How miserly big banks are stiffing savers: They’ve made BILLIONS by hiking loan repayments thanks to Fed rate hike

By Helena Kelly Consumer Reporter For Dailymail.Com

12:02 22 Jul 2023, updated 12:07 22 Jul 2023

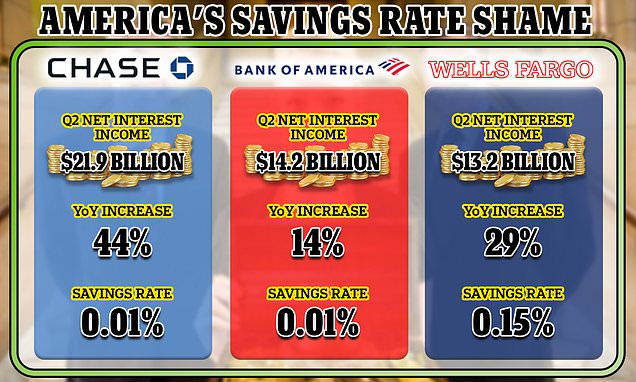

- Three of America’s biggest banks raked in $50 billion from higher interest payments in Q2 of 2023

- Yet analysis by Dailymail.com shows none have passed on these rates to savers

- None of the major banks offer above a 0.15% yield on their savings accounts

Three of America’s biggest banks raked in nearly $50 billion from higher interest payments last quarter – yet none have raised the yields on their savings accounts.

JPMorgan Chase, Wells Fargo and Bank of America this week posted profits much higher than expected as they cashed in on the Federal Reserve’s relentless interest rate hikes which have allowed them to increase the cost of taking out a loan – as well as the repayments on existing loans.

But analysis by DailyMail.com reveals they have failed to pass these high rates onto their savers – as experts urged them to look elsewhere for better returns on their cash.

JPMorgan Chase and Bank of America offer a pitiful 0.01 percent yield on their standard savings account – while Wells Fargo offers a slightly better 0.15 percent.

By comparison a host of tech firms such as Apple and the Walmart-backed One have strayed into the savings space, offering competitive 4.15 percent and 5 percent yields respectively.

It means a saver with an Apple account stands to make 400 times more interest than a Bank of America customer, for example.

This week it was revealed that JPMorgan Chase was the biggest winner of the second financial quarter of 2023.

The firm raked in $14.5 billion in profit, up 67 percent from the same period last year. In net interest income – the money it generates from interest charged to borrowers on loans – it made $21.9 billion, up 44 percent on the year prior.

It was a similar story at Bank of America’s, where profits shot up 19 percent between April and June to $7.4 billion. It also beat analysts’ projections of $6.9 billion.

In net interest income made from interest charged, it generated $14.2 billion, up 14 percent last year.

In a statement, Bank of America CEO Brian Moynihan said that earnings had been bolstered by client growth which had ‘complemented beneficial impacts of higher interest rates.’

Meanwhile Wells Fargo – one of the nation’s largest mortgage lenders – saw its profits jump by 57 percent to $4.94 billion. It made $13.2 billion in net interest income – a 29 percent increase on 2022.

Contrastingly, Citigroup – which rounds off America’s ‘big four banks’ – posted a loss in the second quarter of 2023.

The figures lay bare just how much money banks are making from the Fed’s decision to raise interest rates ten consecutive times in 15 months in a bid to tame inflation.

The Fed’s funds rate is currently between 5 and 5.25 percent – after it made the decision to skip another hike in June. It is expected to increase rates again at its next meeting on July 26.

As a result, banks have been able to charge borrowers more money on loans, with mortgage rates now hovering just below 7 percent.

But, in theory, this figure should also loosely determine the yields banks offer on their savings rates.

Yet the current average yield being offered by banks is a paltry 0.42 percent, according to data from the Federal Deposit Insurance Corp.

Money experts have criticized banks for refusing to up their yields

Jade Warshaw, co-host of The Ramsey Show alongside guru Dave Ramsey, told Dailymail.com: ‘Have you ever wondered why banks have the tallest buildings in every big city? Banks are not your friend!

‘They are greedy and in it to make a profit for themselves.’

She added that customers should search out their own high-yield accounts or invest in the stock market.

And it appears many savers are already heeding this advice by flocking to alternative platforms in search of greater yields.

In April, Apple announced the launch of a new savings account for its credit card customers with a competitive 4.15 percent yield.

The venture – run in collaboration with Goldman Sachs – reportedly attracted more than $1 billion in deposits in its first four days. Some 240,000 new accounts were also said to have been opened.

With an Apple account, a saver with $1000 stands to make $41.50 on their savings in their first year.

By comparison a JPMorgan Chase or Bank of America customer with the same amount of money would make just 10p – a difference of $41.40.

A spokesman for JPMorgan Chase told DailyMail.com: ‘Our customers continually tell us that they choose Chase because of all of the ways we can serve them, and not just the best rate, including our convenient branch and ATM network, our industry-leading digital solutions and security.

‘Chase has competitive CD rates in the market for customers who are looking to earn more on the their money.’

Bank of America and Wells Fargo did not respond to DailyMail.com’s requests for comment.