The Irish Government is strongly resisting a European Commission bid to seek a slice of Ireland’s corporate sector profits as a way to replenish the European Union budget, RTÉ News has learned.

Irish officials have said the move would disproportionately hit Ireland because of the size and profitability of the State’s multinational corporate sector.

The commission proposal envisages targeting a share of member state corporation profits which would then become a revenue-raising mechanism designed to refill EU coffers, sorely hit by Russia’s war in Ukraine and Covid-related expenditure.

The proposal would have to be approved by all member states.

One source described the move as an attempted “grab” of Ireland’s corporate profits, at a time when the State has already moved up into the top bracket of net contributors to the EU budget.

The Department of Finance has told RTÉ News that the commission proposal “could potentially disproportionately increase Ireland’s EU Budget contribution. This is due to the high level of corporate profitability in Ireland linked to the large presence of multinationals.”

According to one calculation, if the mechanism were approved, Ireland’s annual contribution to the EU budget could increase by €1.5 billion from the current amount of €2.6 billion.

The bid to find new revenue streams for the budget has acquired sharper political importance in recent weeks.

It is understood that EU ambassadors have been asked by the Spanish presidency of the EU to address the issue in their weekly meetings in the coming weeks, in the run up to two leaders’ summits in October.

Pressures on EU budget due to Covid, Ukraine war

The pressures on the budget have been caused by a number of factors, officials say.

These include Russia’s war in Ukraine, the costs of meeting Europe’s climate targets, inflation and higher interest rates.

Over the longer term, enlargement of the EU will mean further budget pressures.

The seven-year budget cycle runs from 2021-2027 and member states are currently locked in a mid-term review.

Member states, the European Commission and the European Parliament have all been in agreement since 2020 about the need to find new revenue sources for the EU budget, due in particular to the huge costs of dealing with the Covid-19 pandemic.

At the height of the pandemic the EU launched the so-called Recovery and Resiliance Facility (RRF), a €1.1 trillion fund made up of loans and grants that would be disbursed to member states so they could reboot their post-Covid economies in a way that would also help them meet climate and digitalisation goals.

Much of the money came from the European Commission borrowing on capital markets.

By 2028, the EU will have to begin paying back some of the loans.

New sources of income proposed

Historically. the EU budget has been funded by national contributions, as well as income from VAT, customs tariffs and fines resulting from cases adjudicated by the European Court of Justice.

However, the European Commission has proposed new sources of income, generally referred to as “own resources” in that they are the EU’s own methods of raising funds as distinct from national contributions.

In 2021 a plastics “own resource” came into effect whereby member states would make further contributions based on the amount of non-recycled plastic packaging waste generated.

Member states are also assessing proposals to raise money from the EU’s Emissions Trading System (ETS) and the proposed Carbon Border Adjustment Mechanism (CBAM), whereby carbon-heavy industries outside the union pay a levy to import their goods into Europe.

However, Irish officials have been alarmed by a third proposal that would target what is called the “gross operating surplus” of the corporate sector in member states.

According to the Central Statistics Office (CSO), the gross operating surplus (GOS) refers to the profit made by companies on the goods and services they produce after they have paid their workers and for raw materials, services and overheads.

An EU official said the proposal, known as CPOR (statistical own resource based on company profits), would require national statistical offices to calculate the overall gross operating surplus of the private sector.

Member states would then take 0.5% of that amount on an annual basis from the state exchequer and channel it into the EU budget.

The official insisted it would not be a “tax” on corporations, but would be drawn from national exchequer funds.

Alarm at idea

Officials have said the three new revenue streams could, if approved by member states, raise €17 billion annually, money which would help the EU begin repaying the Covid-related RRF loans.

Irish officials are alarmed at the idea, since the more profitable a member state’s private sector is, the higher the contribution to the EU budget.

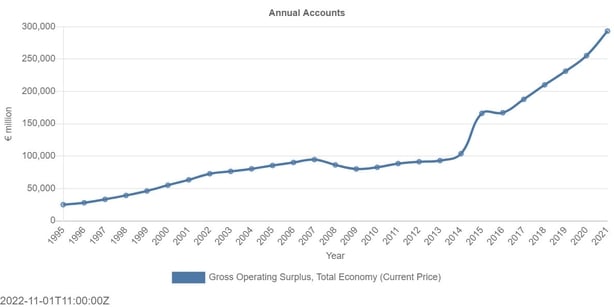

Ireland’s GOS rose from €25 billion in 1995 to nearly €300 billion in 2021, largely as a result of the huge expansion in Ireland’s multinational corporate sector.

Under the proposed formula of 0.5%, that would mean an extra €1.5 billion on top of Ireland’s existing gross national contribution, which stood at €2.6 billion in 2021.

Irish officials have said they are mindful of the huge strain on the EU’s resources, especially given the pressures of Covid-19 and the war in Ukraine.

However, Irish opposition to targeting corporate sector profits appears to have hardened since the proposal was first presented in June.

According to the Department of Finance, “Ireland and other member states have already indicated opposition/reservations towards various elements of the package, including the CPOR proposal.

“Ireland’s concerns relating to the CPOR were put on the record at the ECOFIN meeting of EU Finance Ministers in July by Minister McGrath.”

The department said the commission proposal was “unprecedented” and did not constitute a genuine “own resource” since it would be funded by national exquequers.

The European Commission has said the CPOR would be temporary, to be replaced by a new revenue raising mechanism linked to the global agreement reached last year under the OECD (Organisation for Economic Co-operation and Development) on the allocation of multinational taxable profits.

However, the Department of Finance said the creation of a new revenue resource using the corporate sector would “pre-judge” the outcome of the OECD global taxation process.

Difficult and long process to agree funding

Officials have said the process of member states agreeing new, long-term funding sources for the EU budget – own resources – is typically difficult and long.

One EU diplomat said the chances of getting agreement ahead of next year’s European Parliament elections were “slim”.

According to the Department of Finance, “there is a substantial amount of detailed technical work to yet be undertaken before a conclusion can be reached.”

Irish officials have pointed to a statement by EU leaders in July 2020 stating that any new “own resources” should be characterised by “simplicity, transparency, equity, and fair burden sharing”.

In a statement to RTÉ News, the Department of Finance said: “Our view is that this CPOR proposal does not meet these tests.”

In a statement, The European Commission said that the European Parliament, the council and the commission itself jointly agreed in 2020 that an own resource linked to the corporate sector should be proposed.

It said that the new statistical own resource based on company profits will be “temporary, to be replaced by a possible contribution from Business in Europe: Framework for Income Taxation (BEFIT), once proposed and unanimously agreed by all member states”.

“In the meantime, the own resource put forward in June 2023 will be calculated as 0.5% of the notional EU company profit base, an indicator calculated by Eurostat on the basis of the national accounts statistics,” the statement added.

It added that this is “not a tax on companies, nor does it increase companies’ compliance costs”.

“It will be a national contribution paid by member states based on the gross operating surplus for the sectors of financial and non-financial corporations, which would help to balance the basket of own resources and further diversify the revenue sources of the EU budget,” it added.

“The statistical own resource on company profits would provide revenues as of 2024 of about €16 billion (2018 prices) per year,” the statement concluded.