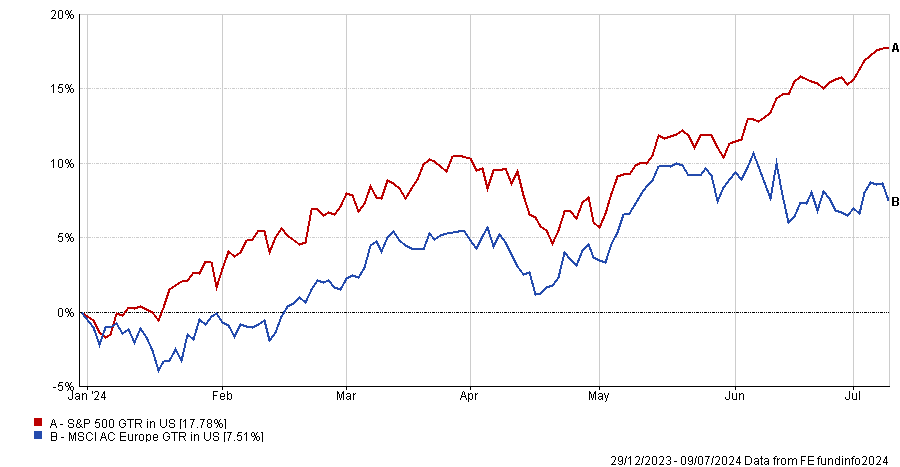

Over the first six months of the year, European equity markets have been lagging the performance of US equities.

The S&P 500 index, largely due to the performance of large-cap tech names, has more than doubled the return of the MSCI AC Europe index so far this year.

European equities in more recent months have been weighed down by the political uncertainty surrounding elections in both the UK and France.

However, with the elections there in the rear-view mirror, investors looking ahead may be wary of the potential impact of US elections this coming November.

For fund selectors looking for diversification from US markets and a potential catch-up rally in European equities, FSA highlights five top-performing Europe inc UK equity funds available for distribution in Hong Kong and Singapore.

Below are five top-ranked funds year-to-date, which are also top-quartile over the past one-year and five-year periods, according to data compiled from FE fundinfo*.

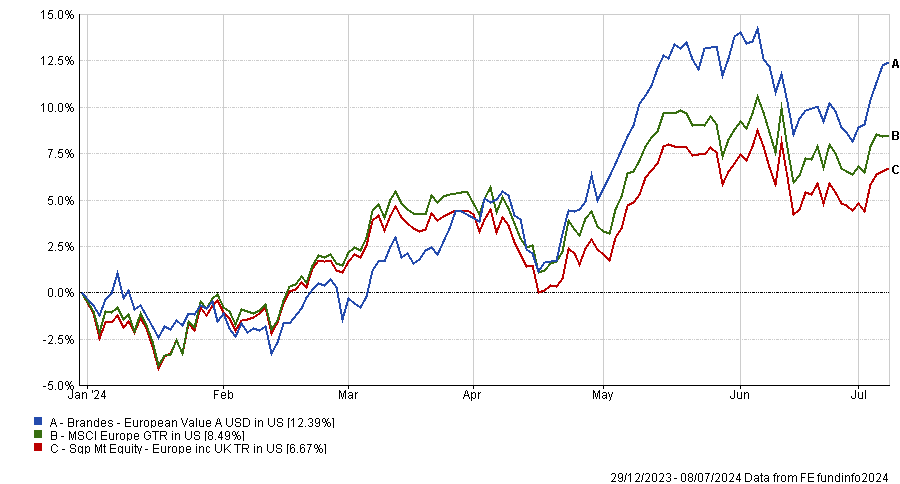

Brandes European Value

This $557m European value strategy is up 12.4% year-to-date and 27.2% over the past 12 months – the highest of this list. It is also the best performer over a five-year period, up 61.8%.

This strategy takes a classic bottom-up value investing approach to European equities, looking for companies trading below estimates of intrinsic value. It is managed by Luiz Sauerbronn, Amelia Morris, Shingo Omura, Jeffrey Germain and Brent Woods.

One of its more notable investments has been its overweight position in Rolls-Royce, the aerospace and defence manufacturer which has rallied 206% over the past 12 months on the back of a turnaround led by recently appointed CEO Tufan Erginbilgic.

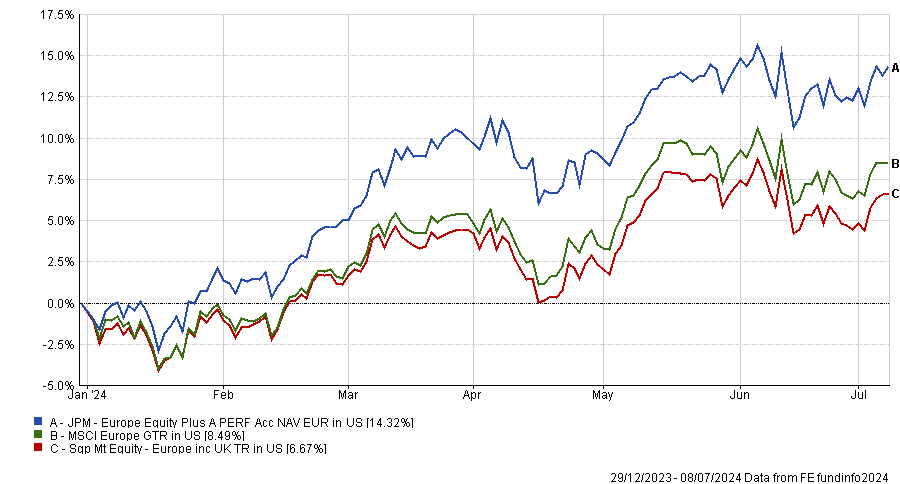

JPM Europe Equity Plus

This $2.2bn European equity fund is up 14.3% year-to-date and 24.6% over the past 12 months. Over a five-year period, the fund is up 59.5%.

Managed by Michael Barakos, Nicholas Horne and Ben Stapley, this fund has benefitted from its overweight in Italian banking group UniCredit as well as Danish pharmaceutical company Novo Nordisk (up 81% over the past year).

It also had large overweight positions in energy, insurance and automobiles and components – where it recently initiated a stake in Swedish car manufacturer Volvo Car.

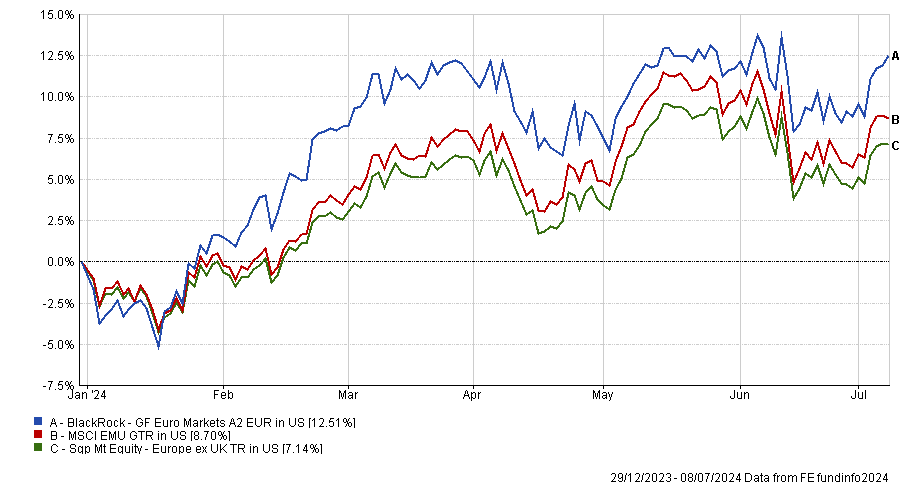

BlackRock GF Euro Markets

Another top performer is this $1.5bn European equity fund, which is up 12.5% year-to-date, and up 18% over the past 12 months. Over a five-year period, it is up 50.2%.

This strategy is run by Andreas Zoellinger and Tom Joy. Its largest position is in Dutch semiconductor equipment manufacturer ASML, which is up 52% over the past year on the back of strong demand for AI chips.

Like the fund above, it also has benefitted from a position in Italian bank UniCredit, which is up 73% over the past year after strong profit guidance and increased capital distributions to shareholders.

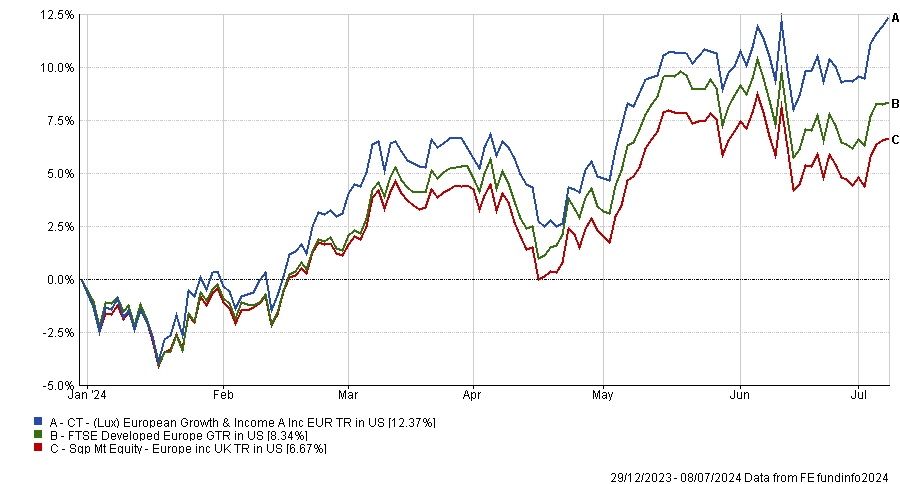

CT (Lux) European Growth & Income

This Columbia Threadneedle European fund is up 12.4% year-to-date and 24.7% over the past 12 months. Over the past five years, it is up 60.2%.

The strategy is geared towards both capital growth and income and is managed by David Moss, the firm’s head of European equities research strategy.

Like the funds above, it has benefitted from large positions in Novo Nordisk and ASML Holdings, as well as some lesser-known names such as small-cap Irish house builder Cairn Homes.

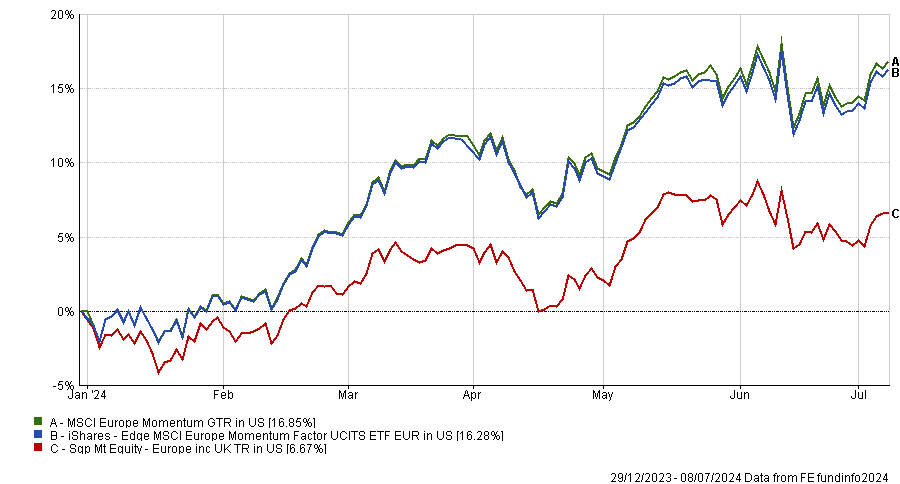

iShares Edge MSCI Europe Momentum Factor UCITS ETF

One passive exchange traded fund, the iShares Edge MSCI Europe Momentum Factor UCITS ETF, also was among the top ranked performers with the best performance year-to-date of 16.3%.

This strategy invests in European stocks screened for momentum, or those which have been experiencing an upward price trend.

Some of these winners include ASML, Novo Nordisk and Rolls-Royce, which are held by some of the other top-performing active funds.

*The top-performing funds were measured in US dollars year-to-date as of 9/7/2024. The funds only includes fund vehicles that fall under the Hong Kong SFC Authorised Mutual or Singapore Mutual Europe inc UK equity sectors as classified in the FE fundinfo platform.