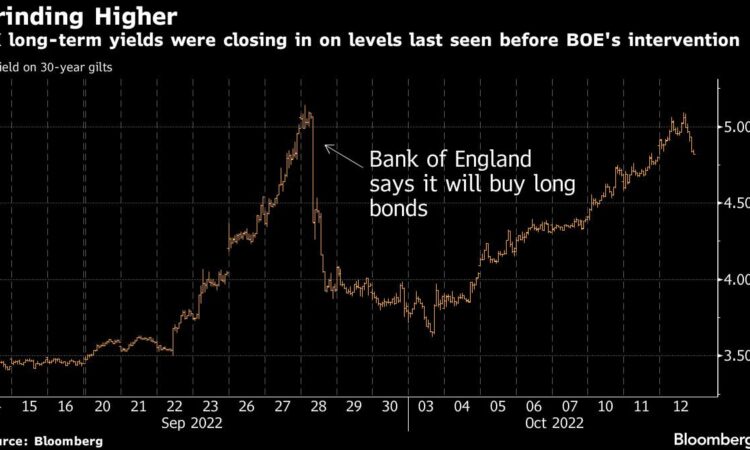

Markets have been in a tailspin since Kwarteng presented a £45 billion package of unfunded fiscal stimulus on Sept. 23. Kwarteng and Prime Minister Liz Truss argue that the measures are necessary to spur the UK economy into higher growth and brushed off concerns from institutions like the IMF and the Bank itself that the package risked adding to inflation pressures.

Bailey this week underlined his commitment to halting government debt purchases on Friday as planned, both to draw a line under a program that is complicating his efforts to tame inflation and to encourage pension funds to get on with closing their positions.

Read More: Bailey Risks BOE Credibility in Vow to End Gilt Buying

Traders will be anxiously watching Thursday’s tender to see whether the funds have listened. On Wednesday the BOE bought £4.4 billion of gilts in its biggest intervention since the package was launched on Sept. 28. Market conditions improved dramatically after the BOE’s move.

Even bigger purchases on the final two days of the operation would suggest that funds are hastily clearing their positions in preparation for the removal of the backstop. The BOE is offering to buy up to £10 billion of bonds on Thursday and Friday.

When the Bank introduced the emergency gilt purchases to head off a firesale of UK assets, it stressed that the intervention was a financial stability operation. The problem is that the policy is a carbon copy of quantitative easing — an earlier bond-buying effort intended to stave off deflation — and that has confused the Bank’s signaling as it tightens monetary policy by raising rates and preparing to sell gilts.

Bailey wants to draw a line under that confusion and restore market discipline, arguing that it is not a central bank’s job to bail out pension funds.

What Happens Next?

Asset managers, regulators and bankers at the Institute of International Finance’s meetings in Washington were divided over how the next few days will unfold.

Thilo Schweizer, head of European affairs at Commerzbank, said people were skeptical that Bailey would be able to hold his position. “The market may test him, and if they do he will eat his own words,” Schweizer said.

If the BOE does backtrack on Bailey’s pledge to end gilt purchases, that would raise credibility issues at a time when the government’s own loss of credibility is central to the market mayhem.

Others said the BOE should not jeopardize its independence any longer by plastering over problems created by the government but instead step aside and force the Treasury to act. Senior Tories are also urging the chancellor to rip up his mini-budget to avoid a financial crisis.

Katherine Garrett-Cox, chief executive of the UK subsidiary of the Gulf International Bank of Bahrain, said: “There is not a silver bullet on this. The Bank has got to keep within the guardrails — its framework and long-term policy mechanism.”

Steven Major, head of fixed income research at HSBC, said another option to ease congestion in the markets would be for the Debt Management Office, which is part of Kwarteng’s Treasury, to change its funding plans. If the DMO opted to raise very short-dated money — a part of the gilt market that is not seeing demand problems — that might help ease the strains in longer-term debt sufficiently to avoid another rout.

And maybe the rout just might not materialize. Funds still have two days of emergency liquidity support to help them clean up their portfolios and after that the BOE also has a number of standard liquidity programs that can be used if pension funds need cash.

All the same, one senior financier warned that relying on that outcome was a risky proposition. They pointed out that those programs require funds to go through the commercial banks and those lenders could be uncomfortable taking risk onto their balance sheets even temporarily.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.