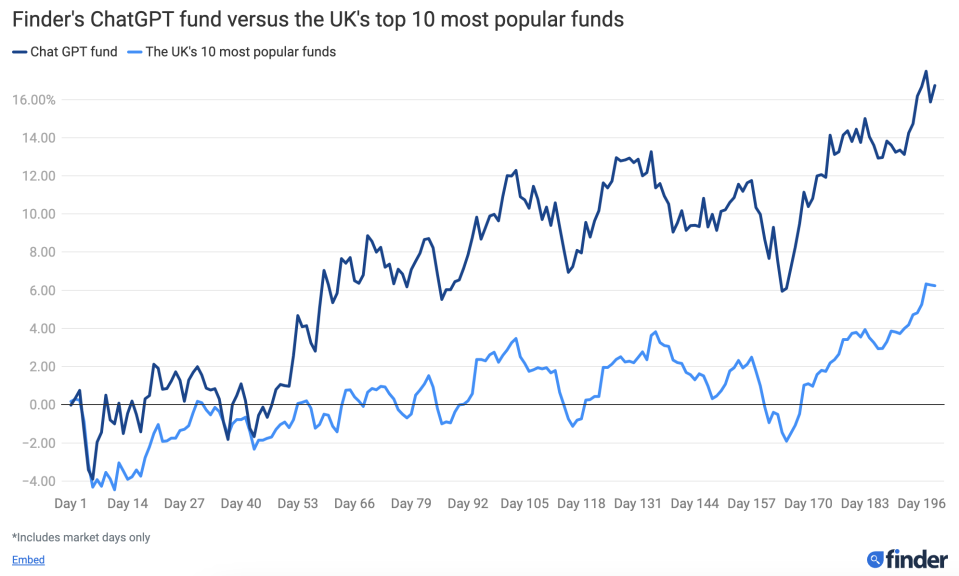

A selection of stocks picked by artificial intelligence chatbot ChatGPT back in March is still beating the UK’s top 10 most popular funds, according to an experiment conducted by finder.com.

Analysts at the personal finance comparison site asked ChatGPT to create a theoretical fund of 38 stocks, following a range of investing principles taken from leading funds.

The “fund” has risen 16.73% in the nine months since it was created on 6 March 2023, outperforming the average of the UK’s 10 most popular funds, which have collectively gained 6.24% in value over the same time period.

Read more: FTSE top trending tickers of 2023

The most popular funds include a range of UK, US and global funds from the likes of Vanguard, Fidelity and HSBC.

At the end of trading on Friday, the ChatGPT fund was currently 10.5 percentage points ahead of the UK’s top funds. It has also led the real funds for 194 of the 199 market days (97%) of its lifespan so far, according to finder.com.

The top performers in the fund so far have been NVIDIA (NVDA), up 105%, Meta (META), up 81%, and Intel (INTC), up 75%, at the end of trading on Friday.

“Would you rather get your advice from an unqualified TikTok star or AI that is capable of processing millions of data points from around the web and giving tailored advice?” CEO of finder.com, Jon Ostler, said.

“Of course, the ideal answer at the moment would be neither. Spending time researching via known primary sources or a qualified advisor would be the safer and recommended approach, but this may not be the case forever.

Read more: Crypto’s movers and shakers of 2023

“The democratisation of AI seems to be something that will disrupt and revolutionise financial industries, although it is far too early for consumers to get carried away when it comes to their own finances. However, fund managers may be starting to look nervously over their shoulders — especially with ChatGPT funds like ours currently outperforming many of them,” he added.

Research in 2021 revealed that half of UK investors used social media for investment advice.

Watch: Top AI stock picks for 2024: Two analysts share their ideas

Download the Yahoo Finance app, available for Apple and Android.