Amazon.com’s heft (AMZN) has made it a top holding among many mutual funds, especially in the wake of its strong performance during the pandemic. But after coming out with a disappointing earnings outlook this week, Amazon stock has extended already large declines for 2022, hitting hard those funds with a big stake in the company.

Through midday Friday, Amazon was down as much as 10%, setting it on track to become the most significant one-day drop since Oct. 14, 2008. While third-quarter results were broadly mixed, investors were mostly disappointed by the company’s guidance for the fourth quarter.

Amazon reported earnings per share of $0.28 that beat mean estimates of $0.17, according to FactSet. Revenue was close to what was expected at $127.10 billion.

At a closer glance, the results showed cost pressures started to accelerate. While Amazon’s third-quarter revenue was up about 15% from a year prior, operating expenses jumped 18%. The company reported a third-quarter operating income of only $2.5 billion—roughly half of what it was a year ago.

North American sales showed a growth rate of 20% from a year ago, but operating expenses grew by 23%, leading to a net loss of $412 million. Meanwhile, Amazon Web Services saw revenue grow 27%, which still fell below expectations. However, AWS operating expenses rose nearly 35% over the last 12 months.

What worried investors the most, however, was the company’s forecast that fourth-quarter sales would be slower than anticipated. The company’s guidance for fourth-quarter sales was between $140 billion to $148 billion, which would mark only a 2% to 8% increase from the fourth quarter of 2021. The new guidance range is far below analyst estimates of $155 billion, according to FactSet, raising alarms that consumer spending is starting to slow, and with it, growth. The latest plunge has the stock down about 40% year-to-date in midday trading on Friday in New York.

Amazon’s stock swings have weighed heavily on the market. As of Sept. 30, the online retailing giant makes up about 2.88% of assets in the Morningstar US Market Index. That led to the company contributing to 1.04% percentage points to the market’s 20.14% overall decline between Jan. 1 and Oct. 27.

Amazon is one of the biggest holdings in the most widely held stock funds. The stock is the third-largest holding in the SPDR S&P 500 ETF (SPY) with a 3.06% weight, and a 2.73% weight in the Vanguard Total Stock Market Index (VTSMX).

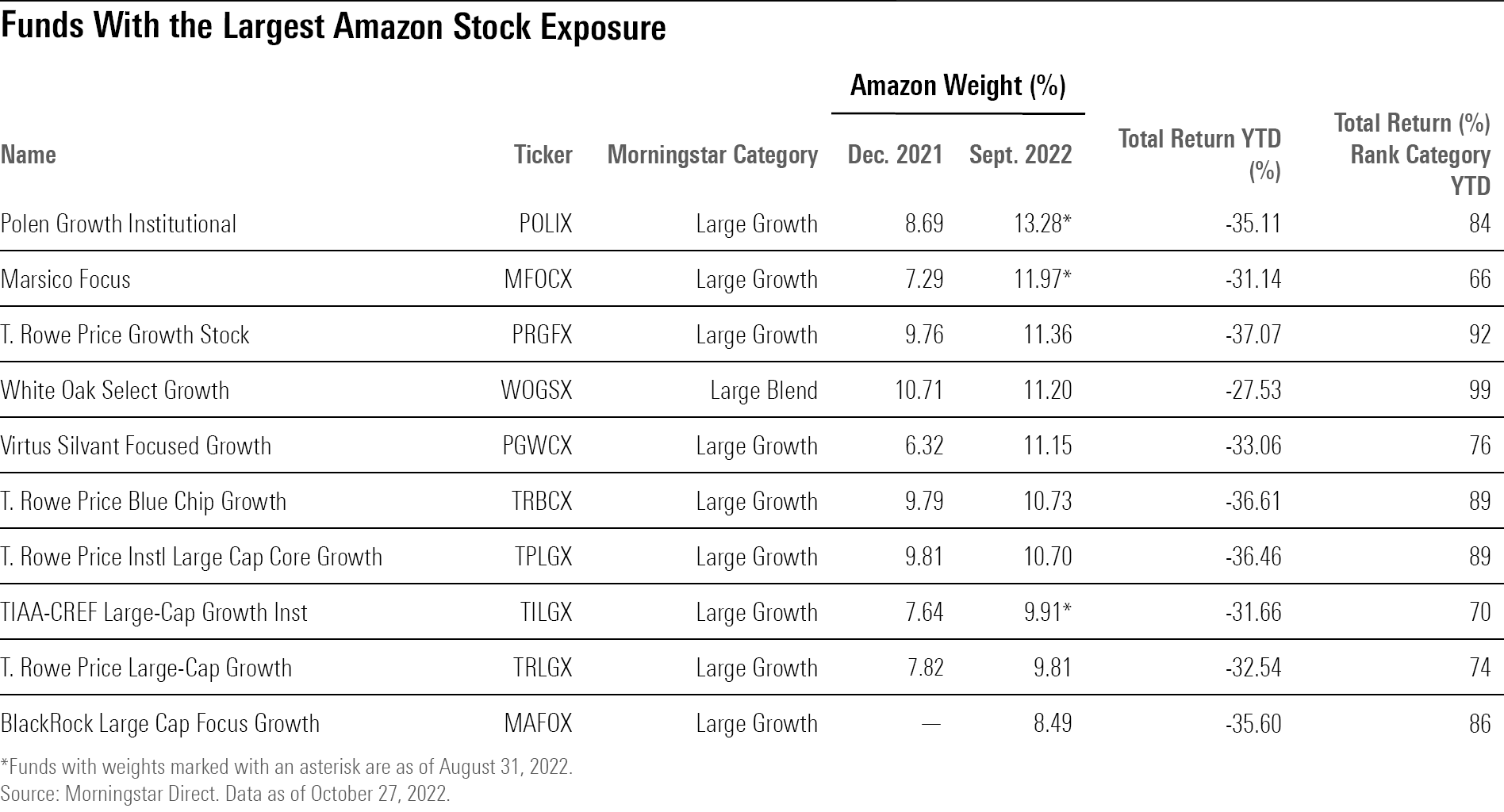

For a number of actively managed funds, the stock has been a top holding. Amazon makes up 11.36% of the $45.2 billion T. Rowe Price Growth Stock’s (PRGFX) portfolio. The managers have held the stock since 2006, and from 2014 through 2021 it was the fund’s largest holding.

Amazon also plays a prominent role in the $56.1 billion T. Rowe Price Blue Chip Growth (TRBCX) portfolio, comprising 10.73% of the fund as of Sept. 30. The fund is down 36.6% this year, putting it in the 89th percentile of the large growth category.

Among other large-growth funds, Polen Growth Institutional (POLIX) has the biggest stake in the company. Amazon represented 13.28% of the fund as of Aug. 31. The stock’s poor performance in 2022 has dragged on the fund, which has lost 35.11% this year, putting it in the bottom 20% of large-growth funds.