More than a third of active equity managers outperformed passive counterparts over the last one-year period. Active bond managers did even better, with 62.7% on average outperforming their passive alternative.

These findings are contained in the mid-year Morningstar’s Active/Passive Barometer, a semi-annual report that measures the performance of European-domiciled active funds against passive peers in their respective European, Asian and African Morningstar categories. It spans nearly 26,000 unique active and passive Europe-domiciled funds that account for approximately €6.3 trillion in assets, or about half of the total European fund market.

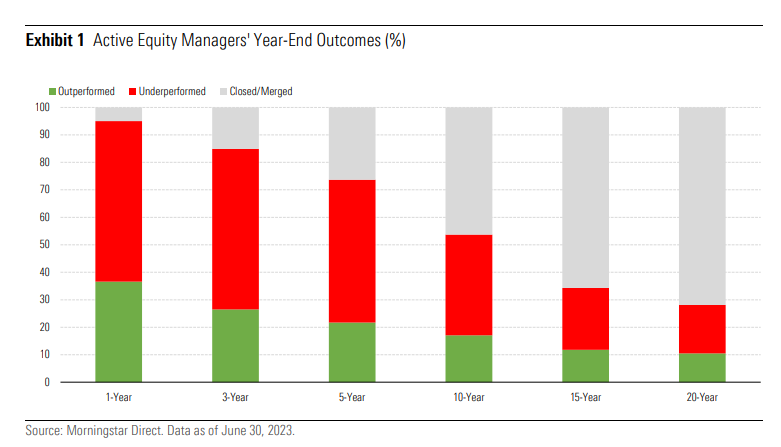

The first half of 2023 was positive for developed equity markets, while emerging markets lagged. On average, 36.6% of European active equity managers in the 43 equity categories analysed by Morningstar surpassed the average passive fund in the one-year period to the end of June 2023. This was up from 33.6% at the close of 2022 and 30.4% a year earlier.

“Typically, success rates for active managers are higher in equity categories focusing on the mid-cap and smaller-cap segments of the spectrum than in large-cap categories”, said Dimitar Boyadzhiev, Senior Analyst of Morningstar Passive Strategies Research in Europe. “Active funds also have higher odds of success in equity categories where the average passive peer’s exposure is structurally biased to a specific economic sector or top-heavy in terms of individual names.”

Not all the active managers joined the party of higher success rate over the last year. Only 19.4% of active managers in the Eurozone large-cap category outperformed passive peers in the year to the end of June 2023, significantly down from 44.1% a year earlier. The year 2023 began on a promising note for the Eurozone, propelled by the tech sector’s momentum. But as the European Central Bank announced mid-year rate hikes, the narrative shifted to risks of economic slowdown and money managers found themselves in choppy waters.

Active Bond Managers Do Even Better

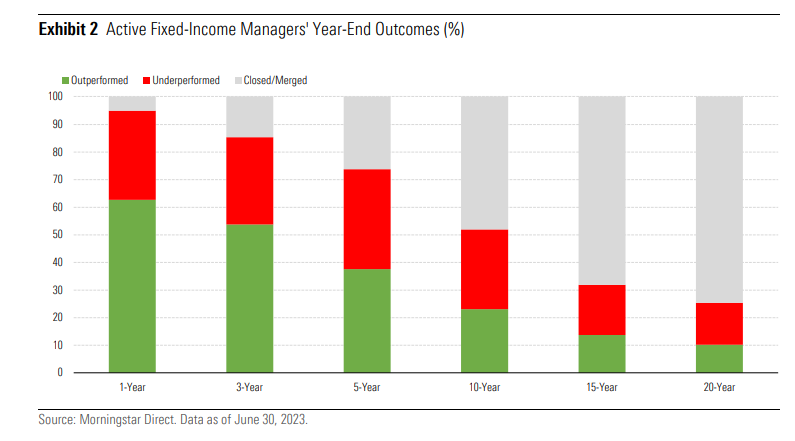

Bond markets also regained strength in the first half of 2023, with rising yields driving the demand for developed government and investment-grade corporate issuers. Market participants also started to position for an eventual peak in interest rates. As a result, investors’ focus has been shifting from the short to the longer end of the maturity spectrum. Against this backdrop, 62.7% active bond managers in the 24 categories analyzed by Morningstar outperformed their passive alternative in the one-year period to the end of June, up from 55.5% at the close of 2022 and 46.2% the year before.

Active managers in the EUR government bond category saw the one-year success rate jump to 66.3% from 38% a year earlier, and active funds in EUR corporate bond category delivered a one-year success rate of 78.7%, strongly up from 27.1% a year earlier. Their peers in the GBP government and corporate bond categories also improved.

Passive Funds Are Still the Long-Term Winners

“While the overall rise in short-term success rates by active managers is encouraging, the long-term picture remains solidly in favor of passive funds”, said Boyadzhiev. “On average, only 17.1% of active equity managers and 23.1% of active bond managers managed to beat their passive alternative in the 10-year period to the end of June 2023”.

Moreover, the Morningstar’s Active/Passive Barometer shows that passive funds tend to survive longer. In the 10-year span to the end of June 2023, on average 53.7% of active equity funds survived, while 63% of index-tracking funds did. The trend is similar in fixed income, where 52% of active funds survived compared with 60.8% of passives. The likelihood of a fund’s survival is linked closely to its success rate. “The primary reason most active funds falter is their short lifespan, often attributed to subpar performance”, said Boyadzhiev.