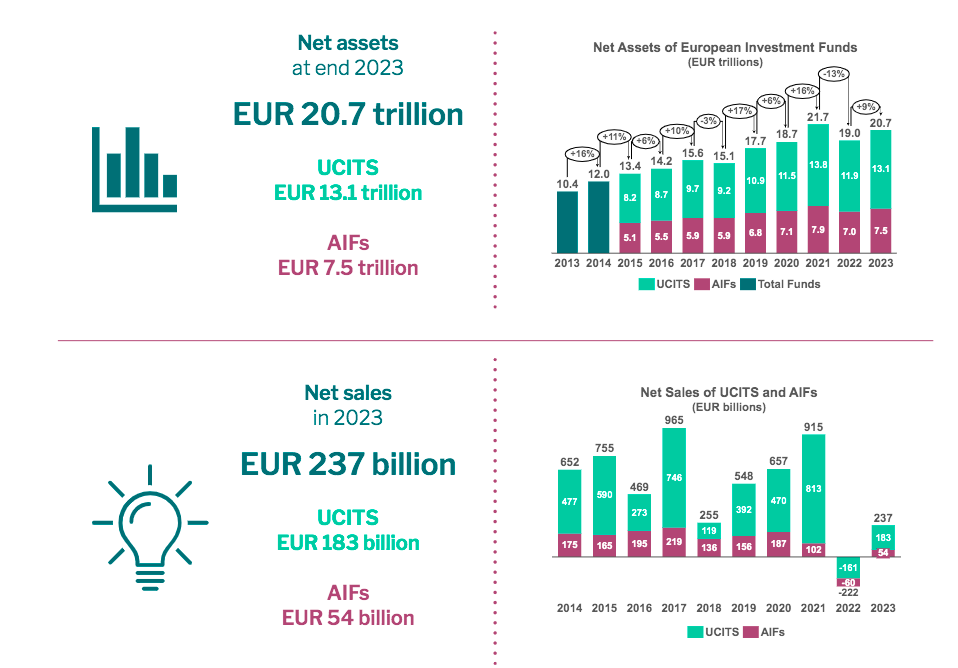

The European Fund and Asset Management Association (EFAMA) has published its annual Fact Book on the behavior and main trends of the European investment fund industry, as well as a general review of regulatory developments in the 29 European countries. One of its main conclusions is that in the last decade, assets in UCITS and AIFs (alternative investment funds) have doubled, reaching €20.7 trillion, demonstrating the industry’s robustness.

“This year’s Fact Book shows that UCITS are delivering good returns with declining costs, attracting both European and foreign investors. While this is good news for the financial well-being of those investors, there are still too many European households not reaping the benefits of investing in capital markets. This is a crucial year of change within EU institutions, with a clear recognition by lawmakers that we need to further encourage retail investment to address the pension gap and support economic growth. To achieve this, we need decisive actions that simplify investment, reduce bureaucracy, and bring us closer to a Savings and Investment Union,” says Tanguy van de Werve, Director General of EFAMA.

Among the data collected in the report, it is noted that net sales of fixed-income UCITS in 2023 were greatly influenced by the evolution of interest rates. Net inflows were driven by the pause in central bank rate hikes and expectations of rate cuts in 2024. It also highlights that inflows into money market funds were mainly driven by short-term interest rates. In contrast, multi-asset UCITS funds experienced their first net outflows in ten years.

One of the trends identified in the report regarding UCITS funds is that large vehicles are gaining more importance in the European market. “UCITS funds with less than €100 million represented less than 4% of the total net assets of UCITS in 2023, with a market share that is gradually decreasing. At the same time, the share of funds with more than €1 billion in net assets is increasing,” the report indicates.

According to the document, the share of US equities in the allocation of equity UCITS has increased significantly. Specifically, it doubled from 22% to 44% in the last decade. EFAMA explains, “This is because US equity markets outperformed Europe, particularly large US tech stocks.”

The Appeal of UCITS Funds

One reason European market funds are attractive is their costs, which, according to EFAMA’s report, have been gradually decreasing. In fact, between 2019-2023, the average cost of long-term active UCITS decreased from 1.16% to 1.06%, while UCITS ETFs dropped from 0.23% to 0.21%. “This trend is expected to continue, driven by greater transparency in fund fees and intensified competition among asset managers,” they indicate.

According to EFAMA, foreign investors are an increasingly significant group of EU fund buyers. Evidence of this is that, in the past five years, foreign investors purchased an annual average of €276 billion in EU investment funds. In comparison, €174 billion were sold cross-border within the EU, and €196 billion were bought domestically.

Additionally, EU retail investors continued to buy funds in 2023 but shifted their focus to bonds. “Given the reluctance of banks to increase interest rates on savings accounts, national governments in countries like Italy and Belgium successfully attracted domestic retail savers by offering bond issues with higher yields,” the report indicates.

In general terms, the average annual performance of all major types of UCITS was positive. Equity UCITS delivered an average of 14.2%, multi-asset UCITS generated 8.7%, bond UCITS 5.7%, and money market funds 3.3%. “With an EU inflation rate of 3.4% for the year, most UCITS proved to be an excellent investment option in 2023,” EFAMA adds.

Sustainable Investment

Something that caught EFAMA’s attention is that sales of sustainable funds slowed down. “Net sales of dark green Article 9 SFDR funds declined compared to 2022. Conversely, Article 6 funds (without a sustainability focus) saw a shift, attracting €41 billion in net inflows. These trends were mainly driven by the growing popularity of ETFs, as most ETFs are Article 6,” the report indicates.