Air travel is seeing an upswing, with the International Air Transport Association (IATA) forecasting 4.35 billion global passengers carried this year alone.

This resurgence, however, presents an ironic twist. As air travel soars, so does the urgency to reduce emissions—not just in airlines but also airports.

Two global powerhouses, the U.S. and European Union (EU), are navigating this challenge, but their compasses point in very different directions. Whereas the former is investing in new airport infrastructure and modernizing facilities to meet ambitious climate goals, the latter is choosing to combat emissions by restricting the number of flights.

The U.S.: Reimagining Infrastructure

The U.S. is staring at a daunting projection: a 158% increase in passenger traffic by 2040 compared to 2019 levels, according to Airports Council International (ACI). This massive influx demands advanced infrastructure to accommodate passengers, ensure seamless operations, stimulate competition and offer world-class customer experiences. These aren’t mere niceties; they’re necessities, especially if you consider that airports contributed an impressive 7.2% to the U.S. GDP pre-pandemic.

But beyond bracing for this surge, there’s another colossal challenge—the commitment to reducing CO2 and other greenhouse gases.

The Federal Aviation Administration (FAA) recently allocated over $90 million to help 21 U.S. airports achieve zero emissions by 2050. It’s a laudable step, aligning with the 2021 Aviation Climate Action Plan, but a gaping financial abyss remains.

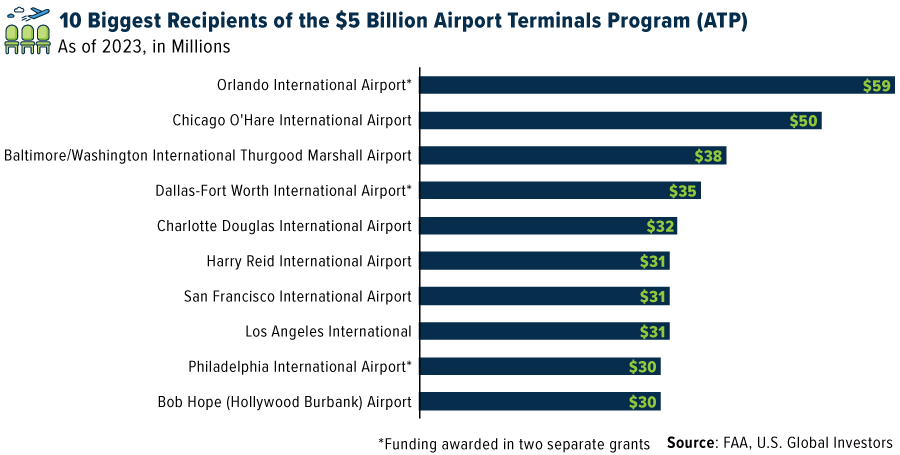

Nevertheless, thanks to the Bipartisan Infrastructure Law, signed in 2021, many U.S. airports are being awarded tens of millions of dollars to upgrade terminal buildings and improve energy efficiency. Among the biggest recipients of federal money is the Dallas-Fort Worth International Airport (DFW), which is getting $25 million to replace an aging HVAC system, install dimmable smart glass in terminal windows and reduce nitrogen oxide (NOx) emissions. A further $10 million is set aside for DFW’s new renewable energy plant, which is on track to deliver 100% net-zero carbon power by 2030.

These grants don’t include the billions that airports are already investing in themselves. The most notable example by far is Los Angeles International (LAX), the fifth-busiest airport in the U.S. and sixth-busiest in the world, which is spending a staggering $30 billion in anticipation of the 2028 Summer Olympics, to be held in LA. It’s believed to be the largest public works program in the city’s history.

Here in San Antonio, home to U.S. Global Investors, the international airport (SAT) is undergoing a $2.5 billion expansion and improvement plan. In addition to getting a third terminal, the airport has plans for a new ground loading facility, which will bolster its capacity. Last month, SAT saw over 1 million passengers, a new record for July traffic.

The European Strategy: Restriction & Redirection

Europe, in contrast, paints a different narrative. While the U.S. leans into infrastructure enhancement and modernization, the EU is nudging its citizens toward alternative modes of transportation.

France stands out in this respect. In May, the country banned domestic, short-haul flights between cities where train alternatives exist. And yet some critics believe this doesn’t go far enough, with some calling for stricter measures such as eradicating flight tax benefits or progressive taxing of frequent fliers.

The same is taking place in the Netherlands. Last month, the Dutch government won a case to cap the number of flights at Amsterdam Airport Schiphol, the country’s main international airport and Europe’s third-busiest airport, having handled 52.5 million passengers in 2022. As a result of the ruling, aircraft movements—defined as the number of arrivals and departures into and out of the airport—will be reduced to 460,000 annually from the current cap of 500,000, before being reduced further to 440,000.

The decision has been met with resistance, as you might expect. Major airlines, including KLM Royal Dutch Airlines, the largest carrier at Schiphol, Delta Air Lines and easyJet, have expressed their disappointment and are advocating for sustainability measures similar to those seen in the U.S.

An Inevitable Crossroads

Both continents aim for the same horizon—a sustainable future for air travel. The difference is that the U.S. is betting on infrastructure improvements and a drive toward modernization, while Europe is gravitating toward shaping traveler habits via regulations and restrictions.

Will the U.S. infrastructure upgrades, with a keen eye on environmental commitments, prove sustainable in the face of rising demand? Conversely, can European restrictions effectively reduce emissions without hampering economic growth and connectivity?

The answers may not be immediate, but as investors, we must remain engaged and informed.

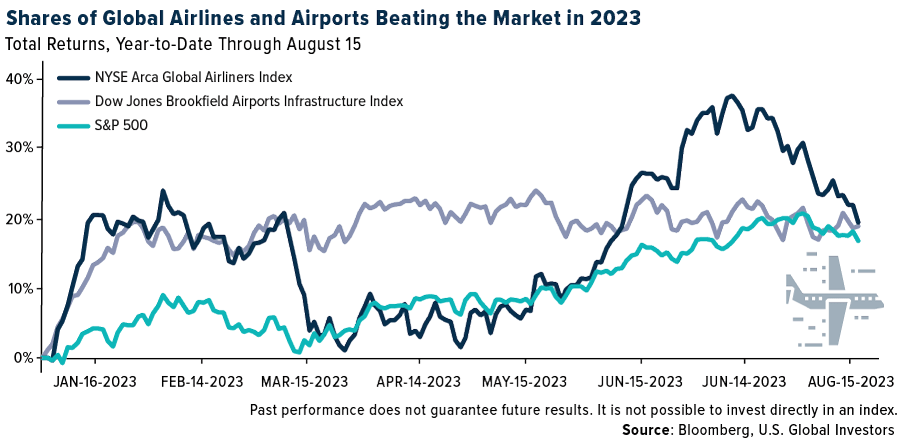

We still like publicly traded airport operator stocks, our favorites being Grupo Aeroportuario del Sureste and Spain-based Aena SME, mainly because they maintain strong moats, or barriers to entry by new competitors. As you can see above, shares of global airlines, as measured by the NYSE Arca Global Airlines Index, and airports, as measured by the 10-member Dow Jones Brookfield Airports Infrastructure Index, are marginally ahead of the market so far this year. Wheels up!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2023): Air France-KLM S.A., easyJet PLC, Delta Air Lines Inc., Grupo Aeroportuario del Sureste, S.A.B. de C.V., Aena SME S.A.

The Dow Jones Brookfield Airports Infrastructure Index is a global index that is designed to measure the performance of pure-play infrastructure companies in the airports sector. The NYSE Arca Global Airline Index is a modified equal dollar-weighted index designed to measure the performance of highly capitalized and liquid international airline companies. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.