- By Natalie Sherman & Tom Espiner

- Business reporters

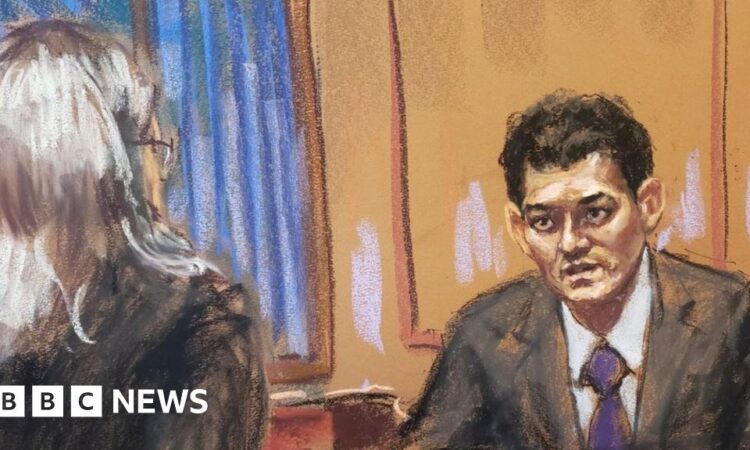

Former crypto boss Sam Bankman-Fried acknowledged “a lot of people got hurt” when the FTX exchange he founded collapsed, in his testimony to the jury at his fraud trial.

The former entrepreneur said he had made many mistakes when running the cryptocurrency exchange.

The 31-year-old is accused of lying to investors and lenders and stealing money from customers.

He has denied those charges, instead arguing that he acted in good faith.

“We thought we might be able to build the best product on the market,” he told his attorneys in his opening questioning. “It turned out basically the opposite of that”.

“A lot of people got hurt, customers, employees, and the company ended up in bankruptcy.”

Mr Bankman-Fried told the Manhattan federal court he made “a number of small mistakes and a number of larger mistakes” while running the now-bankrupt exchange.

The biggest mistake, he said, was not having a dedicated risk management team.

He said he did not defraud anyone or take customer funds.

Mr Bankman-Fried started testifying on Thursday in an unusual hearing after the jury had been sent home.

US District Judge Lewis Kaplan asked him to preview his testimony about the involvement of lawyers in key decisions at the heart of the case so he could decide whether it was admissible as evidence.

Mr Bankman-Fried has argued that he acted on legal advice.

But prosecutors have accused him of using FTX customer funds to prop up his crypto-focused hedge fund, Alameda Research, make speculative venture investments, and donate more than $100m to US political campaigns. He also faces charges of trying to cheat Alameda’s lenders and FTX investors.

Judge Kaplan ruled that Mr Bankman-Fried would not be allowed to present testimony about the work lawyers did on various loans made to Mr Bankman-Fried from Alameda and other policies.

The judge said the evidence “would be confusing and highly prejudicial in implying that the lawyers with full knowledge of the facts blessed what the defendant has done”.

On Friday, Mr Bankman-Fried’s attorneys asked him to recount his time at MIT, when he lived in a group house with Gary Wang and Adam Yedidia – both of whom have testified against him in this case.

Image source, Getty Images

Sam Bankman-Fried pictured in May 2022

Mr Bankman-Fried said it was “nerdy”. “Lots of board games, not drinking.”

The defence tried to paint a portrait of a boss who was more hands off than earlier testimony had suggested.

For example, he said he discussed the “goals” of the FTX site but didn’t read or write the code. “I wasn’t much of a programmer.”

Mr Bankman-Fried said he “wasn’t entirely sure” what happened to the money that FTX customers wired to Alameda when they set up their accounts, trusting staff to handle and track the money.

He said he thought money to repay Alameda’s loans came from the company – not FTX customers as the prosecutors have alleged – and that he never directed his friends to make political donations.

Challenging earlier testimony from others, he said he did not become aware that Alameda owed $8bn in customer deposits to FTX until October 2022. “I was very surprised” he said.

He also said he had not been aware of some of the specific features of Alameda’s account at FTX, including its ability to borrow virtually unlimited sums from the exchange.

Prosecutors have alleged those features were how Alameda ended up raiding customer funds.

Mr Bankman-Fried suggested that the features were the idea of some of his top lieutenants at FTX – Gary Wang and Nishad Singh – as they tried to address his concerns about ensuring that trading on the exchange ran smoothly.

Mr Wang and Mr Singh, who worked at FTX, have both pleaded guilty to various charges and testified against Mr Bankman Fried at trial along with his ex-girlfriend Caroline Ellison, who became chief executive of Alameda.

Mr Bankman-Fried described working as much as 22 hours per day and getting thousands of emails. He said he aimed to have 60,000 unread messages rather than having nothing in his inbox.

The courtroom and two overflow rooms were packed with dozens of reporters and members of the public.

His appearance in court follows 12 days of prosecution testimony in which close former colleagues gave evidence.

If he is found guilty he could face what is effectively a life sentence in prison.

Defendants in the US are not obliged to testify during trials – and are often advised against doing so, since it opens them up to questioning by prosecutors.

Despite the risks, many analysts following the trial predicted Mr Bankman-Fried would take the stand to offer his own version of events and try to undermine the prosecution case.