Strong and predictable public orders are needed for the development of the domestic rail vehicle industry, stressed László Mosóczi, the ministerial commissioner responsible for the coordination of the sector, at the Hungrail Hungarian Rail Association’s Conference on the Railway Rolling Stock Sector.

While investor demand provides a good basis for boosting domestic production of rolling stock, some purchases are made with subsidies and loans, reports Világgazdaság. According to the strategy for rail vehicle production, by 2030, Hungary needs:

- over 100,000 new seats on the railways

- an increase in freight transport capacity from 50 million tons to 70 million tons per year

- the possibility of 160 kilometers per hour on as many lines as possible

- the development of suburban rail transport, especially in the Budapest area

- the improvement of rail accessibility for the Hungarian population living beyond the borders and in neighboring capitals

- and finally, to respond to the needs of the Hungarian defense and NATO.

László Mosóczi hopes that rail vehicle manufacturers and their suppliers in Hungary will also see opportunities in the developments here.

The more domestic rail investment starts, the more jobs will be created.

The ministerial Commissioner recalled that Stadler has the largest fleet on the Hungarian rails. Mosóczi said that innovation, digitalization, and automation are also key to efficiency and sustainability in the sector.

Hungary spent HUF 1,100 billion (EUR 2.8 billion) on railway development in the recently concluded Integrated Transport Operational Programme (ITOP). In the next cycle, a total of around HUF 2,000 billion (EUR 5 billion) in EU funds (not only ITOP) will be available, stressed Szabolcs Ágostházy, State Secretary for EU Development at the Ministry of Construction and Transport.

Among the achievements of the Integrated Transport Operational Programme that have been completed, he listed:

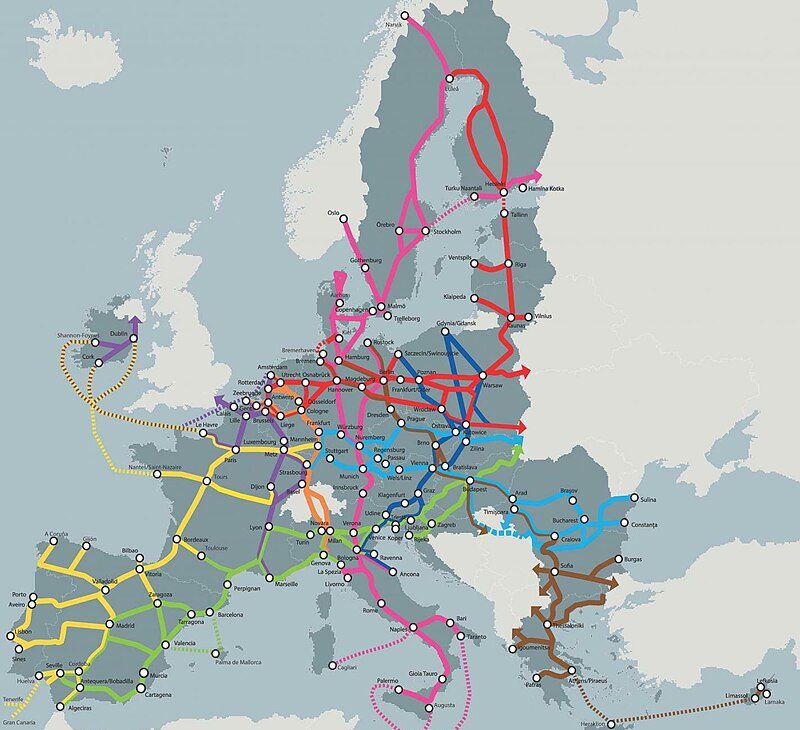

- the 209 km of track upgrading along the EU’s priority rail corridors (Trans-European Transport Network, TEN-T)

- the 212 km of new lines on non-TEN-T lines

- and the creation of 6,400 new railway seats.

Map of the European Transport Corridors. Photo via Wikipedia.

In the new cycle, some of the existing projects will be continued: the TEN-T network, the procurement of motor trains, the development of suburban railways and urban trams, the creation of parking areas near railways, and the interconnection of ports and the rail network.

A new feature of the recovery plan is that HUF 626 billion (EUR 1.6 billion) can be used to implement these measures.

The global rail market is growing at five to six percent a year, but European production is toxic, said Róbert Homolya, President of Stadler Trains Hungary. The challenges of recent years have included the COVID pandemic, followed by the Russian-Ukrainian war, rising crude oil, energy, and raw material prices, and inflation. All of this has reduced the predictability of manufacturers’ operations.

Stadler’s plant in Szolnok (central Hungary). Photo via Facebook/Péter Szijjártó

The global rail vehicle manufacturing market, estimated at EUR 35 billion, has undergone significant consolidation in recent years.

Around half of output is accounted for by two major players, China’s CRRC and following the acquisition of Bombardier’s rail business, France’s Alstom. Siemens, Hitachi, and Stadler share another 30% or so. Homolya also provided some instructive data on the composition of railway production. Of the 27-28,000 rail vehicles produced globally each year,

- a quarter are multiple-unit trains

- a quarter are metro trains

- a fifth are passenger railroad cars

- an eighth are high-speed rail cars

- and one tenth are locomotives.

Via Világgazdaság; Featured image via Facebook/MÁV