Janoka82/iStock via Getty Images

Overview

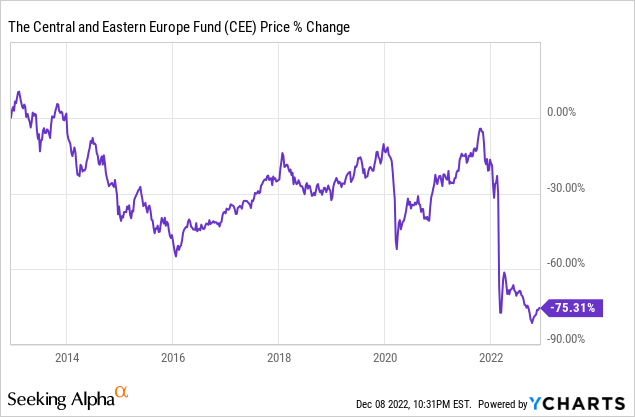

The Central And Eastern Europe Fund (NYSE:CEE) has been through drastic changes since sanctions caused Russian equities to perform poorly in 2022. I have this fund on my watch list and may buy it if there is a significant discount to NAV later. In the meantime, it is possible to attempt to replicate the fund’s performance by investing in other ETFs and ADRs. However, the lack of options available in Hungary and the Czech Republic makes it better to consider this fund in the future as a long-term vehicle to gain exposure to Central and Eastern Europe.

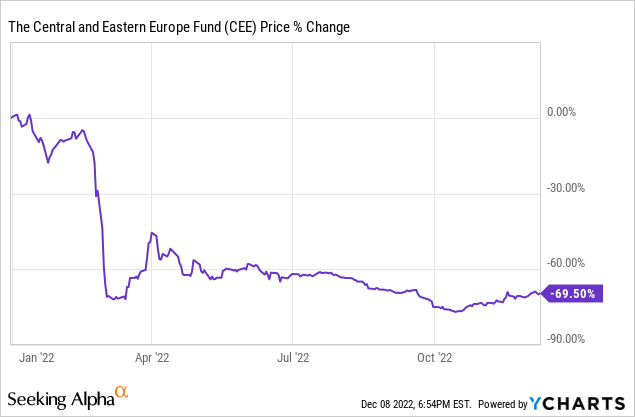

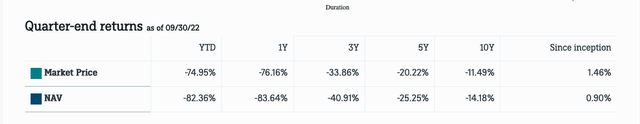

The fund has performed poorly YTD, but this was mainly due to the poor performance of Russian equities. The fund previously had a lot of exposure to Russia, which negatively impacted its YTD performance.

Furthermore, the fund’s NAV has not declined more than the market price, like I anticipated it might when I first looked at this fund.

CEE

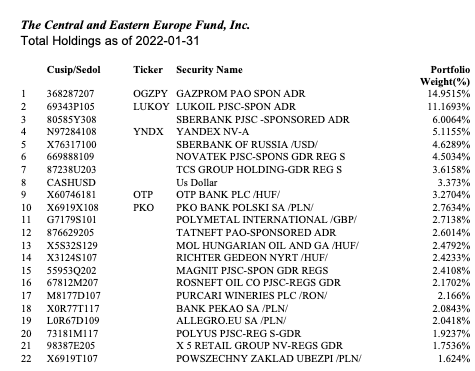

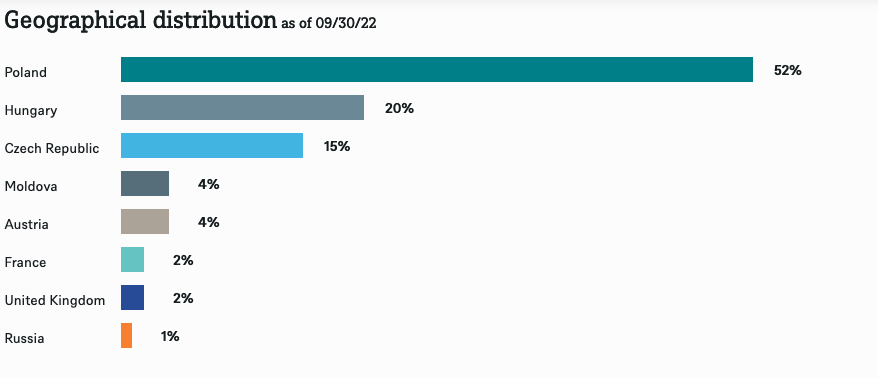

Over 70% of the fund’s assets were invested in Russia as of the end of January 2022. However, the fund has dropped its Russia exposure (only 1% of assets based on the latest info) and primarily invests in Poland, Hungary, and the Czech Republic.

CEE

Future Outlook

Whenever I consider investing in a fund with AUM below $50 million, I examine the risk that the fund might be liquidated. However, this decision often occurs due to other factors, such as the liquidity of the fund and the economic health of the region. The average daily volume is around 26,444, which would be south of $250k of trading activity daily based on today’s price.

Many investors may be skeptical of Europe’s economic outlook and hesitant to invest in this fund because of the performance, even though the 2022 performance does not bear weight on performance moving forward. The fund was established in 1990, which is one reason why I think this fund will continue operating. Moreover, the fund has been reviewing macroeconomic developments and making changes to the country’s constituents, so I think the fund could merely change the index if economic conditions in the region deteriorate. Worst case scenario, you can sell CEE, invest in a Poland ETF and search for other European ADRs.

Eastern Europe

This fund will continue to track the performance of the MSCI Emerging Eastern Europe Index. The Board of Directors recently rejected a plan to change the composition of the fund so that it tracked MSCI Germany (24%), MSCI Austria (4%), MSCI Switzerland (12%), and MSCI Emerging Markets Europe (60%). While this fact is a positive in my view, the fund is still heavily concentrated in a handful of emerging markets in Europe.

CEE

Nearly 90% of the fund’s assets are invested in three countries. However, this is in line with the fund’s index and the only other European emerging market options are Greece and Turkey (in both Europe and Asia). There are individual ETFs for both of these countries, so it is possible for one to blend these with this fund.

MSCI

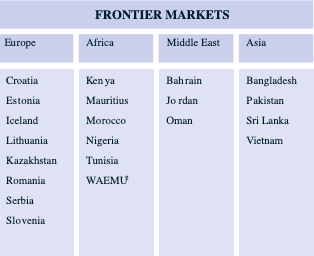

However, what is more interesting to me is some of the smaller European frontier markets that are very hard to access on US exchanges. When limited to US exchanges, Eastern Europe is technically not a complete market, because investors can’t invest in ETFs or ADRs in these markets, and would have to open individual brokerage accounts in each market. This ETF excludes intriguing frontier markets such as Croatia, Estonia, Lithuania, Romania, Serbia, and Slovenia. Moreover, other US listed frontier funds do not focus strongly on these countries, mainly due to liquidity.

Valuation Chart for Equities

Equities in Central and Eastern Europe are trading at a considerable discount to MSCI Frontier Markets, which trades at 9.91x PE and 1.66x PB. This fund invests most of its assets, with the exception of Romania, in all of the markets listed below. These valuation levels are very intriguing, as this type of discount is only found in politically risky markets in Latin America or Asian economies like Sri Lanka or Pakistan that are struggling economically.

|

Country |

PE |

PB |

Dividend Yield |

|

Poland |

5.45 |

0.90 |

3.99% |

|

Czech Republic |

7.66 |

2.15 |

8.55% |

|

Hungary |

4.76 |

0.83 |

1.54% |

|

Romania |

4.94 |

1.15 |

7.56% |

| Slovenia |

6.71 |

0.96 |

6.73% |

| Lithuania |

6.96 |

0.82 |

3.67% |

Source: MSCI Latest data

Some of the smaller Eastern European markets trade at attractive valuations but are hard for US investors to access. However, the emerging European options ( Poland, Czech, and Hungary) also trade in line with frontier Eastern European markets.

Economic Considerations

In my last article on Poland, I covered a lot of the economic risks in Poland and mentioned how these risks were common to many Central and Eastern European countries. Common regional issues include higher inflation, rising interest rates, and relatively higher public debt levels.

|

Hungary |

Poland |

Czech Republic |

|

|

Inflation |

22.5% |

17.4% |

15.1% |

|

Benchmark Interest Rate |

13.0% |

6.75% |

7.0% |

|

Public Debt |

76.8% |

58.7% |

41.9% |

|

Current Account Deficit |

-2.9% |

-4.1% |

-0.8% |

|

FX reserves ( % of GDP) |

16.7% |

19.7% |

44.4% |

|

2022 Estimated Growth |

6% |

4% |

2.3% |

World Bank/Trading Economics/CEIC/IMF most recent data

Most European countries will have slower or negative growth next year, largely because of each country’s export structure. Germany is Hungary’s largest trade partner, and trade with Europe accounts for 79% of its total trade. Around 54% of the Czech Republic’s exports go to Germany, Slovakia, Poland, France, and Austria. With inflation over 10% and growth declining substantially in most European countries, this exposure is somewhat troubling.

Performance

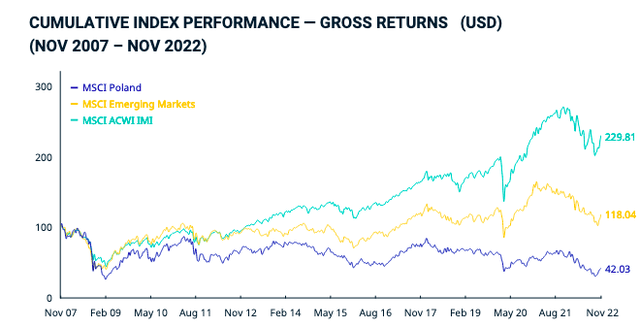

Many European markets have drastically underperformed MSCI Emerging Markets and MSCI World Markets. MSCI Poland is down by over 50% since 2007, while emerging markets are still up, and MSCI ACWI has more than doubled.

MSCI

Performance in Hungary and the Czech Republic has been very similar (Hungary’s value was 68.46 and the Czech Republic’s Value was 78). Equities in this region have underperformed substantially and trade at very attractive levels. It is well worth the time to explore value investments in the region.

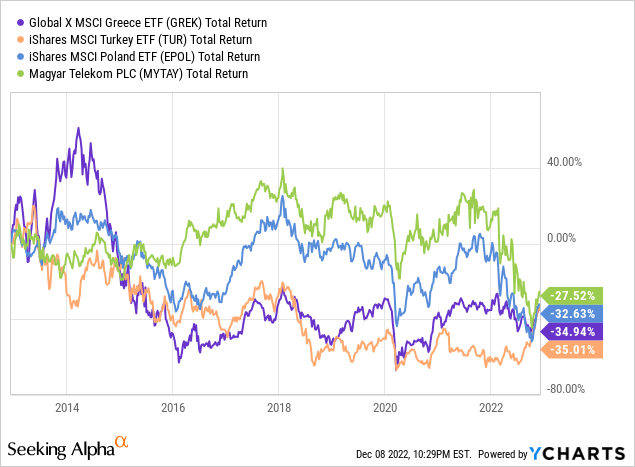

Custom Exposure to Emerging Europe

These ETFs/ADRs below provide investors with exposure to Poland, Hungary, Greece, and Turkey. There is not really a liquid option available in the Czech Republic, and there is not an ETF with significant exposure to the Czech Republic. This closed-end fund is a convenient way to gain access to undervalue and hard-to-access markets in Central and Eastern Europe, so I do think it is a good vehicle to consider if the discount to NAV is ever favorable.

I included Greece and Turkey, even though they are not a part of Central/Eastern Europe, since these are also cheap markets that are worth looking into.

As you can see, the impact of Russia has caused the fund’s index to drastically underperform. However, this is by no means reflective of future performance. This closed-end fund will effectively track its index, and should perform well given the favorable valuation of its constituents. I think this fund is worth following, as there are currently not any Hungary or Czech Republic ETFs. Most of my emerging market exposure includes Latin America, and I have not initiated any positions in Europe yet. However, I think the current setup is interesting, and plan to start building positions in 2023.