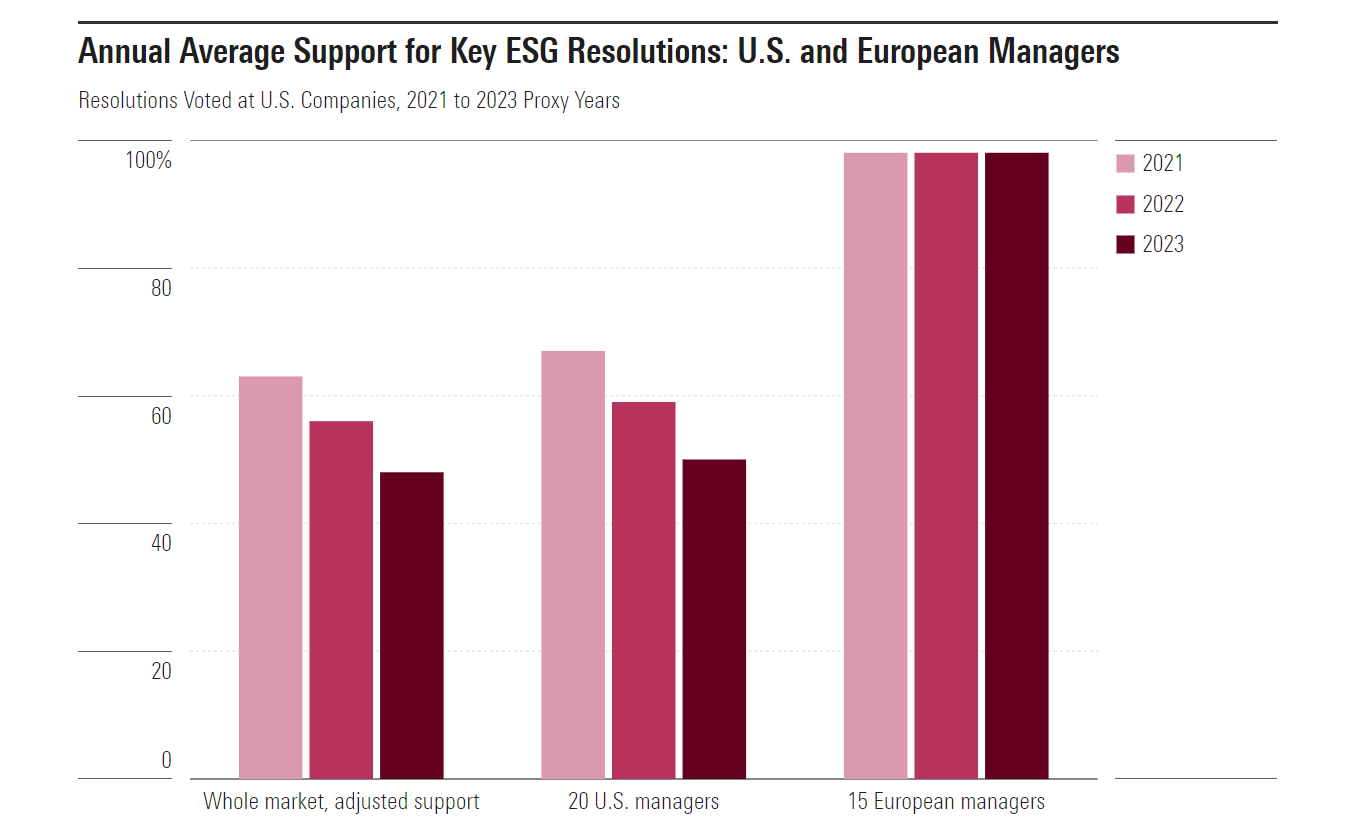

Increasing hostility from the political arena toward the consideration of environmental, social, and governance (ESG) issues in investing appears to be translating into sharply-declining support for ESG shareholder resolutions from the biggest US fund companies.

At the same time, European asset managers have maintained a high level of support for ESG-related shareholder proposals.

As a result, sustainability-focused investors are facing a more complicated landscape, and possibly greater difficulty, when it comes to aligning their investments with their own values.

In Europe, where expectations of support for ESG resolutions are higher, and several of the US firms have large market share, these concerns are growing in intensity. While large index fund providers have begun offering voting choice options, for example, they come with added complexity.

American Century, BlackRock, Capital Group Back Away From ESG Support

Our initial analysis of proxy-voting results for key ESG resolutions at US companies in September indicated a sharp drop in shareholder support. By then, the two largest US shareholders, Vanguard and BlackRock, had already communicated reduced support for such proposals. The two firms deemed many proposals, even some with strong shareholder backing, to be inappropriately prescriptive or redundant.

Yet, our latest research paper indicates that the decline in support for key resolutions wasn’t limited to the largest index managers. Many other large US managers also reduced their backing for even well-supported proposals.

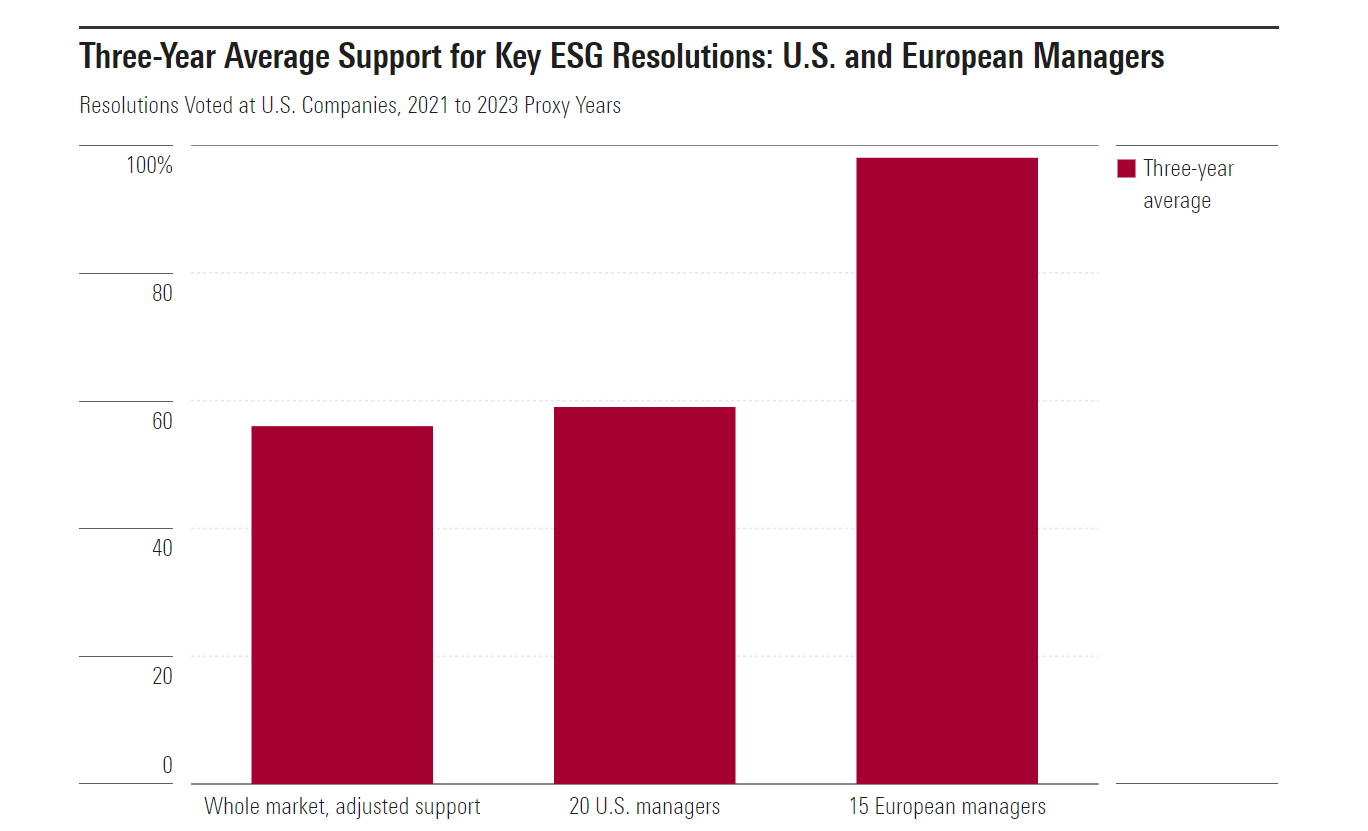

We define key resolutions as shareholder resolutions on environmental and social topics that gain at least 40% support from independent shareholders. (We call this adjusted support.) Analysing key resolutions enables us to compare proposals that are perceived to be of similar quality by voting shareholders.

Our study reviewed the voting disclosures of 35 large asset managers over the last three proxy years (that is, years ended June 30, which are commonly used for proxy-voting analysis). Twenty managers are based in the United States, and 15 are in Europe. Between them, they represent over $19 trillion (£14.9 trillion) of equity fund assets, according to Morningstar Direct.

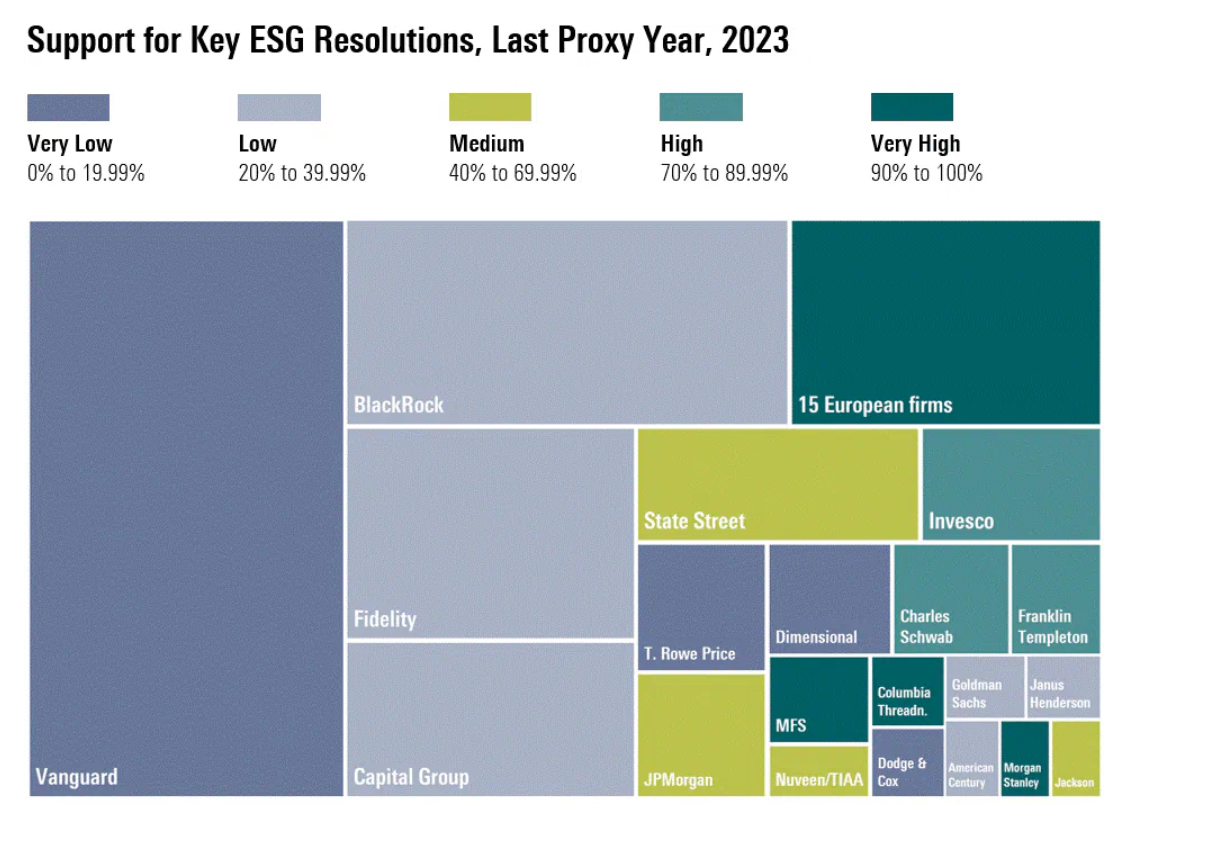

Unsurprisingly, the decline in support for key resolutions by the 20 US managers largely matches that for the market as a whole. Ten of the top 20 equity managers in the US showed low or very low support for key resolutions in 2023, compared with just five based on the firms’ three-year voting record. These 10 managers represent four-fifths of the equity fund assets that the 20 firms manage.

Vanguard and T. Rowe Price Show Very Low Support for ESG Votes

Vanguard, T. Rowe Price, Dimensional, and Dodge & Cox had the lowest absolute level of support in 2023. However, they have been among the lowest supporters of key ESG resolutions for several years running.

American Century, BlackRock, Capital Group, Goldman Sachs, and Janus Henderson exhibited some of the most significant declines in support for key resolutions, which can be seen on the exhibits below changing from green on the first exhibit to gray on the second.

From Europe, Continued Support for ESG Resolutions

Fifteen European managers – including larger houses such as Amundi, Fidelity International, DWS, LGIM, and UBS – are also shown above. In contrast to their US peers, all 15 of the European managers we assessed consistently show very high support for key ESG resolutions.

All this means greater complexity for sustainability-focused investors who care about their managers’ voting decisions.

For investors in funds managed by US firms, the peak in broad-based support for ESG proposals reached two years ago has been swiftly reversed. Also, even these firms’ sustainable funds often just vote the standard house policy, which these days often means relatively low support for environmental and social proposals.

ESG Investors Face More-Complicated Voting Outlook

As a result, sustainability-focused investors are increasingly questioning whether their managers’ voting policies are well-aligned with their own environmental and social objectives. In Europe, where expectations of proxy-voting support are higher and where several of the U.S. firms have large market share, those questions are being asked with greater intensity.

The large index firms have begun offering proxy-voting choice options to those concerned about such misalignment. But with up to 14 policies currently on offer to institutional investors, the choice certainly comes with added complexity.

We believe current trends in support for ESG resolutions won’t change much in the coming proxy season. So, sustainability-minded investors will continue to question whether their objectives are well-aligned with managers who are reducing their support for key ESG resolutions. There may be some big decisions for them to make in 2024.

Data as of January 2 2024. Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Note: charts show data for proxy years ended June 30. Averages of US and European managers are the equal-weighted arithmetic mean for each period