The chair of California‘s reparations panel is apparently pushing for a wealth tax, mansion tax or a property tax to pay billions of dollars to descendants of slaves.

Members of the California task force set up under woke Gov. Gavin Newsom have previously proposed paying each black resident in the state $223,000.

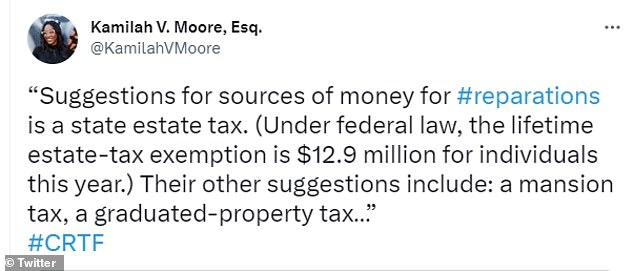

To make up those funds, Kamilah V. Moore tweeted over the weekend that the panel is considering proposing a state estate tax, a mansion tax or a graduated-property tax in its final recommendations to the state legislature, which are due this summer.

Her tweet came after the panel heard from experts in United States tax law who testified that white people are more likely to be wealthy, and so any proposals to redistribute wealth would directly benefit the black population.

Kamilah Moore, the chair of the California Reparations Task Force, is apparently pushing for a wealth tax, mansion tax or a property tax to pay billions of dollars to descendants of slaves

She tweeted over the weekend that the panel is considering proposing a state estate tax, a mansion tax or a graduated-property tax in its final recommendations to the state legislature, which are due this summer

Among the suggestions brought up at the California reparations task force meeting on Friday were proposals to tax the rich, such as through a state estate tax or a mansion tax; incentivizing wealthy people to help fund reparations by providing tax breaks; or helping all taxpayers below the median wealth line by means of a tax credit, MarketWatch reports.

Their suggestions were all based on the notion that current United States tax code favors the wealthy — who they say are more likely to be white.

‘Our tax laws as written have a disparate impact,’ Dorothy Brown, a tax professor at Georgetown Law and author of the book The Whiteness of Wealth: How the Tax System Impoverishes Black Americans & How We Can Fix It testified.

‘Black people are likely to pay higher taxes’ she said, because they are less likely to gain access to the same tax breaks as their white peers.

She said the best idea to fund reparations would be ‘a wealth tax credit applicable to all taxpayers in households with below-median wealth.

‘Given the racial wealth disparity, this will result in a disproportionate percentage of black households receiving the credit,’ she said.

Two estate planners, meanwhile, introduced the idea of taxing ‘swollen’ wealth to replace what they called ‘stolen’ wealth.

Sarah Moore Johnson and Raymond Odom claimed that the racial wealth gap widened after 1981, when then-President Reagan implemented the largest tax cut in American history.

The two cited Federal Reserve data from 2019 that showed the average white household had $812,000 more than the average black household.

They proposed creating a state estate tax, a mansion tax or a graduated-property tax — although they noted it may not be possible in California, because Proposition 13 taxes properties based on their value when they were sold.

Moore Johnson and Odom even proposed a tax on the ‘metaverse.’

And in her testimony, Moore Johnson, a founding partner at Washington DC-based Birchstone Moore, also proposed implementing a reparations tax fund that could receive charitable donations.

Dorothy Brown, a tax professor at Georgetown Law and author of the book The Whiteness of Wealth: How the Tax System Impoverishes Black Americans & How We Can Fix It testified that white people are more likely to be wealthy

Sarah Moore Johnson and Raymond Odom suggested the California Legislature implement a state estate tax, a mansion tax or a graduated-property tax

‘Charitable contributions are currently permitted to the state or federal government, but only for public purposes,’ she said.

‘If racial repair is recognized as a public purpose,’ it could be tax deductible in the same manner as charitable contributions.

But task force member Don Tamaki said of the idea of relying on charitable donations to pay the $569billion proposal: ‘I can’t argue with the fact that charity is not reparations. But in my humble opinion, we need to explore every avenue of funding.’

Then when task force member Sen. Steven Bradford asked the two whether they think wealthy residents would be opposed to new wealth taxes, they vehemently denied the idea.

‘What I hear from my clients is a level of guilt about being able to give this much money to their heirs,’ Moore Johnson said, adding: ‘From where I stand, what I see, I see some support.’

Odom, an estate tax lawyer and the director of wealth-transfer services at Northern Trust in Chicago, agreed, saying he helped ‘wealth get concentrated’ for decades by having wealthy Americans set up foundations and charities to avoid taxes.

‘It’s a joy being able to talk to people who could change that,’ he said, adding he has ‘talked to wealthy white folks who are behind this.

‘I can tell you unequivocally: Very wealthy people have lots of trouble figuring out what to do with their wealth,’ he said.

In the end, Brown, the tax professor, just had two final suggestions for the task force.

She said reparations should not be treated as taxable income, citing the precedent of tax free payments to Holocaust survivors and Japanese Americans who received compensation for internment in World War II.

And, she said, black people should not have to pay for their own reparations, claiming it ‘would be entirely inconsistent with the intent and spirit of the task force’s goals.’

The Rev Tony Pierce lashed out at the reparations panel over the weekend, arguing that $223,000 payments are ‘not enough’

The expert suggestions came just moments before an activist lashed out at the panel, arguing that $223,000 payments are ‘not enough.’

The Rev. Tony Pierce also slammed the residency requirement which has been discussed during previous meetings.

As of the 2022 census, 6.5 percent of California’s residents, roughly 2.5 million citizens, identify as black or African-American.

‘There should be no residency requirements for California! We have to encourage our people to come back to California! What better way to encourage our people to come back to California if we have no requirements?’ Pierce asked.

If the $223,000 payment were to be paid out to all 2.5 million black residents, the estimated total financial impact would be around $569 billion.

‘How will reparations be paid?’ Pierce asked.

Another activist also called for tax-exempt status, free college education, business and home grants and direct-cash payments for black residents.

And in a previous meeting, an attendee called for payments of $350,000 per person.

Marcus Champion with the Civil Justice Association of California at the time called for the ‘direct cash payments, tax-exempt status, free college education, grants for homeownership, business grants, access to low to no business funding and capital.’

Many in the Golden State support the idea of reparations and the work being done by the task force. Morris Griffin is pictured here holding up a sign in favor of reparations

Walter Foster, 80, held up a sign in September urging reparations payments

The proposed payments would be sent to black residents as recompense for housing discrimination and ‘racial terror.’

Among the questions that are expected to be addressed are when prospective recipients’ ‘harm’ started, and how the ‘form of payment’ can properly align with the ‘estimates of damage.’

The housing discrimination under examination by the nine-member task force would have occurred between 1933 and 1977 in the state.

Moore, the chair of the panel, has said she plans to be as ‘radical as possible.’ She is pictured here with vice-chair Amos C Brown in September

In a meeting in December, an attendee called for payments of $350,000 per person

Moore has previously stated she plans to be as ‘radical as possible’ when it comes to her job.

Some of the major issues being discussed include the mass incarceration of black residents, unjust property seizures, devaluation of black businesses and health care.

‘We are looking at reparations on a scale that is the largest since Reconstruction,’ task force member Jovan Scott Lewis told the New York Times in 2022.

Reconstruction refers to the period immediately after the Civil War from 1865 to 1877 when several US administrations sought to reconstruct society by establishing and protecting the legal rights of the newly freed black population.

In 2022, the task force put together a 500-page document outlining why African Americans that are descendants of 19th century slaves were due ‘comprehensive reparations.’

At the time, the group said those eligible for the reparations would have to be descendants of enslaved African Americans or of a ‘free black person living in the United States prior to the end of the 19th century’.

The task members have also spoken with historians to get a sense of how reparations had been paid in previous circumstances, such as after World War II.

People are seen lining up to speak during a reparations task force meeting at Third Baptist Church in San Francisco in April

But while many in the Golden State support the idea of reparations, others have called out the process and urged for more specifications about who would receive these hefty payments.

Josiah Williams, a member of American Redress Coalition of the California Bay Area, spoke at Friday’s meeting and called for targeting of the reparations.

‘I wanted to add that if there is anyone else who has their own claim, they can definitely write it up, get someone to champion it and I would support them in that effort,’ Williams said. ‘But this is for a specific group of people.’

California Secretary of State Dr. Shirley Weber said at the meeting she welcomed public comment.

She said the group is working with individuals to move the process along and end up in a positive situation.

‘And we will need every supporter in California and beyond to pull this off,’ said Weber.

The task force was set up under woke Gov Gavin Newsom in 2020

One issue facing the proposed payments and often pointed out by opponents is California’s history with slavery.

The Golden State was admitted into the Union September 9, 1850 as a free state.

The payments are also a long shot and potentially years away.

‘Under AB 3121, any reparations program will need to be enacted by the Legislature and approved by the Governor. The Reparations Task Force’s role is to develop recommendations for future Legislative action. Therefore, at this time, there is no claims process,’ according to the State of California’s Department of Justice website.

The reparations task force was set to dissolve when it submits its final report over the summer, but voted on Saturday to remain intact for another year to help with the implementation of its proposals.

It is set to meet again on March 3 in Sacramento.