The best performing fund in the IA UK Equity Income sector has a portfolio primed for Labour’s ‘get Britain building’ initiatives.

Ahead of the UK general election on 4 July, the investment industry was rife with speculation about whether the Labour Party’s proposed policies would be a boon for the domestic stock market. In the end, Kier Starmer’s landslide victory heralded an immediate boost and the strength of the rally even surprised the fund managers who benefitted the most.

The election spurred one of the best weeks of performance in 20 years for the JOHCM UK Equity Income fund, according to co-manager James Lowen.

“We’ve got a very good fund for their mantra, which is ‘get Britain building’, whether it’s infrastructure, clean energy or housebuilding, and that’s all starting to manifest itself,” he said. “It was quite clear Labour were going to win”, however, so the market waiting to move until the week of the election itself was “a bit odd”, he acknowledged.

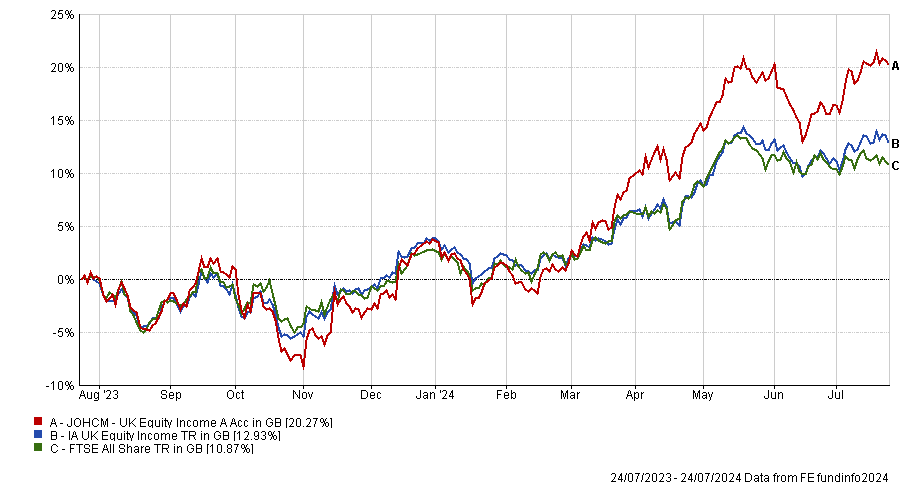

Nonetheless, Labour’s clear majority helped propel the fund to the very top of the IA UK Equity Income sector for the year to 24 July 2024, returning 20.3% versus 10.9% for the FTSE All Share and 12.9% for its average peer.

Performance of fund vs sector and benchmark over 1yr

Source: FE Analytics

Below, Lowen told Trustnet why he thinks the UK’s renaissance is only just getting started.

What is your investment process?

Our hallmarks are dividend yield criteria, a focus on valuation, normalised earnings and balance sheets. First, every stock has to have a dividend yield higher than the benchmark, on a forward-looking basis.

Second, if you sat next to Clive and me for a day, you’d be astonished by how much we talk about valuation. People tend in this industry to overpay for what they think is safe.

Then we calculate normalised earnings – the earnings we think a company can achieve if things normalise.

Finally, we prefer companies with strong balance sheets. Over 20 years, we’ve been burnt several times, as everyone is, but you’ve got to learn from that. When we came into the financial crisis, we had too much leverage in the underlying stocks so ever since then, we have focused on stocks with low leverage.

How will the Labour government’s policies impact your portfolio?

At the moment, the UK builds 140,000 homes a year but Labour’s policy is to build 300,000. Even if Labour only builds 200,000 homes a year, our fund will be well placed to benefit.

We’ve got 10% of the portfolio in the housing ecosystem. Only 2% is in housebuilders, down from 7%. We’ve been reducing our exposure to housebuilders all year because some of them have doubled and their potential is priced in.

Instead, we’ve got exposure to companies that manufacture things that go into houses. We added Forterra six weeks ago, which is the second-largest brick producer in the UK; we already owned Ibstock, which is number one. We also just added a property name.

We own several retailers with exposure to housing, such as sofa company DFS and home improvement specialist Wickes. These stocks are like a coiled spring, given where they trade. Earnings are depressed following the cost-of-living crisis but when things normalise and revenues recover, as interest rates fall and the Labour party’s housing policy feeds in, these stocks should start trading on price-to-earnings (P/E) multiples of 10-12x versus 3-4x normalised earnings now.

Have you made any other changes to the portfolio recently?

We added British Gas owner Centrica to the portfolio in March and April and bought more of it yesterday morning (25 July 2024) to keep building our position, after the share price fell on its results.

Yesterday was Super Thursday – the biggest results day of the year. Five of our companies, worth c.10% of the fund, reported on their interim results.

Centrica was down 9%, which seemed a ridiculous reaction. The market wanted £350m of buybacks and Centrica has done £200m, so there’s a bit of disappointment but it has taken out 10% off market cap, which is £700m.

Our interest in Centrica was triggered when we had lunch with the chief executive officer of BP in February. He said that fund managers don’t realize how much electricity demand will increase globally because of artificial intelligence and data centres. We did a lot of work since then and invested in Centrica, then in April/May we added Morgan Advanced Materials.

How has your fund achieved such strong performance over the past year?

Three buckets have performed well: merger and acquisition activity (M&A), banks and domestic policy – housing and construction.

We’ve outperformed by 800 basis points so far this year and M&A has added 200 basis points. We’ve had five bids this year, some of which have disappeared like Currys, and some which were consummated, such as Hipgnosis Songs and DS Smith. Currys is now trading above its bid price.

Another big driver of performance has been banks, which in February had their best results season in more than 20 years. Management teams came out with clear guidance in terms of their capital allocation policies and higher interest rates have boosted profit margins.

In the third bucket, some of our small-cap names have performed well. In construction, Kier is up 43.7% year-to-date and Galliford Try is up 31.9%. Before Galliford started moving, it was trading at less than cash, which was astonishing.

The UK equity market has hit all-time highs this year; is there much upside left?

Valuations were extremely low and now they’re very low, so not yet at fair value. Our stocks have plenty of upside. Barclays is one of our top performers this year and its share price has moved from £1.40 to £2.20 but it’s still got a long way to go. It had a price-to-book value of £3.30 at the end of last year and in 2026, its book value will be £4.85. In comparison, Lloyds and NatWest are now trading at book value.

The UK is having a renaissance. We’re surrounded by catalysts with inflation falling, interest rate cuts on the horizon, GDP growth being better than expected, companies performing well, mergers and acquisitions and share buybacks. I actually look forward to reading RNS announcements in the morning because the news flow is good and the results are quite solid.

Which stocks have detracted from performance?

Oilfield services company Petrofac and Mobico Group (formerly National Express) have been the biggest detractors. Petrofac needs to raise funds to refinance its balance sheet so we are waiting to find out how it will do that, hopefully sooner rather than later.

Mobico has too much leverage so two years ago, we wrote to the board to suggest selling its US business. There was a clear way forward and we felt the stock had a 60% upside. Since then, the company has had several profit warnings and it is planning to sell its US business in the second half of this year.

What do you enjoy doing outside investing?

I collect wine and play golf and I go on skiing holidays.