In recent years, the United States and the European Union (EU) have stepped up their controls on inbound foreign investment to guard against the risks it poses to sovereignty and the protection of intellectual property. Now, the focus has been extended to outward investment from the US. and Europe to certain “foreign countries of concern” – primarily China.

In the U.S., President Biden signed an executive order on August 9, 2023, targeting American investments in certain Chinese technologies. This order imposes notification requirements and prohibitions that are set to take effect in 2024. In light of these U.S. initiatives and encouragement, the EU has also been examining, over the past few months, whether additional control tools are necessary. The EU Commission published its first White Paper on Outbound Investments in January 2024. Unlike the Biden administration, the Commission does not explicitly target China.

A narrow set of technologies, which are the focus of our study, are attracting growing political scrutiny:

• semiconductors

• artificial intelligence (AI)

• quantum technology

• biotechnology

For both Brussels and Washington, one of the main challenges in assessing the risks associated with outbound investments is the lack of available data on these investments. The Commission’s White Paper even refers to a “substantial knowledge gap” in this area.

The aim of this study is therefore to provide some preliminary insights to help close this knowledge gap through a quantitative analysis of European and American investments in the four sectors mentioned above. What is the scale of these investments? Among these four sectors, which technology sector attracts the most investment from Americans and Europeans? Who are the main investors? Can we already identify any high-risk transactions?

Unsurprisingly, the data collected shows a sharp increase in investments in all four technology sectors, both in terms of the number of transactions and the amounts invested. The two graphs below chart the evolution of investments in these sectors over the last twenty years, across all investor nationalities.

Four rapidly growing sectors

1/ The AI boom

The annual number of funding rounds for AI in China grew steadily from 2003 to 2018, accelerating sharply at the start of the 2010s due to promising new developments in research (particularly in deep learning). With a threefold increase in the total known value of funding rounds between 2015 and 2017, the Chinese AI market grew very rapidly, due in particular to “mega-rounds” whose value reached several billion dollars (for investment in Didi or Inspur for instance). The Chinese market lost some of its momentum in the years that followed, weighed down by the pandemic and its lasting economic repercussions, as well as by a number of restrictive measures introduced by the Chinese authorities to maintain control over the sector (for example, by restricting the conditions for IPOs and foreign investments). More recently, after 2021 was marked by an overall surge in investments, the Chinese market shrank once again. It is, however, important to nuance this observation with the increase in the number of AI funding rounds whose figures are undisclosed, beginning in 2020.

2/ Biotechnology, a key sector impacted by the pandemic

Among all four sectors, biotechnology saw its share of total investments grow significantly, in particular between 2017 and 2020, when it rose from 22% to 37%. This growth resulted both from the contraction of the Chinese AI market over this period, and from a rise in the number of transactions in Chinese biotechnologies. They have grown nearly without interruption over the last fifteen years, 2019 being the only exception, and in 2023 the number of funding rounds in biotech surpassed that of AI companies.

In terms of the known amounts invested in the sector, there has been a significant increase since 2015, the year in which Xi Jinping made biotechnology one of the ten key sectors to be developed as part of his “Made in China 2025” industrial strategy.

Despite this recent growth, which peaked in 2021 with $14.4 billion of investment, the Covid-19 pandemic has exposed a number of shortcomings in the country’s innovation potential, has had a significant negative impact on total investment in the sector. While the number of transactions slowed only slightly before rising again, the annual sums attached to these funding rounds have fallen significantly, dropping to $6.3 billion in 2023, a 56% reduction compared with 2021. However, these figures must again be read in the context of the significant increase in the number of funding rounds for Chinese biotech companies whose figures are undisclosed: they have almost doubled between 2020 and 2023, reaching 48% of the total.

3/ Strong growth in semiconductors since 2019

Investment in semiconductors rose sharply from 2019 to 2023, both in terms of the number of funding rounds and of the total amount disclosed. Since 2020, the semiconductor sector is in fact the most dynamic of the four in our database, which reflects China’s efforts to boost its capabilities in this sector and reduce its dependence on Western nations, at a time when access to chips and the equipment necessary to manufacture them is becoming increasingly restricted. Our estimates only capture part of this Chinese expansion, however, as over 50% of investment figures have been undisclosed since 2019.

The spike in funding seen in 2017 can be attributed to a single transaction: the China Development Bank’s investment of nearly $22 billion in Tsinghua Unigroup, a state-backed semiconductor group, which had also previously secured $1.5 billion in investment from Intel in 2014. It is worth noting that of the ten largest funding rounds for Chinese semiconductor companies, seven have taken place since 2021, three of which involved the China Integrated Circuit Industry Investment Fund, also known as the Big Fund.

4/ Investments in quantum technology: fewer and more Chinese

Investment in quantum computing and communication is less substantial than in the other three sectors, given the sector’s limited technological maturity. The available data concerning this sector is also more sparse. However, there has been an increase in the number of funding rounds since 2021, tripling to 10 in 2023. The Chinese quantum market is highly insular (as in most countries), with investments coming predominantly from local actors. Out of 37 disclosed funding rounds, 25 involved only Chinese investors. The few funding rounds which did involve Western investors, however, resulted in a number of high-value transactions.

The strong growth in these four sectors is mostly fueled by Chinese investors.

A look at investors

The vast majority of investment in these four technology sectors comes from Chinese investors (headquartered in China). In all four sectors, more than three-quarters of transactions were made by Chinese investors: 77% in AI, over 78% in semiconductors and biotechnology, and 84% in quantum technology.

The United States is – lagging far behind – the second largest investor in these Chinese technologies, with around 7% of deals in each sector. The leading European investors by number of transactions were Germany, France and the Netherlands.

The U.S., and even more so European investors, therefore have limited involvement in Chinese technologies. Over the last twenty years, only 12% of funding rounds in these sectors have had any U.S. or European participation. The vast majority (62%) of funding rounds in Chinese strategic technologies since 2003 have involved only Chinese investors.

When a European or U.S. investor participates in this ecosystem, it is usually in association with a Chinese or foreign partner, as the following graph illustrates.

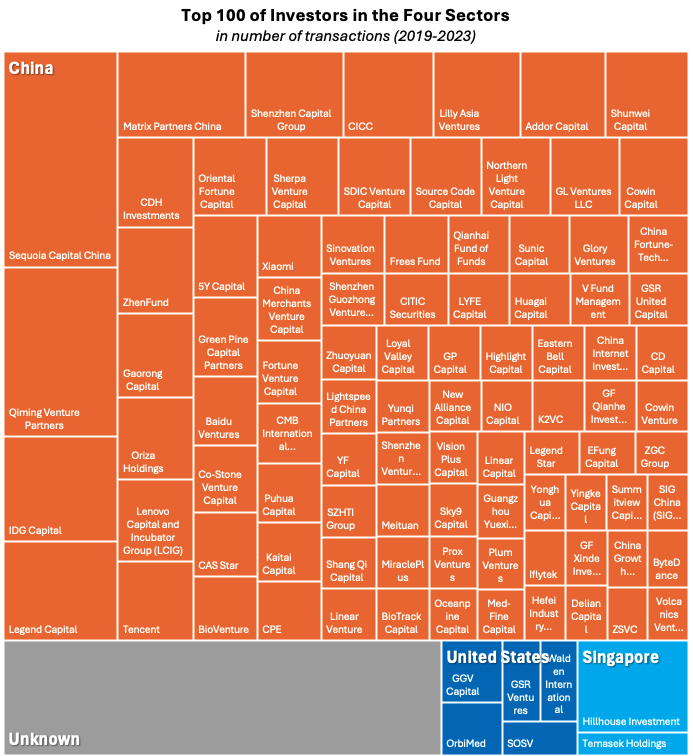

The list of top investors in these four technology sectors since 2019 also reflects the predominance of Chinese actors.

It also highlights one of the limitations of our approach based on headquarters localization. Indeed, according to our data, the leading Chinese investor (by number of transactions) is Sequoia Capital China. Sequoia Capital China is indeed a venture capital giant, with nearly $56 billion in assets under management. It has invested in Chinese tech giants such as Alibaba, ByteDance and Zoom, and is headquartered in Beijing. Yet Sequoia Capital China was established in 2005 as an arm of U.S.-based Sequoia Capital, and its U.S. limited partners account for about half of its investors.

The leading Chinese investors in these four sectors are large venture capital funds, specializing in technology in the broadest sense. Some of these Chinese funds have several limited partners in the U.S.: IDG Capital’s partners include a number of U.S. foundations (Rockefeller Foundation, Carnegie Corporation of New York), investment banks (Goldman Sachs AIMS Group), and pension funds for public sector employees in Texas and Delaware. In addition to their investments in China, these Chinese funds invest in tech start-ups abroad, mostly in the United States. At the end of January 2024, IDG Capital became the first investment fund to be added to the Pentagon’s list of “Chinese Military Companies Operating in the United States”.

This list also includes major Chinese tech companies such as Tencent, Lenovo, Xiaomi, Alibaba, Baidu and Iflytek.

While Chinese investors are largely dominant in their national market, it is interesting to examine European and American investments to better understand the dynamics they reflect, the major players involved and their interests, as well as the potential risks they raise.

Although they have received very little attention in the literature, European investments are worth examining at a time when Washington is encouraging Europe to assess their potential risks. These investments first began in 2005. The number of funding rounds involving European participation then rose, first modestly before increasing sharply after 2015, and especially in 2019. After peaking in 2022, it has fallen back to 2020-2021 levels.

However, this increase in the number of investment cycles with European presence should be viewed in the context of the aforementioned sharp growth of all investments (foreign and Chinese) in AI, biotechnology, and semiconductors. Although it is difficult to establish a clear trend due to the small size of the dataset, as a percentage of the total number of investments, European participation has still been more significant between 2019 and 2023 (between 2% and 4% per year, compared to 1% since 2014). In terms of deal value, Europeans have been involved in significantly larger funding rounds than before.

Europe rarely invests alone

Funding rounds involving only European investors are rare. Looking more closely at the 2019-2023 period – the period which has received the Commission’s attention – only 17 out of a total of 93 funding rounds are “100% European”. Even funding rounds with U.S. (4) or other (3) investors, but without China, are very rare. In the vast majority of cases, European investors are present alongside Chinese investors, sometimes exclusively (26), and at other times with U.S. investors (20) or investors of other nationalities (23).

AI is the first target

Over this 2019-2023 period, the majority of European investments targeted companies in the AI sector (64 transactions, as part of 58 funding rounds), a figure largely driven by German and French investments. These investments in AI primarily target the automotive sector (28 transactions during the period 2003-2023) and the software sector (27 transactions). Investments in biotechnology and semiconductors were much more modest, with 25 and 11 transactions involving Europeans respectively.

Although quantum is mentioned in the European White Paper, we found no evidence in the Crunchbase database of any European investments in Chinese quantum technology over the entire period (2003-2023). Cross-referencing with the LSEG database yielded a single European investment in Chinese quantum technology: investment by the Italian branch of the British fund Amber Capital (created by Joseph Oughourlian, a French citizen) in Siliang Intelligence Technology in February 2022.

The predominance of German investors

As the map shown above illustrates, European investments are dominated by Germany, the leading investor in the four Chinese sectors in question, with a total of 49 investments over the last twenty years. Next come France (36), the Netherlands (12), Portugal (12) and Italy (8).

The top nations’ lead has widened in recent years: Germany, France and the Netherlands together account for 77% of EU investments in Chinese tech since 2019. This is consistent with data measuring European FDI in China across all sectors. Understanding European investments in Chinese technologies therefore requires examining investments from these three countries more closely.

The European top 3: Germany, France and the Netherlands

German investments

Germany is the leading country of origin of European investments in China in general, as well as in Chinese technology in particular, with 49 transactions made since 2003 in the four sectors under consideration. Although the first German transaction in these sectors dates back to 2013, they remained very few in number (one or two per year) until 2019. They then picked up significantly, peaking in 2021 (14 transactions). Since then, a downward trend appears to have set in: German investors carried out 12 transactions in 2022 and only 5 in 2023, returning to 2019 levels. Over the last five years (2019-2023), Germany alone has accounted for 41% of European investments, a proportion which has been rising over this period.

It is worth noting that 40% of these transactions came from large industrial groups in the automotive or chemicals sectors, such as BASF, Bayer, Bosch, Mercedes-Benz, Volkswagen and ZF Group. These groups account for a significant proportion of German investment in China in general, beyond the four sectors studied here. According to Rhodium Group, these companies continue to invest heavily in China, because they are trying to insulate their activities in China from growing global risks by localizing their operations, and because “[they] feel they must continue to invest and develop products in China in order to […] remain competitive with increasingly innovative domestic rivals, for example in sectors like electric vehicles”. In fact, according to our data, nearly a third (30%) of German tech investments (the vast majority of which are from the groups mentioned above) are aimed at Chinese companies (such as Momenta, AutoAI, TrunkTech, WeRide and Enjoy Move) connected with the automotive industry, and more specifically autonomous driving technologies.

German investments and sanctioned Chinese companiesA detailed analysis of these transactions revealed one instance of a German investment in partnership with a Chinese company sanctioned by the United States, and another investment in a firm subject to U.S. sanctions. The only European investment in a company on the U.S. Entity List was completed by a German investor, this time in the semiconductor sector. This investment involves Chinese foundry SJ Semi, which (along with SMIC) was added to the Entity List in December 2022 for its contribution to the modernization of the Chinese military. It has completed three funding rounds (2015, March 2022 and April 2023), each time with Chinese and U.S. investors (Qualcomm in 2015, Walden International in 2022, Leafoison Capital in 2023). Germany’s High Tech Private Equity invested in SJ Semi during the 2022 funding round. This fund, which Crunchbase says is headquartered in Saxony, appears relatively small, however. This investment in a company on the U.S. sanctions list is not currently prohibited – especially for a non-American company. However, it illustrates the existence (albeit limited) of ties that could be risky from a security standpoint (risk that SJ Semi contributes to Chinese military modernization, according to American authorities) and from an economic standpoint (risk in case of tightening American regulations). |

French investments

France is the second largest European investor in the Chinese technologies we examined, with 36 transactions completed since 2003 (32% of the European total). French investments were very rare before 2018. In fact, half of the investments made over the last twenty years took place in and after 2021.

France’s investment profile is largely dominated by Cathay Capital, a global private equity and venture capital investment firm based in Paris. It specializes in cross-border investments between Europe and China,and accounted for nearly 67% of French transactions over the entire period. The known amounts of funding rounds in which Cathay Capital participated total 2,576 million dollars. However, almost half of these amounts (11 out of 25) are not disclosed.

French investments mainly target AI companies and, to a lesser extent, biotechnologies. Very few investments in semiconductors appear in our data (3 in total, including 1 in 2006), and none in quantum technology. A quarter of investments target autonomous vehicle technologies. Some of these investments involve major European manufacturers in the sector (Mercedes-Benz, Bosch, Renault-Nissan-Mitsubishi) and/or major Chinese firms (Tencent, Baidu, Lenovo, Sequoia Capital China or IDG Capital).

In three investment rounds in AI and biotech, French investors (Cathay Capital and Valéo) partnered with Chinese investment fund IDG Capital, which has been on the U.S. list of Chinese Military-Industrial Complex Companies (CMIC) since the end of January 2024. All of these transactions took place prior to IDG Capital’s designation, however, with the most recent occurring on January 3, 2024.

Dutch investments

Finally, further down the ranking, the Netherlands is the third largest European investor in Chinese technology, with a total of 12 investments since 2003, mainly in AI and biotech. Chronologically, the acquisition of Shenzhen PG Biotech in 2005 by Dutch firm Qiagen makes the Netherlands the first European investor recorded in our data. From 2018 onwards, Dutch investments became more frequent. These transactions remain limited in number, however: around one a year since 2018, excluding a peak in 2021 (with three transactions).

Unsurprisingly, American investments in Chinese technologies far surpass European – or any other foreign – investments. According to our database, 1,602 transactions have been made by American investors in the four Chinese sectors since 2003. U.S. investment increased significantly from 2017 onwards, as the Chinese venture capital market began its dramatic growth. Like the rest of the global venture capital market, the number of U.S. investments peaked in 2021.

Many of the largest funding rounds in China have involved U.S. investors: previous analyses have reported this trend across all sectors, and our data confirms it in the tech sector, particularly in AI. The largest known funding rounds include those for Didi (in 2015, 2016 and 2017), data center operator Tenglong Holding Group in 2019 and Alibaba in 2011 and 2012 – all with at least one U.S. investor.

Proposed U.S. restrictions, but especially China’s political decision-making and economic context, do however seem to have initiated a downward trend since last year, with only 76 funding rounds involving at least one U.S. investor in 2023.

And as illustrated by the chart above, while the absolute number of funding rounds including U.S. investments has risen sharply during the 2010s in these high-growth sectors, the percentage of investments involving U.S. investors has fallen. This decline reflects the increase in Chinese investment power (and, to a lesser extent, those of other nationalities). Both charts confirm the downward trend in U.S. investment in these Chinese technologies since 2023.

Who is the U.S. investing with?

U.S. investors generally do not invest alone (only 17% of funding rounds), but in partnership with investors of other nationalities, mainly Chinese.

Nearly 75% of funding rounds involving U.S. investors also include Chinese investors. And in 61% of cases, no other nationality is represented, with only U.S. and Chinese investors being involved. Partnering with Chinese investors has a number of advantages for U.S. investors, including access to better knowledge of the local market, reduced operational uncertainty and less competition in the bidding process.

Is the U.S funding the Chinese quantum computers?

Compared to German and French investors, U.S. investors invest proportionally less in AI and more in biotechnology, and to a lesser extent in semiconductors. Over the past five years, U.S. investors have made roughly as many transactions in biotechnology as in AI.

Unlike Europeans according to Crunchbase data, certain U.S. investors have invested in quantum computing in China. Our cross-search of the Crunchbase and LSEG databases however only identified a very small number of transactions: two in total, including one by Sequoia Capital China. Both took place in 2022, the peak year for quantum investments in China and worldwide.

|

Given the government’s heavy involvement in the quantum computing sector, as well as its military importance, these two cases are particularly noteworthy, and raise questions regarding their implications for U.S. national security.

However, these transactions also reveal that the U.S. (and, even more so, European) financial contribution to China’s quantum sector appears to be very limited. While both the U.S. restrictions and the European White Paper cite investment in quantum computing among their concerns, our analyses of the LSEG and Crunchbase databases identify only three investments in this sector. Although a limited number of investments may have been carried out beyond the scope of our research, these modest results seem to confirm one U.S. official’s hypothesis that this sector’s inclusion in the scope of the restrictions is “mainly symbolic”.

Major U.S. investors already on Congress’ radar

The top 10 U.S. investors in China’s four technology sectors include several major venture capital groups that have already attracted the attention of U.S. politicians and researchers for their contribution to Chinese tech development, including GGV Capital, GSR Ventures and Walden International. This ranking reveals the importance of venture capital compared to corporate venture capital, with VC fund that are more active (in terms of the number of transactions) than the VC subsidiaries of large corporations, such as Intel or Qualcomm.

According to our data, GGV is the most active U.S. investor in Chinese technology, with a total of 75 transactions since 2004 (including 61 in AI, 8 in biotechnology and 6 in semiconductors). It is also the most active over the 2019-2023 period. While GGV is also active outside of China, its activity in Chinese AI represents more than a third of its total known transactions according to CSET. As this heavy involvement in China attracted the attention of U.S. politicians, GGV Capital announced in September 2023 that it would legally separate its U.S. and Asian activities into two separate entities.

GSR Ventures is a technology-focused fund with headquarters in California, but whose operations are primarily carried out in China. It appears to be partially affiliated to Chinese fund GSR Capital. In January 2015, the U.S. Committee on Foreign Investment in the United States (CFIUS) blocked the acquisition of Lumileds by several firms, including GSR Ventures, citing the risk of technology transfers (in this case related to a semiconductor material, gallium nitride) to China. GSR’s Linkedin profile describes GSR Ventures, GSR United Capital and GSR Capital as “independent yet complementary teams” in 2016 (i.e., just after the failed Lumileds acquisition). However, as with Sequoia Capital and GGV Capital, the specific ties – financial, personal or informational – between the Chinese entities remain unclear.

Walden International, founded in 1987, describes itself as a “pioneer” of venture capital in China . It invests predominantly in semiconductors (38 out of 47 transactions), and to a lesser extent in AI (9 transactions).

Although less prominent in the existing literature, OrbiMed is one of the world’s largest healthcare investment funds, having made some forty investments in Chinese biotechnologies since 2010, notably in drug development and genome editing.

Two U.S. semiconductor giants are also among the leading investors in Chinese technology via their innovation-accelerating investment arm: Intel and Qualcomm. In some cases, these companies’ investment allowed them a seat on the Chinese companies’ board of directors. This practice is commonplace, but some analysts find it problematic, as it grants “intangible benefits” such as name recognition and access to networks, which facilitate Chinese technological development.

Several U.S. investments in sanctioned Chinese companies

Of the top ten U.S. investors listed above, seven have invested in recent years in Chinese companies currently sanctioned by the U.S. for their ties to the military, involvement in human rights abuses or actions contrary to U.S. foreign policy interests.

In total, according to our data, at least twelve Chinese AI and semiconductor companies that are now on U.S. sanctions lists (Entity List or CMIC list) have benefited from U.S. funding. In most cases, these U.S. investments predate the sanctions. However, these Chinese companies’ involvement with the Chinese military or surveillance ecosystem was often known prior to their inclusion on the U.S. lists.

|

For instance, though Chinese facial recognition company Intellifusion won the Xinjiang Security Excellent Enterprise Award in 2017, Walden International participated in subsequent funding rounds at least once, in April 2020, praising the company’s successful work with Chinese police forces . Intellifusion was added to the U.S. Entity List in June 2020. |

Some of these investments, however, took place after the announcement of U.S. sanctions.

|

For example, SenseTime, one of China’s leading startups specializing in facial recognition, was added to the U.S. Entity List in 2019 for its role in human rights violations against Uighurs, and in 2021 was listed as part of China’s military-industrial complex. Several U.S. investors (such as Qualcomm, Qualcomm Ventures, Silver Lake and Tiger Global Management), one from the UK (SoftBank Vision Fund) and one from Singapore invested in SenseTime alongside Chinese investors in 2017 and 2018. Even after SenseTime’s designation by U.S. authorities, two U.S. investors participated in SenseTime’s 2020 funding round: iResearch Capital, the U.S. investment arm of Chinese company iResearch Consulting (which specializes in research on the U.S. internet industry) and investment fund Parkway Venture Capital, which specializes in technologies including AI and quantum. |

In addition to these direct investments in companies under sanctions, both before and after they were placed on U.S. lists, our data also reveals several cases of co-investment – i.e., transactions within the same funding round – between listed companies and U.S. investors.

The examples given above do not represent an exhaustive list, firstly for the sake of readability. But it is also clear, when comparing our data with the report published by the Select Committee on the CCP, that no exhaustive list of these transactions could currently be compiled with the information available in databases like Crunchbase and LSEG. This limitation of our study is actually a result in itself: although our work does provide some insight into European and U.S. investments in Chinese technologies, the data disclosed by these firms is insufficient to map them out in fine or exhaustive detail. As the debate over restrictions on China-bound transactions intensifies, an important first step for such policies should be to push for greater transparency in private equity.

Investments in AI, biotechnology, semiconductors, and quantum computing, whose advancements will provide significant commercial and military advantages, have seen a substantial increase in China and worldwide over the past decade.

While U.S. (and to a lesser extent European) investments in Chinese tech have contributed to this growth, they represent only a very limited and declining portion of the funding available to the Chinese tech ecosystem. In each of these four sectors, the majority of European and U.S. investments are made in collaboration with Chinese partners, and over 75% of transactions are carried out by a Chinese investor. This necessarily limits the impact any restrictions on European or U.S. investments may have on the development of these technologies in China.

This study does however shed light on the extent of the entanglement between U.S. investors and certain Chinese companies closely associated with the military or with the government’s mass surveillance efforts, which do indeed appear to run counter to U.S. interests.

Unsurprisingly, European investments are much more modest, and this initial investigation identified very few potentially problematic investments: a single investment (out of Italy) in a company in the quantum sector, and two investments (from Germany) in or with a company under U.S. sanctions. The broader European investment landscape is dominated by Germany and France, and seems to reflect investors’ desire to maintain contact with Chinese innovation in sectors like autonomous vehicles.

This study’s methodological limitations highlight a further conclusion. The political ambition – which differs slightly on either side of the Atlantic – to better control the risks associated with trade (in goods, capital and expertise) with China will have to contend, when it comes to investments, with the complexity and opacity of these international flows. Before considering restrictive measures, progress must be made to improve transparency on the part of investors, while government analysis capabilities must be strengthened, particularly in Europe. Political authorities will need to more clearly define the scope of activities or the companies deemed to pose a risk in sectors like AI, biotechnology, semiconductors or quantum technology, to give businesses greater visibility as well as to more accurately assess risks.