The European Securities and Markets Authority

(“ESMA“) has published its Final Report

on the Guidelines on funds’ names using ESG or

sustainability-related terms (the

“Guidelines”). ESMA was provided with

the mandates to develop guidelines on unclear, unfair or misleading

fund names in the updated Alternative Investment Managers

Directive1 (“AIFMD“) and

UCITS Directive, which are now in force.

We cover here the funds that are intended to be in scope of the

Guidelines, what the Guidelines entail and their proposed

timing.

From the outset, we note that Member States must implement the

Guidelines and there is the potential that the approach to such

implementation may vary in terms of how embedded they are in

regulatory regimes and how strictly they may be applied.

Which funds are in scope?

All alternative investment funds

(“AIFs“) that are managed by EU

alternative investment fund managers

(“AIFMs“) alongside UCITS managed by

UCITS management companies are in scope. ESMA has estimated that

around 1,702 EU-domiciled AIFs will be affected by the new

rules.

The Guidelines do not directly address the applicability of

non-EU managers marketing funds in the EU under the AIFMD’s

national private placement regimes. However, we do note that the

mandate for ESMA to produce the Guidelines is in Article 23 of

AIFMD, which covers the disclosures needed for investors for both

EU AIFs and those marketed into the EU. Further clarity on this

position may be provided by local regulators in the Member States

as we cover under “Are the Guidelines mandatory?”

below.

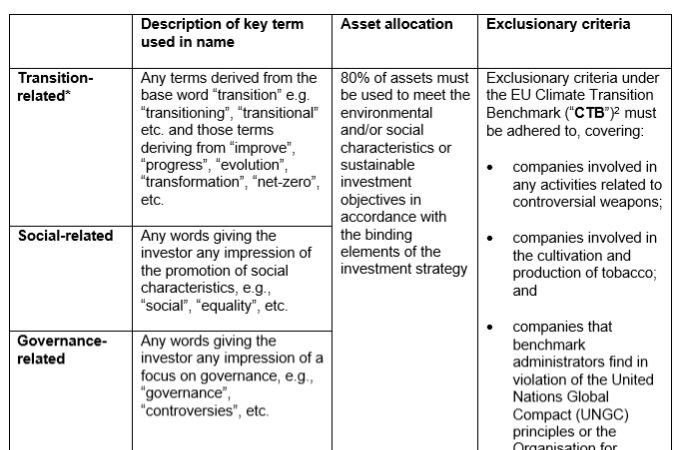

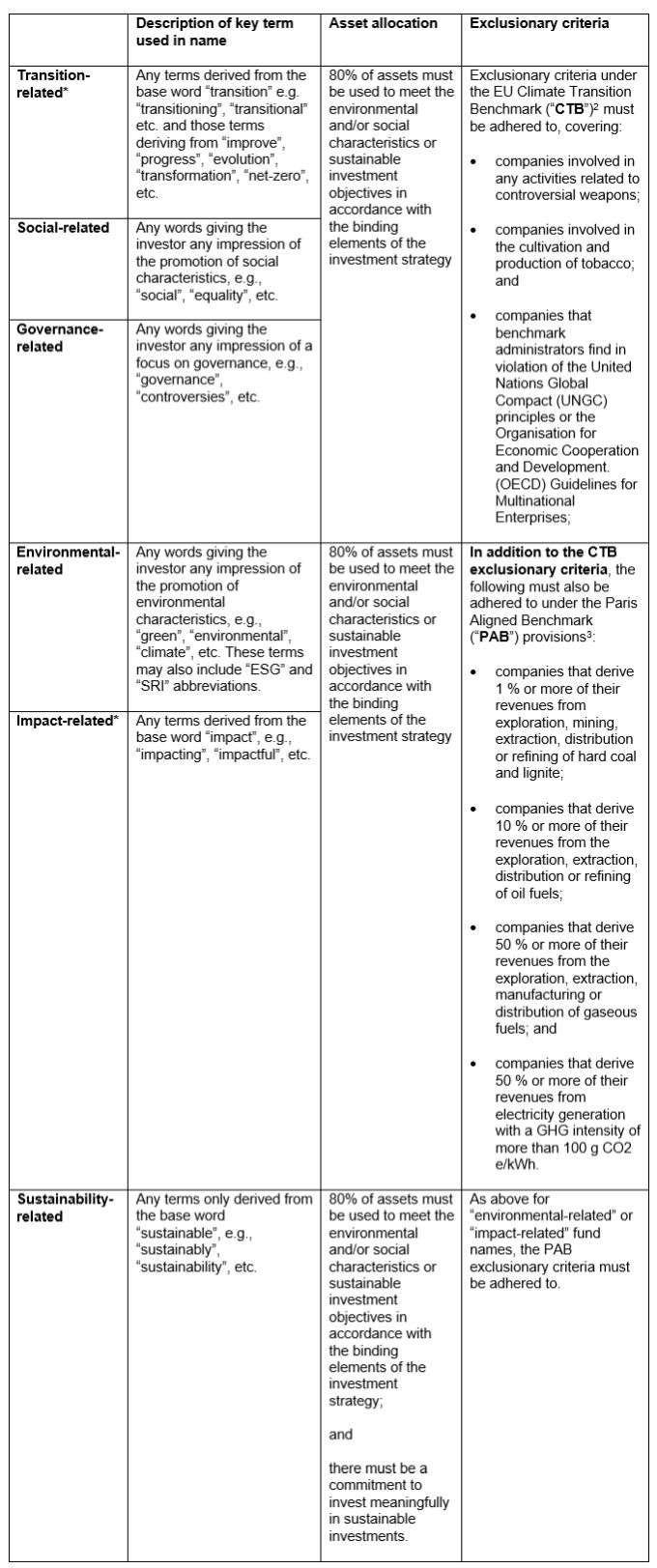

What do the Guidelines require?

The Guidelines include thresholds for asset allocation and

exclusionary criteria that varies dependent on the ESG or

sustainability-related term used in the name. We have summarised

the Guidelines here:

*What are the additional recommendations for

“transition-related” or “impact-related” named

funds?

Funds using “transition-related” or

“impact-related” terms in their names should also ensure

that the investments used to meet the thresholds specified are on a

clear and measurable path to social or environmental transition or

are made with the objective to generate a positive and measurable

social or environmental impact alongside a financial return.

The aim is to create an additional qualifying link between the

strategy and fund name, ensuring there is a measurable dimension to

the strategy itself.

What is meant by “meaningfully” investing in

sustainable investments?

Previously ESMA had suggested a 50% threshold for sustainable

investments in the “sustainability-related” name

category, however, this has been replaced with

“meaningfully” investing in sustainable investments. ESMA

sets out that as the “sustainability-related” fund name

can apply to either (1) funds disclosing under Article 9

Sustainable Finance Disclosure Regulation

(“SFDR“); (2) funds disclosing under

Article 8 SFDR which in part invest in economic activities that

contribute to environmental or social sustainable investment

objectives; and (2) funds disclosing under the Taxonomy-Regulation,

that there should be flexibility and no firm threshold. However,

whatever the commitment is to sustainable investments, ESMA notes

that this should be met by financial products at all times. Asset

managers will need to consider carefully their judgement of what

“meaningfully” is.

What is meant by the “binding elements of the

investment strategy”?

As noted above, the threshold recommendations for asset

allocation refer to being linked to the “binding elements of

the investment strategy”. There is a requirement in the

mandatory templates of SFDR Article 8 and 9 pre-contractual

disclosures to commit to the binding elements of the ESG or

sustainability-related investment strategy. “Binding

elements” means those elements of the investment strategy that

apply to environmental and/or social characteristics promoted or

sustainable investment objective that cannot be overridden with

discretion and apply to the “whole holding

period”4.

Why does the exclusionary criteria vary dependent on the

fund name?

ESMA has taken the view that for funds using

“environmental-related” or “impact-related”

terms in their names, it is reasonable for investors to expect that

there would not be significant investments in fossil fuels and

therefore the PAB exclusionary criteria should be followed.

However, for the “transition”, “social” and

“governance” related fund names, ESMA has the view that

these categories should not penalise investment in companies

deriving part of their revenues from fossil fuels

— in the case of “social” and

“governance” related names any environmental

considerations may not be the focus and for “transition”

related names the strategy could be in investments fostering a path

to transition towards a greener economy, including those with

fossil fuels as part of their revenue base.

What kind of assets do the exclusionary criteria apply

to?

The exclusions apply to “companies” regardless of how

investment in those companies are made or which financial

instrument those companies may issue, for example, they cover

bothequity and debt investments. There is no guidance on whether

the Guidelines should be applied on a look-through basis for any

fund of funds or for any real assets or other non-investee company

asset classes.

What is the application of the Guidelines to

closed-ended funds?

ESMA noted the feedback that respondents had provided on

closed-ended funds, including that as they are no longer open for

distribution, they should have no need to adhere to the

naming-related provisions as they are not being marketed or sold to

investors. ESMA also details the feedback that respondents set out

there would be little rationale in applying the provisions, as it

would be seen as an inappropriate retroactive change.

However, despite the feedback, ESMA has sets out that the

Guidelines are intended to apply without distinction to either

open- and closed-ended funds. ESMA is of the view that it would be

“meaningful” to ensure that the name of the fund matches

with the underlying investments even for investors in a

closed-ended fund (including existing investors).

Whilst this initially appears far-reaching in scope, the capture

of closed-ended funds is not directly addressed in the Guidelines

themselves and it will be up to individual Member State regulators

as to how the Guidelines will be approached, as we set out under

“Are the Guidelines mandatory?”. We recommend that asset

managers with ESG or sustainability-related named closed-ended

funds keep a watching brief on the Member States’

implementation of the Guidelines for a firmer position on the

expectation for such funds.

Are the Guidelines mandatory?

Within two months of the date of publication of the Guidelines

on ESMA’s website in all EU official languages, the competent

authorities (local regulators) must notify ESMA whether they (i)

comply; (ii) do not comply but intend to comply; or (iii) do not

comply and do not intend to comply with the Guidelines. In case of

non-compliance, the competent authorities must also notify ESMA

within two months of the date of publication of the Guidelines the

reasons for non-compliance.

Local regulators are tasked with making every effort to comply

with the Guidelines and to incorporate them into their national

legal and/or supervisory frameworks and ensure through supervision

that financial market participants comply with the Guidelines.

However, the optionality of confirming compliance, the nature of

them being termed “Guidelines” and that scoping points

such as on closed-ended funds and non-EU AIFMs marketing into the

EU are not covered in the Guidelines themselves means there is a

watch and wait for how each Member State approaches the

implementation of the Guidelines. There could be a variety of

approaches to how deeply the Guidelines are embedded and how

broadly they are applied in regulatory regimes.

Nevertheless, for EU funds moving forwards with new ESG or

sustainability-related fund names, we do recommend that the

Guidelines are factored into strategy considerations.

What are the supervisory expectations?

There is a broad range of supervisory expectations set out in

the Guidelines, which may provide some reassurance to asset

managers on a proportionate approach being encouraged to be taken

by regulators in relation to the Guidelines. They include that a

temporary deviation from the threshold and exclusions should be

treated as a passive breach and corrected in the best interest of

the investors, provided it was not deliberate by the asset manager.

“Further investigation” and “supervisory

dialogue” is also recommended to be considered where:

- there are discrepancies in the level of the quantitative

threshold which are not passive breaches; - there is a fund that does not demonstrate sufficiently high

level of investments to use the transition-, ESG-, impact- or

sustainability-related terms in its name; or - where the competent authority considers that using transition-,

ESG-, impact- or sustainability-related terms in the fund name

would result in investors receiving unfair or unclear information

or in a failure of the manager to act honestly or fairly thus

misleading investors.

However, there is no specific enforcement action or penalties

recommended in the Guidelines.

How do these fund name Guidelines relate to any

categories introduced as part of SFDR 2.0?

SFDR is currently under consultation which we have reported on

most recently here, which has

sought feedback on the introduction of categories and a labelling

system funds. ESMA notes that “SFDR may take many years to

complete, while greenwashing risks in funds need to be addressed in

the present”. ESMA further sets out that it “supports

labels but these would require legislative changes and they will

require a long time to be implanted and will not help tackling the

issue at stake in an urgent manner”. This is potentially

useful insight into the timing of any SFDR developments and can be

read that the market must work with the current SFDR disclosure

regime and these additional Guidelines rather than expect any

imminent wholesale change with SFDR 2.0.

When do the Guidelines apply?

They will apply three months after the date of the publication

of the Guidelines on ESMA’s website in all EU official

languages. ESMA sets out that managers of any new funds created

after the date of the application of the Guidelines should apply

the Guidelines immediately in respect of those funds. For managers

of funds existing before the date of application of these

Guidelines they should apply the guidelines in respect of those

funds after six months from the application fate of the Guidelines

(nine months in total). However, as noted under “Are the

Guidelines mandatory?” there could be variations in approaches

to timing and scope under the individual Member State

implementation of the Guidelines.

What are the next steps?

We recommend that asset managers keep a watching brief when the

Guidelines are published in all EU official languages on the ESMA

website and the individual Member State implementation of the

Guidelines for clearer direction on how strictly the Guidelines

will be applied and how widely in terms of funds managed by non-EU

AIFMs and closed-ended funds.

For AIFs managed by EU AIFMs we do recommend that the Guidelines

are considered in strategy setting moving forwards where there

might be an ESG or sustainability-related name.

Footnotes

1 For our article on AIFMD II, please see: AIFMD 2.0 –

Evolution Rather than Revolution – Insights – Proskauer

Rose LLP

2 Article 12(1)(a)-(c) of Commission Delegated Regulation

(EU) 2020/1818

3 Article 12(1)(a)-(g) of Commission Delegated Regulation

(EU) 2020/1818

4 JC 2023 18 –

Consolidated JC SFDR Q&As (europa.eu) – Question 2

– Answer provided by the European Commission on the

interpretation of the SFDR, published on 14 July 2021 and Recital

11 of Commission Delegated Regulation (EU) 2022/1288

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.