An index fund is an investment that tracks a market index, typically made up of stocks or bonds. Index funds typically invest in all the components that are included in the index they track, and they have fund managers whose job it is to make sure that the index fund performs the same as the index.

1. Pick an index

1. Pick an index

There are hundreds of different indexes you can track using index funds. The most popular index is the S&P 500 index, which includes 500 of the top companies in the U.S. stock market. Here’s a short list of some additional top indexes, broken down by the part of the market that they cover:

In addition to these broad indexes, you can find sector indexes tied to specific industries, country indexes that target stocks in single nations, style indexes that emphasize fast-growing companies or value-priced stocks, and other indexes that limit their investments based on their own filtering systems.

2. Choose the right fund

2. Choose the right fund for your index

Once you’ve chosen an index, you can generally find at least one index fund that tracks it. For popular indexes like the S&P 500, you might have a dozen or more choices, all tracking the same index. If you have more than one index fund option for your chosen index, you’ll want to ask some basic questions. First, which index fund most closely tracks the performance of the index? Second, which index fund has the lowest costs? Third, are there any limitations or restrictions on an index fund that prevent you from investing in it? And finally, does the fund provider have other index funds that you’re also interested in using? The answers to those questions should make it easier to pick the right index fund for you.

3. Buy shares

3. Buy index fund shares

You can open a brokerage account that allows you to buy and sell shares of the index fund that interests you. Alternatively, you can typically open an account directly with a mutual fund company that offers an index fund you’re interested in.

Again, it pays to look at costs and features when deciding which way is best for you to buy shares of your index fund. Some brokers charge extra for their customers to buy index fund shares, making it cheaper to go directly through the index fund company to open a fund account. Yet many investors prefer to have all their investments held in a single brokerage account. If you anticipate investing in several different index funds offered by different fund managers, then the brokerage option can be your best way to combine all your investments under a single account.

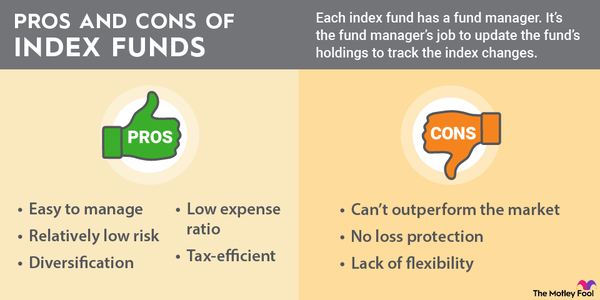

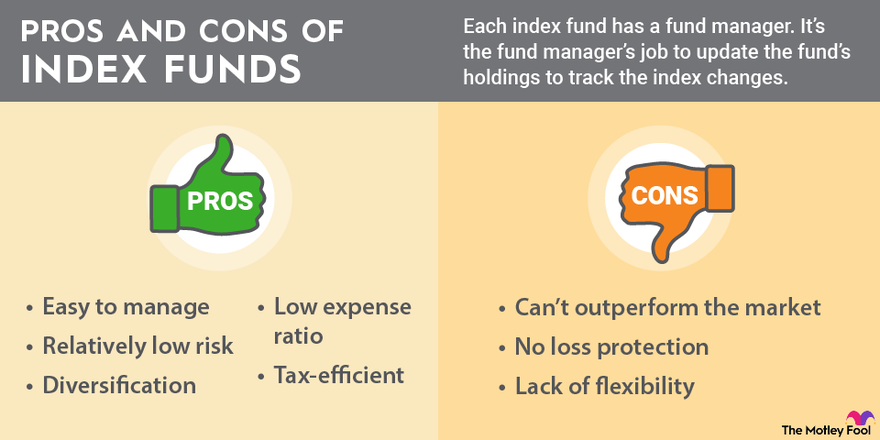

Pros and cons

Pros and cons

Image source: The Motley Fool.

Why invest

Why invest in index funds?

Investing in index funds is one of the easiest and most effective ways for investors to build wealth. By simply matching the impressive performance of the financial markets over time, index funds can turn your investment into a huge nest egg in the long run — and best of all, you don’t have to become a stock market expert to do it.

Investors find index funds especially useful for many reasons:

- Minimal investment research: You can rely on the index fund’s portfolio manager to simply match the performance of the underlying index over time.

- Managed investment risk: Diversification leaves you less likely to suffer big losses if something bad happens to one or two companies in the index.

- Lots of choices: You can buy broad index funds, such as those that track the S&P 500, or more focused index funds that invest in specific sectors or trends.

- Low fees: Index funds are usually far less costly than alternatives like actively managed funds. That’s because an index fund manager just has to passively buy the stocks or other investments in an index — you don’t have to pay them to try to come up with stock picks of their own.

- Tax efficiency: Index funds are quite tax-efficient compared with many other investments. Index funds generally don’t have to do as much buying and selling of their holdings as actively managed funds, so they avoid generating capital gains that can add to your tax bill.

- Building your portfolio over time: When you use index funds, you are a passive investor. You can invest month after month and ignore short-term ups and downs, confident that you’ll share in the long-term growth of the market and build your nest egg.

Why not to invest

Why not invest in index funds?

As simple and easy as index funds are, they’re not for everyone. The downsides of investing in index funds include the following:

- No chance of beating the market: Index funds are designed solely to match the market’s performance. If you want to prove your mettle as a superior investor, index funds won’t give you that chance.

- Short-term downside risk: Index funds track their markets in good times and bad. They can be volatile places to put your money. When the market plunges, your index fund will plunge as well. Investors learned this lesson firsthand in the 2022-23 bear market.

- Lots of different stocks: The diversification of an index fund works both ways. Depending on the index you choose, you can end up owning some stocks you’d rather not own while missing out on others you’d prefer.

To address some of these shortcomings, you can always keep a mix of index funds and other investments to give you greater flexibility. If you plan on solely using index funds, however, you’ll have to get comfortable with their limitations.

Starter funds

Four index funds to get you started

If you’re looking for some index fund ideas to help you invest better, the following four are a good place to start.

- Vanguard S&P 500 ETF (VOO 0.05%): Tracks S&P 500 index; $3 annual cost for a $10,000 investment.

- Vanguard Total Stock Market (VTI 0.02%): Tracks index of U.S. stocks of all sizes; $3 annual cost for a $10,000 investment.

- Vanguard Total International Stock Market (VXUS 0.35%): Tracks index of global stocks, excluding the U.S.; $7 annual cost for $10,000 investment.

- Vanguard Total Bond (BND 0.2%): Tracks index of various bonds; $3 annual cost for a $10,000 investment.

It’s worth noting that the annual costs mentioned here aren’t actual out-of-pocket costs you have to pay. They are the fund’s various management fees (known as an expense ratio) and are reflected in the share price of the index fund over time.

Vanguard funds are widely regarded as an easy entry point for new index fund investors, but you can find similar funds from other providers as well.

The bottom line is that by allowing you to form a stock and bond asset allocation that is appropriate for your risk tolerance and investment goals, index funds like these let you create a portfolio without the need to research individual stocks or pay an expensive investment advisor.

Related investing topics

Are index funds right for you?

To be sure, if you have the time, knowledge, and desire to create a portfolio of individual stocks, by all means, go for it. But even if you do own individual stocks, index funds can form a solid base for your portfolio.

Index funds offer investors of all skill levels a simple, successful way to invest. If you’re interested in growing your money but would rather put some or all of your investments on autopilot, index funds can be a great solution to achieve your financial goals.

Index fund FAQs

How do index funds work?

Index funds are a special type of financial vehicle that pools money from investors and invests it in securities such as stocks or bonds. An index fund is designed to track the returns of a designated stock market index. A market index is a hypothetical portfolio of securities that represents a segment of the market. For example, the S&P 500 index represents 500 of the largest U.S. companies.

What is the average index fund return?

The average annual return for the S&P 500 is almost 10% over the long term. The performance of the S&P 500 index is better in some years than in others, though. In fact, in the past 60 years, the single-year total return (including dividends) of the S&P 500 has been as high as 37.6% or as low as negative 37%, but it averaged an annualized gain of 9.9% over the entire period.

What are low-cost index funds?

Low-cost index funds are among the most advantageous investment vehicles for those focused on the long term. It’s important to know a fund’s expense ratio, which denotes how much money in management fees you’ll pay before investing your hard-earned dollars. Here are some top low-cost index funds and their expense ratios:

- Vanguard S&P 500 ETF 0.03%

- Vanguard Large-Cap ETF 0.04%

- Schwab U.S. Large-Cap ETF 0.03%

- Vanguard Mid-Cap ETF 0.04%

- Schwab U.S. Mid-Cap ETF 0.04%

- Vanguard Small-Cap ETF 0.05%

- iShares Core S&P Small-Cap ETF 0.06%

- Schwab U.S. Broad Market 0.03%

- iShares Core S&P Total US Stock Market 0.03%

- Vanguard Total Stock Market 0.04%

How can I directly invest in index funds?

You can directly invest in index funds by opening and funding a brokerage account. All brokers allow you to directly buy shares of ETFs on the open market, and most allow you to directly invest in mutual funds if you prefer to use those.

How much is needed to invest in an index fund?

The minimum needed depends on the fund and your broker’s policies. If your broker allows you to buy fractional shares of stock, you may be able to invest in index fund ETFs with as little as $1. If not, your minimum investment will be the cost of one share of the ETF. Index funds that are mutual funds typically have a minimum initial investment set by the mutual fund provider.

How do I start investing in an index fund?

Index funds come in ETF and mutual fund forms, and can be invested in directly through a brokerage account. Alternatively, you can automate your index fund investing by opening an account with a robo-advisor.