“Inheritance tax is the most inequitable tax there is. I have no objection to paying tax, but why should my children have to pay inheritance tax in such excessive amounts, on money I have already paid tax on? Even if the Government just reduced the rate to 10pc or 5pc, it would be more tolerable. This is going to have a detrimental impact on my children.”

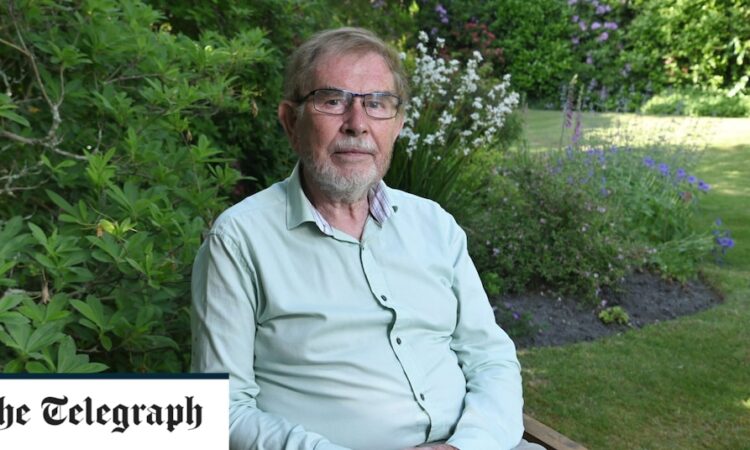

Ted Franke, 67, Buckinghamshire

Mr Franke, an entrepreneur, said that death duties punish ardent savers and penalise business owners.

“Inheritance tax has been on my mind for at least the last thirty years. It doesn’t stop me working as I enjoy the buzz. However, it would pain me to know that the business I have built from nothing would need to be broken up to pay death duties. I know it’s not my problem when the time comes but those left behind will face the terrible dilemma of trying to salvage something.”

Dianne Whitehead, 69, Leicestershire

Ms Whitehead lost most of her mother’s estate to inheritance tax.

“When my stepfather died a sum of money was left in trust. The interest was for my mother to live on and the capital would revert to his children upon her death. When my mother died 32 years later, the trust reverted and we had to pay 40pc death duties on it. How can that be fair?”

Gillian T, 81, south-west London

Ms T bought her small house in south-west London in 1985 as a single parent to two young boys. Now worth £650,000, the value of her property means her sons will have to pay death duties.

“I have savings of about £60,000 built up as a rainy day fund but they will be insufficient to pay off the IHT bill. My sons will have to take out a bridging loan at high interest rates to pay it before they can get probate and sell the house. I am disgusted by this and think it is morally wrong.

“I worked hard all my life to bring up my boys and put a roof over our heads and now I can’t even spend my savings as I choose before I die.”

Richard Stanmore, 61, Anglesey, north Wales: “I’ve worked my whole life and paid my taxes — now they want more”

Mr Stanmore has been working since the age of 15. He will be the first in his family to pay inheritance tax, falling outside the main tax free allowance band of £325,000.

A dad of three, Mr Stanmore has built his wealth from nothing as a salesman. He fears more and more ordinary people are falling foul of the tax, which raised £7.1bn for the Treasury in the last tax year.

He said: “I’ve worked my whole life and paid my taxes. But when I die, the Government is going to have its hand in my money again. I think it’s disgusting.

“I’ve got three children, two girls and a boy, who I want to leave my estate to — whatever that estate might be.

“My parents are still alive, but they don’t have any money.”

Mr Stanmore didn’t go to university, or attend many lessons at school. He has sold anything from double glazing to Kirby vacuums to cars. Now, he is a student landlord, renting out a handful of properties.

He added: “This tax is dragging down more and more people. It won’t be long before you’ll have a two-bed flat worth more than the threshold.

“It’s not supposed to affect the normal working man on the street. It needs a drastic rethink and ideally be abolished.”

How has inheritance tax impacted you? Do you have a story for our campaign? Email money@telegraph.co.uk