- Our reader wants to cut costs by buying investment trusts

- But his Isa currently has 20 funds and a handful of stocks

- His Lifetime Isa is also entirely invested in shares and needs to be changed

Reader Portfolio

Bruce

26

Objectives

- Change funds into cheaper investment trusts

- Grow Isa as much as possible

- Make sure the Lifetime Isa is ready to buy a home in five years

Portfolio type

Investing for growth

Investment trusts versus funds. A debate as old as time, or at least since 1931 when M&G launched the first unit trust. It’s often thought that trusts are the preferred vehicle of the experienced investor and funds for those new to the habit of investing. That isn’t the case for Bruce, who is 26 and has a conundrum on his hands.

Bruce has done very well for his age: he has just shy of £100,000 in an Isa after just eight years of investing, which he simply wants to grow as much as he can, and £44,000 in a Lifetime Isa (Lisa) which he wants to use to buy his first home in around five years.

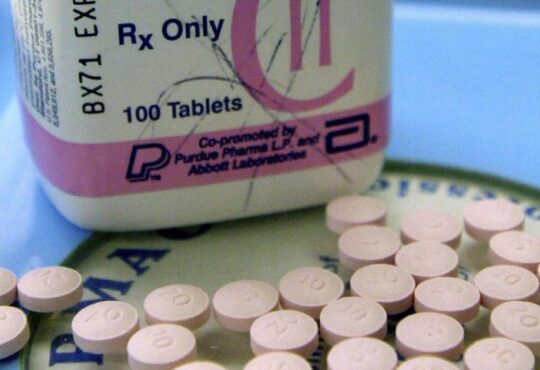

But he has encountered an issue. Bruce’s Isa, which he holds with Hargreaves Lansdown, consists of 20 open-ended funds and five individual stocks. This means he has fallen foul of Hargreaves’ uncapped charges for funds and is paying around £450 a year for his current portfolio. If it was entirely invested in investment trusts, exchange traded funds (ETFs) and shares it would be capped at £45.

Bruce says: “I have two options for reducing my fees: move entirely to shares or investment trusts or move to a different provider such as Interactive Investor. Can I replicate my portfolio of open-ended funds with a selection of closed-ended trusts with similar style and geography? This would reduce fees but also because many investment trusts are currently trading at large discounts.”

The portfolio itself is built up of active and index tracker funds with 50 per cent in global stocks and 36 per cent in UK stocks, with the remainder in Asian companies or bonds (see table below).

He adds: “When I first started investing, I liked buying individual companies, but I was never any good at selling. For the likes of Glencore (GLEN) and BAE Systems (BA.), that turned out extremely well and I have doubled my investment. However, it has not gone so well for British American Tobacco (BATS). Some of my shareholdings are small, so I’m slightly reluctant to sell them on Hargreaves due to trading charges.

“More recently, I have bought open-ended funds and core tracker funds, in the interest of reducing costs. There are a few fund managers that I have grown to like over the years, though, such as Terry Smith and Nick Train.”

He is considering replacing Fundsmith Equity (GB00B41YBW71) with the company’s Smithson Investment Trust (SSON) and similarly, adding the Lindsell Train Investment Trust (LTI) instead of the company’s open-ended funds. “I can replace some of the passive tracker funds with either iShares or Vanguard ETF equivalents,” he adds.

He is also wary of not having any renewable energy funds, an area trading on high discounts. “Two trusts I am considering for this are The Renewables Infrastructure Group (TRIG) and Greencoat UK Wind (UKW),” he says.

In addition to changing his individual savings account (Isa) portfolio, Bruce is worried about his Lisa which is entirely invested in shares, via funds (see table below). He saves the maximum £4,000 per year (and gets the £1,000 bonus) and will now direct this into relatively safer investments as he approaches buying his first home.

NONE OF THE COMMENTARY BELOW SHOULD BE REGARDED AS ADVICE. IT IS GENERAL INFORMATION BASED ON A SNAPSHOT OF THESE INVESTORS’ CIRCUMSTANCES

Rob Morgan, chief analyst at Charles Stanley Direct, says:

Your broad asset allocation in the Isa, with the majority in stocks and a modicum of bonds, feels right. There’s also a good mix of different regions and styles, although there is a distinct ‘home bias’ to the UK. Possibly that’s not a bad thing given how cheap it is, but at some point, I’d temper that.

If you want to move away from funds, I would use ETFs for larger companies and the biggest, most liquid stock markets to keep costs low. Meanwhile, investment trusts can potentially add more value in specialist areas.

For ETFs consider the following for core exposure: Vanguard FTSE All-World ETF (VWRL), Fidelity Global Quality Income ETF (FGQP), Invesco EQQQ NASDAQ-100 ETF (EQQQ) and SPDR Bloomberg Global Aggregate Bond (GLAB).

For investment trusts, the following a worth looking at, but in smaller chunks: AVI Global Trust (AGT), Monks Investment Trust (MNKS), Scottish Mortgage Investment Trust (SMT), Pantheon International (PIN), Schroder Asian Total Return (ATR), Blackrock Greater Europe IT (BRGE), CC Japan Income & Growth (CCJI), TwentyFour Income TFIF), BlackRock Smaller Companies Trust (BRSC), Finsbury Growth & Income Trust (FGT) and Fidelity Special Values (FSV).

Regarding Fundsmith Equity and Smithson, the two are quite different even though they use a similar investment process, so there is no reason you can’t have both as they have little overlap. It depends more on where you would rather focus – large or small companies. From the principle of differentiation, Fundsmith Equity is somewhat easier to approximate through a lower-cost passive, or indeed a rival active fund, whereas Smithson is more of a unique portfolio.

Either of your suggested renewables trusts would add diversification. Although they do have quite a bit of correlation to bonds in the shorter term given their sensitivity to interest rates, the linkage to inflation or power prices stands to offer a better long-term return. At current discounts, they both look attractive.

For the Lisa, five years is an awkward horizon as it is too short to take significant risk but long enough for cash to seem a wasted opportunity. So a balanced approach here seems appropriate, for instance allocating a third in each of stocks, bonds and cash (or cash-like), although you should start with more in the shares bucket and change as you go.

This is easy to achieve via ETFs. I would exclude investment trusts as the additional volatility of their borrowing and potential discounts adds unwanted risk.

The following should be considered for the core positions: For stocks, Vanguard FTSE All-World ETF, and for bonds, SPDR Bloomberg Global Aggregate Bond, and for cash Lyxor Smart Overnight Return ETF (CHS2). The latter should provide returns close to Sonia, which is close to the Bank of England base rate.

Ben Yearsley, investment director at Fairview Investing, says:

You have your head screwed on right but try not to become obsessed with costs – choosing the right investments for you is far more important. Nonetheless, as you said, it would make more sense to have the Isa in trusts and shares as it is bigger and always will be – I do this myself. However, what I think is more important is a wholesale change to your Lisa, so I’m not sure if you have the time or capacity to disrupt both. You have picked some good funds, with a smattering of shares too. But I will suggest some changes for the Lisa and tweaks for the Isa.

Starting with the Lisa, this money is to buy a house at some point in the future, and while that date is unknown, it could come sooner rather than later especially given how savvy you are.

Therefore, you should have a fairly cautious portfolio. Bond-heavy, light on stocks. Three years ago, this wouldn’t have worked but investment-grade bonds now pay a 5-6 per cent yield and high-yield bonds 8 per cent. Plus it’s a good opportunity to lock in some tax-free, lower-risk returns via gilts. This cautious portfolio below gives a good blend of styles and geographies while not being too fussy.

Turning to the Isa: some glaring things need addressing. Firstly, L&G International Index and L&G Global Technology have the same four stocks in the top five holdings, albeit at different weights. Also, why bother having Amazon (US:AMZN) when it’s in the International Index fund? I would also sell Abrdn Global Smaller Companies – it’s passed the glory days. I would sell JPM Japan too.

The other funds I’d highlight are the two Lindsell Train ones: why have both when there’s a large degree of overlap – just have the global one and sell the UK one. I would also argue that Fundsmith Equity, HL Select UK Growth and Lindsell Train all have quality growth biases, as does Rathbone. The top eight holdings account for 53 per cent of the portfolio and are all growth-style investments except the FTSE 100 tracker. You have to get down to CT UK Equity Income fund or Jupiter Global Value Equity (where the manager has just announced he’s leaving) to get anything different. There are a few value shares held such as Shell (SHEL) and British American Tobacco (BATS), which are cheap and pay good dividends, but both are 1 per cent or less of the portfolio – what’s the point in them?

Instead, you should consolidate the Isa into a 75/25 portfolio with 75 per cent in funds and trusts and 25 per cent in direct shares or specialist trusts.

On those top eight holdings, pick two or three to pair with the International Index or Global Tech fund: I’d keep Rathbones and Lindsell Train Global. Then add some more UK stocks to go alongside CT Equity Income, such as Artemis UK Smaller Companies (GB00B2PLJL57). Switch the L&G UK 100 tracker for the Vanguard UK Equity Income Index (GB00B59G4H82) and replace Abrdn with Montanaro Global Select (GB00BJRCFN97).

I like FSSA Asia Focus, it is a good core holding but maybe up the weight to 5 per cent or more and complement it Redwheel Next Generation Emerging Markets (LU1940965343) or even Ashoka India Equity Investment Trust (AIE).

As you have upped the bond weight in the Lisa, I would remove bonds from the Isa. Finally, add Polar Global Insurance – my go-to unique fund for virtually every portfolio.

I will leave you to pick your own 25 per cent specialist shares, but I like your renewables idea. A trust such as Downing Renewables & Infrastructure (DORE) is on a 25 per cent discount.