By Jeff Prestridge, Financial Mail on Sunday

21:51 22 Apr 2023, updated 21:51 22 Apr 2023

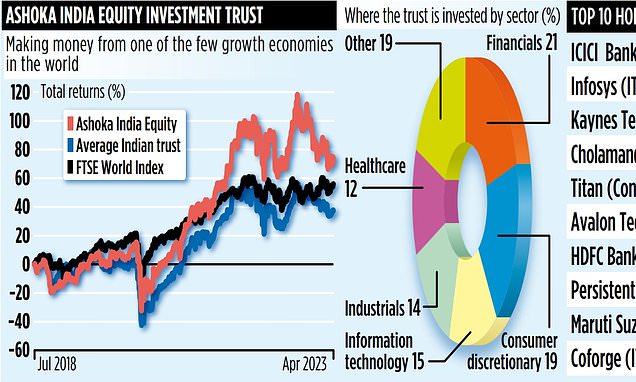

Investment trust Ashoka India Equity is a fund set up to generate investment returns for shareholders from a booming Indian economy. So far, it has done pretty well, delivering profits in excess of 70 per cent since launch in July 2018.

Yet, an economy growing at 6 per cent a year, or just below, does not guarantee investment success. Over the past year, the Indian stock market has got a little bit of the jitters as a result of dual fears over a possible world economic recession and the continuing war being waged on Ukraine by Russia.

A fragile global economy means fewer exports for some of India’s key IT giants. Hanging over markets is also next year’s General Election and the possibility of the business-friendly National Democratic Alliance government being replaced.

The nervousness of markets is reflected in Ashoka India Equity’s short-term performance numbers – the fund’s price is down by 7 per cent over the past year.

The trust, listed on the UK stock market, is managed by investment house White Oak Capital, a specialist in Indian equities with offices in Mumbai, Singapore, Mauritius and Europe (including the UK). White Oak was set up in 2017 by Prashant Khemka who earned his stripes running Indian and emerging markets investment portfolios for Goldman Sachs.

Ayush Abhijeet, who helps run the trust, says one of the contributory factors behind the trust’s recent subdued performance is the investment team’s refusal to invest in parts of the market that have held up well – for example, utility and energy stocks, buoyed by high prices.

The team prefers to focus on companies that will benefit from the economy’s long-term growth – driven by a burgeoning middle class with money to spend, and the country’s reputation for expertise in areas such as healthcare and IT.

Related Articles

HOW THIS IS MONEY CAN HELP

As a result, the trust’s assets, valued by the market at just above £200 million, are heavily invested in the banks whose accounts people with money are taking out – institutions such as ICICI Bank and HDFC Bank.

It also has big holdings in companies that are making the goods that the middle classes are buying – the likes of cars (Maruti Suzuki) and jewellery (Titan). Four of the trust’s top 10 holdings are IT orientated. The trust is currently invested in 88 companies from a universe of 750 stocks.

Given the trust’s focus, it is no surprise that Abhijeet is optimistic about the Indian economy. He says: ‘The economy is growing at 6 per cent a year and unlike other parts of the world, the banking system is in good shape – its best shape, I would say, for some 20 years. Companies are also carrying low debt levels.’ He adds: ‘As for the consumption-led economy, it is not being hit by inflation to the same extent as elsewhere in the world. Inflation is more benign and is running at between 6 and 7 per cent. As for food, the country is self-sufficient and is not importing food inflation from overseas.’

Not everyone is so optimistic. Amitabh Chaudhry, boss of Indian bank Axis, says higher interest rates could have an adverse impact on the economy, resulting in expectations for growth having to be ‘tempered a little bit’. The trust has ongoing annual charges of 0.34 per cent and its stock market identification code is BF50VS4 and ticker AIE. Other companies that manage Indian investment trusts include Abdrn, JP Morgan and Ocean Dial Asset Management.

Last week, White Oak published details of a new emerging markets trust – Ashoka WhiteOak Emerging Markets – which will launch on the London Stock Exchange early next month.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.