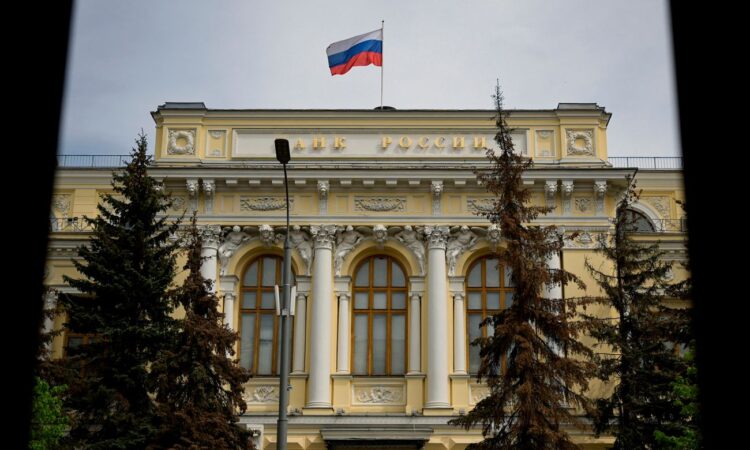

On 12 February, the European Council adopted new measures targeting profits from the frozen assets of the Central Bank of Russia (CBR), immobilized as a result of the EU’s restrictive measures following Russia’s full-scale invasion of Ukraine in February 2022.

With over $250 billion in CBR assets frozen in G7, EU, and Australian jurisdictions—over two-thirds of which are held within the EU—this decision represents a significant effort to leverage economic sanctions against Russia for Ukraine’s benefit.

In a move that aligns with the G7’s stance, the Council today adopted measures to specify the prohibitions on transactions related to the management of these assets and outline the legal status of revenues generated by Central Securities Depositories (CSDs) from holding Russian immobilized assets.

The Council’s decision mandates that CSDs possessing over €1 million in CBR assets must segregate extraordinary cash balances accrued as a result of the EU’s sanctions and keep the corresponding revenues separate, prohibiting the disposal of net profits. However, recognizing the financial burdens associated with holding these assets, CSDs are permitted to seek authorization from their supervisory authority for the release of a portion of these net profits to meet statutory capital and risk management requirements.

This framework sets the stage for the Council to consider establishing a financial contribution to the EU budget from these net profits aimed at supporting Ukraine’s recovery and reconstruction. This potential contribution would be funneled through the EU budget to the Ukraine Facility, in line with a provisional agreement reached between the Council and the European Parliament on 6 February 2024.

The backdrop to these measures includes a December 2023 statement by G7 leaders emphasizing the need for private entities to redirect revenues from Russia’s immobilized sovereign assets toward aiding Ukraine.

Read also: