Data snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

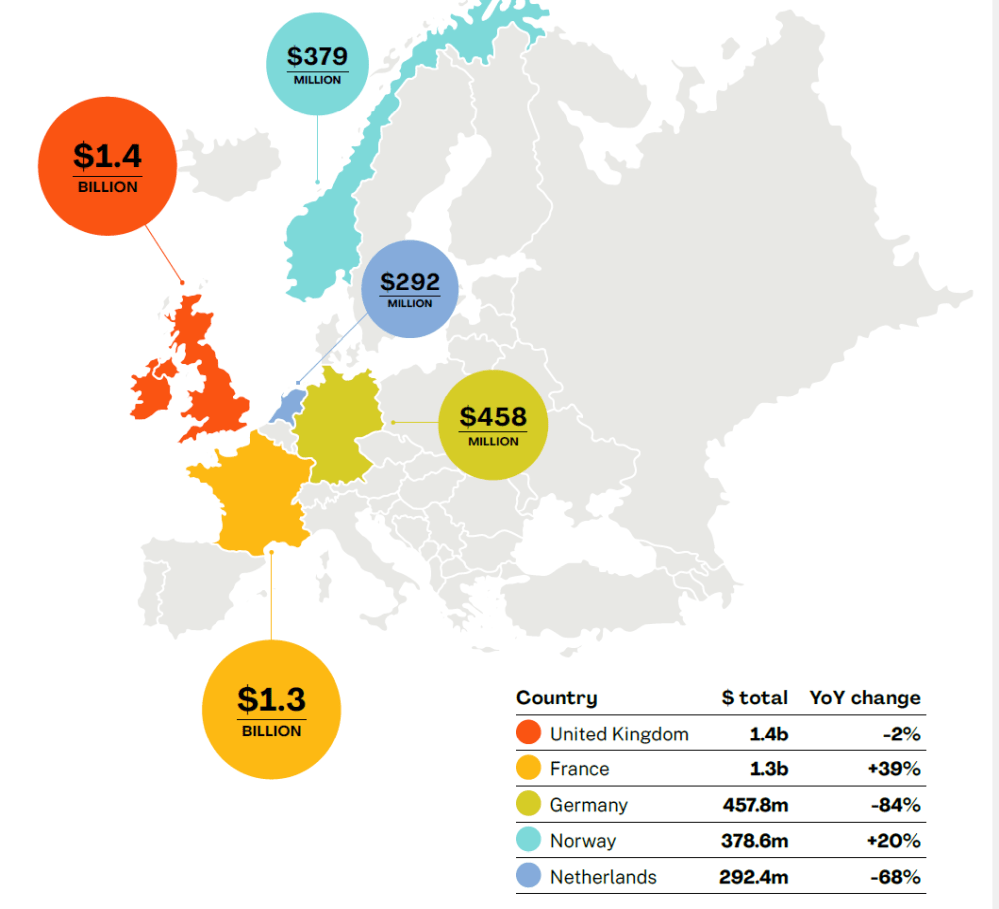

Agrifoodtech investment in Europe fell 46% to $5.1 billion in 2022 against the backdrop of a 44% drop in global funding, according to AgFunder’s 2023 Global AgriFoodTech Investment Report. However, the region still registered a hefty increase versus 2020, when European startups in the sector raised $3.3 billion.

There were some bright spots in 2022, with growth in categories such as novel farming, farm robotics and automation, bioenergy and biomaterials, alternative proteins, and ag biotechnology, although this could not offset a dramatic slump in investment in European eGrocery startups (where funding fell off a cliff from $4.3 billion in 2021 to $824 million in 2022).

Within Europe, there were some sharp variations between countries, with funding plunging 84% in Germany to $458 million, and surging 39% in France to $1.3 billion. France’s momentum was driven by a couple of mega deals: InnovaFeed’s $249 million series D round to expand its edible insect operation, and DNA Script’s $200 million series C round (the second tranche) to expand its on-demand DNA printing operation.

Investment in the largest player in the region — the UK — was down 2% to $1.4 billion in 2022.

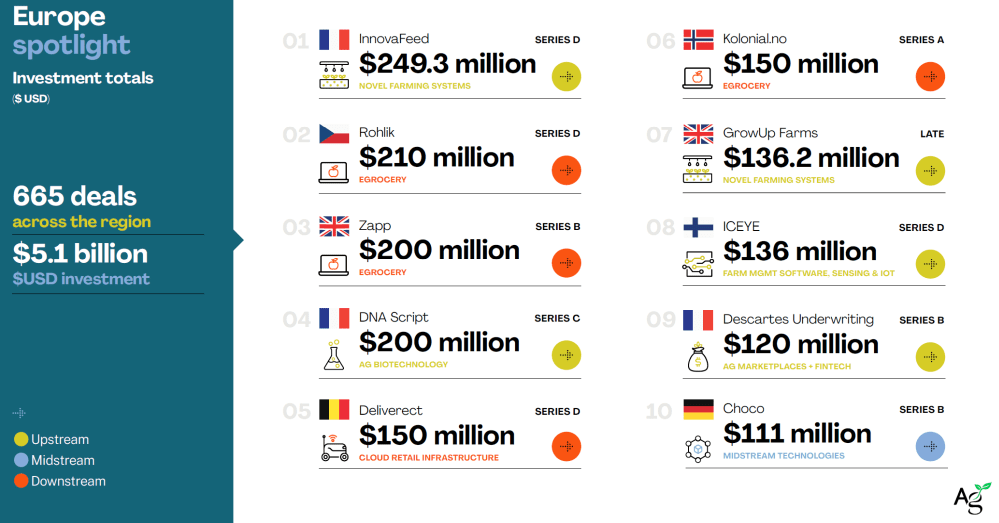

According to AgFunder data, the top 10 deals in Europe in 2022 spanned a broad range of categories from insect agriculture (InnovaFeed) to eGrocery (Rohlik, Zapp, Oda), to agricultural biotechnology (DNA Script).

Top 10 funding rounds in innovative foods in Europe, 2022

In innovative foods, (an AgFunder category that includes alternative proteins, functional foods, novel ingredients and nutraceuticals) funding was down a modest 6.2% to $609 million in Europe, while investment in this category slumped 52.5% to $1.64 billion in North America in 2022.

According to AgFunder data, the top 10 funding rounds in innovative foods in 2022 in Europe were dominated by players from the UK and France, with the majority of the money going into early stage (series A) financing:

1 – Planted (plant-based meat, Switzerland): $71m, series B

2 – Gourmey (cultivated meat, France): $48m, series A

3 – HappyVore (plant-based meat, France) $37m, series A

4 – Ivy Farm Technologies (cultivated meat, UK): $33m, series A

5 – Umiami (plant-based meat and fish, France): $30m, series A

6 – La Vie (formerly 77 Foods, plant-based bacon, France): $28m, series A

7 – Mycorena (fungi-based meat, Sweden): $27m, series A

8 – Better Dairy (animal-free cheese/precision fermentation, UK): $25m, series A

9 – Huel (meal replacements, nutritional beverages, snacks, UK): $24m, series B

10 – Hoxton Farms (cultivated meat, UK): $22m, series A

Alternative proteins: Europe up, North America down

While AgFunder doesn’t break out alternative proteins as a standalone category, the data suggests that North America and Europe moved in very different directions in this space in 2022, with the Good Food Institute recording a 24% increase in funding in Europe while funding to North American alt protein startups fell by 63%.

Retail data from NielsenIQ in Europe (via the Good Food Institute) and SPINS in the US (via the Good Food Institute and the Plant Based Foods Association) also suggests a divergence between the two regions when it comes to retail sales of plant-based foods in 2022.

While unit sales of plant-based meat and milk both fell in US retail (dropping -2% and -8% respectively), for example, unit sales of plant-based milk and meat were up 6% and 1% respectively in Europe.