While being underweight domestic stocks has hurt active managers, a white paper from the asset management house argues that this positioning could eventually pay off.

New research by Invesco claims to have found the reason why active UK funds have underperformed trackers over the past few years, but argues that this might not be a disadvantage over the long run.

The recent underperformance of UK funds has been stark, with the average IA UK All Companies fund making a total return of just 14.5% over the three years to the end of 2023 compared with a 28.1% gain from the FTSE All Share index. Only 40 funds out of 208 in the sector beat the index over this period and 12 of those were passives, mainly tracking the FTSE 100.

In a white paper entitled Active management of UK equities: Understanding historical underperformance and identifying long term opportunity, Invesco UK equities product director Neville Pike and EMEA investment analysis manager Miguel Ucha aim to identify why this underperformance has occurred and ask if active management still offers value to investors.

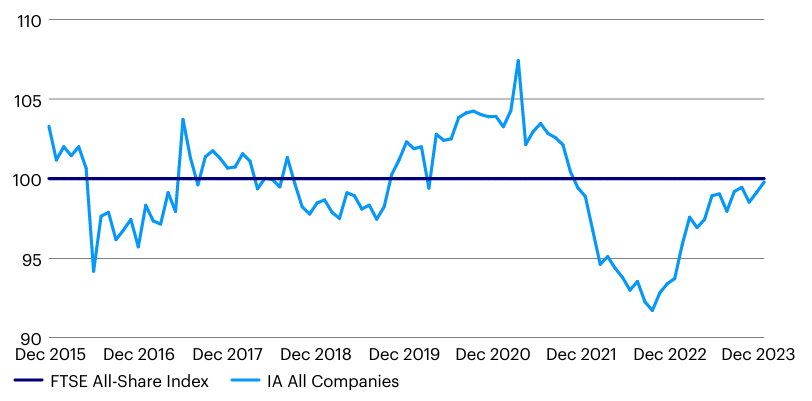

Total return of IA UK All Companies funds relative to FTSE All Share over rolling 12 months

Source: Invesco, Investment Association

Looking back over history, Pike and Ucha found that this underperformance is not typical – in fact, the IA UK All Companies sector was ahead of the FTSE All Share in almost 60% of the rolling 12-month periods between December 2015 and October 2021 (shown in the chart above).

“Peak relative outperformance by the IA sector occurred in March 2021, but active performance then faded such that by September 2022, there had been a swing of 16 percentage points in favour of the FTSE All Share index,” they said.

“Relative performance of active management vs the index therefore appears to move in cycles. The rotation that we can observe over the past three years in favour of the FTSE All Share is not unusual in its incidence. But what sets it apart from previous rotations is its magnitude.”

Putting the past three years under the microscope to explore this further, Invesco created a portfolio of (which it calls Model IA) of the top 50 holdings in the sector for each month in the three-year period. It compared this to the composition and performance of the FTSE All Share.

“The clear inference from this analysis is that the average fund manager represented in the IA sector is significantly underweight a relatively narrow base of the very largest companies in the FTSE All Share index, with active overweights spread more broadly across a larger number of smaller companies (not just in small- and mid-caps) below the top tier,” the paper argued.

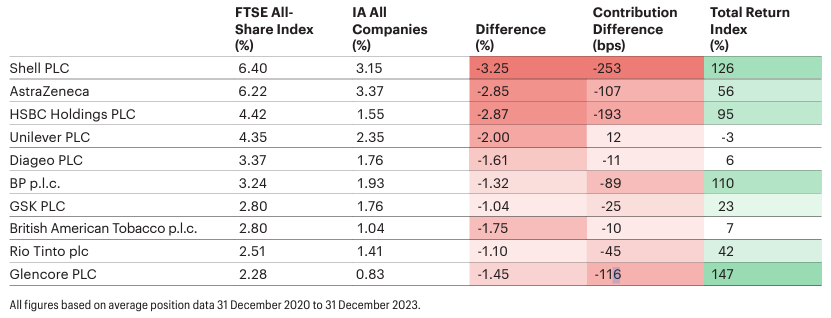

The table below shows the biggest underweights among IA UK All Companies funds and how they have impacted performance relative to the index.

Impact on total return from weight differences between FTSE All Share and IA All Companies

Source: Invesco, Factset, Morningstar

Invesco estimated around 95% of the underperformance of the Model IA relative to the FTSE All Share resulted from being underweight the 10 largest positions in the index.

In a separate note, Rathbone UK Opportunities Fund manager Alexandra Jackson pointed out that the UK market is very concentrated even when compared with the US, with the FTSE All Share’s top 10 stocks accounting for 40% of its weight. This causes problems for active managers.

“These top-heavy indices make it hard for active managers to be ‘at weight’. Doing so would mean jettisoning reasonable diversification and taking on huge risks that wouldn’t benefit investors. In some cases, it would nudge close to, or even exceed, regulatory limits on position sizes,” she explained.

“High concentration also means that performance (for good and bad) is driven by an ever-smaller group of stocks – in the UK, for example, the top end of the market is dominated by a few, very mature, often ex-‘growth’ names (albeit ones paying big dividends). Lots of oil, mining, banking, tobacco and consumer staples – but no technology. This seems to crowd out dynamism as well – in the UK, at least – with few changes to the top-10s from year to year.”

In addition to this, Invesco’s white paper suggested that UK active managers are underweight the largest companies because global/pan-European strategies and UK trackers (which tend to be benchmarked against the FTSE 100 so have an even greater weighting than the All Share to the biggest constituents) are essentially reducing the availability of stock for domestic funds.

“The overall conclusion is that, for reasons associated with ownership of some of the largest UK listed companies in non-UK funds, and the growth in passive funds tracking the FTSE 100, the opportunity set for active managers is structurally very different from the FTSE All Share and weighted more to companies below the top quintile” Pike and Ucha wrote.

The above explains why active UK funds are underweight the large-cap stocks that have led the market over the past three years but the paper warns this should not necessarily be seen as a long-term disadvantage.

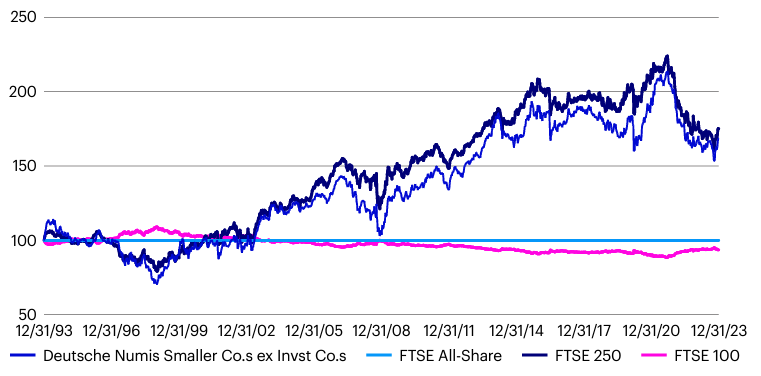

Total return relative to FTSE All Share (Indexed, 31 Dec 1993=100)

Source: Invesco, Factset

While the past three years have witnessed the significant underperformance of the small- and mid-cap indices, and outperformance of the FTSE 100 (thus the underperformance of active funds), the opposite is true over the long run – as shown above.

“There have been times (in the build up to the first dot.com boom, during the global financial crisis, around the Brexit Referendum of 2016, the first wave of Covid in April 2020, and the most recent period since September 2021) when smaller and mid-caps have underperformed,” the research finished.

“But the long-term outperformance of smaller and mid-caps, and the ‘oxygen’ of increased volatility that fuels opportunity for stock picking, suggests that the long-term outlook for UK active managers, relative to passive funds, remains especially attractive.”

Active managers outside of Invesco agree, with Rathbones’ Jackson liking the opportunities created by the FTSE 250. Just 11% of the UK mid-cap equity index is in its 10 largest names, so it is well-diversified, and Jackson believes this means it is home to quality companies “flying under the radar”.

“Many of these businesses are little known, with strong opportunities for growth both at home and abroad,” she said. “And they seem cheap relative to their counterparts in other markets and when compared with the past.”

Over at Premier Miton, Gervais Williams thinks markets could be approaching “an explosive period of small-cap recovery”.

With the very strong performance of global mega-caps such as Microsoft, Apple, Tesla and Novo Nordisk being driven by “an unusually large rise in their valuations” rather than earnings growth, Williams sees them as being vulnerable to a snap-back.

“The key point is that quoted small-caps have already had their bear market. They’re already standing on absurdly sub-normal valuations because capital flows over recent years have skewed so heavily into mega-caps,” the Premier Miton UK Smaller Companies co-manager said.

“Reallocating just 1% from mega-caps to small-caps dramatically scales up its impact, so the new small-cap supercycle is currently on a hair trigger.”