(Bloomberg) — Some European leaders are warming up to the idea to use financial engineering to boost the profits from the immobilized Russian sovereign assets to generate a much higher level of funding for Ukraine.

Most Read from Bloomberg

Belgian Prime Minister Alexander De Croo announced a proposal on Thursday to issue bonds backed by the profits generated by the frozen assets.

We could “use the proceeds to pay the interest on some kind of perpetual bonds,” De Croo told reporters after a meeting with his counterparts in Brussels. “Then you can actually leverage that much on a much wider level.”

However, German Chancellor Olaf Scholz poured cold water on the suggestion, saying the bloc for now would focus on using those profits directly to buy more weapons for Ukraine.

“The utilization of the windfall profits and their steering in the direction of arms aid is a huge step forward,” Scholz told reporters after the summit.

“I believe that we will use them directly and not develop new constructions now,” Scholz said. “The fact that people are thinking every day about how to do this even better with the support of Ukraine is worth the sweat of the noble souls, but it didn’t play a role here.”

About $280 billion in Russian assets have been frozen by the EU and its allies, with more than two thirds of those blocked in the EU. The vast majority of the Russian funds has been frozen through the Belgium-based clearing house Euroclear where they generated about €4.4 billion in profits last year.

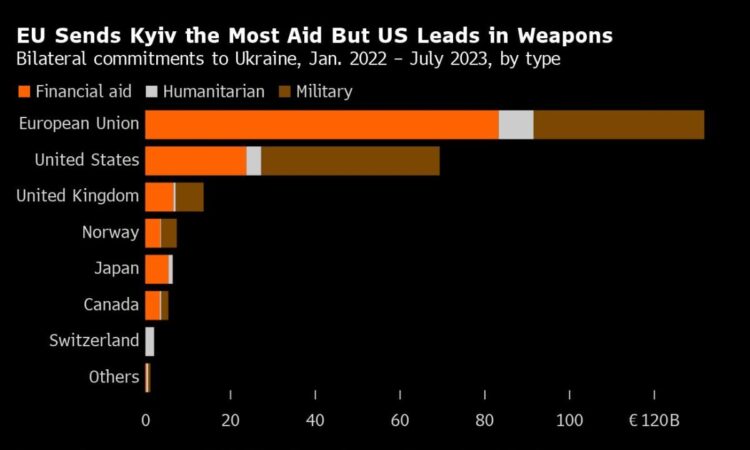

European leaders are struggling to pull together financial and military support for Kyiv at a crucial moment in its war, with Ukrainian troops facing ammunition shortages and Russia making advances in the east. During a summit Thursday, they discussed how to use Russian assets stranded in the continent to aid Ukraine.

Ukraine’s bonds have rallied after Bloomberg reported this week that the US proposed to its Group of Seven allies to create a special purpose vehicle to issue at least $50 billion of bonds backed by the Russian assets.

Some European countries including Belgium have been reluctant, however, to do anything that could be perceived as effectively seizing the assets, which they worry could run into legal challenges, risk the stability of the euro and face retaliation from Moscow.

For now, EU leaders are nearing an agreement to use the proceeds of the blocked assets to help fund Ukraine’s military needs. Under plans presented this week, the bulk of windfall profits, which are mostly held through Euroclear, would be transferred to the European Peace Facility, a mechanism used primarily to reimburse governments for military purchases bound for Ukraine, and a smaller share to the regular EU budget’s Ukraine facility.

–With assistance from Kevin Whitelaw and Daniel Hornak.

(Updates wtih Scholz quotes starting in frouth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.