Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

Small business loans are a source of funding business owners can use to operate and expand their companies. They can apply for these loans through traditional banks, credit unions and online lenders. Funds are typically disbursed as a lump-sum payment and repaid monthly unless otherwise stated by specific lenders.

Best Business Loans Of May 2024

Summary: Best Small Business Loans Of May 2024

Tips for Comparing Small Business Loans

Consider these tips when comparing small business loans:

Where possible, prequalify.

Determine how you want to receive your funds.

Consider the repayment terms and flexibility.

Look out for additional fees.

Evaluate the lender’s customer support options.

Pro Tip

When deciding between the best business loan options, always compare monthly payments and long-term interest costs. A loan with a low monthly payment isn’t always the cheapest option if you choose a long repayment term. The longer the repayment term is, the more interest you could pay over time. Qualifying for a loan with a low-interest rate and shorter loan term could save you money and help you pay off your loan faster.

What should business owners consider when choosing a small business loan?

Complete Guide to Small Business Loans

What Is a Small Business Loan?

A small business loan is a source of funding business owners can access to cover the costs associated with operation and growth. Like personal loans, business owners can get small business loans through traditional banks and credit unions as well as online lenders—including those backed by the U.S. Small Business Administration (SBA). Depending on the type of loan, you can use funds for everything from working capital and equipment acquisition to larger purchases like real estate.

How Do Small Business Loans Work?

Small business loans help companies make large purchases and cover the cost of doing business. Loans generally are issued as a lump sum that can be used to make a specific purchase or manage cash flow and then repaid with interest. However, there are other types of small business loans—like lines of credit, merchant cash advances and invoice financing—that can be used to access cash more quickly and on an as-needed basis.

The best loan for a business depends on a number of factors, including its creditworthiness, how much it needs to borrow, what the funds will be used for and how quickly it needs access to loan proceeds.

Read More: How Do Business Loans Work?

Common Types of Small Business Loans

In general, small business loans help businesses access the money they need to operate and grow. However, there are several types of small business loans, and it’s important to find the best fit for your needs.

SBA Loans

Term Loans

Lines of Credit

Invoice Factoring and Financing

Merchant Cash Advances

Equipment Financing

Commercial Real Estate Loans

Bank Loans

Find the Best Startup Business Loans of 2024

Pros and Cons of Small Business Loans

Pros of Small Business Loans

- Provides funds you can use to start, grow or expand your business

- Receive funding without losing equity

- Repayment terms extend up to 25 years

- Loan amounts up to $5 million

Cons of Small Business Loans

- Most lenders require a personal guarantee or collateral

- Lenders typically require a minimum credit score of 670

- Approval and funding may take up to several weeks

- May charge high interest rates and other processing fees

Best Place To Get a Business Loan

Small business loans are available from a variety of traditional banks and credit unions as well as online lenders. However, each lender is limited by its own financial products and lending requirements.

1. Banks & Credit Unions

2. Online Lenders

Related: Best Same-Day Business Loans

How To Get a Business Loan

How To Choose a Small Business Loan

Just as certain types of loans are more appropriate for certain businesses, some lenders may be better suited to your business than others. Consider these factors to choose a small business loan:

- Lender reputation. Check online reviews so you’re aware of any red flags or potential issues before you sign on the dotted line. If you plan to work with a local bank or credit union, check with other local business owners to see which institutions have the best reputation.

- Qualification requirements. Most small business loans are underwritten based on the business owner’s personal credit score and are personally guaranteed. The minimum credit score required to qualify for a small business loan depends on the lender and the type of loan. So, it’s generally a good idea to check your personal credit score and then research each lender to compare minimum credit score requirements.

- Available loan amounts. Loan amounts vary by lender and loan type. Before choosing a small business lender, evaluate your business’ borrowing needs and shop for a loan that fits those parameters.

- Underwriting and funding speed. The amount of time it takes to process an application and receive funds varies widely by lender and loan type. In general, it can take anywhere from a couple of days (in the case of a merchant cash advance) to several months (for an SBA loan) to receive funds after submitting an application. If you need a loan quickly, choose a loan type and lender that can meet those time constraints.

- Annual percentage rate. APRs also vary by loan type and lender, but generally range anywhere from 5% to 99%. The most creditworthy applicants qualify for the lowest rates, but some lenders are more competitive than others.

- Additional costs. Many lenders charge origination fees that cover the costs of processing applications and underwriting loans. Likewise, some lenders charge prepayment penalties for borrowers who opt to pay off their loans early, while others charge draw fees on lines of credit. However, borrowers should not be charged application fees, and any fees levied prior to loan approval are a red flag.

How To Qualify for a Business Loan

The requirements for small business loans can vary by lender. But in general, lenders may review the following information to approve you for a loan:

- Personal credit. You may be able to qualify for a business loan with a credit score as low as 500. However, a good score of at least 670 could give you a better shot at getting approved for a competitive rate.

- Time in business. Lenders typically require that you be in business for at least six months to two years to qualify for a loan.

- Business checking accounts. Lenders may require that you have a business checking account with several months of transactions to show cash flow.

- Business revenue. Most lenders require that you have between $100,000 to $250,000 annual business revenue to qualify.

Pro Tip

To approve you for a business loan, lenders may check your business and personal credit and ask for financial documents, like bank statements, income statements and your business plan to measure ability to repay the loan. Getting financial statements together, checking your credit and fine-tuning your business plan are good ways to prepare before applying since turning in supporting documents quickly could help expedite the application and approval process.

How To Get a Small Business Loan in 5 Steps

The business loan application and underwriting process varies by lender, but most banks and lenders follow the same general guidelines. To get a small business loan, expect to follow these general steps:

- Determine the type of loan you need. Some lenders limit what industries they’ll finance or how loan funds may be used, so determine how you’ll use the cash before applying for a loan. Also evaluate how much you need to borrow, as this may impact the type of loan you apply for and the best lenders to approach for funds.

- Familiarize yourself with your credit profile. Lenders typically look at a business owner’s personal credit score when evaluating a loan application. You should have a score of at least 680 to qualify for an SBA loan or a traditional bank loan, and 630 for equipment financing or business lines of credit. Short-term financing and merchant cash advances typically have less stringent requirements—averaging around 600 and 550, respectively.

- Research lenders. When shopping for a small business loan, determine whether your current bank offers small business loans that meet your needs. This can streamline the application process because the bank will already have your financial information on file. Next, research other banks, credit unions and online lenders to compare available loan amounts, repayment terms and rates.

- Gather required documentation. Required documentation varies by lender. However, most lending institutions require a business plan, at least 12 months of personal and business bank statements, tax returns for at least two years and details about any current and past business loans. Lenders also require copies of applicable business licenses and legal documents, details about available collateral and a description of how loan proceeds will be used.

- Submit a formal loan application. Once you research the best small business loans and prepare your business for due diligence, submit a formal loan application. The process varies by lender, so familiarize yourself with the application process and contact customer service with questions.

How To Get a Business Loan With Bad Credit

It can be tough to qualify for a business loan with bad or limited credit. If possible, giving your business time to become more established can make qualifying for a loan easier.

If you can’t wait, start by looking for online lenders as they can have more flexible qualification requirements. Nonprofits that focus on microloans can also be an option to fund a new business venture.

Lastly, business partners that are willing to invest in your business or co-sign on a loan can be another option to fund your business.

Alternatives to Small Business Loans

If a small business loan doesn’t seem right for your specific needs, consider other options to get the financing your business needs.

Business Line of Credit

Business Credit Card

Crowdfunding

Personal Loans for Business

Small Business Grants

Methodology

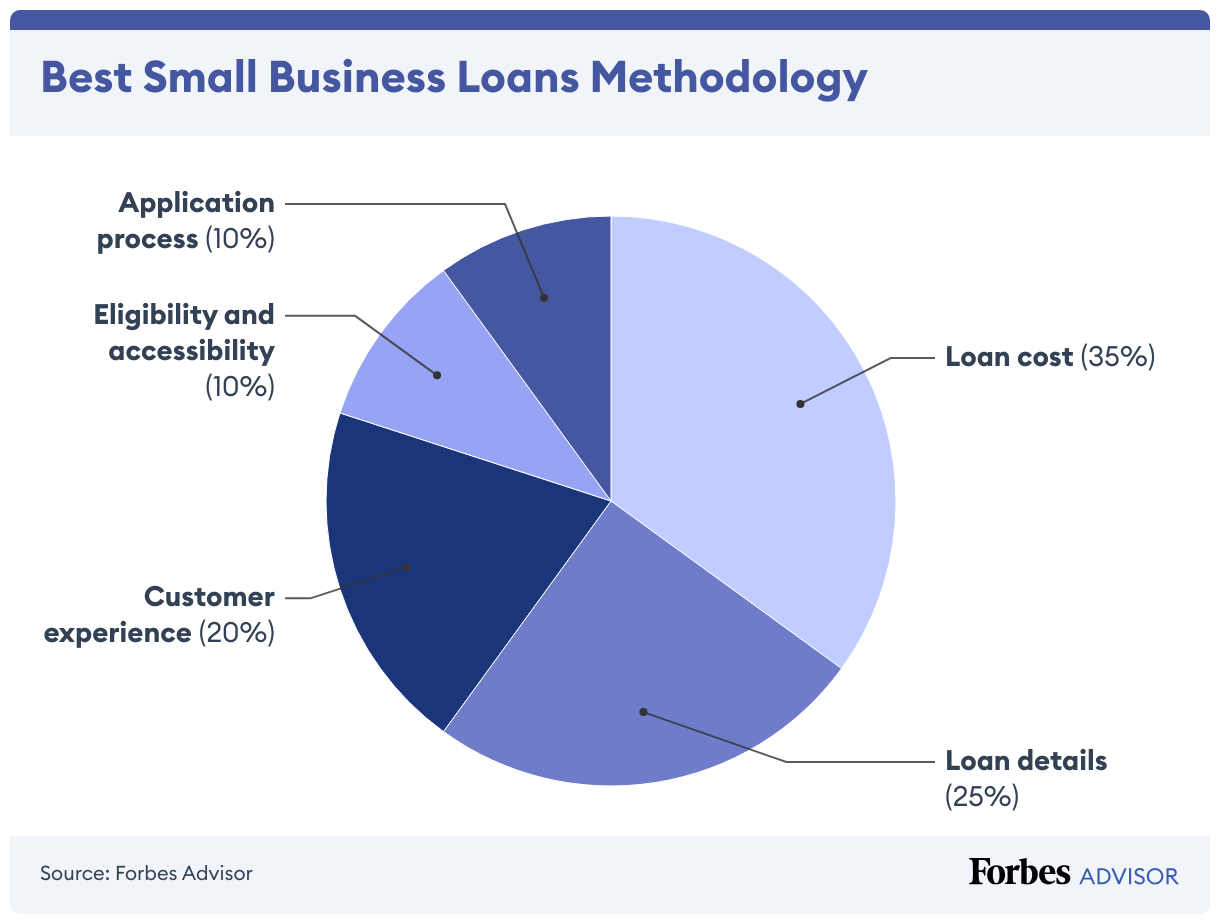

We reviewed 25 popular lenders based on 16 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the application process. We chose the nine best lenders based on the weighting assigned to each category:

- Loan cost. 35%

- Loan details. 25%

- Customer experience. 20%

- Eligibility and accessibility. 10%

- Application process. 10%

Within each major category, we also considered several characteristics, including available loan amounts, repayment terms and applicable fees. We also looked at minimum credit score and time in business requirements and the geographic availability of the lender. Finally, we evaluated each provider’s customer support tools, borrower perks and features that simplify the borrowing process—like online applications, prequalification options and mobile apps.

Where appropriate, we awarded partial points depending on how well a lender met each criterion.

To learn more about how Forbes Advisor rates lenders, and our editorial process, check out our Business Loans Rating Methodology.

Frequently Asked Questions (FAQs)

Can you get a small business loan with bad credit?

As with personal loans, it’s possible to get a small business loan with bad credit—scores as low as 580. However, you’ll have to demonstrate strong cash flow, and banks are more likely to require collateral to reduce the risk of lending.

Small business borrowers with bad credit also qualify for less competitive rates and pay more in interest over the life of the loan. If possible, giving your business time to become more established can make qualifying for an affordable loan easier.

What credit score is needed for a small business loan?

Traditional banks generally prefer a credit score of around 700 or higher for a small business loan. However, online lenders and credit unions might consider scores as low as 500. The specific requirements can vary significantly depending on the lender and your financial history.

What can you do if you’re denied a small business loan?

There are a number of steps you can take if you’re denied a small business loan. First, try to find out why your application was denied. If your SBA loan application is denied, you’re entitled to a notice of denial that details the reasons; you may receive this directly from the SBA or from your lender.

If, instead, you are denied a small business loan through an online lender or other financial institution, contact them to find out why you were not approved. They may be able to provide insight into how to improve your future approval odds.

Once you know why your loan application was rejected, take steps to rectify the underlying issues. For example, you may need to improve your credit score, establish more consistent sales or reassess the amount you need to borrow.

How hard is it to get a small business loan?

Getting a small business loan may prove more challenging than other financing options like business credit cards. Although qualification requirements vary by lender, most lenders typically look at the business owner’s personal credit score and the business’ annual revenue. Many lenders require a minimum personal credit score of 600 to 660 and annual revenue between $100,000 and $250,000.

We recommend confirming the qualification requirements with your preferred lender before applying.

What is the easiest way to get a small business loan?

The easiest way to get a small business loan may be through online lenders instead of traditional banks because borrower requirements may be more flexible. With an online lender, you may be able to quickly prequalify and get funding as soon as the same business day as long as you meet eligibility requirements.

How much income do you need to get a business loan?

Typically, lenders require businesses to have an annual revenue of between $100,000 and $250,000. If your business makes less than that, there are business loans for low-revenue companies that may offer funding options for your business.

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.